Imagine receiving regular payouts just for owning a portfolio of stocks…

What is Dividend Investing?

Dividend investing is the process of building a dividend portfolio that pays a regular stream of dividends. These dividends are usually released quarterly, although the specific calendar date may vary for each stock. With a substantial portfolio, dividend investors could retire early and live off their dividend “pay checks”.

In fact, I argue that dividends are the best form of mental wellness!

How does dividend investing differ from regular stock investing?

Regular stock investing usually equates to buying and selling stocks to receive profits. This is also referred to as capital gains. You buy a stock at a lower price and sell it at a higher price to receive a profit. (if that’s what you’re interested in, read our Value Investing Guide)

In contrast, dividend investing provides its shareholders a yield for holding the stock.

Think of the stock as a goose. With capital gains, you have to sell the goose to get a return on your investment. But with dividend investing, you get to keep the goose and receive profits through the eggs it lays.

If you aspire to become a dividend warrior whose portfolio can keep paying you while it grows, then this dividend investing guide is for you. Below, we’ll explore how dividend investing works, why you should consider it and two dividend investing strategies you could use now.

Why Invest in Dividends?

Many people find that investing in capital gains is simpler.

While this may be true, there are three main reasons why you should consider dividend investing, especially if you are an investor in Singapore:

i) Dividends preserve their value

Dividend stocks tend to preserve their value better during economic downturns and bear markets.

They tend to to grow over time, and tend to be less volatile.

ii) Dividends are tax-advantaged

Most dividends are tax-advantaged, meaning they are either non-taxed or the tax rate is less than that imposed on regular income.

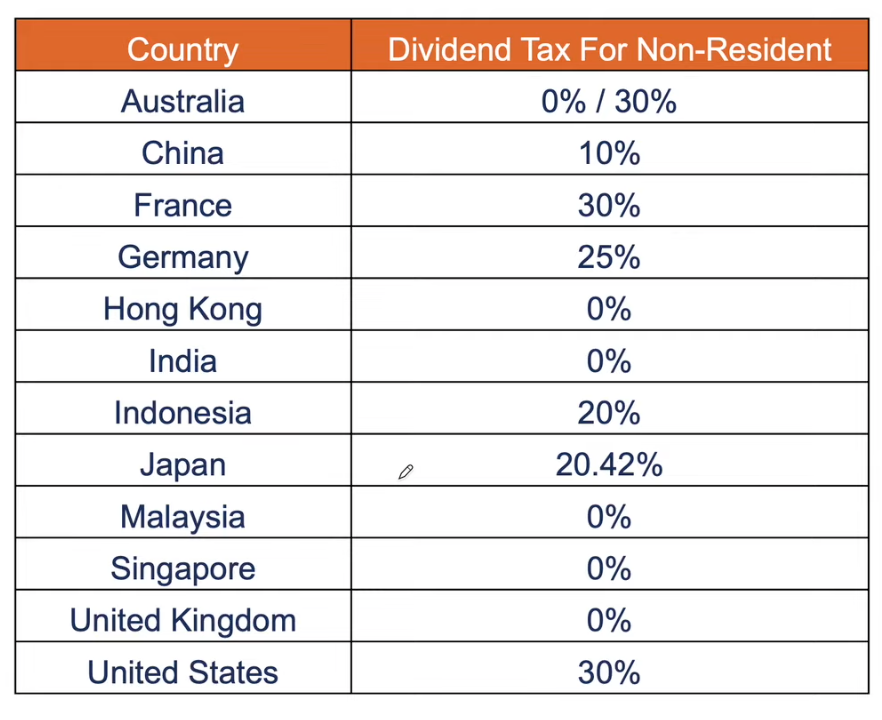

In some countries like Singapore, dividends are not taxable. Other countries may have taxation depending on their laws. The normal range is 10%-30% in dividend tax. If you are a non-resident, the rate may also be different than if you are a citizen of said country.

A tip is that ex-British colonies or Commonwealth countries do not usually have dividend tax.

