There are 631 stocks listed on the Singapore exchange. I’ve limited the dataset to the Straits Times Index (STI) constituent stocks, then use the SGX Stock Screener to filter for those with a Price-to-Book (PB) ratio of less than 1 which means that they are trading below their net asset value.

Would we be able to find undervalued blue chip stocks in the Singapore market today? Well as of 6 May 2024, here are the 10 undervalued stocks in Singapore we’ve identified:

10 undervalued stocks in Singapore (May 2024)

| Name | Ticker | Price / Book | P/E Ratio | Dividend Yield | Market Cap | Industry |

|---|---|---|---|---|---|---|

| Hongkong Land Holdings Limited | H78 | 0.22 | na | 6.8% | US$7.17B | Real Estate Management & Development |

| Jardine Matheson Holdings Limited | J36 | 0.39 | 16.44 | 5.7% | US$11.28B | Industrial Conglomerates |

| UOL | U14 | 0.43 | 6.75 | 2.7% | S$4.81B | Real Estate Management & Development |

| City Developments Limited | C09 | 0.60 | 17.41 | 2.0% | S$5.41B | Real Estate Management & Development |

| Mapletree Pan Asia Commercial Trust | N2IU | 0.68 | 11.09 | 7.3% | S$6.51B | Retail REITs |

| Wilmar International Limited | F34 | 0.74 | 9.80 | 5.3% | S$20.62B | Food Products |

| Frasers Logistics & Commercial Trust | BUOU | 0.86 | na | 7.0% | S$3.78B | Industrial REITs |

| Mapletree Logistics Trust | M44U | 0.90 | 12.36 | 6.0% | S$6.74B | Industrial REITs |

| CapitaLand Investment Limited | 9CI | 0.92 | 72.82 | 4.6% | S$13.79B | Real Estate Management & Development |

| Jardine Cycle & Carriage Limited | C07 | 0.97 | 6.42 | 6.0% | S$10.63B | Industrial Conglomerates |

p.s. Several of these undervalued stocks are down by >10% YTD! Alex shared his analysis and picked 2 of these undervalued stocks as potential buys.

1. Hongkong Land (H78): P/B 0.22

Hongkong Land is a property investment, development and management group and is considered one of the property blue chip stocks in Singapore.

As its name suggests, most of its portfolio is concentrated in Hong Kong (57%). In Singapore, Hongkong Land owns part of the Marina Bay Financial Centre (MBFC) properties. Their portfolio of investment properties are primarily office and retail properties, and recently made our list of Singapore Blue Chip stocks with Moats.

However, Hongkong Land continues to struggle due to its exposure to Hong Kong and China properties. Hong Kong’s investment properties are still struggling to recover while the China property market debt crisis has yet to be resolved.

That said, Hongkong Land has continued to pay out dividends even through the tough times. At the point of update, its dividend yield is about 6.8%.

Hongkong Land’s P/B is currently at 0.22, making it the most undervalued stock on this list. This is also lower than its historical average of 0.3 and its industry P/B of 0.4.

2. Jardine Matheson Holdings (J36): P/B 0.39

Jardine Matheson (JDM) is a conglomerate with a diverse range of businesses under its umbrella, with a hand in sectors ranging from property to retail and even heavy machinery and construction.

Given JDM’s complex business and size, Alvin had ranked it as “JOMO” in his Singapore Blue Chip Stocks ranking video.

It holds 75% of Jardine C&C, 52% of Hongkong Land and many more.

JDM has continued paying out dividends through the dark pandemic years and at the point of update, its dividend yield is about 5.7%.

Jardine Matheson is trading at a P/B of 0.39 at the point of update which is below its historical P/B of 0.8 and its industry average of 0.9 which suggests that it might be undervalued.

Please keep in mind that JMD’s business is cyclical, such stocks are not that suitable for holding long term. Instead, you might want to rely on its momentum and consult related technical indicators if you wish to ride JDM’s price action.

3. UOL (U14): P/B 0.43

UOL is a real estate management company with an extensive portfolio of development and investment properties.

The business environment continues to be challenging for UOL. Group revenue was down 16% in FY2023, to $2.68 billion, with lower contributions from property development which was partially offset by a 38% increase from hotels due to rebound in tourism segment.

Group pre-tax profit before fair value and other gains/losses was down 24% to $475.1 million. The declines were partly offset by better performance from hotel operations and higher investment income.

At the point of update, UOL’s dividend yield is about 2.7%. Its current P/B of 0.43 is lower than its historical P/B of 0.7.

4. City Developments (C09): P/B 0.60

City Developments Limited (CDL) is a real estate operating company with a diverse property portfolio of residential, commercial and hotel properties (M social and Millennium hotel brands) located worldwide.

They are involved in property development, asset management and hotel operations. CDL also owns ~ 50% of iREIT Global which has a portfolio of commercial and retail properties across Europe.

