Helped by the pandemic and global lockdowns, SaaS companies have started gaining significant traction in 2020, with investors reporting crazy returns of >200%.

Then the music stopped in 2022 when interest rates were set to increase.

We think that the overpriced but highly valuable SaaS companies will continue to grow after this market correction. If you’re of the same mindset, and want to trim your portfolio to prepare for the next bull run:

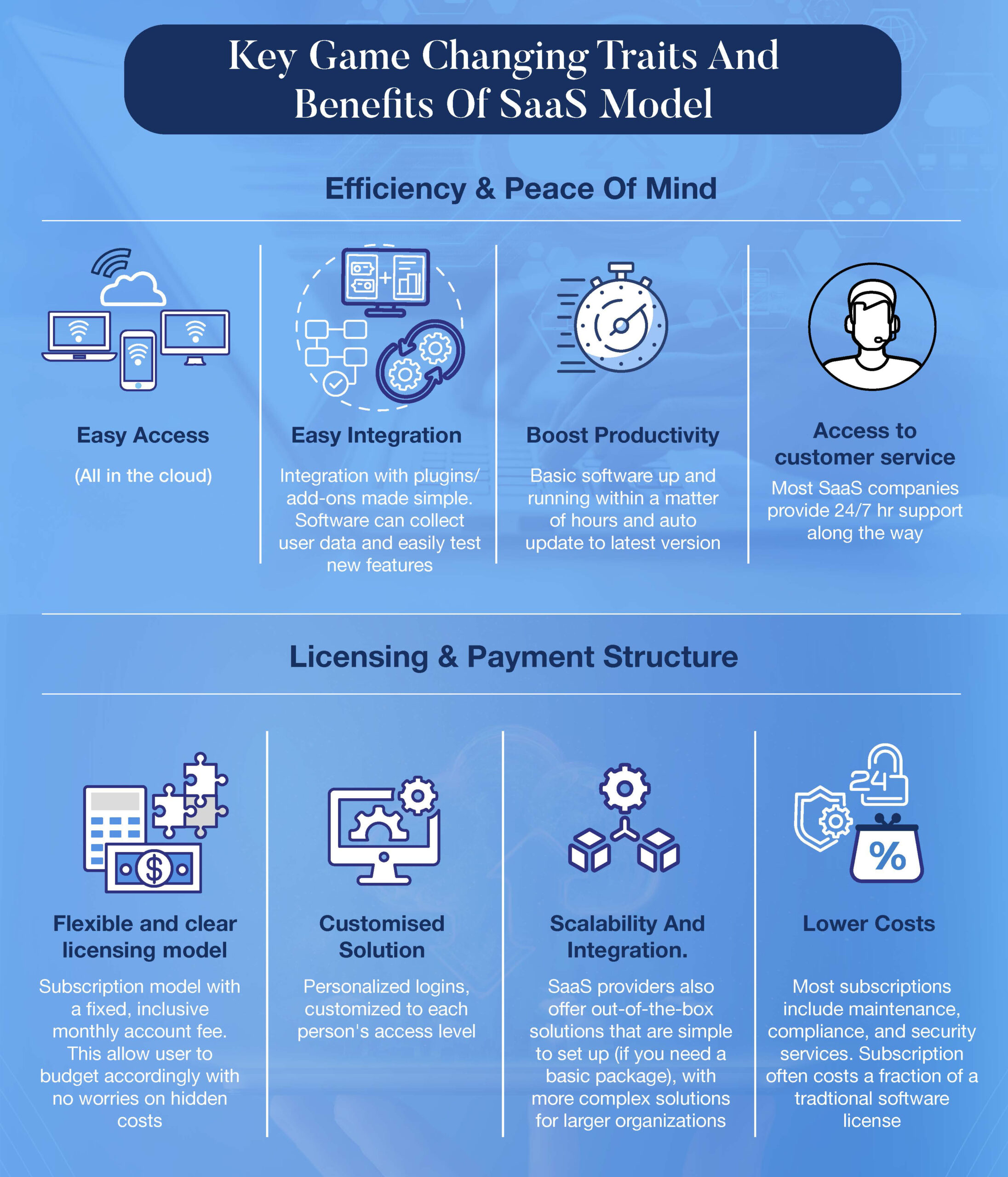

Here’s an infographic that gives you the essentials of investing in SaaS companies:

What is a SaaS company?

SaaS refers to Software as a Service and these companies rely on a delivery model for centrally located, (usually) cloud-based software that is licensed to their customers.

In layman terms, SaaS companies host the software for their clients and charge them a subscription fee on an ongoing basis. Traditionally, software companies offer self-hosted solutions for a one-time license fee.

Why invest in SaaS stocks?

The subscription model allows SaaS companies to own recurring revenue, which is a key reason that makes them enticing for investors.

