Inside: Discover the Unified Strategy Of Investing that’ll help you grow your money, regardless of how the markets are doing.

“We think this guide will help you to hack investing, the simple way.”

Alvin Chow, Founder & CEO

Believe it or not, over the past decade, a revolutionary investing strategy has emerged.

Whether you believe in value investing, dividend investing or trend following — you are going to love this, because never before has one strategy brought them all together.

Introducing: Factor-Based Investing;

An investing system backed by the peer-reviewed, gold standard of academic research and top money managers. It draws from the experiences of professional investors from the world’s richest man Warren Buffett to commodities speculator Richard Dennis, who turned $1,600 into $200 million within a decade.

This guide shows you exactly how a ridiculously simple, yet powerful investing approach can reduce your investment risks, and bring you market-beating returns. So read on!

CONTENTS

#1. What is Factor-Based Investing all about?

What is Factor-Based Investing?

You feel tired after a day’s work.

You wonder what caused the exhaustion since you have had enough sleep the previous night. Noticing your eye bags, a sales representative approaches you to share how the multi-vitamin supplements can help you get through your day with more vigour.

You listen, and your rational self asks a question.

“How do I know if it really works?”

Similarly, how do you know if a particular investment strategy would really work?

So you search the internet for answers. You come across a credible organisation which has conducted scientific research into the effects of supplements only to conclude that the benefits are marginal. Since the research is conducted independently and replicated by other researchers, you would want to assign more weight to them rather than your friend or the salesperson. You would be more inclined to believe what these doctors, scientists and nutritionists are saying.

You want to know if the supplement really works, but who can you look to for answers? If you attempt to ask your friends, those who take supplements will say they work while those who have not will convince you otherwise. The answers will be biased based on personal circumstances.

Unable to overcome the doubt, you say ‘no’ to the sales representative despite his repeated attempts to convince you.

Your close friend might recommended you a stock because he has heard some rumours about a takeover. The stock is going to sell at twice its current price soon, he whispers. You may have attended a talk by an investment guru who forecasts boldly that the market is going to crash and you should sell all your stocks and stay in cash. Or you might have met up with a financial advisor who tells you not to listen to both your friend and the guru and that you should stick to prudent long term investments. He then proceeds to show you a set of unit trusts you should be investing in.

Each is a self-proclaimed expert. Each touts his method to be the best. Who can you trust?

Can their investment strategy pass the ‘vitamin test’?

Like vitamins, finance has also been backed by established research. For stocks investing, there are proven Factors or metrics that will produce higher investment returns. If you have bought stocks that exhibit the characteristics, you will achieve better investment results.

These Factors and metrics have undergone rigorous statistical tests with decades of data as a validation process. The studies must also be able to stand against the stringent peer review process, whereby the findings remain consistent when other researchers repeat the tests.

Hence, these Factors can be considered proven and dependable primary drivers of investment returns.

Here is a simple analogy. If you want to build muscles you will need sufficient protein in your diet. Chicken meat is high in protein. Muscles are akin to investment returns, chicken meat is the asset that you buy (Eg. Stocks) and protein is the Factor you seek (Eg. Value).

We will discuss each Factor in more details.

VALUE AND SIZE FACTORS

The Father of Value Investing and His Descendants

1934 was the year ‘Security Analysis’ was first published.

Benjamin Graham and David Dodd were the authors. At that time, investing was largely speculative with very little talk about stock valuation. Security Analysis changed all that by dealing with the subject in depth.

Young Warren Buffett (left) and Benjamin Graham (right)

It bought about a paradigm shift for investors and the financial industry and the book laid the foundations for investment analysis today. Security Analysis is a timeless classic and Benjamin Graham is often referred to as the Father of Value Investing.

Interestingly, Graham did not use the term Value Investing in his literature. This term was coined after people realised he has started a movement. The movement has grown even stronger with the years. The flag bearer for Value Investing is none other than Graham’s disciple Warren Buffett.

Few would deny that Warren Buffett is the most successful investor of our time. He has spoken about his journey several times on print and on TV. He first got interested in investing after reading Security Analysis. He came to know that Graham and Dodd were teaching at Columbia Business School and he wrote to Dodd asking to be accepted to the school. He succeeded.

First edition Security Analysis selling at USD 20,000

Graham had a profound influence on Warren Buffett’s initial years as an investor. Buffett diligently followed Graham’s teaching to buy stocks which trading very cheaply against the value of its assets. The company he runs today, Berkshire Hathaway, was one of the cheap stocks Buffett came across in the early days.

Buffett was not the only disciple. In 1984, Buffett wrote an article “The Superinvestors of Graham-and-Doddsville” in honor of the 50th anniversary of the publication of Security Analysis.

In the article Buffett shared the market beating results of several value investing practitioners. It was a testament for Graham’s investment philosophy and a tribute to his teacher.

The Superinvestors of Graham-and-Doddsville by Warren Buffett

| Fund | Manager | Fund Period | Fund Return | Market Return |

|---|---|---|---|---|

WJS Limited Partners | Walter J. Schloss | 1956–1984 | 21.3% | 8.4% |

TBK Limited Partners | Tom Knapp | 1968–1983 | 20% | 7% |

Buffett Partnership, Ltd. | Warren Buffett | 1957–1969 | 29.5% | 7.4% |

Sequoia Fund, Inc. | William J. Ruane | 1970–1984 | 18.2% | 10% |

Charles Munger, Ltd. | Charles Munger | 1962–1975 | 19.8% | 5% |

Pacific Partners, Ltd. | Rick Guerin | 1965–1983 | 32.9% | 7.8% |

Perlmeter Investments, Ltd | Stan Perlmeter | 1965–1983 | 23% | 7% |

Washington Post Master Trust | 3 different managers | 1978–1983 | 21.8% | 7% |

FMC Corporation Pension Fund | 8 different managers | 1975–1983 | 17.1% | 12.6% |

Margin of Safety, Klarman’s out-of-print book on Amazon

Value investing is still widely practised today by legends like Seth Klarman of Baupost Group and Joel Greenblatt of Gotham Capital. They are more famous than most value investors because they share their ideas publicly.

Otherwise, value investors are a pretty reserved bunch and most prefer to make good money quietly. Klarman’s out-of-print book, Margin of Safety, is selling close to US$1,000 for a used copy.

Greenblatt is known for his quantitative value investing strategy, Magic Formula Investing, which has achieved market beating results since it was published in 2006.