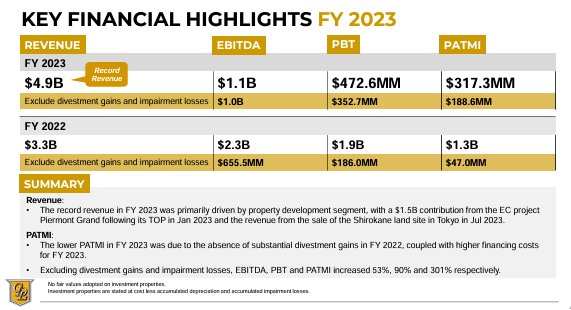

CDL reported a record revenue of $4.9B in FY2023 but net profit for FY2023 had declined significantly from FY22’s $1.3B to a mere $317.3m. High financing costs in 2023 was the main culprit for the poor profits.

CDL has several launches in its pipeline with about 1800 units scheduled for launch in 2024. However, the company’s capital management remains worrisome with net gearing at 103% and average borrowing cost at 4.3%. It would be prudent to keep an eye on how CDL manages their debt in 2024.

As of the current update, City Dev is currently trading at a P/B of 0.60. Compared to its historical P/B of 0.8 and their industry sector’s P/B of 0.8, City Dev seems to be undervalued.

5. Mapletree Pan Asia Commercial Trust (N2IU): P/B 0.68

Mapletree Pan Asia Commercial Trust (MPACT) is the renamed entity after Mapletree Commercial Trust (MCT) acquired and merged with Mapletree North Asia Commercial Trust on 3 Aug 2022.

Following the merger, MPACT now has 18 properties across five key gateway markets of Asia – five in Singapore, one in Hong Kong, two in China, nine in Japan and one in South Korea. We covered the merger here.

While MPACT is currently undervalued (based on its Price/book), it has delivered outstanding results over the last 10 years. Alvin shares his deep dive into SREIT performance here.

Although its Singapore portfolio did well, MPACT’s performance is being held back by its China portfolio and this trend will likely continue for the near future. You’ll need to be comfortable knowing that the China property market may not perform as well, especially in the short term.

For FY 23/24, MPACT’s Gross Revenue and NPI Increase are up by 16.0% and 15.2% yoy to S$958.1 million and S$727.9 million respectively. This is despite forex and interest rate headwinds as overseas income is tempered by strong SGD against JPY and RMB.

The REIT has also taken measures to defend against headwinds. It’s fixed rate debt is kept above 70% to shield against interest rate uncertainties and is currently at 77.1% as at 31 Mar 2024. Its Aggregate Leverage Ratio remains at 40.5% and adjusted Interest Coverage Ratio has lowered to 2.9x (from 3.5x last year).

On the dividend yield front, MPACT is currently yielding 7.3%.

As of the current update, MPACT is currently trading at a P/B of 0.68. Compared to its historical P/B of 1.3, MPACT seems to be underpriced currently.

6. Wilmar International Limited (F34): P/B 0.74

Wilmar International is a consumer goods and commodity conglomerate involved in the entire supply chain. Some of its business processes include the cultivation of palm oil and sugarcane, distribution of consumer food products as well as processing and distribution of animal feeds and industrial agri-products like biodiesel.

2023 was a difficult year for the company with revenue and profits down by -8.5% and -36.5% respectively.

This was attributed to lower earnings across all segments, with Food Products being the biggest loser. These lowered earnings were despite higher sales volume, mostly due to the softening of commodity prices.

That said, Wilmar has been paying dividends since 2013. At the point of writing, its dividend yield is about 5.3%.

At the current update, Wilmar International is currently trading at a P/B of 0.74, which is lower than its historical P/B of 1.

7. Frasers Logistics & Commercial Trust (BUOU): P/B 0.86

Frasers Logistics & Commercial Trust (FLCT) is a REIT that gives you exposure to a portfolio of 105 industrial and commercial properties valued at ~S$6.5 billion across five major developed markets.

As of FLCT’s latest (1QFY24) business update, they have maintained a healthy aggregate leverage at 30.7% and 76.8% of their borrowings were made at fixed rates.

FLCT had reported a FY23 DPU of 7.04 cents, which is down 7.6% from FY22. It is currently trading at a P/B of 0.86. Compared to its historical P/B of 1.2, FLCT appears to be slightly undervalued. However, if compared against its industry sector’s P/B of 0.8, FLCT seems to be overvalued as of May 24.

Although 2024 began with hopes that interest rates will recover, as of the latest Fed meeting, it seems headwinds might continue to haunt REITs for a little while longer. If you’re a REIT investor, here’s what you must know about the state of S-REITs now.