On top of that, SaaS stocks:

- Enjoy a higher average valuation

- Enjoy higher exit revenue multiples

- Have a proven business model

- Offer predictable revenue

- Offer a lower barrier of entry for their clients, hence they are lightly to reduce cost of acquisition

- Tend to scale easily

Understanding the SaaS Investment Model

The SaaS Business Model

As mentioned above, Software as a Service (SaaS) businesses deliver cloud-based software to their clients. Their subscription based revenue generating model allows SaaS companies to own recurring revenue, which could increase their customer lifetime value.

This is great news for investors because it suggests that a SaaS company can generate recurring revenue on every client it takes on, allowing it to scale easily and grow faster. In general, if the SaaS company has a greater market share, we are potentially looking at a higher future valuation.

Power of Network Effect

Network effect is where increasing the number of users help to improve the value of a service.

SaaS companies provide software solutions that are centrally hosted which gives them access to an ever-growing database of users. These SaaS companies can tap into their user data to improve on their offerings. As their user data grows, their software would improve, encouraging more users to sign on. This network effect creates a positive cycle of user acquisition, which would generate more revenue.

Stages of a SaaS Business

It is important for investors to identify stage that a SaaS business is in. Here are three key stages:

- Start Up

At this stage, a SaaS company could be testing out their concept and product offerings.

They’ll be highly focused on software development, acquisition of their first few customers and delivering the best experience. Once their concept has been proven, they would shift their focus towards customer acquisition. Those whose services can solve an immediate need would move to the next stage.

Most startup SaaS companies are not listed and may only be raising money from private angel investors or venture capitalists.

- Hypergrowth

At this stage, the company would be focusing on customer acquisition while learning to scale up its infrastructure.

They will also start to encounter competition in the markets as new competitors emerge and incumbents pivot and threaten to encroach their space.

A successful hypergrowth SaaS company would have to balance revenue growth, cost and service quality while fending off competitors. Only winners would move into the third stage.

Early hypergrowth SaaS companies may be listed on public stock exchanges.

- Stable

At this stage, the SaaS company would have built a healthy, stable revenue that translate into a healthy profit. Customer acquisition and growth starts to slow down. The company may also experience an increase in customer attrition or “churn”.

How to analyse growing but loss-making SaaS Companies?

With recurring revenue and potentially decreasing cost of acquisition, SaaS companies may sound like the perfect asset for investors. Alas, if you look at their income statements, you’d be confused. Many of them are reporting losses, even as their customer base grows.

This is inevitable because these SaaS stocks are currently in a race to outspend their competitors, in order to gain market share.

Qualitative analysis of SaaS stocks

As Cheng puts it, a good SaaS company is one which can immediately report profits if they decide to stop spending on acquisition. There are a few factors that separates good SaaS companies from the average ones. They are:

- Low cost per acquisition

SaaS companies have to spend to grow – they need to market their services and improve their infrastructure to accommodate more customers. However, a better SaaS company is capable of acquiring a customer at a lower cost.

This also translates to a shorter window to profitability per customer.

- Reducing cost per acquisition

As the market matures, a good SaaS company is also able to reduce its cost per acquisition.

- High Retention rate

Good SaaS companies keep their users satisfied and paying over a longer period. This translates to increase in recurring revenue over time and lower expenses on customer acquisition.

- Ability to increase Customer Value

On top of keeping their customers happy, good SaaS companies are also capable of getting their existing customers to spend more. This could be done through higher priced plans, cross selling of complementary products, add-on and more.

Improving retention and monetisation has 4x the impact of focusing on acquisition.

Key SaaS Business Metrics

SaaS companies call for a whole new range of metrics because many of them are not profitable yet. These metrics include:

- Customer acquisition Cost (CAC)

This gives you an idea of how much the company is spending to get one customer.

CAC = Total sales and marketing cost / Number of customers acquired

In general, the lower the CAC, the better.

- Lifetime Value (LTV)

This tells you how much revenue the company can extract from one customer.

In general, the higher the LTV, the better. Also, the CAC should not be higher than the LTV.

- Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

These tell you how much recurring revenue the company is expected to receive, at different time periods.

ARR = Annual Revenue / Client

The higher the MRR and ARR, the better.

- Churn Rate

This tells you how many customers the business is losing in a given time period.

Churn Rate = (Customers at beginning of time period / Customers at end of time period) * 100

The lower the churn rate, the better.

Key SaaS Investing Metrics

- Price to Sale Ratio (PS)

Tells you how overpriced the stock is in the markets.

Price to Sale Ratio = Market capiitalisation / Company’s sales in previous 12 months

A P/S of 1 means you are paying $1 for every $1 sales that the company brings in.

- Compound Annual Growth Rate (CAGR)

Gives you an idea of the company’s growth rate.

Use a CAGR calculator instead.

Higher the CAGR, the better.

More SaaS ideas

You’re probably here because you’re looking to pick great SaaS stocks that could grow your portfolio. Here’re some:

Curious what the Top 10 SaaS stocks are? See our compilation here.