That said, if a company quality is really good and you want long-term stability or growth, then the dividend tax may not be a heavy price to pay.

iii) Dividends provide a sustainable cashflow

Dividend stocks are meant to be held through a long period of time, for as long as there’s nothing wrong with the business. As opposed to investing in capital gains, wherein the share price movement is of utmost necessity to secure profit, the share price movement in dividend investing is just a distraction.

What is important in dividend investing is that you can get a sustainable cashflow through your stocks, regardless if the market goes up or down.

Even when the company has not been profitable in a particular year, if they were profitable the years prior, they will still be able to give out dividends.

Taxes: Why Dividend Investors in Singapore have an Advantage?

The following table reflects the dividend tax for non-residents in several nations:

As mentioned earlier, some countries have dividend tax while others do not. Of course, as an investor, you would prefer not to have your yield taxed.

Dividend investors in Singapore have an advantage because their dividends are not taxed. So, after one tier of corporate taxation, which is around 17%, the dividend is released to the stockholders. There is no taxation on a personal level thereafter.

Where do Dividends Come From?

Stock dividends can come from three possible sources, and you can find them on the cashflow statement within a company’s annual report:

i) Operations

Ideally, all your dividends would come from operations.

This is when you’re getting money from the company’s buying and selling of products and services.

ii) Investments

You receive dividends from a company’s investments when they sell their plants and equipment. You would not want your dividends to come from this.

iii) Financing

Some enterprise managers borrow money from a bank to pay investors in the form of a dividend. You do not want your dividends to come from this source either.

Good vs Bad dividends

So, how do you distinguish between a good dividend and a bad dividend?

A good dividend comes from cashflow from operations, these are usually sustainable as the business grows.

Dividends from other sources tend to be lumpy and one-off.

3 Key Metrics that Dividend Investors should use

a) Payout ratio

The payout ratio is computed by dividing the dividends paid by net income. It reflects how much a company pays its shareholders in proportion to its earnings.

To be considered good or sustainable, a payout ratio should be less than 1.

To understand how this works, let us consider McDonald’s stocks. In FY2020, they made $4.7 billion. They then decided to give $3.7 billion as dividends. If we divide $3.7 billion by $4.7 billion, we get 0.8, which is the payout ratio.

This means that for every $1 that McDonald’s earns, it pays out 80 cents to its investors. Although this is considered generous, it is still sustainable as the company is paying within its means.

Meanwhile, if the payout ratio is more than one, the company is paying out more than it earned. This could be unsustainable in the long run and you should start taking note if you’re vested in such dividend stocks.

b) Cashflow

We must not forget the cashflow, as profits may not always be in cash due to accrual accounting standards.

Profits or revenue are recognized when the products or services are delivered. However, some companies deliver their products or services first, then they collect cash later.

In this case, a company’s income statement can look good as earnings are high. But it can still be cash poor at the same time, as it doesn’t collect the cash from its customers in time. Hence, there is a discrepancy between the income statement and the cashflow statement.

Free cashflow payout ratio

We then compute for the free cashflow payout ratio by dividing the dividends by the free cashflow. It is similar to the payout ratio formula, except we’re changing the denominator.

Let’s use McDonald’s as an example again. We divide $3.7 billion by $4.6 billion, which is the company’s free cashflow. You could literally take this money out and count it if you wanted to. Now, this results in 0.8. Since it is less than 1, it is still considered sustainable.

Why does cashflow matter?

Dividends are usually paid out in cash, so a company needs to have a high cashflow to release revenue to the stockholders. If a company has profits but no cashflow, then it wouldn’t be able to pay out its dividends on time.

c) Dividend yield

The dividend yield tells you how much a company pays in dividends relative to its share price. Divide the annual dividends per share by the current share price to get the dividend yield.

Again, let’s look at McDonald’s. The annual dividend per share is $5.16, and the current share price is $224.20. This amounts to a dividend yield of 2.3%

Is this percentage good or bad?