Not Warren Buffett’s Brand of Investing

Mention Value Investing, and most people would immediately picture the gentile and avuncular Warren Buffett. He is the most successful investor in the world, and such an association is only normal. However, what we have in mind when we say ‘Value Investing’ is somewhat different from what Buffett has in mind.

Let us explain.

Warren Buffett was schooled under Benjamin Graham at the Columbia School of Business. After receiving his Degree, Buffett went on to work at Graham’s firm before managing money on his own. He was a keen follower and a very successful applicant of Benjamin Graham’s philosophy. He termed it the cigar butt investment approach and he explained it in Berkshire Hathaway’s 2014 shareholder’s letter.

Warren Buffett

“My cigar-butt strategy worked very well while I was managing small sums. Indeed, the many dozens of free puffs I obtained in the 1950s made that decade by far the best of my life for both relative and absolute investment performance… Most of my gains in those early years, though, came from investments in mediocre companies that traded at bargain prices. Ben Graham had taught me that technique, and it worked. But a major weakness in this approach gradually became apparent: Cigar-butt investing was scalable only to a point. With large sums, it would never work well.”

What prompted Buffett to give up on buying value small caps was that he became a victim of his own success. He made too much money from the strategy such that his capital became too large to invest in small and undervalued companies. He admittedly and regretfully said in 1999 to Businessweek:

“If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that. The universe I can’t play in [i.e., small companies] has become more attractive than the universe I can play in [that of large companies]. I have to look for elephants. It may be that the elephants are not as attractive as the mosquitoes. But that is the universe I must live in.”

Buffett met Charlie Munger in the early part of his career and together they built a new investment approach that was often in opposition to Graham’s teachings. While Graham advocated paying for a fraction of the asset value of a company, Buffett and Munger had no problem paying above the asset value as long as they are confident that the company’s cash flow would outgrow the premium in the future. While Graham advocated a well diversified portfolio to minimise risk, Buffett and Munger swung for the fences with concentrated bets.

Charlie Munger (left) & Warren Buffett (right)

These were strong divergence from Graham’s original strategy. Buffett eventually proved that it was a right move with the amount of wealth he had gathered applying his new found strategy together with Charlie Munger.

But as retail investors, we do not have many advantages if we were to copy Buffett’s approach. His business acumen and access to management are out of reach for the average joe. Without which, assessing the investment potential would be very inaccurate due to the many assumptions involved.

The good news is that retail investors do have an advantage that Buffett does not have. We can fully exploit the Value and Size Factors by sticking to Graham’s philosophy – buying small and undervalued companies – the exact method Buffett made his earlier fortunes with.

Value Investing Proven By Research

For the longest time, academics have firmly believed that the stock market is efficient.

They believed that all the information surrounding a company or a stock would have been reflected in its price. Hence, no investor has an advantage over another. This rendered stock selection a futile activity. Instead of expending effort to select stocks, investors should just focus on asset allocation, diversifying into a large number of stocks, bonds and cash. This is known as the Modern Portfolio Theory. It has since permeated the entire financial industry and has established itself as the cornerstone of portfolio management.

Eugene F. Fama (left) and Kenneth R. French (right)

The Cross-Section of Expected Stock Returns, by Eugene F. Fama and Kenneth R. French, was published in The Journal of Finance Vol. XLVII, No. 2 June 1992. We will dissect the key findings of this paper in the following paragraphs.

aka Price to Net Asset Value (NAV) ratio

First, Fama and French defined cheapness by Book-to-Market value. This is an inverse of the more commonly known Price-to-Book value. This is appropriate since Book Value is the accounting value or the net worth of a company, while Market Value is the price that the investors are willing to pay to own the company. This is also consistent with how Graham defined value, buying assets for a fraction of their worth.

Fama and French complied all the U.S. stocks and ranked them from the lowest to the highest according to their Book-to-Market value. They were then divided equally into 10 groups. The first group consists of the top 10 percent lowest Book-to-Market stocks, or the most expensive ones. The last group consists of the top 10 percent highest Book-to-Market stocks, or the cheapest ones.

This ranking and grouping was revised annually and the performance of each group measured from Jul 1963 to Dec 1990. During this period, the cheapest group gained an average of 1.63% per month while the most expensive group gained an average of 0.64% per month. There was an outperformance of 0.99% per month buying the cheapest group of stocks!

Figure 1 – Stocks ranked and grouped by Book-to-Market and their corresponding monthly returns

Next, Fama and French ranked all the stocks listed in the U.S. by market capitalisation and again sorted them in ten groups. The first group consist of the top 10 percent largest stocks by market capitalisation while the last group consist of 10 percent of the smallest stocks.

This ranking and grouping was carried out annually and the performance of each group was again measured from Jul 1963 to Dec 1990. The largest group returned 0.89% per month while the smallest group returned 1.47% per month, an outperformance of 0.58%!

Figure 2 – Stocks ranked and grouped by Market Capitalisation and their corresponding monthly returns

Lastly, Fama and French applied both the Book-to-Market and Market Capitalisation groupings to the stocks. They discovered that the smallest and cheapest group of stocks delivered the best performance in the study period, with a 1.92% return per month. This is higher than buying the smallest or cheapest group independently. This suggests that an investment style that focuses on small cap value has a statistical edge to achieve higher returns.

Figure 3 – Combining Book-to-Market and Market Capitalisation Applied Together (ME refers to Market Equity or commonly known as Market Capitalisation)

Over the years, this paper has grown to become the definitive reference for Factor Investing. The model within came to be known as the Fama-French Three Factor Model. As with all good academic research, it throws up a lot more questions than it answers. In the process, it serves as an inspiration for the rest of academia to seek out other Factors that affect investment returns.

The CNAV Strategy

The Conservative Net Asset Value (CNAV) strategy is a means to exploit Value and Size Factors, focusing on smaller cap stocks trading below their asset value (less liabilities). The strategy consists of two key metrics and a 3-step qualitative analysis.

#1. Determining the Conservative Net Asset Value

One of Benjamin Graham’s most famous strategies was the Net Current Asset Value (Net-Net) whereby an investor can find bargains in stocks which are trading below two-thirds of net current assets (defined as Current Assets minus Total Liabilities).

Walter Schloss kept the philosophy close to his heart and has applied it throughout his investment career. He makes a good point about investing in assets,

Walter Schloss

“Try to buy assets at a discount than to buy earnings. Earnings can change dramatically in a short time. Usually assets change slowly. One has to know much more about a company if one buys earnings.”

