Options trading has been gaining popularity. You might have even heard of Singapore investors dabbling in Options Trading and how these savvy investors are using it to maximise their returns.

p.s. this guide was first published in 2019 and has been updated on May 2023

Options Trading for Beginners

This guide was created for beginners who want the fundamentals of options trading. I’ll be explaining how Options work and you’ll learn about options trading terms, types of options, the differences between intrinsic and extrinsic value and much more:

Before we proceed, I would like to say that options can be a dangerous tool. It remains a double-edged sword in the investor’s toolbox and many would regard it as a risky endeavour.

While it can bring about huge profits, unprecedented losses can also happen if you do not know what you are doing. It is a complicated instrument where, unlike stocks, prices are determined by several factors that can easily swing from one end to the other. Thus, you should avoid using it if you do not understand its mechanics well.

I’ll do my best to present the fundamentals that’ll help you get started in the right (and safer) direction. So, if you are planning to trade options in Singapore but don’t know where or how to get started, then you are just in the right place.

But before anything else, let us first define what options are:

What are Options?

An option is a contract between a buyer and a seller which gives the buyer the right to buy (call options) or to sell (put options) the underlying assets at a specific price on or before a certain date to the seller.

For a complete, academic definition, we refer to Investopedia which states:

“a financial derivative that represents a contract sold by one party (the option writer) to another party (the option holder). The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security or other financial asset at an agreed-upon price during a certain period of time or on a specific date.”

Options are a powerful tool that can be used by investors as a hedge from market crashes, while also generating recurring income.

On the other hand, it can also be used by traders to magnify their returns and generate profit in any market condition.

What is Options Trading?

Options Trading is the process of trading options. Investors use options trading for various purposes such as earning extra income on their stock positions, earning extra income while waiting for their desired stock to drop to a certain price, and many more.

P.S. I’ll share beginner options trading strategies that you can learn and execute in another article. But first, let’s get our fundamentals right.

How is Options Trading different from Stocks Trading?

When you trade stocks, you’re actually buying and owning the stock, which is a financial asset. As a shareholder, you gain access to shareholder meetings, dividend payouts and more.

However, when you trade options, you’re dealing with a derivative instrument that gives you the right to buy or sell an underlying asset at pre-determined prices. You don’t actually own the underlying asset.

Option Trading terms you must know

Before we proceed, here’re some terms you should know:

- Strike Price: price at which a put or call option can be exercised.

- Expiry Date: date on which your option will expire.

- Premium: current market price of the option contract

- Call Option: option that gives the buyer the right to buy

- Buy Option: option that gives the buyer the right to sell

- In the Money (ITM): refers to an option that possesses intrinsic value

- Out of the Money (OTM): refers to an option that only contains extrinsic value

- At the Money (ATM): when an option’s strike price is identical to the current market price of the underlying security

Overwhelmed? Don’t worry, we’ll go through the concepts with a (hopefully) clear case study!

Two types of Options

At its core, there are two types of options, Call and Put options.

However, you can either buy or sell them. I’ll explain these four scenarios in this section, using Microsoft as an example.

For this case study, let’s assume that Microsoft is currently trading at $260.

1) Call Options

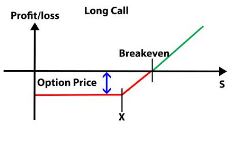

How Call Options work (as a Buyer)

A call option gives a buyer the right to buy 100 shares of a stock at a specific price on or before an expiration date from a seller.

Here’s an example of how a call option works.

Let’s assume that Microsoft is currently trading at $260. If I believe that its share price will go up within the next 2 months, I can buy a call option expiring two months for now.

More specifically, I would buy a call option with 60 days to expiry, at a strike price of $270 (the price I believe Microsoft would hit). Doing so I would pay a premium of $430 for each contract (do note that each contract represents 100 shares).

60 days later…

If Microsoft remains below my strike price of $270, I will lose my premium. There is no point in converting my options contracts to shares since I can get the shares from the stock market at a price cheaper than $270.

However, if Microsoft share price were to shoot up beyond $270 plus my premiums paid, my options would become profitable. I can exercise the options to convert them into shares.

That said, most Options traders usually sell their options for a profit, rather than converting them into shares.