That’s up to you. Are you happy with a 2.3% dividend yield? If yes, then feel free to purchase the stock at its current price. If you’re not happy with that, then you can wait for the stock price to go down before you invest.

How to Find the Best Dividend Stocks today

Finding the best dividend stocks entail research, data, and comparison. To understand this section better, we will continue to use McDonald’s as an example.

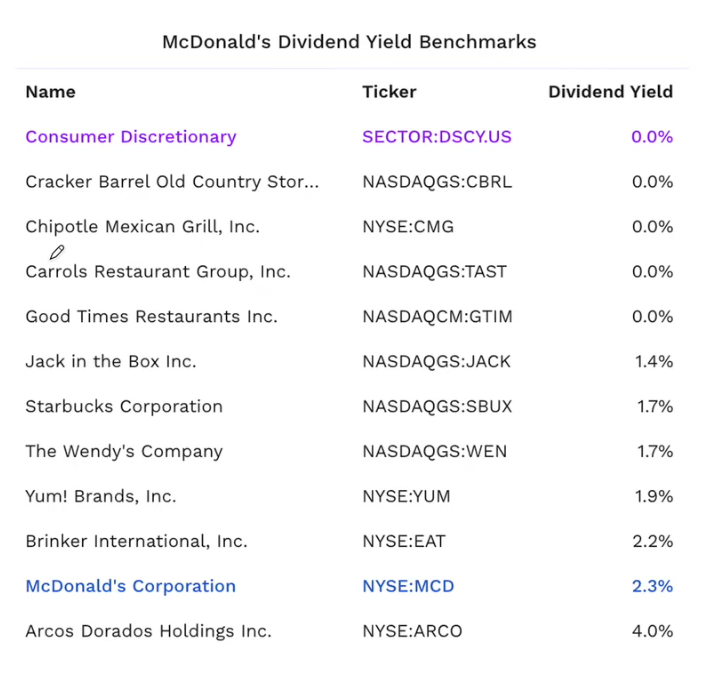

1) Compare the dividend yield of similar companies

You can only conclude that your stock is the best if you are aware of the performance of other companies. It would help if you compared the dividend yield of your chosen company to its peers and competitors.

We can see from the table that Chipotle, the Mexican grill, doesn’t give any dividends. Meanwhile, Starbucks and Wendy’s give out 1.7% dividends.

The closest competitor that’s comparable to McDonald’s is Yum! Brands, which has KFC, at 1.9%. So, at 2.3%, McDonald’s has a higher yield than its competitors or industry peers.

This suggests that the current share price of McDonald’s is not that high, which makes it a better deal than similar companies.