The late Dr Michael Leong, the founder of shareinvestor.com explains the concept in his book Your First $1,000,000, Making it in Stocks. He prefers to invest in ‘free’ businesses where the company’s cash and properties are worth more than the total liabilities. An investor will not be paying a single cent for future earnings. The way he frames the perspective is brilliant! In other words, pay a fraction for the good assets that the company owns, instead of paying a premium for future earnings.

We gather a very important principle from these brilliant people:

Pay a very low price for very high value of assets.

Going one step further, we do not just take the book value of a company. This is because not all assets are of the same quality. For example, cash is of higher quality than inventories. The latter can expire after a period of time.

Hence, we only take into account the full value of cash and properties, and half the value for equipment, receivables, investments, inventories and intangibles. And only income generating intangibles such as operating rights and customer relationships are considered. Goodwill and other non-income generating intangibles are excluded.

In doing so, the CNAV will always be lower than the NAV of any stock. This additional conservativeness adds to our margin of safety.

It is easy to find many stocks trading at low multiples of their book value. Many of them are cheap due to their poor fundamentals. Hence, we need to further filter this pool of cheap stocks to enhance our probability of success.

#2 Calculating The POF Score

Imagine you are in a fashion shop. The latest arrivals get the most attention and are sold at a premium (think hot stocks or familiar blue chips). In a corner there is a pile of clothes which remained unsold from the previous season and they are now trading at big discounts (cold and illiquid stocks).

Not all the clothes in this bargain pile are worth our time. They must be relatively less attractive since no one buys them in the first place. However, you can find nice ones (value stocks) sometimes if you are willing to dive in and search in the pile.

Although conceptually shopping for clothes and picking stocks are similar, the latter is actually more complex to understand and execute properly.

We turn to Dr Joseph Piotroski’s F-score to find fundamentally strong low price-to-book stocks that are worth investing in. He used a 9-point system to evaluate the financial stability of the lowest 20% price-to-book stocks and found that the returns are boosted by 7.5% per year.

As we have already added conservativeness in our net asset value, we do not need to adopt the full 9-point F-score. A proxy 3-point system known as POF score would be used instead. POF is detailed in the following paragraphs.

Profitability

While our focus is on asset-based valuation, we do not totally disregard earnings as well. The company should be making profits with its assets, indicated by a low Price-To-Earnings Multiple. Since we do not pay a single cent for earnings, the earnings need not be outstanding. Companies making huge losses would definitely not qualify for this criteria

Operating Efficiency

We have to look at the cashflow to ensure the profits declared are received in cash. A positive operating cashflow will ensure that the company is not bleeding cash while running its business. The operating cashflow also give us a better indication if the products and services are still in demand by the society. If not, the business should not continue to exist. A negative operating cashflow would mean that the company needs to dip into their cash to fund their current operations, which will eventually lower the company’s NAV and CNAV. The company may even need to borrow money if their cash is insufficient and this raises further concerns for the investors.

Financial Position

Lastly, we will look at the gearing of the company. We do not want the company to have to repay a mountain of debts going forward. Should interest rate rises, the company may have to dip into their operating cashflow or even deplete their assets. Equity holders carry the cost of debt at the end of the day and hence the lower the debt, the stronger it is.

How to avoid value traps?

We use a time stop of 3 years to get out of a position.

Behavioural economists, De Bondt and Thaler, came to the realisation that people do not make decisions rationally. Their decisions were distorted by the vast amount of cognitive errors they have to contend with.

Werner F.M. De Bondt

Richard H Thaler

Does the Stock Market Overreact? Werner F. M. De Bondt and Richard Thaler. The Journal of FinanceVol. 40, No. 3, Papers and Proceedings of the Forty-Third Annual Meeting American Finance Association, Dallas, Texas, December 28-30, 1984 (Jul., 1985), pp. 793-805

They were keen to discover how much of this is translated into stock prices. Are stocks priced correctly at all? Do investors overreact when it comes to stock prices? If they do, does it mean that stocks exposed to good news have become over-priced? Could it be that stocks that have had a bad run are actually undervalued in comparison with the general market? They set out to test their hypothesis.

They did so by mining price data from the New York Stock Exchange (NYSE) from January 1926 to December 1982. In the process, they created ‘Winner’ and ‘Loser’ portfolios of 35 stocks each. These are the top and bottom performing stocks for the entire market at each rolling time period.

The hypothesis is straightforward. If there is no overreaction involved, the winners will continue to outperform while the losers will continue to languish. However, if human beings being the imperfect decision makers they are display overreaction to stock price on the basis of good or bad news, the winners will eventually perform in a worse off fashion than the general market. And stocks in the loser portfolio will eventually catch up.

This is what they found.

To quote directly from the paper

“Over the last half-century, loser portfolios of 35 stocks outperform the market by, on average, 19.6%, thirty six months after portfolio formation. Winner portfolios earn about 5% less than the market. This is consistent with the overreaction hypothesis.”

From the outcome, there is little doubt investors get caught up with euphoria and over pay for stocks having a good run. They also become fearful of poor performing stocks, selling them and causing their prices to fall beyond what is reasonable.

Two other details about the study caught my attention.

De Bondt and Thaler choose the time frame of 36 months because it is consistent with Benjamin Graham’s contention that ‘the interval required for a substantial undervaluation to correct itself averages 1.5 to 2.5 years’.

As the graph has shown, most of the reversal took place from the second year onwards. This is consistent with Graham’s observations. It takes time for the market to eventually function as the proverbial weighing machine.

Secondly, the overreaction effect is larger for the loser portfolio than the winner portfolio. Stocks that have been beaten down due to investors overreacting to their bad performance eventually recovered faster and more than stocks whom investors have overvalued.

In a second study in 1987, Debondt and Thaler found that investors focused too much on short term earnings and naively extrapolated the good news into the future, and hence caused the stock prices to be overvalued.

They repeated the experiment in the first study, examining the 35 extreme winning stocks (Winner Portfolio) and the 35 worst performing stocks (Loser Portfolio). They wanted to track the change in earnings per share over the next four years.

They found out that the Loser Portfolio saw their earnings per share increase by 234.5 percent in the following four years while the Winner Portfolio experienced decreased earnings per share by 12.3 percent.

Eyquem Investment Management LLC plotted the changes in the average earnings per share of these two portfolios in the following diagram. This was taken from Tobias Carlisle’s book, Deep Value

The Undervalued Portfolio which had their Earnings Per Share dropped 30%, went on to improve their earnings by 24.4 percent in the following four years. The Overvalued Portfolio, which had 43 percent gain in Earnings Per Share in the past three years, only managed to achieve 8.2% in the next four years.