As a buyer in this Call Options scenario, you are exposed to:

- Max loss = $430 + commission fees

- Breakeven point = $270 + $4.30 = $274.30

- Profit if Microsoft hits $280 = ($280-$270) X 100 shares – $430 premium = $570

- Max profit = Unlimited (assuming Microsoft’s price has the ability to go to the moon )

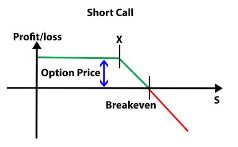

How Call Options work (as a Seller)

Selling a call option allows you to collect the premium from the buyer.

If it does not reach the intent strike price, the seller would be able to keep this premium. However, if the stock shoots up in value, the option seller would have to sell its shares to the buyer at a loss. (If options are exercised.)

Using the same scenario as above, here’s how it would play out if you are the seller instead of the buyer of call options. As a seller, you believe that Microsoft would not increase to $270 within the next two months so you are more than willing to sell the call options.

More specifically, you would sell a call option at a strike price of $270 with 60 days to expiry. By doing so, you collect $430 for each contract (noting that each contract represents 100 shares).

60 days later…

If Microsoft indeed stayed below $270, you would get to keep the premium given to you at the start since it is unlikely the buyer would exercise it.

However, if Microsoft share price were to shoot up beyond $270 plus premiums paid, your options would now be making a loss and the buyer could choose to buy your shares over at $270. Even if the current price for Microsoft is $280.

As a seller in this Call Options scenario, you are exposed to:

- Max loss = Unlimited

- Breakeven point = $270 + $4.30 = $274.30

- Max profit = $430 – commission fees

This is the main reason why you do not want to sell naked call options. A jump in share price would result in a huge loss!

2) Put Options

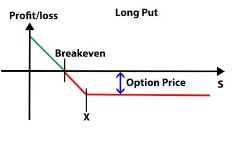

How Put Options work (as a Buyer)

A put option gives a buyer the right to sell 100 shares of a stock at a specific price on or before an expiration date from a seller.

Now here’s an example of how a put option works, assuming once again that Microsoft is trading at $260.

If I believe that Microsoft share price would drop in the next two months, I can choose to buy a put option expiring two months for now.

More specifically, I would buy a put option with 60 days to expiry, at a strike price of $250 (the price I believe Microsoft would at least drop to). Doing so I would pay a premium of $655 for each contract (noting that each contract represents 100 shares).

60 days later…

If Microsoft remains above my strike price of $250, I will lose my premium. There is no point in selling my shares to the options seller, since I can sell them on the market for a price higher than $250.

However, if Microsoft share price were to drop beyond $250 minus my premium paid, my options would become profitable. I can exercise them to sell my shares at a higher price than what is trading on the market.

Note: most Options traders usually sell their options for a profit rather than converting them into shares.

As a buyer in this Put Options scenario, you are exposed to:

- Max loss = $655 + commission fees

- Breakeven point = $250 – $6.55 = S243.45

- Profit if Microsoft drops to $240 = ($250-$240) X 100 shares – $655 premium = $345

- Max profit = till Microsoft drops to $0, which is almost impossible

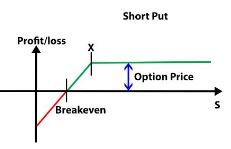

How Put Options work (as a Seller)

Selling a put option allows the seller to collect the premium from the buyer.

If it does not reach the intended strike price, the seller would be able to keep the premium. However, if the stock drops in value, the option seller would have to buy shares from the options buyer at a loss. (If options are exercised.)

Likewise, let’s use the same scenario as above, from the POV of the seller.

As a seller, you believe that Microsoft would stay above $250 within the next two months so you sell the put option to the buyer above. More specifically, you sell a put option at a strike price of $250 with 60 days to expiry. By doing so, you collected $655 for each contract (noting that each contract represents 100 shares).

60 days later…

If Microsoft indeed stayed above $250, you would get to keep the premium given to you at the start since it is unlikely the buyer would exercise it.

However, if Microsoft share price were to drop below $250 plus the premium paid, your options would now be making a loss and the buyer could choose to sell their shares to you at $250 per share. Even if the current price for Microsoft is lower than $250.

As a seller in this Put Options scenario, you are exposed to:

- Max loss = till Microsoft drops to $0

- Breakeven point = $250 – $6.55 = S243.45

- Max profit = $655 – commission fees

Similarly, you should not sell naked put options as a sudden drop in share price would result in a huge loss.