2) Look at the historical data

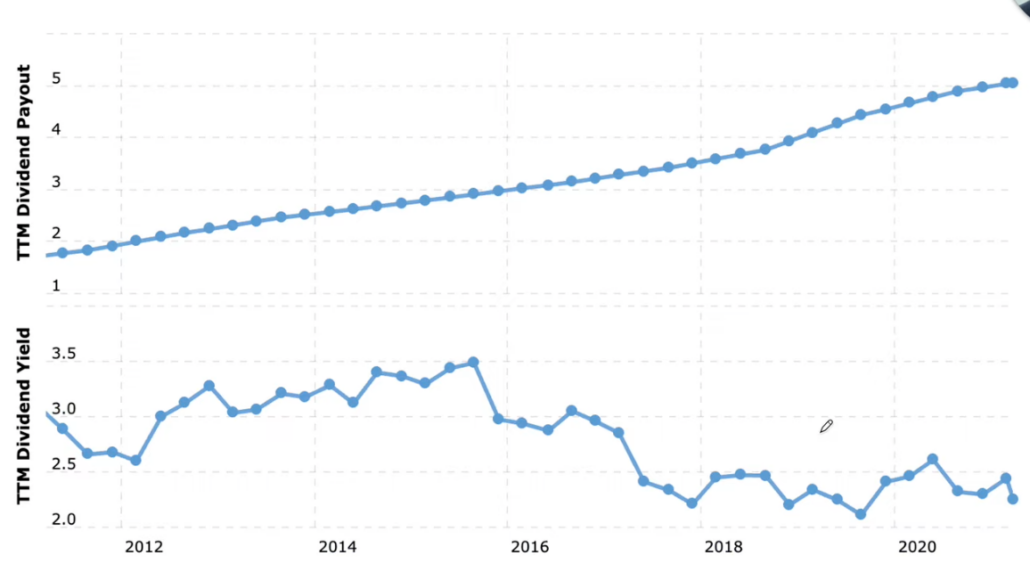

An excellent way to assess a stock’s dividend valuation is to see how well it has historically performed in this regard. In the image below, you can see McDonald’s dividend performance over the past ten years.

Dividend per share

The first graph in the image above is called the dividend per share. Every year, you can see that the dividend per share goes up. This is good news. It means that McDonald’s keeps making money and giving higher dividends to its investors.

Similarly, you would want to choose a stock with an upward dividend per share.

Historical dividend yield

The second graph is the historical dividend yield, which we will highlight in this section. As share prices change, the dividend yield will also change as well. This is because, as you may recall, the share price is part of the dividend yield calculation.

We can see that the dividend yield of McDonald’s reached 2.1% in late 2019. Meanwhile, the highest point was 3.5% in late 2015. This means that the 2.3% from 2020 is closer to the lower end of the range.

This reflects that while the dividend yield of McDonald’s is still higher compared to its peers, it has been on a decline. Compared to its past, it’s already trading at a higher price range.

And so, to compromise, you may choose to wait until it goes to around 2.8% before you buy. At that point, it’ll have a better valuation, if its business fundamentals remain the same.

You may find these interesting:

Two Dividend Investing Strategies You Could Use

1) Sustainable Dividend Investing Strategy

Build a sustainable portfolio

There are three ways to build a dividend portfolio:

i) Look for stocks that have higher current yield

ii) Select companies with lower payout ratios

iii) Ensure that dividends come from cash flow

This strategy would help you choose higher quality dividend stocks.

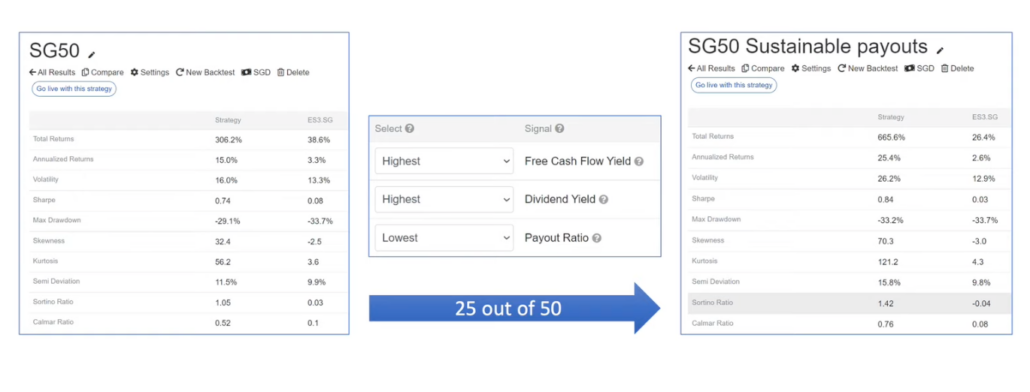

For evidence that this method works, refer to the image below:

But if you just chose the top 25 stocks that had the highest dividend yield, highest free cashflow, and lowest payout ratios, your annualized return would go from 15% to 25.4%.

The test of free cashflow

Free cashflow is computed by subtracting the capital expenditure from the operating cashflow. If the company’s free cash flow exceeds the dividends given out, then the stock is of good standing.

