On 24 March 2022, Singapore made a decisive move towards living with COVID-19 and took a major but measured step in opening up.

Entry rules into Singapore will be relaxed significantly from 1 April 2022, providing for quarantine free entry into Singapore for all fully vaccinated travellers without any on arrival test or quarantine requirements.

🎉

5 Singapore Hotel stocks likely to benefit

With this, we have identified 5 stocks with Singapore hotel assets that are likely to benefit from higher bookings and revenue per available room (RevPAR), as the industry benefits from an increase in travellers into Singapore.

1) Far East Hospitality Trust (SGX:Q5T)

Approx. -18% from pre covid levels.

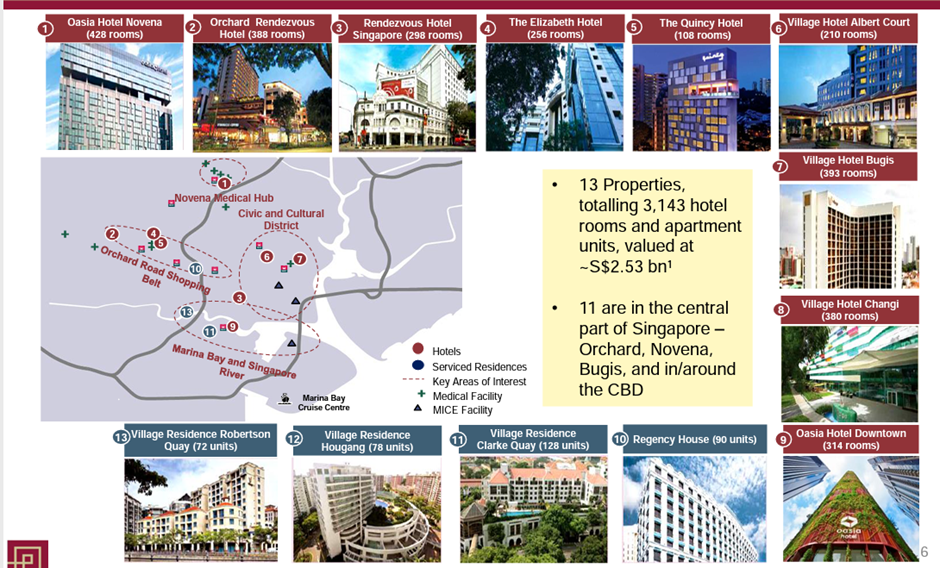

Far East Hospitality Trust (FEHT) has a portfolio of 9 hotels and 3 service residences entirely in Singapore. In addition, FEHT has a 30% stake in a joint venture which owns 3 assets in Sentosa, namely, Village Hotel Sentosa, The Outpost Hotel Sentosa and The Barracks Hotel Sentosa.

The stock is currently trading at S$0.64, below its net asset value(NAV) of S$0.83. FY21’s distribution per unit (DPU) was S$0.0263, of which S$0.0153 was distributed in 2H21, indicating that 2H21 was stronger than 1H21, mainly because of higher occupancy in the Hotel segment. RevPAR also picked up in 2H21. This is still much lower than FY19’s DPU of S$0.0381.

FEHT also recently divested Central Square for S$313.2 million, thus reducing its total portfolio size to S$2.3 billion and reducing its aggregate leverage from 41.3% as at December 2021 to 33.5%. This will allow for greater financial flexibility to seek out potential yield accretive opportunities.

2) Amara Holdings Ltd (SGX: A34)

Approx. -22% from pre covid levels.

Amara owns a portfolio of hotels and resorts under the Amara brand in Singapore such as the Amara Singapore, a 388 guestroom hotel and the Amara Sanctuary Resort in Sentosa, which comprises of 140 guestrooms, suites and villas. Amara also owns the 100am retail mall, situated just beside the Amara Singapore and manages the Thanying Restaurant and Silkroad restaurant situated in Amara Singapore. The company also has a hospitality portfolio abroad in countries such as China and Thailand and is also involved in property investment and development.

