In 2002, Capitaland Malls Trust became the pioneering Real Estate Investment Trust (REIT) to be listed on the SGX, paving the way for many other REITs to follow suit. Fast forward to today, and the SGX is now home to over 50 REITs and business trusts.

Among them, 23 have at least 10 years of trading history for us to make a performance comparison.

Given that REITs are typically known for their high dividend yields, it is important to evaluate their performance based on both capital gains and dividend returns, also known as total returns. This is because while the share price may appear stagnant at times, the cumulative dividends received over the years can add up significantly and contribute to the total return on investment.

18 REITs had gains, 5 lost money after 10 years

Over the past 10 years, the majority of REITs have performed well, with 18 out of 23 REITs showing positive returns to unit holders, while only 5 out of the 23 REITs have generated negative returns. This suggests that investing in REITs over a longer term can offer attractive returns to investors.

An analysis of the 23 REITs with at least 10 years of trading history reveals that an investor who bought and held these REITs over the past decade would have earned a total return of 55%, equivalent to a compounded annual return of approximately 4.5%. While this may not seem overly impressive, it is still better than the 36% return generated by the Straits Times Index ETF (ES3) over the same period.

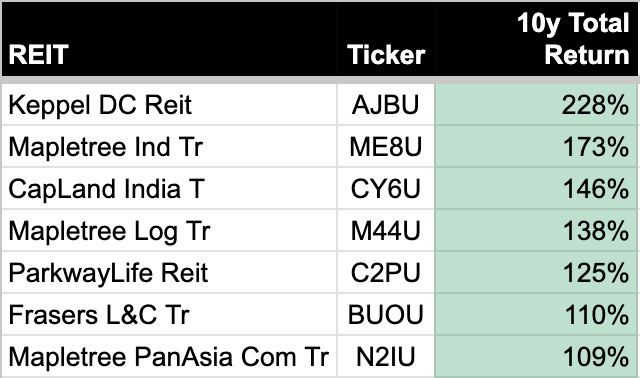

It’s important to note that not all REITs perform equally, with some demonstrating better returns than others. Out of the 23 REITs with at least 10 years of trading history, 7 have delivered total returns of more than 100% over the past decade.

The top performer was Keppel DC REIT, which generated an impressive total return of 228%. This can be attributed to the market premium placed on data center properties, in which Keppel DC REIT has a significant exposure. Another REIT that has benefited from the growing demand for data centers is Mapletree Industrial Trust, which ranked second to Keppel DC REIT with a total return of 173%.

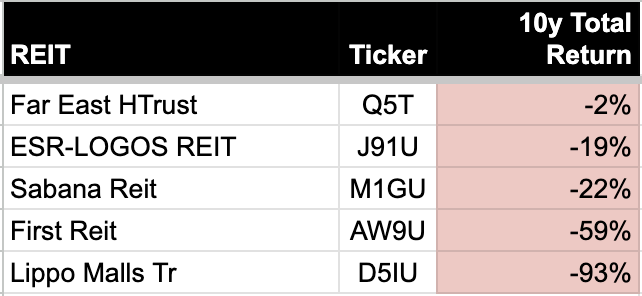

On the other end of the spectrum, the worst performer among the 23 REITs was Lippo Malls Trust, which suffered a significant decline of 93% in total return over the past decade. The REIT has faced challenges in meeting its debt repayments, contributing to its poor performance.

Singapore properties outperform overseas properties by 2x

I had a perception that local REITs may be outperforming their overseas counterparts, but I wanted to verify this with data.

To determine whether local or overseas REITs perform better, I will categorize a Singapore-based REIT as one where at least 50% of its revenue is derived from Singapore. REITs with less than 50% of revenue from Singapore will be classified as overseas REITs.

I have compiled a table below that shows the 10-year total returns of various REITs classified into the two categories:

On average, Singapore-based REITs have delivered a total return of 68%, which is double the average return of overseas REITs. Based on this data, there appears to be a tendency for Singapore-based REITs to perform better.

Upon closer examination of individual REITs, it is evident that there are overseas REITs that have outperformed their Singapore-based counterparts. For instance, CapLand India Trust, Mapletree Logistics Trust, and Frasers Logistics & Commercial Trust have all delivered total returns of over 100% in the past decade, surpassing many Singapore-based REITs in terms of performance.

It should be noted that the table presented earlier only includes REITs with at least 10 years of trading history. There were many overseas REITs that did not have such a long trading history. However, if we instead focus on the past 5 years’ returns, it becomes clearer that overseas REITs have generally underperformed, with the majority of them experiencing losses. On average, overseas REITs have lost 12% in the past 5 years, while Singapore-based REITs had a 27% return.