This imply that earnings also tend to revert to the mean.

Challenges Of Implementing Value and Size Factors

If more people adopt your strategy, would it not stop working? If the strategy is so good, why are you sharing it with everyone?

The truth is, investing in CNAV stocks is very unnatural and uncomfortable. Not many people are psychologically capable of investing in this manner.

For example, everybody knows that the strategy to keep lean and fit is to exercise more and eat less. But not many people can execute this strategy to achieve what they want.

Unfamiliar stocks

CNAV stocks tend to be unknown companies which many investors have never heard of. It is easier to buy a stock that is a household name than an unknown one. Unfamiliar names do not give the sense of assurance to the investors. Investors subconsciously think that these companies are more likely to collapse than ones that they are more familiar with.

Problems Present

These undervalued stocks tend to have problems that put investors off. The business may be making losses, the industry may be in a downturn, or simply the earnings are just not sexy enough. There are many reasons not to like the stock. Similarly, it is much easier to invest in stocks that are basked in good news – growing earnings, record profits, all-time high stock price, etc. Investors are willing to pay for good news in anticipation of better news. After all, isn’t investing all about buying good companies and avoiding bad ones? This problem is a second-level one. The good news and even potential good news have been factored into the price. In fact, investors often overcompensate for the good news without even realising it.

Low Liquidity

To make things worse, there is little liquidity in CNAV stocks. The lack of volume increase the doubts about these small companies. We are wired with the herd instinct and intuitively believe such stocks are lousy because few investors are invested in it. We have always based our judgement on the effect of the crowd. We want to buy books and watch movies with lots of good reviews. We like to try the food with the longest queue. We also apply the same crowd effect on the stock market to determine if a stock is ‘good’.

High Volatility

Due to the low liquidity, the bid and ask spread tends to be wider. This means that a little buying or selling can move the stock price by large percentages. Such large fluctuations do not bode well with investors as most are unable to handle volatility. Investors tend to overestimate their tolerance for volatility. They want 0% downside and 20% upside. Such investments do not exist in this world. It is a naive demand projected on stock market reality. Sadly, the only outcome is disappointment for the investor.

The reason why value investing works in the first place is because the majority of the investors are unable to overcome their psychological barriers. This results underpricing of value stocks. It is precisely this mis-pricing that we are trying to exploit.

MOMENTUM FACTOR

Trend followers are a group of traders who believe that price movements is the most important signal.

Go long if the price trend is up and short if the trend is down. Such a simplistic notion is often dismissed by investors who do not share the same belief. Value investors would find this approach absurd since their mantra is to buy an asset that has gone down in price and not buy something when the price has gone up.

Trend following has a history as long as value investing, with generations of practitioners delivering above market returns.

Jesse Livermore, one of the first trend followers. He was worth $100 million (today’s money est. $1.1 to $14 Billion) at the peak of his fortune in 1929.

The Father of Trend Following and His Descendants

Richard Donchian may not be a familiar name to most people. This is despite him being known as the Father of Trend Following. It was Donchian who developed a rule-based and systematic approach to determine the entry and exit decisions for his trades.

The most famous trend following story has to be about the ‘Turtles’.

Richard Dennis was a successful trader and reportedly turned $1,600 to $200 million in 10 years.

He believed that successful trading could be taught while his friend, William Eckhardt, believed otherwise.

They had a wager and Dennis recruited over 20 people without trading experience from various backgrounds.

Dennis called his disciples ‘Turtles’ and taught them a simple trend following system, buying when prices increased above their recent range, and selling when they fell below their recent range.

The story was written in the book The Complete Turtle Trader by Michael W. Covel

Richard Dennis

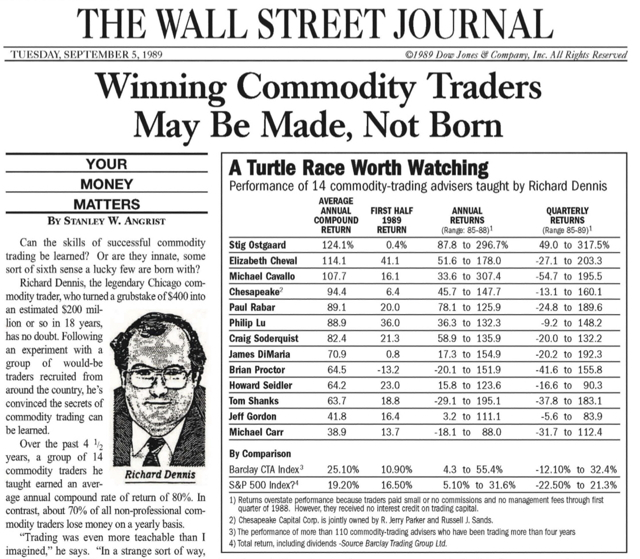

Winning Commodity Traders May Be Made, Not Born.

Richard Dennis sharing his top 14 commodity-trading advisers trading performance on WSJ.

William Eckhardt

The more successful Turtles were given $250,000 to $2 million to trade and when this experiment ended five years later, the Turtles earned an aggregate profit of $175 million. Besides proving that trading success could be taught, it also showed that trend following strategy can produce serious investment gains when executed well.

For time-series Momentum, we decide to go long or short by looking at the historical prices of a security, independent of the other securities. The other form of trend following is known as cross-sectional Momentum whereby we need to compare the historical returns among a group of assets to determine which ones to go long or short. Both approaches have been proven to produce above market returns.

Momentum Proven By Research

Narasimhan jegadeesh, Ph.D. Finance, Columbia University

Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency by Narasimhan Jegadeesh and Sheridan Titman [The Journal of Finance, Vol. 48, No. 1(Mar.,1993), pp. 65-91.]

Sheridan Titman, Ph.D. Carnegie, Finance, Mellon University

One of the most widely quoted and influential research about momentum is Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency by Narasimhan Jegadeesh and Sheridan Titman [The Journal of Finance, Vol. 48, No. 1(Mar.,1993), pp. 65-91.]

Jegadeesh and Titman divided the stocks into 10 groups by their historical performance for the past 3 to 12 months. They went on to observe the performance of these groups in the next 3 to 12 months. The stock selection was purely based on historical prices and not by any other valuation metrics.

The Study proved the Momentum effect – the Group with the highest historical returns was also the Group that delivered the highest returns in the ensuing months! Figure 4 shows the Group formed by stocks with the highest past 12 months returns gained 1.74 percent in the following month while the Group formed by stocks with the lowest 12 months returns gained 0.79 percent in the following month.

