Tether (USDT) is a stablecoin that is pegged at the price of US dollars. It is a type of cryptocurrency that is designed to maintain a stable value. As of 12 Oct 2021, its market cap is around USD$62B.

Not sure what stablecoins are? Read our introduction to stablecoins.

Who created Tether?

Tether was developed by a company called Tether Limited in 2014. Its management team included a significant number of people from Bitfinex, a cryptocurrency exchange.

The Tether team used to claim that it is 100% backed by USD.

However, there was a dispute about whether it has the dollar reserves to back all USDT tokens in circulation.

Despite the many controversies surrounding it, Tether has steadily been growing and is now one of the biggest cryptocurrencies by market cap.

Why was Tether created?

Tether’s purpose is to facilitate transactions in cryptocurrency markets with speed and efficiency. It also aims to provide traders and users with a stable alternative to Bitcoin.

The idea behind Tether was to give people the option to secure the value of their cryptocurrency holdings, while still have the liquidity and the speed offered by crypto exchanges.

How does Tether work?

As mentioned above, Tether is a stablecoin that is pegged at the value of US dollars. Hence, it has a dollar value of 1 USD most of the time.

It maintains its peg by holding an equivalent amount of USD in its reserves.

Is Tether safe?

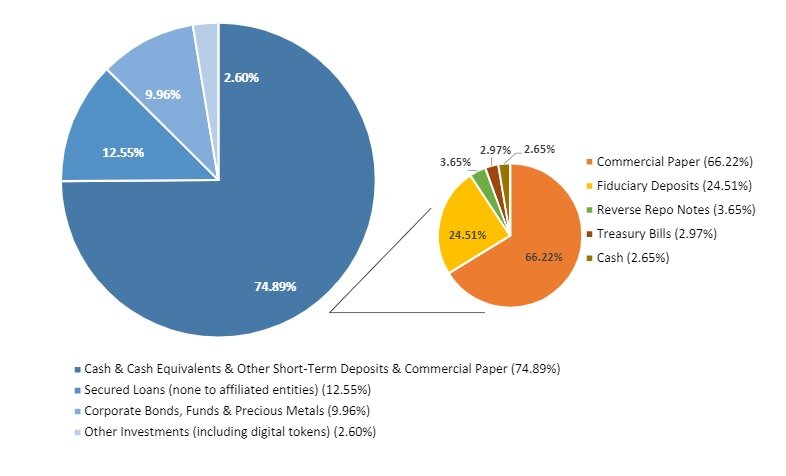

The company publicised its reserves breakdown for the first time in May 2021, revealing that 76% of its reserves are cash or cash equivalents. But if you look closely at the breakdown, only 2.65% of it is actual cash.

Although its reserve breakdown paints a weak picture of Tether’s ability to hold its peg, investors still seem confident in it.

USDT’s market cap had grown from US$58 million to US$68 million (at the time of writing), since the publication of its reserve breakdown in May 2021. They now maintain a ‘transparency’ page that shows their current balances.

How do you buy Tether?

1) Buy from a cryptocurrency exchange

The easiest way to buy Tether (USDT) is through a cryptocurrency exchange or broker service.

Previously, we could get Tether on Binance.com. But since the ban, this is no longer a viable option. At the time of writing, you can purchase Tether using SGD from the following exchanges that have applied for an exemption from the MAS PS Act:

- Kucoin

- Zipmex

Every exchange might have a different process. Here’s how you can buy Tether on Kucoin:

- Create an account on Kucoin.

- Go to ‘Buy Crypto’ and select your method.

- Input your desired amount.

- Check the details and click ‘Confirm’.

- Wait for your transaction to be processed.

Take note that you may not be able to purchase Tether using SGD on every exchange. I’ve found that many of the MAS PS Act-exempted cryptocurrency exchanges do not offer the direct option of SGD-USDT. This means it can be difficult for you to buy USDT using Singapore dollars.