The stock is currently trading at S$0.36, below its net asset value(NAV) of S$0.70. FY21’s earnings per share was S$0.0131, of which S$0.0081 was earned in 2H21, indicating that 2H21 was stronger than 1H21, as the company recorded higher revenues from its hotel business. However, FY21’s result was still significantly below FY19’s pre pandemic revenue and earnings.

The company also provided a favourable 2022 outlook across all segments, with the Hospitality segment underpinned by the reopening theme while its property investment segment would benefit from increase prices for private residential.

3) CDL Hospitality Trusts (SGX: J85)

Approx. -22% from pre covid levels.

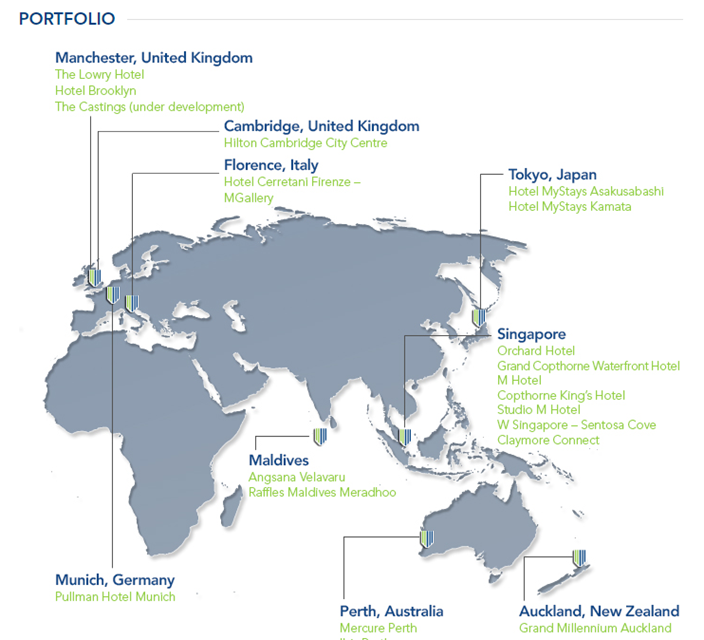

CDL Hospitality Trusts (CDLHT) has a portfolio of 20 properties, comprising 18 hotels, 1 retail mall and 1 apartment in 9 countries across the world. In Singapore, it has 7 properties which comprise 6 hotels and 1 retail mall, Claymore Connect. The 6 hotels are Orchard Hotel, Grand Copthorne Waterfront Hotel ,M Hotel, Copthorne King’s Hotel, Studio M Hotel and W Singapore–SentosaCove.

The Singapore properties account for S$1.7 billion or 65% of the total asset valuation and contribute 45% of the net property income(NPI).

The stock is currently trading at S$1.28, below its net asset value (NAV) of S$1.33. FY21’s DPU was S$0.0427, of which S$0.0306 was distributed in 2H21, indicating that 2H21 was stronger than 1H21, mainly because of higher contributions from 7 countries. Similarly, occupancy and RevPAR also picked up in 2H21. This is still less than half of FY19’s DPU of S$0.092.

CDLHT also recently acquired Hotel Brooklyn in Manchester, United Kingdom for approximately S$43.8 million, thus increasing its total portfolio size to S$2.6 billion. Assuming the acquisition was completed in Dec 2021, Aggregate leverage would increase from 39.1% as at December 2021 to 40.0%. DPU would increase from S$0.0427 to S$0.0432. With a dual prong approach of accretive acquisition and increased operational profit from the reopening, CDLHT is looking at higher YoY distributions to unitholders.

4) OUE Commercial Trust (SGX: TS0U)

Approx. -24% from pre covid levels.

Since the Merger of OUE Commercial Trust (OUECT) and OUE Hospitality Trust(OUEHT) in 2019, OUECT now has a portfolio of 7 properties in Singapore, with the former OUEHT contributing a total of 3 properties to the portfolio, 2 properties being Hotels and 1 property being a retail mall. The 2 hotel assets are Hilton Singapore Orchard and Crowne Plaza Changi Airport while the retail mall is Mandarin Gallery.

The hotel and retail property account for S$2.1 billion or 36% of the total asset valuation and contribute 41% of the total revenue.