Sounds easy?

Well, the above is only one part of the options pricing mechanism.

It has only accounted for the intrinsic (inherent) value of the options while its extrinsic value has been excluded.

What is the “Extrinsic Value” of an Option?

Well, extrinsic value is the difference between the market price of the options and its intrinsic value. In other words, it is the ‘hope value’ – the hope that the options would reach the strike price.

This is determined by the time left till the option contact expires aka the ‘time value’ and its implied volatility aka the ‘degree of price swings’.

- Time Value

Usually an options contract with a longer time frame has a higher premium due to the higher probability that the strike price will be hit before expirations.

As a contract nears its expiry date, it starts to lose its time value as there is less time for the underlying stock to move in the desired direction.

- Implied volatility

When the underlying stock has higher implied volatility, it means that its price fluctuates substantially. This poses a greater risk to options sellers as stocks with higher implied volatility have a higher probability of hitting the strike price.

As such, stocks with higher implied volatility tends to have a higher extrinsic value and are traded at a higher premium.

At the end of the day, as an option reaches its expiry, the extrinsic value would drop to $0, leaving only the intrinsic value of the option, aka its true price.

What are Options Greeks?

All in all, intrinsic and extrinsic factors can be measured by four indicators, collectively are known as the “Options Greeks”:

Theta

Theta measures the rate of time decay of an option contract.

As time passes, options start to lose their value, this decay tends to accelerate as the options near expiry as the probability of hitting the strike price is reduced.

By looking at the Theta of a particular options contract, we can determine the rate of this decay, which allows the seller and buyer to weigh the risk and reward of trading that contract.

For example, an option contract with a Theta of -1.5 is losing $1.50 in value each day.

Delta

Delta measures the change in option premium as a result of the change in the prices of the underlying securities.

The Delta value can range from -1.00 to 0 for Put options and 0 to 1.00 for Call options. Put options have a negative relationship with the price of the underlying asset thus their delta are negative. Whereas Call options on the other hand, have a positive relationship with the price of the underlying asset.

- If a call option has a Delta of 0.50, a $1 increase in the price of the underlying asset will result in a $0.50 increase in the options price.

- Conversely, if a put option has a Delta of -0.50, a $1 increase in the price of the underlying asset will result in a $0.50 decrease in the options price

Note: In-the-money options (options at their intended strike price) tend to have a higher delta as compared to out of the money call options.

Delta is also commonly used to determine the probability of an option to expire in the money. As such, a call option will a Delta of 0.25 has roughly a 25% chance of being profitable.

Gamma

The Delta of an option changes over time and this is measure by Gamma which measures the rate of change of Delta over time. (If you studied physics, Gamma is akin to acceleration while Delta is the velocity). Unlike Delta, Gamma remains constant and thus is useful to determine the stability of an option price.

Gamma is at its highest when the option is at the money. If an option has a Gamma value of 0.20, for every $1 increase in the underlying stock, a call option Delta would increase by 0.20 while a put option Delta would decrease by 0.20.

Another way to think of it is that, Delta measures the probability of the options being in the money while Gamma measures the stability of this probability over time.

Vega

Vega measures an option’s sensitivity to implied volatility.

We have mentioned how the volatility of the underlying stock has a certain impact on the option price. Vega seeks to measure how much this price will increase or decrease, as a result of the change in the implied volatility of a stock.

In general, an option seller would benefit from a fall in implied volatility because, lower implied volatility means a lower probability of hitting the strike price, which is what an option seller wants to achieve. The reasoning is reversed for options buyers.

Now that we have that covered, let us now move on to the 5 things you need to know about trading options in Singapore:

5 Things to Know Before Trading Options in Singapore

#1 Be Wary of Unregulated Online Trading Platforms

Usually, newbies fall trap into signing up for Foreign Exchange or Forex trading seminars on unregulated online trading platforms. And it’s not your fault, especially with all the “get rich quick” advertisements and their claims of having 100% return trading options.

However, instead of believing such claims, you might want to take these as red flags 🚩🚩🚩.

Remember that the options trading world is very dynamic. Nothing can be set to stone. Those who claim to make 100% success with their returns are more often than not, exaggerating.