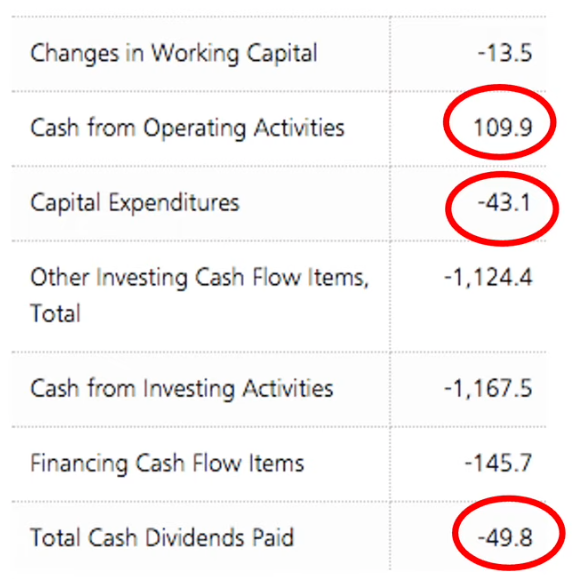

So you can see this at play, let us look at Oxley’s data from 2017. This is in millions of dollars.

$109.9 million minus $43.1 million equates to $66.8 million in free cashflow. Meanwhile, the dividends paid are $49.8 million. Since the free cashflow is greater than the dividends paid, then we can say that Oxley has sustainable dividends.

Include fundamental analysis

Sometimes, having a dividend strategy is not enough. To rely on it alone could result in poor performance. It is then essential that you also conduct fundamental analysis.

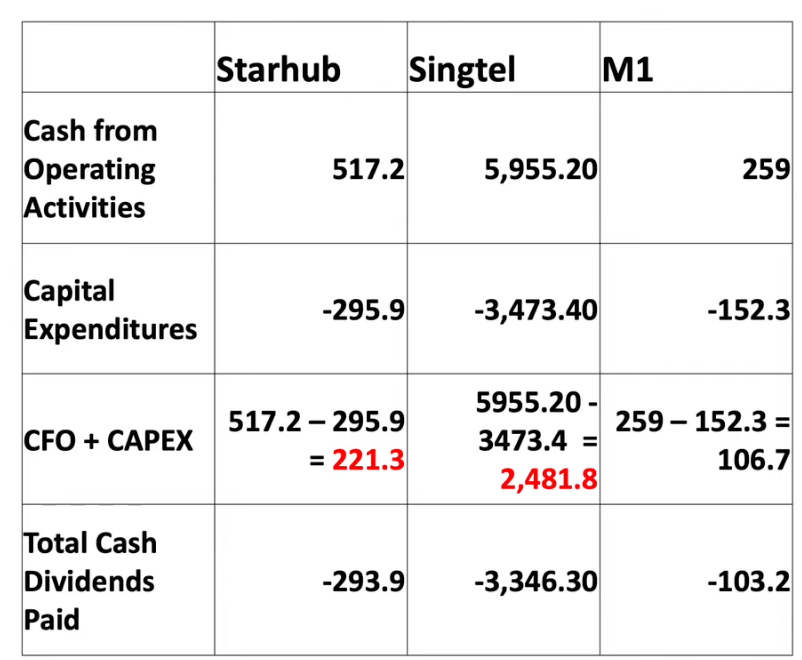

As an example, consider the following data from 2017, when Singapore still had three telcos in the stock market.

You may observe from the table that the free cash flow of Starhub and Singtel were less than the dividends they paid out. Time reveals that this was a sign of Starhub not doing well in the stock market.

However, there is a good reason for Singtel’s data. At the time, Singtel hived off their fibre assets in the form of a Netlink trust. As such, their lack of free cashflow is forgivable.

In this case, we see the importance of understanding the context behind the numbers.

2) Dogs of the STI

How it works

This strategy focuses on investing in Singapore blue-chip dividend stocks. It is based on the Dogs of the Dow, an investing strategy famous in the United States.

The Dow Jones is an industrial index with 30 stocks, and the Dogs of the Dow teaches investors to buy the top 10 stocks with the highest dividend yield.