Figure 4 – Average Monthly Returns of Stocks Grouped by Their Past 12 Months Performance

They also found that the look-back period of the past 12 months returns produced higher returns than other look-back periods of past 9, 6, or 3 months. A look-back period of 12 months produced 1.92 percent per month while a look-back period of 3 months produced 1.4 percent per month. There was an outperformance of 0.52 percent per month. See Figure 5.

Figure 5 – Average Monthly Returns of Momentum Stocks with Various Look-Back Periods

Lastly, they found that holding the Momentum stocks for 3 months would produce higher returns than holding them for much longer periods. A holding period of 3 months would gain 1.31 percent in a month compared to 0.68 percent when holding the same stocks for 12 months, see Figure 6. This suggests that returns decline as we hold outperformed stocks longer than necessary.

Figure 6 – Average Monthly Returns of Momentum Stocks with Various Holding Periods

The findings tell us that we should use a look-back period of 12 months and hold the best performing group of stocks for another 3 months. This resolved the contradiction with the Value Factor.

In the short run, the Momentum Factor prevails. Investors will do well to ‘chase’ returns and hold these winners for a short period of time. However, in the long run, the mean reversion phenomenon kicks in. It would be better to buy undervalued stocks and avoid outperformed stocks if one plans to hold the positions for years.

The MODO Strategy

Leveraging on the findings from Jegadeesh and Tittman’s research, we will use a look-back period of 12 months to rank the returns of the stocks. We will prefer to long the stocks that are ranked in the top decile for the past 12 months.

Since Momentum Factor relies on prices alone without the need to analyse the fundamentals of the underlying businesses, technical analysis would be more suitable to generate entry and exit signals. We use the Donchian Channel as the indicator that was developed by Richard Donchian. The indicator forms price resistances and supports by the highest and lowest price points in the past 20 days. We prefer this over the favourite moving average indicator because the latter provide very little entry points after a trend is established, while the Donchian Channel enables an investor to join a trend easily as soon as prices break above the highest point in the past 20 days.

Momentum and Donchian Channel are abbreviated as MODO for this strategy.

Although the MODO strategy can be applied to stocks, we prefer to use it on ETFs. This is because individual stocks are often the subject of corporate actions. In such cases, we need to calculate and amend orders to accommodate changes in stock prices due to events like splits, consolidation and bonus issues. That would be too much work for short term holdings (about 3 months).

Hence, we found it much easier and even more diversified when we use ETFs. There are over 2,000 ETFs listed in the U.S. and we could easily find a country, or sector, or an asset class to long (or short with an inverse ETF). This has an additional benefit of exposing our Multi-Factor portfolio to include asset class diversification.

Frog-in-pan Stocks Perform Better

Human beings are slow to react to small incremental changes but are very alert to sudden large dislocations. It is analogous to leaving a frog on a pan and slowly heating the pan up. The frog would not notice the gradual increase in heat and hence would not jump out of the pan. It would have been cooked before it realised that the heat. On the other hand, the frog would jump out of a boiling pot of water if you throw it in.

Stocks that rise up slowly gets less attention from investors as compared to the stocks that have a sudden jump in prices. A study titled Frog in the Pan: Continuous Information and Momentum by Zhi Da, Gurun and Warachka, proved that stocks with frog-in-pan characteristics have more superior and persistent returns than those with more volatile and discrete price movements. Using the following diagram to illustrate, Stock A has a smoother path compared to Stock B even though their share prices started and ended at the same values. Stock A is the better choice for a Momentum play. In other words, the journey matters.

How To Handle Momentum Crashes

Momentum has another peculiarity – it backfires sometimes. Booms and busts are common in the financial markets and Momentum is particularly vulnerable when the market recovers. For example, during the post-Financial Crisis in 2009, you would have lost 163% shorting the weakest stocks and gained only 8% on the long side. Overall you would have blown up your account. This is known as a Momentum Crash.

There are 3 principles we abide with in order to mitigate the impact of Momentum Crashes.

First, a Momentum Crash affects the short side rather than the long side when the market recovers from a major crash. We only go long on Momentum counters and avoid shorting or the use of any inverse ETFs.

Second, we do not take leverage to invest in Momentum stocks. This is to prevent multiplying our losses when things do not go our way. It is very unlikely to blow up our capital when we go long on a group of stocks or ETFs without leverage.

Third, we pre-determine a sell price before the trend turns against us. It is commonly known as a stop loss order whereby our position will be closed if price fall below this stop order. This is a safety mechanism to take us out when we are proven wrong by the market.

Lastly, if all the precautions above failed to protect us, the last layer of defence lies in our Multi-Factor Portfolio. Within this portfolio, our maximum exposure to the Momentum Factor is capped at 20%. We will be well protected by the Value, Size and Profitability Factors.

Challenges of Implementing the Momentum Factor

Flight when we should FIGHT

The MODO strategy uses a price breakout approach where an investor buys only when the price surpass the past 20-day high, and sell when the price breaches the 20-day low. Such a breakout approach tends to be low probability in nature. It would be common for the investor to take consecutive losses but he must continue to put in the trades as the opportunities arise. It is not human nature to keep doing the same thing that invokes pain in us.

Fight when we should FLIGHT

The investor must be disciplined to take losses to preserve the capital even when it is painful to do so. One of the major dangers is to procrastinate taking losses and harbour the hope that the prices would recover. The losses can snowball to larger amounts which makes them even harder to bear. Eventually these large losses become a drag on the overall portfolio returns.

PROFITABILITY FACTOR

It is common sense for investors to look for profitable companies and avoid the unprofitable ones. One way to determine profitability is to focus on earnings or net profits. Ultimately, earnings should drive stock prices.

There are few arguments against this point among investors. Hence, we should be able to make investment gains as long as we can value a company by its earnings and pay a price lower than this value.

The obsession with earnings is obvious. Analysts often make estimates on companies’ next quarter earnings and stock prices often react according to how far their reported earnings deviate from analysts’ estimates.

Profitability Is Key To Investment Returns

Although investors agree on the role of earnings, few agree how best to use earnings to determine the value of stocks. John Burr Williams developed the intrinsic value concept. He said that the value of a company is based on the sum of its future earnings and dividends. Some would go further and use cash flow instead of earnings since the latter includes the less desirable non-cash gains.

Regardless, Williams had laid the foundation for methods like Gordon Growth Model and Discounted Cash Flow which are widely used today in the financial industry.