Trading with unregulated online platforms puts you out of the protection of laws and regulations made by the Monetary Authority of Singapore (MAS) to safeguard investors. Doing so will make you vulnerable to scams and put you in the position of being unable to resolve any grievances.

On the other hand, regulated financial institutions are subjected to MAS’ regulations that aim to protect investors’ money and assets. Furthermore, these institutions are required to maintain segregated customers accounts, controls, and records to safeguard your privacy and personal information.

As an investor, you are strongly encouraged to only deal with financial institutions regulated by MAS. You can refer to MAS’ website to double-check if your broker is regulated by MAS.

#2 Be Wary of Binary Options

In line with the first point, unregulated online trading platforms tend to offer another form of investment instrument that you must also be wary of, binary options. A binary option is a type of option that references an underlying instrument.

This instrument can be in a form of asset classes like stocks, commodities, currencies, and interest rates.

The returns of this type of Options are dependent on the instrument. If the threshold amount is exceeded, then there will be payment received. On the other hand, if the threshold is not met, no payment at all.

While it is true that binary options may provide the potential for high profits, it could also expose you to unnecessary risk which could lead to a significant amount of loss.

Always be skeptical when unregulated platform providers advertise binary options as “trading with zero risk”, “trading amounts of as little as $1”, or “profit payout of 500% per trade”. These are indications that these platforms are using Binary Options. They also tend to be based outside Singapore and you will unlikely be able to recover any amount of money lost should anything happen to the platform.

#3 Singapore Uses Warrants Instead of Listed Options for Trading

Do note that Singapore uses structured warrants as the market equivalent of options instead. Like options, warrants are contracts between the issuer and the investor that allows the investor the right but not the obligation to buy or sell the underlying stock at a fixed price during expiration.

They are securitized so that they can be traded like a stock in a derivatives exchange.

Warrants and Options also work the same way when it comes to call and put. However, they also differ in a lot of ways.

Here is a list of the main differences between structured warrants and standardised stock options, as listed by OptionTradingPedia.com:

| Structured Warrants | Standardised Stock Options | |

|---|---|---|

| Contract Terms | Defined by issuer | Standardised by exchange |

| Trading | Cannot be freely shorted | Can be shorted |

| Strike Prices | Only those issued | Usually a lot more strike prices and expiration |

| Delivery | Delivered by issuer | Delivered by investors |

#4 There is Not Much Difference Between Options in Singapore and Options in US

Options listed in Singapore are not much different from those listed in the US. At the onset, an option is simply a derivative based on an underlying instrument. There is no difference.

However, the only thing that contrasts the two is the size of their markets. The US market is wider and deeper. So there is a lot of liquidity.

There are also options listed available in US stocks. This provides a wider selection of trading choices for traders.

#5 Many Option Traders in Singapore trade exclusively in the US

Since the rise of online platforms in trading, more online options trading brokers allow Singaporean investors to trade on their platforms. As a result, options trading in the US market has become more accessible to traders in Singapore.

Singaporeans can now directly conduct options trading in the US market which is more convenient to them in terms of having their money wired to and from their accounts.

The most important reason why Singaporeans do this is that the US market is the biggest and provides more liquid options in the world. Therefore, there are more trading opportunities and grants exposure to international blue chips.

Furthermore, the US Market’s standardised stock options come with a lot more strike prices across more expiration dates.

Warren Buffett’s Option Strategy

Now that you’ve learnt how Options is a complicated instrument, you would know that its prices are determined by several factors that can easily swing from one end to the other.

As such, is it not surprising that Warren Buffett, one of the most successful investors of our time, has urged investors time and time again, to stay away from options and other forms of derivatives.

Here’s a snippet from the Berkshire Hathaway 2008 Annual report on Warren Buffett’s view on derivatives:

Derivatives are dangerous. They have dramatically increased the leverage and risks in our financial system. They have made it almost impossible for investors to understand and analyze our largest commercial banks and investment banks…

A normal stock or bond trade is completed in a few days with one party getting its cash, the other its securities. Counterparty risk therefore quickly disappears, which means credit problems can’t accumulate. This rapid settlement process is key to maintaining the integrity of markets. That, in fact, is a reason for NYSE and NASDAQ shortening the settlement period from five days to three days in 1995…

Derivatives contracts, in contrast, often go unsettled for years, or even decades, with counterparties building up huge claims against each other.