8. Mapletree Logistics Trust (M44U): P/B 0.90

Mapletree Logistics Trust offers exposure to logistics real estate across Asia. At the point of writing, its portfolio is valued at S$13.2B with an occupancy of 96% at a weighted average lease expiry of about 3.0 years.

In its latest earnings, MLT reported a growth in Gross Revenue of only 0.4%. With China & Hong Kong SAR accounting for 41.9% of Assets Under Management (AUM) and 35.8% of Gross Revenue, investors may not be confident that the REIT can contain any losses from the poor real estate market sentiment in Hong Kong and China, as well as the currency weakness of JPY, CNY, AUD, HKD, MYR. This lack of investor confidence was reflected in its share price, which dropped by 10% in just 1 week in April.

As of the current update, Mapletree Logistics Trust is currently trading at a P/B of 0.90. Compared to its historical P/B of 1.2, MLT seems to be slightly undervalued. However when compared against its industry peers with a historical P/B of 0.8, MLT is considered overvalued.

MLT rarely trades below a P/B of 1, so this might be a good time to take a deeper look into this REIT if you’d like to load up on some REITs in 2024.

Despite its current valuation, MLT was one of only three S-REITs that increased their dividend payout in 2023. The REIT also made our list of top 10 Blue Chip Stocks with consistent payout!

9. CapitaLand Investment Limited (9CI): P/B 0.92

CapitaLand Investment (CLI) is a REIT with a longstanding history. It underwent a major restructure and the new CLI which includes the fund management and lodging business segments was listed as 9CI in 2021.

As with most REITs, CLI didn’t have a stellar 2023 due to macroeconomic headwinds. Cash profits are down 6% in FY2023 while total profits are down 79% due to non-cash fair value losses, mostly due to the revaluation of properties in China and USA.

However, CLI’s capital and debt management remains healthy. The management is also on track to shifting the business towards recurring fee income through the fund management arm.

For 1Q2024, its total revenue remained stable at S$650 million, with Fee Income-related Business (FRB) revenue up 7% yoy while Real Estate Investment Business (REIB) Revenue down 4% yoy.

As of the current update, Capitaland Investment is currently trading at a P/B of 0.92. While that makes CLI look undervalued, if we were to compare against its industry sector’s P/B of 0.8, CLI remains overvalued against its peers.

That said, CLI is a REIT that rarely trades below or close to a P/B of 1, so this might be a good time to take a deeper look into this REIT as well.

10. Jardine Cycle & Carriage (C07): P/B 0.97

Jardine Cycle & Carriage is a highly diversified business despite being known as an automobile company. You can learn more about their business in our Jardine C&C stock analysis here.

The company reported a 3% growth in revenue and 64% growth in net profit for FY23, as compared to the year before. While its Indonesian business group, Astra grew by 21%, its Vietnam business THACO saw a significant drop of 57%. The management has noted that THACO may continue to lag in performance in the coming year.

Costs was also up significantly in FY23, eating into their profits.

In their latest management statement for 1Q2024, Jardine C&C reported softer trading conditions in its businesses in Indonesia and Vietnam and warned of continued headwinds due to the global geopolitical and economic uncertainties.

At the point of update, Jardine C&C’s dividend yield is about 6% and it is trading at a P/B of 0.97. Compared to its historical P/B of 0.9, it looks slightly overpriced in this latest update. However, you might want to note that their industry sector’s P/B is about 0.7.

Conclusion

I’ve listed 10 undervalued stocks in Singapore for May 2024, based on their Price-to-Book ratio and I hope this article gave you some investing ideas to research into.

Also, please keep in mind that although PB may be a good primary filter of undervalued stocks, you should do your own deeper research into the fundamentals and performance of any stock that you wish to invest in.

If you’re not sure how to start, refer to our value investing guide, or join Alvin at his upcoming webinar where you’ll learn how you can pick undervalued stocks using Dr Wealth’s i3 investing strategy.

Hi is there a mistake in the p/b for yzj shipping? Should it be 1.36 instead?

Hey there, the P/B value may be different depending on how it is calculated. I’m using the SGX stock screener to quickly screen for these stocks as a 1st pass. They calculate the P/B using the Current Price divided by the latest interim period Book Value per share.

Hi, Thanks for the sharing! MPAT seems trading at an interesting price level! NAV 1.759, Gearing is 40.9% a little bit high in my opinion! Yearly dividend is about 9 cents, yield is 5.5% based on current price of 1.63.

“As of the current update, Capitaland Investment is currently trading at a P/B of 0.96. Compared to its industry sector’s P/B of 0.8, CLI seems to be slightly undervalued.

CLI is another REIT that rarely trades below or close to a P/B of 1, so this might be a good time to take a deeper look into this REIT as well.”

CLI is not a REIT per se, more like a management company. Also, if the P/B is 0.96 and the industry sector’s P/B is 0.8, wouldn’t CLI be overvalued compared to the industry average?

you’re right! thanks for picking that up!