This is a relatively easy method to secure profit, as the industrial index has already pre-screened stocks. This means that you no longer have to do much fundamental analysis, as the index has already done the work for you. If a company is declining, it will just be kicked out of the index, thereby ensuring that no matter what stocks you choose, they are sure to have solid businesses.

Now, just like the Dow, the STI also has 30 stocks. One advantage that you have when you invest in STI over Dow is that you won’t be taxed with the former. Saving on that 30% is substantial, making Singapore a more worthwhile place to invest in dividend stocks.

Determining its performance

Some investors have complained that the STI is not giving them returns. However, it’s just a matter of strategy. Applying the Dogs of the STI can yield a much higher profit.

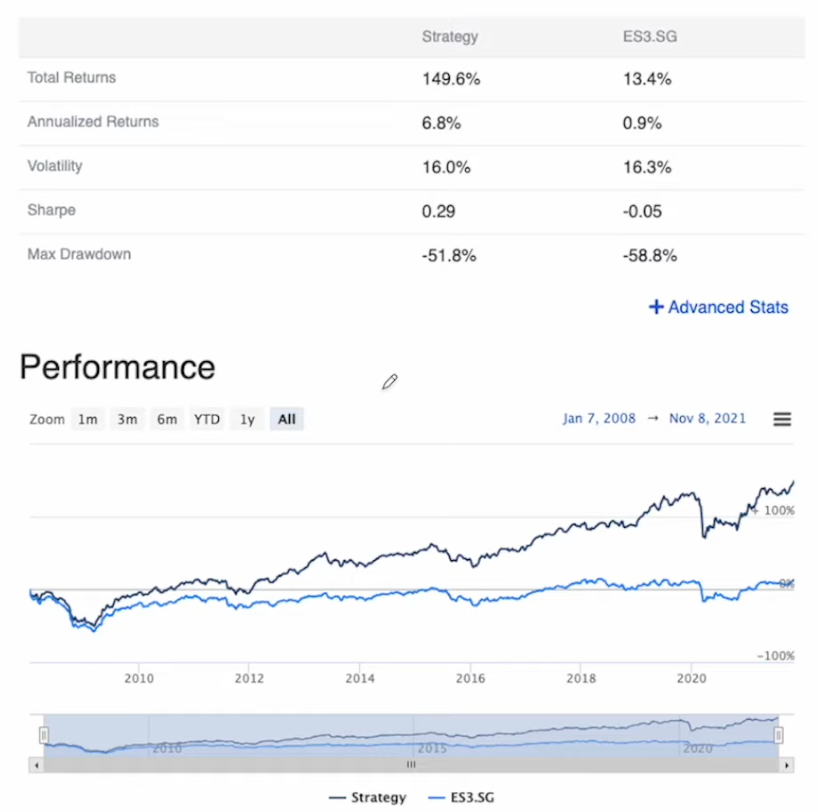

The following image compares the strategy’s performance to the performance of the STI ETF.

We can see from the data that if you follow the Dogs of the STI, you will get a 150% total return over 13 years. Meanwhile, if you invested in the STI ETF, you would only get a return of 13.4% over the same period. The Dogs of the STI basically performed ten times better.

The annualized return is also considerably higher, with Dogs of the STI at 6.8%. This is in comparison with the annualized return of the STI ETF at 0.9%.

Choosing the ten stocks

i) Get the list of the latest constituents from www.sgx.com/indices/products/sti

Every quarter, the STI changes its ranking. It is then vital that you always get an updated list of the constituents. This is also to ensure that you’re not buying stocks that have been kicked out of the index.

ii) Find out their dividend yields through www.sgx.com/securities/stock-screener

iii) Use a spreadsheet to rank

After ranking the stocks from highest to lowest, you can allot 10% of your capital to each of the top 10 stocks. In this way, they have equal weights on your portfolio.

Maintaining the strategy

The good thing about Dogs of the STI is that it is very low maintenance. You don’t need to monitor stock prices daily. You don’t even need to check them every week. Just look at the list of constituents once a year and make sure that your ranking is up-to-date.