Berkshire Hathaway 2008 Annual report

Nonetheless, despite his warning against the use of derivatives, Warren Buffett’s holding company Berkshire Hathaway has been using options strategies to enhance its portfolio returns.

Here’s how they do it:

Berkshire Hathaway’s Put Selling strategy

Berkshire sells put options across 4 major indices:

- S&P 500 in the US,

- FTSE 100 in the UK,

- Euro Stoxx 50 in Europe, and

- Nikkei 225 in Japan

Their Put options contracts typically have a long time horizon of more than 15 years and the options are only exercisable at expiry.

Hence, Warren Buffett does not need to worry about the options being exercised earlier. This allows him to use the premiums received from selling the puts, to work through their investments.

We have added modestly to the “equity put” portfolio I described in last year’s report. Some of our contracts come due in 15 years, others in 20. We must make a payment to our counterparty at maturity if the reference index to which the put is tied is then below what it was at the inception of the contract. Neither party can elect to settle early; it’s only the price on the final day that counts.

To illustrate, we might sell a $1 billion 15-year put contract on the S&P 500 when that index is at, say, 1300. If the index is at 1170 – down 10% – on the day of maturity, we would pay $100 million. If it is above 1300, we owe nothing. For us to lose $1 billion, the index would have to go to zero. In the meantime, the sale of the put would have delivered us a premium – perhaps $100 million to $150 million – that we would be free to invest as we wish.

Berkshire Hathaway 2008 Annual report.

Let’s be clear. There’s no way retail investors like us will be able to sell 15-year puts like Berkshire Hathaway. Hence, the above-mentioned strategy would not work for retail investors like us.

Instead, here’re two option trading strategies that we could use:

How to Maximising your Investment Returns with Options (2 strategies)

A common way to use a similar strategy to Berkshire’s is known as the Cash-Secured Puts strategy which retail investors can access in the listed market.

This strategy is also used by Warren Buffett and is useful for investors who want to get paid while waiting to buy a stock at a predetermined price.

By repeating this strategy, you can repeatedly make money from the regular premium and also have a chance to buy your favourite stock at a discount. Not too shabby right?

Here’s how it works:

1 – Cash Secured Puts Strategy (Buffett’s Options Strategy for Retail Investors)

Selling cash-secured puts essentially means selling a put option while ensuring you have the required cash to back it up, should the options get exercised.

This is a useful strategy if you want to buy fundamentally good companies at a discount.

Here’s a scenario to help illustrate how it works.

Let’s say you have identified Nike as a fundamentally good company with growing revenue and a strong balance sheet. However, at the current price of $132, you think it is still expensive and you are only willing to buy if it drops to $123 (7% decline).

Instead of waiting and refreshing the charts every night, you decide that it’s better to get paid while you wait.

Hence, you decide to sell a put option with a strike price of $123, preferably with a date to expiry of 30 days since options decay much faster in the last 30 days).

By selling this put option, you will receive a premium of $100 per contract. As we get nearer to the expiry date, if Nike stays above $123, you get to keep the premium of $100. However, if Nike’s share price were to drop below $123, you would be able to purchase Nike stock at $122 ($123 – $1 options premium received) which is a great discount as compared to the initial price.

Win-win for you!

Potential Risk of Cash Secured Put Strategy

As explained above, you’re going into a Cash Secured Put option because you want to buy the stock at a discount.

This means that you may be assigned with the stock if prices drop below your strike price. Hence, you have to ensure you have the required capital before using this strategy.

The main risk is when you try to do this without having sufficient cash to back you up. That would efficiently become a naked put, which can be dangerous and lead to all the scary horror stories we have heard about options and margin calls.

In our scenario above, for each contract, you need to have at least $12,200 ($122 X 100 shares) in your account ready to buy the Nike shares.

With a premium of $100 and a buying power of $12,200, the monthly return is around 0.8%. Annualizing it, we would be getting around 9.8%, just to wait for a stock to drop to our ideal buy price.

Returns may vary!

Your return may vary depending on:

- the strike price you choose and,

- the volatility of the stock

The nearer your strike price is to the current stock price, and the more volatile the stock, the higher the premium you will get. But that also means there’s a higher chance of the options getting executed.