The stock is currently trading at S$0.42, below its net asset value (NAV) of S$0.57. FY21’s DPU was S$0.026, of which S$0.0137 was distributed in 2H21, indicating that 2H21 was stronger than 1H21, mainly because of higher contributions from its hospitality segment. The Retail segment saw rents declined through the year due to the sustained operational challenges facing the prime retail segment due to the pandemic.

The Hilton Singapore Orchard Hotel was rebranded from Mandarin Orchard at a cost of around S$90 million. The hotel now has 1,080 rooms and five restaurants and bars. Its meeting and function spaces will span 3,765 square metres and include three ballrooms. OUECT expects a projected return on investment of roughly 10 per cent on a stabilised basis from its $90 million expenditure.

It was officially reopened in February 2022 with new MICE (Meetings, Incentives, Conferences and exhibitions) facilities and fresh dining concepts after the asset enhancement works were completed. The completion is timely to meet growing demand for regional and global MICE events from Singapore’s reopening. The hotel will also benefit from Hilton’s global distribution network and established partnerships and receive more direct bookings through Hilton’s loyalty programme.

5) Fraser Hospitality Trust (SGX: ACV)

Approx. -32% from pre covid levels.

Fraser Hospitality Trust (FHT) has a portfolio of 15 properties, comprising 9 hotels and 6 service apartments in 9 cities across the world. The 15 properties comprises of 3,071 hotel rooms and 842 serviced residence units.

In Singapore, it has 2 properties, namely the Intercontinental Singapore, a hotel with 406 rooms and Fraser Suites Singapore, a service residence with 255 units. The Singapore properties account for S$798 million or 36% of the total asset valuation and contribute 21% of the NPI.

The stock is currently trading at S$0.49, below its net asset value (NAV) of S$0.65. As FHT has retained some of its distribution in the past few financial years to conserve cash and maintain financial flexibility, we compared distributable income (DI) instead and noted that 2H21 was significantly stronger at S$12.4 million compared to S$8.6 million in 1H21 for a total of S$21million for FY21. This is still less than half of FY19’s DI of S$84 million.

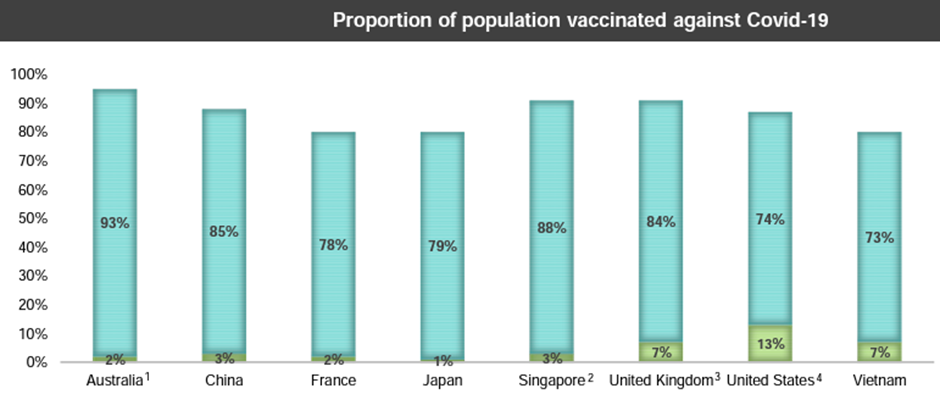

Similar to the other stocks mentioned above, FHT is poised to benefit from the reopening of Singapore’s borders. In addition, it also has a large percentage of assets based in countries such as Germany, Australia and UK which are countries with high vaccination rate and are also looking to reopen its borders.

The reopening of the Singapore borders is finally here after two long years!

Hotel stocks are asset heavy and geographically limited in nature and were severely impacted by travel restrictions and border closures. With the reopening providing for positive fundamental tailwinds, investors are presented with reasons for a potential buying opportunity.

While there could be other considerations such as interest rate hikes providing some headwinds, after weighing the pros and cons, investors may find that these Singapore hotel stocks could still provide value.