If a stock has been kicked out of the top 10, sell it and replace it with the new stock.

Now, sometimes, the price of a stock will appreciate. Your 10% allocation for one stock may become 15%. In this scenario, simply rebalance by selling 5% so that it goes back down to 10%.

Meanwhile, if a stock loses value and falls below 10%, just buy more until up get it back to 10%.

Remember, though, that this strategy is not fool-proof. There may be some years wherein it will not outperform the STI ETF. But you just need to have the conviction and confidence that you will see greater returns by following Dogs of the STI in the long run.

3) REITs

This is a bonus strategy for newbies.

REITs are a great way to dip your toes into dividend investing, here’s a quick beginner REITs strategy that you can use, from Christopher Ng:

If you’re new to REITs, our Singapore REITs guide may be a good starting point.

The Dividend-Paying Process: When will you get paid?

So, you’ve pick the ideal dividend stocks for your portfolio. What’s next? Seat back and wait for your dividends, of course. Here’s what you can expect when its time to collect dividends!

Whenever a company elects to pay dividends, the decision has to be approved by the Board of Directors. This process has four key milestones that investors should note:

Declaration Date

This is the date when the dividend payout is announced. The dividend to be paid is recorded as a liability in the business’s accounts and paying the stockholders becomes an obligation. The next two dates below are determined on the declaration date.

Ex-Dividend Date

This is the cutoff date by which an investor must become a shareholder to be entitled to the dividend.

An example: Company A announces a dividend for its shareholders. If you purchased the stocks of Company A after the Ex-dividend date, you will not receive the dividend payout this round. Instead, the shareholder who sold the stock to you would be receiving the dividend.

Some investors would ask if it makes sense to buy before the ex-dividend date, collect the dividend then sell the share. Chris Ng shares his view on this strategy and backs it up with data from research papers.

Date of Record

Usually 2 days after the ex-dividend date, the date of record is when the company looks at its list of shareholders to determine who will be receiving the dividend.

Payment Date

This is the date when you will receive your dividends.

Different types of Dividend Payouts

Did you know that there are ‘special’ dividends that you get to enjoy as an investor? Here’re three different types of dividend payouts you should keep an eye out for:

Cash Dividends

The most common type of dividend, these are regular cash dividends paid out to shareholders. As a shareholder, you can choose to collect these as income or reinvest these into the company. Check with your broker on your options.

Companies may have common stocks and preferred stocks. One of the vital differences between these two forms of stock is how dividend payments are treated.

Payments to preferred stockholders always have priority, and all obligations to preferred stockholders must be met before profits can be paid to common stockholders. Generally, dividend rates on preferred stock are stable over time, while a company’s Board of Directors may adjust the dividend of common stock.

Scrip Dividends

A scrip dividend is in the form of additional shares of the company’s stock rather than cash.

Unlike cash dividends, which provide shareholders with immediate income in the form of money, scrip dividends increase the number of shares an investor holds without involving any monetary transaction.

Here’s a comparison between Cash vs Scrip dividends, and which is better for you as an investor.

Special Dividends

Dividends usually pay off in a consistent and predictable fashion, but exceptional circumstances may lead to a company paying out a special dividend.

Major cash surpluses coming from asset liquidation, divestiture, or litigation can lead to one-time dividends.

One-time dividends be in the form of cash dividends or property dividends.

Conclusion

In this guide, we’ve covered the basics of dividend investing, why Singapore investors have an advantage with dividends as well as two (+1) dividend investing strategies that you can use.

We hope you’ve found it useful and that it’ll help you take the first step to building your own dividend portfolio.

Do remember to do your own research, be clear of your investing goals and know what you’re putting your hard earned money into!

If you prefer to learn directly from someone who has done it all, Christopher Ng will be sharing his personal dividend investing strategy that allowed him to retire at 39 years old, bring up his children, take a law degree, start his own business and more, all on a sustainable dividend payout. Learn more here.