For example, Gemini and Coinhako don’t offer Tether at present. Coinbase only started to support USDT in May 2021, but it is not supported in Singapore. Tokenise exchange has delisted some of their stablecoin offerings as well.

They might have done this to align themselves with the MAS PS Act. This law prevents companies from issuing securities or equivalent exchange-traded products without approval and requires them to comply with AML/CFT requirements.

Alternatively, you can use an exchange like FTX that lets you fund your account with USD, then swap the USD for USDT.

2) Swap your BTC or ETH for USDT

An indirect method would be to buy BTC or ETH from your favourite cryptocurrency exchange. Then send them over to an exchange that lets you swap BTC or ETH for USDT.

This option gives you the flexibility to choose from a whole range of decentralised exchanges (DEX) as well. But DEXs is another topic for another day.

3) Mint Tether via the Tether Treasury

The third way is to mint Tether via the Tether Treasury, like this whale:

To mint Tether, you’ll have to deposit USD to the Tether Treasury.

What is the Payment Services Act?

The Payment Services Act 2019 (PS Act) is a law that was passed in Singapore on 20 Feb 2019. It lays out the regulations for payment services providers operating in Singapore.

There are two broad categories under this regulation:

1) Regulated entities

2) Non-regulated entities

Regulated entities are operators who provide payment services to consumers, businesses, and banks in Singapore. This includes cryptocurrency exchanges which allow you to buy cryptocurrencies with fiat money from your bank account. On the other hand, non-regulated entities offer payment services to other non-regulated entities or international businesses.

How do you store Tether (USDT)?

There are 3 common options to store Tether tokens (USDT), which we will discuss in detail below:

1) Exchange Wallets

The easiest way to store your Tether is to hold them on the cryptocurrency exchange where you purchase them. While this has its risks (like what happened with Mt. Gox and Bitfinex in 2016), holding your Tether on exchanges is the fastest way to access them when you need them for transactions.

2) Wallet Apps

There are a number of wallets available for Tethers that are simple enough for non-technical users. Although this is not advisable if you want absolute security (in which case hardware wallets would be the safest), they are a great option because your Tether coins are easily accessible.

Some examples include coinomi, MyEtherWallet and Exodus Wallet.

3) Hardware Wallets

If you want the highest level of security for your cryptocurrencies, then a hardware wallet is what you need. Popular hardware wallet brands include Trezor and Ledger Wallet.

However, as a stablecoin that would be used mainly for transactions, this option might be the least feasible to store your Tether coins.

What is Tether used for?

Store of value

As a stablecoin, Tether can be used as a store of value. Crypto investors can store their cash in USDT while waiting for investment opportunities. This is way better than storing their cash in the form of Bitcoin, whose price volatility can be high depending on market demand.

Facilitate crypto transactions

Tether can also be used to facilitate transactions in the crypto market. For example, if you want to buy altcoins with no direct USD pairing, then you can deposit US dollars in your account with an exchange that supports Tether, before purchasing the altcoin on said exchanges.

Earn returns by staking or lending

For investors who want to earn an “interest” on their Tether, you can either lend them out or stake them by locking away a certain amount of it as collateral, and then wait as the coins generate more coins. It’s like earning interest in a bank account without paying any fees or making withdrawals.

There are various ways to earn returns such as staking on certain exchanges or on DeFi platforms like Hodlnaut or Cake DeFi. We’ll explore this topic in a future article.

Conclusion

Tether coin is the first stablecoin that was launched in 2014 and other stablecoins have been launched for various purposes since then.

Today, we see protocols like Terra launching their own stablecoin (UST) to facilitate transactions within their ecosystem.

Going forward, it may be easier to treat stablecoins like currencies from different countries – different countries accept and transact with their preferred stablecoins.

As investors and users, we need to understand how stablecoins work and maybe even start getting used to transacting with this new type of currency.

I hope you found this article helpful! You can read related cryptocurrency articles below, or learn directly from our cryptocurrency trainers in this free webinar.