Even Warren Buffett articulated something similar in 1986 with his definition of owner earnings,

“These represent (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges…less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume….Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since (c) must be a guess – and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes…All of this points up the absurdity of the ‘cash flow’ numbers that are often set forth in Wall Street reports. These numbers routinely include (a) plus (b) – but do not subtract (c).”

The bottom line is, valuation of a company’s profitability is subjective. To complicate the matter, investors also look at qualitative aspects of a company to determine its future profitability. This goes beyond what the financial statements entail.

Philip Fisher’s Common Stocks, Uncommon Profits was one of the few investing books recommended by Warren Buffett. This is a great endorsement from the world’s best investor.

The book is still in print since it was first published in 1958, further proving the utility and dominance of his ideas even today. The thesis focused on finding exceptional listed companies that offers growth in sales and profits. Fisher believed that a company would become more valuable as they rake in more profits.

Hence an investor needs to identify traits that would allow a company to earn more profits in the future. He laid out 15 points in his book to guide investors on evaluating potential companies to invest in.

Common Stocks, Uncommon Profits by Philip Fisher

The evaluation includes the quality of management and the competitive advantages of the company. You could see many similarities in Warren Buffett’s investment philosophy.

Warren Buffett shared the concept of economic moat, an analogical reference to ancient castles with moats to ward off attacks. He painted a picture of what competitive advantage would look like.

Warren Buffett

“In business, I look for economic castles protected by unbreachable ‘moats’.”

Competitive advantage can be tricky to determine especially for investors with little experience and business acumen. Methods like Porter’s Five Forces are subjective at best and individuals may arrive with different assessment of competitive advantages.

Luckily, research has pointed out a metric that would quantify profitability and competitive advantages to a large extent. This is helpful for investors to implement an investment strategy with more objectivity and less personal judgement.

Profitability Proven By Research

Image taken from University of Rochester

Robert Novy-Marx defined a new paradigm to look at profitability. Instead of using earnings, he found that Gross Profitability was a better determinant of future investment returns.

He documented his research in The Other Side of Value: The Gross Profitability Premium [Journal of Financial Economics 108 (2013) 1-28].

His empirical studies proved that stocks with high Gross Profitability can have equally impressive returns as with value stocks.

Gross Profitability = Gross Profits divided by Total Assets.

Gross profits = Revenue – cost of goods sold / cost of sales

It ignores other costs that does not contribute directly in the production of a good or provision of a service. Some would argue the value of gross profits since it excluded numerous cost considerations such as marketing costs and depreciation. Others feel that earnings should be a better metric. Novy-Marx explained,

Novy-Marx

“Gross profits is the cleanest accounting measure of true economic profitability. The farther down the income statement one goes, the more polluted profitability measures become.”

Novy-Marx believes that earnings is a ‘dirty’ number which should not be used in valuation. He went on to substantiate his point,

“[A] firm that has both lower production costs and higher sales than its competitors is unambiguously more profitable. Even so, it can easily have lower earnings than its competitors. If the firm is quickly increasing its sales through aggressive advertising or commissions to its sales force, these actions can, even if optimal, reduce its bottom line income below that of its less profitable competitors. Similarly, if the firm spends on research and development to further increase its production advantage or invests in organizational capital that helps it maintain its competitive advantage, these actions results in lower current earnings. Moreover, capital expenditures that directly increase the scale of the firm’s operations further reduce its free cash flow relative to its competitors. These facts suggest constructing the empirical proxy for productivity using gross profits.”

The reason for using total assets as a denominator in place of equity was mainly to avoid the differences in capital structure among the companies. Some companies take on more debt while others less. The companies that took on more leverage will have an advantage as the book value is small (denominator). Hence, using total assets would remove the degree of leverage used by the companies and make the comparison fairer.

With most things equal, a company that generates more gross profits while using less assets would be of higher productivity and quality than her competitors.

Novy-Marx ranked the stocks by Gross Profitability and divided them into five groups. The Group with the highest Gross Profitability produced a monthly return of 0.6%, versus a negative return of 0.16% in the Group with the lowest Gross Profitability, see Figure 7.

Figure 7 – Average Monthly Returns of Stock Groups By Gross Profitability

Tobias Carlisle and Wesley Gray, the authors of Quantitative Value, conducted a separate test on the range of profitability metrics as shown in the table below.

Tobias Carlisle

Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors by Tobias Carlisle and Wesley Gray.

Wesley Gray

Earnings / Total Assets | Free Cash Flow / Total Assets | Return On Capital | Gross Profits / Total Assets | S&P 500 Index | |

|---|---|---|---|---|---|

Annual Gains | 9.84% | 10.80% | 10.37% | 12.56% | 10.46% |

His findings was consistent with Novy-Marx – Gross Profitability had the best returns compared to either earnings or free cash flow metrics.

Fong Wai Mun

A Profitable Dividend Yield Strategy for Retirement Portfolios [Journal Of Investment Management, Vol. 14, No. 3, (2016), pp. 1–11] by Fong Wai Mun and Ong Zhe Han.

Ong Zhe Han

Fong Wai Mun and Ong Zhe Han further enhanced the Gross Profitability with Dividend Yield as an additional criteria. The findings were published in A Profitable Dividend Yield Strategy for Retirement Portfolios [Journal Of Investment Management, Vol. 14, No. 3, (2016), pp. 1–11].

Similar to Novy-Marx’s approach, they grouped the stocks into quintiles by Gross Profitability. They labelled the highest Gross Profitability group of stocks as G5 and the lowest Gross Profitability group as G1.

Separately, they rank the stocks by their dividend yield and group them into quintiles. The group of stocks with the highest dividend yield was labelled D5 while the lowest dividend yield group was known as D1.

Fong and Ong found that the excess return per month was 1.04% for stocks that are in both G5 and D5 Groups, which are higher than the 0.66% in the G5 group. This enhanced the returns of a portfolio of Gross Profitability stocks. In fact, the simulated portfolio was more stable and fluctuated lesser (lower standard deviation) with the additional dividend criteria.

The GPAD Strategy

The Gross Profitability Assets Dividend (GPAD) Strategy is developed to identify stocks that possess the Profitability Factor. We have leveraged on Novy-Marx’s Gross Profitability (GPA) and Fong and Ong’s augmentation of dividend yield (D) criteria to the GPA to form the core metrics for our approach. Hence, it would be convenient to abbreviate the strategy or stocks with such characteristics as GPAD.

