Frasers Logistics & Commercial Trust (FLCT)* is an industrial (logistics and data centres) and commercial REIT which remained resilient during the pandemic, and continues to benefit from digitalisation.

*Frasers Logistics & Commercial Trust was previously named Frasers Logistics & Industrial Trust (FLIT). This change came about as a result of a merger with Fraser Commercial Trust (FCOT) in 2020.

With strong operating performance, FLCT’s share price has been climbing steadily. This growth has lead to FLCT’s inclusion into the Straits Times Index, a market capitalisation weighted index that tracks the performance of the top 30 companies listed on SGX.

Since the crash in Mar 2020, FLCT’s share price has run up significantly. Will it continue to perform well? Or will its share price plateau from here on?

In this article, we shall analyse FLCT’s potential growth and its risk. Thereafter, we can determine if it is a good buy now.

Frasers Logistics & Commercial Trust’s Portfolio Overview

FLCT’s portfolio comprises of 97 industrial and commercial properties, worth approximately $6.3 billion, across five major developed markets namely Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

Unlike other Singapore REITs which have most of their properties geographically located in Singapore, FLCT’s properties are mostly located overseas with only 20.1% in Singapore. Of its overseas properties, it has the most properties in Australia accounting for 47% of the total portfolio value.

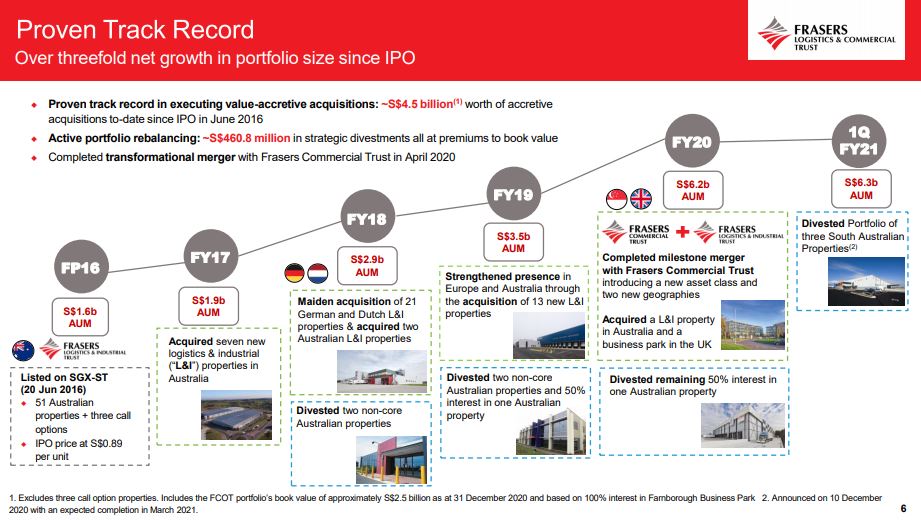

Originally named Frasers Logistics & Industrial Trust, FLCT was listed in 2016 with a focus on Industrial and Logistics properties. However, following its merger with Frasers Commercial Trust in 2020, its investment strategy has since expanded to include business parks (comprising primarily non-CBD office space and/or research and development space) and commercial buildings (comprising primarily CBD office space).

As of May 2021, FLCT has 58.7% of its portfolio in Logistics & Industrial properties while the remaining 41.3% is shared between its Business park and Commercial properties.

Other than the merger, FLCT’s AUM growth can also be attributed to multiple acquisitions it has completed over the years. These acquisitions which are mostly yield accretive assets has continued to provide shareholders with a higher yield. This is a positive sign of a great management.

Financial Performance

Revenue

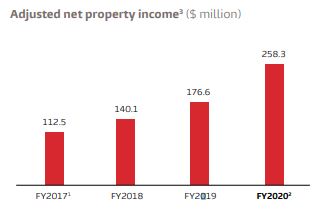

Since its listing, FLCT’s revenue has been on an uptrend with growing revenue and net property income increasing year on year including in FY2020 when many REITs had been impacted by the pandemic.

Revenue for FY2020 is up 53% compared to FY2019. The huge jump was mostly contributed by the merger between FCOT and FLCT made effective from 15 April 2020. If we take into account that the Industrial sector makes up 74.7% of the total revenue as stated in its financial report, FY2020 revenue without FCOT properties would come to $248 million which is still a substantial 14.2% growth compared to last year.