For the example above, the put option has a delta of 0.21 which means it has a 21% chance of getting exercised. If you are lost here, I covered more about the value of an option and its delta in part I of this series.

2 – Wheel Option Strategy

There are many ways to profit with options, and a good student must surpass his mentor.

Instead of stopping at the cash-secured put strategy, let’s bring our options trading one notch higher with the wheel option strategy.

What is the Wheel Option Strategy?

The Wheel Option Strategy is an options strategy is made up of two parts:

- Selling cash-secured puts to collect the premium. This is done repeatedly till we are assigned with the shares of the underlying stocks.

- Sell covered calls to collect even more premium till our shares get called.

- Rinse and repeat.

How to execute the Wheel Option Strategy

1) Sell Cash Secured Puts

The first step is to sell a cash-secured put as mentioned above.

Doing so, we will collect the premium from selling the put options. Using Nike as an example again, we will collect $100 premium per contract, with a date to expiry in 30 days.

By the end of the month when the options expire, one of the two scenarios will happen.

- If Nike share price stays above $123, which has a 79% probability base on its Delta, we just keep the premium of the options and repeat by selling another put options to collect more premium.

- If Nike share price drops below $123, we will be assigned with Nike shares. Once you are assigned the Nike shares, you will proceed to the next step.

2) Buy assigned shares

As Nike share price drops to your strike price, you would be assigned with its share using the cash you have allocated previously.

For each contract, you will receive 100 Nike shares at $123 per share. As such for 1 contract it would be $12,300.

This is where the basic cash-secured put strategy ends. But the subsequent steps would complete the loop to form the wheel strategy

3) Sell Covered Calls

As a proud owner of 100 Nike shares, you can now sell call options against your shares with a covered call option.

In this example, we will sell a 30 date to expiry call option with a delta of 0.40, meaning it has a 40% chance of being executed.

At the current price, we will be able to collect $450 per contract. By the end of the month, either of these two scenarios would happen:

- If Nike remains below the strike price, you will retain the share and can sell another covered call options for additional premiums.

- If Nike rises above your strike price, your Nike shares will be called over and would be sold to the options buyer, at your strike price.

4) Sell your share

As your shares get called away, you will receive the cash from the sale while also keeping the premium you had initially received.

With your cash freed up, you can repeat the whole cycle again by selling a new cash-secured put.

Your actual returns would vary depending on the underlying stocks, the implied volatility, and the Delta at which you sold the options. A safe estimate would be about 2% to 3% return a month which would annualise to 24% to 36%.

Potential Risk of Wheel Option Strategy

Nonetheless, this strategy does come with risks.

As with any stock, if the share price dips after you have been assigned, you would be sitting with an unrealised loss.

For this reason, this strategy should only be used on fundamentally strong stocks that are likely to rise in value in the long run. For a start, look for companies that have strong economic moats and have a huge market cap.

Conclusion

We’ve covered the fundamentals of Options trading and provided you with 2 options trading strategies in this article.

Undeniably, options is a complicated instrument with many factors affecting its price. It’ll take time to get the hang of, however, it would pay off in the long run if you decide to start using it to boost your investment returns safely.

Nonetheless, if you are still unsure of what you have just read, it may be a better option (no pun intended) to read up more before attempting to use options as an investment instrument.

Finally, there are many more options strategies out there that require lesser capital. Start small and explore your options safely!

If you’re thinking of generating an income stream with Options, join us at our Options Trading masterclass to discover how you can do it on your own.

Also, if you want to download this entire guide and keep it for your reference, simple let us know where to send it using the box below:

Hi, I am a newbie to stock option. Try out on demo trial on one of the trading firm.

Would like to seek your expertise on why I still make a loss when the stock value rises when I have made a sell to open call option. What other factors affect a call option profit when stock price rises.

Stock: LMT

Stock price when option exercised 334.71

Strike price at 330

Open price at 8.30

Expiry 9 days

Await your advise. Many thanks.

U r selling an ITM call in the hope that underlying will fall below strike 330 with 9 days to expiration.

Good articles to read. But I still not confident to go into option at the moment.

What are the reputable brokers for trading US options in Singapore?

Proper calculation can help you to become successful trader. The formula that you explained is really easy to understand.