The GPAD strategy relies on relative valuation, which is unlike the absolute valuation used in the CNAV strategy. This means that knowing the value of Gross Profitability and the Dividend Yield would not provide sufficient information to make a buy or sell decision. We would need to know how well this stock ranked against the rest of the stocks to ascertain whether they belong to the top 20% group in GPA (G5) and Dividend Yield (D5). Hence, all the stocks in a stock exchange have to be calculated and ranked for this strategy.

A stock in the G5D5 group is an asset light business, that has competitive advantage over the other companies and the management is able and willing to distribute decent dividends. Hence, the GPAD strategy is suitable for investors who seek dividend paying stocks while enjoy potential capital gains too.

However, the GPAD strategy would penalise Real Estate Investment Trusts (REITs) despite of their high dividends. This is because properties are capital intensive and would constitute a large amount in the denominator of GPA, rendering a low ratio in comparison to those asset light businesses. Financial institutions are unique by their own measure and would also not rank well in the GPAD criteria.

An asset light business is easier to scale.

Marriott discovered that it would take a long time to build up capital to buy the next property and convert it into a hotel. They figured out that they are known for their hospitality, and expansion would be easier if they operate the hotel while others own the properties. The profits could be shared between the hotel operator and the building owner.

This model worked so well that allowed Marriott to be one of the biggest hotel chains in the world, and many other competitors have used the same model too. Secondly, asset light businesses do not require large reinvestment. Most of the profits could be ploughed into expansion or distributed as dividends, further enhancing the competitive advantage and attractiveness of these businesses. A stock that is able to produce higher dividends is likely to see higher stock prices, rewarding the shareholders with dividends and capital gains.

Gross Profits is the difference between Revenue and Cost of Goods Sold (COGS). While it is obvious that Revenue growth is a good sign, it is equally important to watch the COGS such that it does not grow at a higher rate and cause the Gross Profit Margin to reduce. COGS are costs related directly to the production of the goods for sale. This would be the variable cost of the company – COGS increases as more goods are sold.

A good company should increase Revenue and lower COGS at the same time, a sign that it has achieved economies of scale. A company with larger Gross Profits should be more advantageous than the competitors, suggesting competitive advantage is factored into the GPA metric.

Therefore, a high GPA stock is operationally efficient, using very little assets to produce high gross profits than their competitors.

We have also enhanced the stock picking process by adding Payout Ratio, average Free Cash Flow Yield and Earnings Yield criteria. Lastly, we also conduct simple qualitative analysis to identify any possible risks that might have been missed with the quantitative approach.

Payout Ratio

The Payout Ratio indicates the fraction or percentage of the earnings being paid out as dividends. A low Payout Ratio indicates that most of the earnings are retained by the company, especially if the funds are needed to fund growth opportunities. A high Payout Ratio indicates that most of the earnings are distributed as dividends, keeping little funds in the company. Usually mature and profitable companies are able to maintain a high Payout Ratio. It shows stability as well as low growth prospect.

We should expect a stock with low Payout Ratio to produce more capital gain in the future. Assume Company A and B each earns $1 per share. Company A decided to distribute $0.20 as dividends and its Payout Ratio would be 0.2 while Company B decided to distribute $0.70 as dividends and its Payout Ratio would be 0.7. Correspondingly, Company A and B would retained $0.80 and $0.30 per share respectively.

The retained earnings would increase the Net Asset Value (NAV) / Book Value / Shareholder’s Equity. In other words, Company A and B’s NAV per share would increase by $0.80 and $0.30 respectively. Their share prices should gain by the same amount if they were to reflect fundamental value of the companies, hence producing capital gains to the shareholders.

The Payout Ratio gives us a gauge of the proportion of returns in the form of dividends and capital gains.

This assumption may not hold when the company pursue expansion plans. For example, if Company A invests the retained earnings of $0.80 per share but wasn’t successful, the $0.80 value might be destroyed. If successful, the retained earnings might multiply beyond $0.80 per share, generating more wealth for shareholders.

A sustainable Payout Ratio would be below 1, so that the dividends is paid within the amount of earnings. It is very likely the dividend distribution would drop the following year if the Payout Ratio is more than 1, thereby trapping unaware investors who were misguided by the high dividend yield.

Average Free Cash Flow

Most of the companies uses the accrual accounting format, which simply means that earnings can be cash and non-cash based. We will use a lemonade stall to illustrate the differences.

Scenario A | Scenario B | Scenario C |

|---|---|---|

Sold 30 glasses of lemonade and received $30 cash payments at the point of sale. | Delivered 30 glasses of lemonade to a party and invoiced the customer $30. | A customer paid $30 in cash for 30 glasses of lemonade to be delivered to a party next week. |

Revenue = $30 | Revenue = $30 | Revenue = $0 |

Cash Received = $30 | Cash Received = $0 | Cash Received = $30 |

We can see that the revenue and cash received by the company may not always be the same amount. This is the effect of accrual accounting whereby revenue is recognised after the goods or services have been rendered. It is independent of whether the cash has been received by the company.

Given a choice, Scenario C is the best for the lemonade stall as it is better to collect the cash first to buy the ingredients for the lemonade, and deliver later. It is quite difficult for the stall to go bust if they can continue to receive the cash orders. Scenario B is the worst since the stall owner always has to fork out the ingredient costs and run the risk of some customers defaulting their payments.

With this understanding, this is why we cannot rely on earnings alone and analysing the cash flow is crucial to any business. A company with losses but good cash flow will last a long time. A company with large profits but poor cash flow will run the risk of bankruptcy.

One of the most stringent ways to analyse cash flow is to use Free Cash Flow (FCF). It is calculated by deducting the capital expenditures from its Operating Cash Flow. Capital Expenditures (CAPEX) are investments on fixed costs or long term assets that are crucial to the operations of the company. In the case of the lemonade stall, the CAPEX could be flasks, ladles and dispensers. These are cheap items and we can conclude that the CAPEX for the business is low and it should be able to generate good FCF.

Good GPAD stocks should have high FCF since they are asset-light businesses that require little CAPEX. They are also more likely to distribute most of these cash as dividends.

FCF tends to be lumpy as CAPEX may not happen every year. It is thus more usable to average the FCF across five years before comparing to the latest dividend distribution. We deem the dividend distribution sustainable when the average FCF is larger than the dividend distributed.

Expected Total Returns From A Stock (Earnings Yield)

It is important to look at the total returns in a stock even if you are a dividend investor. Total returns is essentially dividend gains plus capital gains.

This relates to the payout ratio criteria. If the payout ratio is low (dividends are low), we expect a higher capital gain, and vice versa. Hence, we can use dividend yield and payout ratio to determine the expected total return of a stock.