Likewise, for its Net Property Income, we can see a healthy growth over the years. After removing the contribution from FCOT, which makes up 21.6%, FY2020 NPI grew 14.6% which is a commendable growth.

Given that Australia makes up the most of FLCT’s Revenue and Net property income, it is heartening to see that Industrial Prime Grade Rent and Prime CBD Commercial Rent is on a stable and upwards trending for some. As such we can expect this REIT to perform well in the coming years.

Occupancy and Lease Expiry Profile

As of 31 Mar 2021, FLCT maintains a high portfolio occupancy rate of 96.8%. Breaking it down, its logistics & industrial portfolio has a 100% occupancy rate while its commercial properties (acquired during the merger with FCOT) has an occupancy rate of 92.6%.

With a Weighted Average Lease Expiry of 4.7 years, the vacancy risk is low for FLCT which translates to a stable rental income for FLCT. This risk is further minimised with its well spread-out lease expiry as no more than 17% of Gross Rental Income (GRI) expire each year.

FLCT’s tenant base is well-diversified across different sectors with the highest percentage making up 23.6% only. Of all its tenants, one-third of the logistics and industrial portfolios are also engaged in e-commerce related activities which have been and will continue to benefit from the digitalisation trends.

Drilling down to its top 10 tenants, we notice that a majority of its tenants are government entities and multinational companies which provides a stable base of rental income to FLCT.

More importantly, these top 10 tenants make up only 24.1% of GRI and none of them accounts for more than 5.1% of total GRI. This reduces the dependency of any individual tenant, which could upset its revenue, should they not renew their leases.

Distribution Per Unit (DPU)

While the revenue and net property income of FLCT has shown tremendous growth over the last 5 years since its listing, its DPU has remained relatively flat. This can be attributed to the growing number of FLCT shares as it raises capital to acquire more properties. The growing pie is now shared with more people thus leading to a levelled DPU.

On a positive note, the recently announced DPU for 1HFY21 was 3.8 cents, up 9.5% from 3.47 cents in 1HFY20. While this is not sufficient to predict the future trend, this growth may be a sign that FLCT’s yields accretive acquisitions are starting to reap results.

Nonetheless, we should remain cautious as roughly half of its properties in terms of property values are in offices and business parks that are currently affected by the pandemic.

Net Asset Value

FLCT’s Net Asset Value (NAV) per unit has been growing ever since its listing. This is great as a growing NAV per unit means that each share is worth more now. This rise in NAV could be attributed to the rise in the valuation of its properties and the acquisitions of NAV accretive assets in recent years.

Financial Strength

FLCT’s balance sheet is strong as ever. As of 31 March 2021, its gearing ratio is 35.3%, well below the 50% regulatory limit. In addition, FLCT high-interest coverage ratio of 6.8x shows that the company will have no problem servicing its outstanding debt.

To note, FLCT’s current cost of borrowing stands at 1.9%. With such a low cost of borrowings, I believe FLCT can tap on the debt market for more loans easily should the need arise.

FLCT’s average Weighted Debt Maturity is at 3.1 years and as seen from the figure above, its debt maturity is rather spread out. (though we should keep a lookout for the FY2024 and FY2025 debt levels)

Strong sponsor

FLCT is sponsored by Frasers Property Limited which is one of the major property developers in Singapore. With a strong sponsor like Frasers Property Limited, FLCT would have access to loans with a lower interest rate from financial institutions due to its reputation.

Apart from that, it also ensures a pipeline of assets that FLCT could acquire from Frasers Property Limited. This ROFR* pipeline as mentioned in the last AGM was upwards of $5 billion granted by Frasers Property. This is approximately 2.0 million sqm, of which the majority comprise logistics and industrial assets (75.5%), followed by office and business parks (19.2%) and CBD commercial (5.3%). By geography, the majority of the ROFR `pipeline are located in Australia (36.0%), Germany (26.9%) and the UK (24.4%).

*Typically, there is usually a right of first refusal (ROFR) agreement between the REIT and its sponsor. As such, when the sponsor wants to sell its property, the REIT will be offered the right to purchase it before it is being offered in the open market.