Industrial was the best performing sector and hospitality was the worst

Let’s take a look at which sector has delivered the best performances. For the purpose of this analysis, we have grouped office and retail REITs into the commercial sector, while logistics and industrial REITs are categorized under the industrial sector. It is also worth noting that data center REITs are part of the industrial sector.

Frasers Logistics & Commercial Trust has been categorized as diversified, as it could be considered both a commercial or industrial REIT. It would be excluded from the comparison. As for the healthcare and hospitality sectors, there are too few REITs to draw any meaningful comparisons in terms of average performances.

If we focus on the Commercial and Industrial sectors, it becomes clear that the Industrial REITs have significantly outperformed the Commercial ones, with returns that are more than two times higher.

The outperformance of Industrial REITs over Commercial ones could be attributed to the ongoing transition to a digital economy. For instance, there is an increasing reliance on data centers, resulting in higher valuations on these properties. Additionally, the rise of e-commerce has made logistics properties essential for delivering goods around the world. This has led to higher demand, higher rents, and higher valuations for logistics properties, which in turn, have led to better share prices for Industrial REITs.

On the other hand, office properties have faced headwinds due to the work-from-home trend that emerged after Covid-19. As a result, they have struggled to raise rents and or to even maintain occupancy rates.

Mapletree was the best performing sponsor, almost doubling the returns of CapitaLand managed REITs

Lastly, it is also believed that REITs with strong sponsors tend to perform well. In this regard, I found only four sponsors that offer more than one REIT each, which allows for meaningful comparisons. The other sponsors only have one REIT each, making it difficult to draw any meaningful conclusions.

These four sponsors – CapitaLand, Frasers, Keppel, and Mapletree – are well-known in the industry and are often regarded as strong sponsors.

One notable observation is that the REITs sponsored by CapitaLand, Frasers, Keppel, and Mapletree have all managed to avoid losses over the past 10 years. While Keppel REIT is approaching negative territory, the overall performance has been impressive. Among these sponsors, Mapletree stands out with an average return of 140%, which is more than double that of CapitaLand’s average performance.

The lessons we can draw from this 10 year performances

Based on the performance comparison over the past 10 years, it appears that investing in Singapore-based REITs with a strong sponsor in the industrial sector could be a potentially successful investment strategy.

It is important to understand that the data we have analyzed has its limitations. We only had a sample size of 23 REITs to compare, which may not be statistically significant. Additionally, historical performance does not necessarily indicate future results. The past 10 years may not be indicative of the next 10 years, so even the best-performing REITs may not continue to perform well in the future.

It’s more important to understand the underlying drivers of performance and consider if those drivers are likely to continue or if there are any potential changes that could impact them. For example, we learned that industrial REITs outperformed because data centers and e-commerce did well. So we have to ask if these trends will continue. If so, these REITs are likely to outperform.

Singapore-based REITs have done better than overseas ones. Why? It is likely due to Singapore’s limited land and its relatively stable economy. It has political stability and no natural disasters. The same cannot be said in a foreign country. Again, would this trend continue? That’s the kind of thinking that we need to do.

Lastly, REITs with strong sponsors have delivered better returns. Why? The strong sponsors of REITs may have established a strong reputation and track record in the real estate industry. Being the pioneers in the industry, they already own properties in prime locations and are more experienced to manage their portfolios more efficiently, leading to better performance. Additionally, having a strong sponsor may also provide access to resources and expertise that may not be available to other REITs. For example, they can negotiate for lower interest rates given their good credit status.

Due to their well-managed properties in better locations, property values and rental incomes are able to increase, potentially resulting in higher stock prices. Therefore, it’s crucial to look beyond just the brand names and credibility of the sponsor, and instead, examine the track record of these fundamentals to assess if their competitive advantages can be sustained over the long term.

Hope this article has been helpful. Do share it if you know someone would benefit from this and subscribe to our newsletter for more informative content!

Very good analysis and findings. MPACT has overseas AUM in HK and Greater China. FREIT has a small asset in Singapore. Fyi. Again a great report! Thank you.

Very thorough and useful report. Thank you for the effort and time you have spent putting it together.

Opine that the return should be more than 150% to be positive over 10 yrs.

150% – 100% (price u bought) = 50% / 10 yrs = ~5% per yr

Is abv correct?

Already excluded the capital for the above calculation. Inclusive of dividends too. So you don’t need to minus 100% anymore.