For example, if a stock has a dividend yield of 5% and the payout ratio is 0.8, the expected total gain would be 5% divided by 0.8 which gives us 6.25% per year. This isn’t attractive returns and we might just want to sit this out. In general, we would only invest in the stock when its total returns exceeds 10% per year. There are caveats of course.

If a company has some growth prospect, we can accept below 10% total returns. This is because the earnings and dividends should grow over time and we would achieve higher returns in the future. It can also happen to cyclical stocks such as those in the commodities industry.

For example an oil and gas stock has a dividend yield of 5.7% and a payout ratio of 0.7. This stock would give an expected total returns of 8.14% which is less than 10%. One can still invest because the current low earnings was due to the poor outlook for oil and gas industry. We should expect it to ‘grow’ back to previous earnings when oil prices recovers, and we should be able to get more than 10% total returns per year in the future.

The way we have estimated the total return is similar to the earnings yield of a stock, which is the inverse of its PE ratio (a value metric). A PE 10 stock would give you an earnings yield of 10% (1/10). A PE 5 stock would be an earnings yield of 20%. Hence, when we set an earnings yield of 10%, we are indirectly buying stocks with PE less than 10.This concept of estimating annual returns cannot be used for stocks in general because of accrual anomaly – stocks with high earnings but largely non-cash basis would have lower returns. This means that even a low PE stock or high earnings yield stock may underperform if the earnings are non-cash in nature.

It works for GPAD stocks because they have been assessed to have largely cash-based earnings and moreover able to distribute cash dividends. This helps us minimize the accrual anomaly effect and the earnings yield becomes more accurate as a measure.

A MULTI-FACTOR PORTFOLIO

Benjamin Graham has always preached a well-diversified portfolio of stocks, on top of the margin of safety that can be achieved from each stock.

This is because an investor neither know which stock would rise in price in order to weigh a lot of capital prior to the price movement, nor does the investor know which stock would deteriorate in the fundamentals to warrant a sell off.

In fact, you would just need a few stocks with big runs to contribute to the overall returns in your portfolio. Walter Schloss had large number of stocks and still achieved 15.3% returns per year and Warren Buffett praised Schloss for that,

Warren Buffett:

“Walter has diversified enormously, owning well over 100 stocks currently. He knows how to identify securities that sell at considerably less than their value to a private owner. And that’s all he does. He doesn’t worry about whether it it’s January, he doesn’t worry about whether it’s Monday, he doesn’t worry about whether it’s an election year. He simply says, if a business is worth a dollar and I can buy it for 40 cents, something good may happen to me. And he does it over and over and over again. He owns many more stocks than I do — and is far less interested in the underlying nature of the business; I don’t seem to have very much influence on Walter. That’s one of his strengths; no one has much influence on him.”

The following question is:

How Many Stocks To Diversify Into?

We turned to the academics for the answers.

We have to define two types of risks.

Systematic Risk

This is also known as the market risk. You may have experienced good stocks coming down in price when the overall stock market is weak, and stocks with bad fundamentals can still go up if the stock market is bullish. Hence, regardless what stocks you have pick, their price movements are also affected by the overall market sentiment.

Unsystematic Risk

This type of risk is more stock- or industry-specific. For example, a company is fraudulent in nature and the effect of the collapse of this company only affect the shareholders of this stock and not the entire stock market. Or it can be a particular industry that is undergoing a bear cycle and hence most, if not all, the stocks in that industry would be affected.

With reference to the chart below, it is evident that the systematic risk of the stock market is the minimum risk we must accept when we invest in stocks. This risk cannot be diversified away.

However, if we are able to build a portfolio of stocks that are of various industries, we would be able to reduce our investment exposure to unsystematic risks. As we add more stocks, the unsystematic risk reduces exponentially. This means that we do not need a lot of stocks to achieve a good diversification.

Diversifying By Factors

The Modern Portfolio Theory (MPT) has dominated the way we plan finances since it was made popular decades ago. The Theory advocates asset allocation – diversifying our capital into stocks, bonds and cash. If we are more aggressive and willing to take more risk, we should have a higher proportion in stocks. Else, we should have a bigger proportion of bonds and cash in the portfolio.

We are able to diversify further and reap higher investment gains after the discovery of Factors. Currently most of the Factors apply to stocks but research is catching up with Factors for bonds too. Below is a pictorial depiction of a multi-asset and multi-factor portfolio.

Larry Swedroe and Andrew Berkin backtested a multi-factor portfolio comprising various Factors in their book, Your Complete Guide To Factor-based Investing. They found that any combination of Factors performed better than a single Factor alone.

Larry Swedroe

Your Complete Guide to Factor-Based Investing: The Way Smart Money Invests Today by Larry Swedroe and Andrew Berkin

Andrew Berkin

The possibility of underperforming the market reduces by 3 to 4 times as you combine more Factors in a Portfolio.

This is because one particular Factor may not produce the best performance all the time. Value could dominate the returns for a few years while Profitability lagged, but all of a sudden Value could lose its shine and Profitability reigns.

Lack of the ability to know which Factors would perform well, a prudent approach is to diversify by Factors.

In finer details, we have observed that CNAV and GPAD are very different stocks. CNAV (Value and Size) would focus on asset-heavy companies such as property stocks that GPAD (quality) would penalise. GPAD would benefit asset-light companies like F&B and healthcare while CNAV would not value them highly. This means a portfolio that uses both strategies would have more options to diversify.The returns and risks were impressive when value and quality stocks were combined, as discovered by Novy-Marx,

“An investor running the two strategies together would capture both strategies’ returns, 0.71% per month, but would face no additional risk. The monthly standard deviation of the joint strategy, despite having positions twice as large as those of the individual strategies, is only 2.89%, because the two strategies’ returns have a correlation of -0.57 over the sample.”

The non-correlation is an important consideration for portfolio construction. Value stocks do not work all the time and we would like quality to work well to compensate. Novy-Marx added that,

“Profitability performed poorly from the mid-1970s to the early-1980s and over the middle of the 2000s, while value performed poorly over the 1990s. Profitability generally performed well in periods when value performed poorly, while value generally performed well in the periods when profitability performed poorly. As a result, the mixed profitability-value strategy never had a losing five-year period over the sample.”

In a nutshell, Factor-Based Investing is the new frontier of investing and investors should be open to explore how it could help you lower risks and increase returns. While asset allocation still plays an important role, tilting your portfolio towards a variety of well established Factors could help you reach your financial goals faster.

3 thoughts on “Factor-Based Investing: The Complete Guide”

Comments are closed.