Recent Acquisitions

FLCT has recently completed a private placement of 240 million new units at an issue price of $1.399 per new unit (2.4% discount from last traded price). The proceeds of this private placement (approximately $335.8 million) together with debt facilities, will be used to fund the proposed acquisition of six freehold properties in Germany, the Netherlands and Britain. Comparing this deal with the current properties valuation of $6.3 billion, this $546.7 million acquisition is roughly 8% of its total portfolio.

This deal has shown FLCT’s interest in the European market and its attempt to strengthen its foothold in key logistics markets. With more properties in Europe, it would allow FLCT to capitalise on strong logistics industry tailwinds there, given that the pandemic has accelerated online retail spending there.

This latest deal also shows the managers proactiveness in acquiring properties that are beneficial to investors. This deal would be DPU and NAV per Unit accretive which would provide a good yield over the years.

In addition, I am glad that the fees payable to the Manager for the EU acquisitions will be in the form of FLCT units, which they are prohibited from selling within one year from the date of issuance. This shows the manager’s skin in the game and that they are not trying to profit from the one-off acquisition fee at the expenses of shareholder, which has been the case for some REITs in the past.

Risk

Commercial properties continue to be affected by the pandemic

After merging with FCOT in 2020, FLCT now has offices and business parks in its portfolio. This sector has been affected badly last year and continue to be as countries face a resurgence of Covid-19 cases.

Take Singapore for example, a recent increase in the number of locally transmitted Covid-19 cases has prompted the authorities to made work from home the default. This was a sharp contrast to the 75% headcount in offices on April 5, just two months back.

Likewise, in Germany and the Netherlands, there was a surge in infection cases which has only dropped recently. This shows how uncertain the situation FLCT is facing and one they would have to find ways to get through it together with the tenants.

Australia’s strained relationship with China

The number of Covid-19 cases in Australia has remained low with little to no community transmissions. Together will the rollout of vaccines, Australia is right on track to recovery if there is no resurgent of Covid-19 cases. This is great news to FLCT given that a huge proportion of its properties are situated there.

However, another issue facing FLCT would be the strained relationship between Australia and China.

As you may have heard from the news, China and Australia are not the best of friends now. Following a tit for tat move in the political arena, China has started to impose trade restrictions on Australia’s goods. With China being Australia’s largest trading partner, this has raised concerns over the deterioration of relationships between both countries. If this were to continue, there may be implications to the supply chain which will subsequently affect logistics properties like those FLCT has.

FLCT’s valuation

So, is FLCT at a good price now? Let us look at its valuations.

Price to Book

With a PB ratio of around 1.3, even with the run-up of its share price, FLTC seems fairly priced as of now when we compare it to its historical average.

Source: Finbox

Comparing this with some of its industry peers, Mapletree Logistics Trust (SGX: M44U), Mapletree Industrial Trust (SGX: ME8U), and ARA LOGOS Logistics Trust (SGX: K2LU), FLCT PB ratio seems in line with the industry and hence is fairly priced. (Do note there this is not an apple-to-apple comparison as FLCT has a mixed of Logistics, Industrial and Commercial Properties.)

Source: Finbox

Dividend Yield

Source: Finbox

In terms of dividend yield, with an annualized dividend yield of 5.94% currently, FLCT is slightly overvalued as compared to its average return of 7%.

Will I consider?

No doubt, FLCT has a great management team driving its strong performances over the years. The team has ensured that acquisitions it undertook were DPU and NAV per unit accretive which continues to benefit shareholders. And under their management, FLCT has grown its revenue and net profit over the years, which is commendable.

However, as most of FLCT properties are out of Singapore, I do not have a strong conviction in this because I do not know much about the industrial and logistics demands in Australia and Europe.

As opposed to China which we can bet on its high economic growth, Australia and Europe are pretty much mature economies with limited growth, hence the risk to reward ratio is not appealing to me.

In addition, the merger with Fraser Commercial Trust has reduced the appeal of FLCT in my opinion. While the merger has grown FLCT’s market capitalisation and allowed them to take advantage of increased capital base and higher debt headroom, I feel this merger is done to ‘save’ FCOT from its poor performance.

Looking at Frasers Commercial Trust FY2019 financial report, from FY2017, its NPI has been decreasing while its DPU remained stagnant.

For these reasons, I shall watch at the side-lines for now.

Of course, if you have more insights of the Australia and European market and believe that there is a future for FLCT moving forward, there is no harm to nibble a bit.