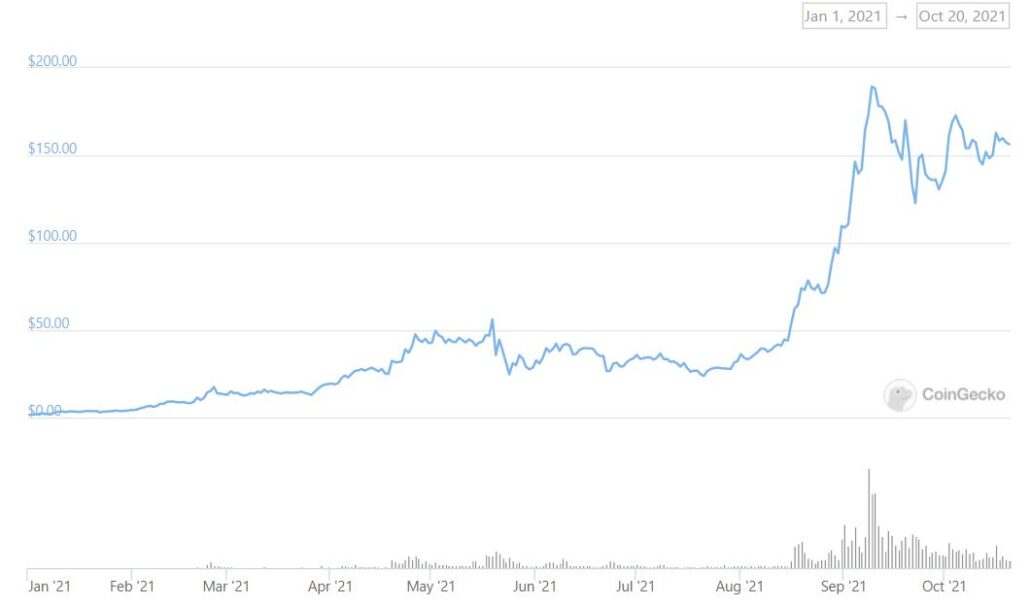

Solana started at USD 1.80 this year then surged to almost USD 200. Although it declined from its peak of USD 189 to USD 172 at the time of this writing, that is still an impressive 94x price increase!

So, what is Solana and why is it buzzing in the crypto world?

What is Solana?

Solana is a low-cost and super fast decentralised blockchain that was built to overcome the key problems of earlier crypto-like scalability. Solana boasts of less than $0.01 transaction fees and 400-millisecond transaction timing, which is incredible compared to currently popular blockchains like Bitcoin which takes 60 mins and Ethereum at 6 mins. Like most blockchains, Solana is decentralised which allows it to be censorship-free. This means no one can stop or control it.

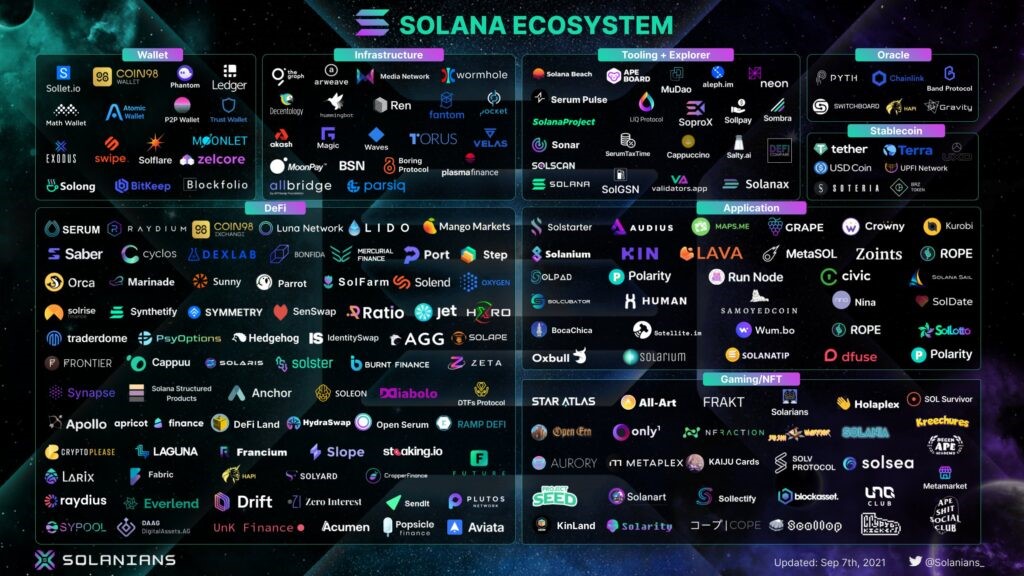

Solana is an open infrastructure that is similar to Ethereum, which allows decentralised applications (DApps) to be built on it. Its impressive transaction time and low cost have been attracting many developers to build on it. As of 29 Sep 2021, Solana has 368 DApps listed in its ecosystem.

Having been launched in 2020, Solana has been around for only a short period. It has a star-studded, veteran team of former Qualcomm and Apple employees and is led by Anatoly Yakovenko.

Solana’s USP: Proof of History

One of Solano’s very unique innovations that allows it to outpace competitors and have such attractive features is its Proof of History (POH) blockchain, which can be thought of as a blockchain clock.

What is Proof of History?

Proof of History (POH) is exactly what its name suggests; it’s a technique that uses the history of the blockchain as validation. The cryptographic proof of the order and timestamp of each message helps us know which event must come first.

Each Solana node has its own cryptographic clock that helps the network sync to agree on the time and order of events, without needing to hear from other nodes. This means that nodes can constantly communicate with each other without needing to sequentially queue and wait for network confirmation because the transactions can be rearranged in the right order based on the cryptographic stamps.

This enables high throughput – the rate of something that is being processed without compromising on security; thus removing bandwidth issues as a bottleneck to transaction speeds.

3 reasons why Solana price has skyrocketed

Perhaps most of us have missed the boat on Solana, but we can look back and find out the catalysts that propelled its growth.

1) Attracting top talent and anticipation of exciting projects

At the date of this writing, there are over 300 projects in the Solana ecosystem and it is growing. Among these exciting projects are decentralized exchanges, lending, and staking platforms. One highlighted project is Serum – a decentralised exchange that has the advantages of extremely fast speed and low cost since it is powered by Solana and hence, inherits its properties. You can read more about Serum here and explore Solana’s ecosystem here.

2) High value locked up in Solana projects

As per De-Fi Liama, Total Value Locked (TVL) in Solana DeFi Projects is USD 8.7B, growing 10x since July 2021. TVL represents the value of all the tokens locked in the smart contract of a project. This is significant as it shows the health of the De-Fi protocol, which we can understand by how much of the capital is being staked in the protocol. The huge increase in TVL of Solana shows that money is flowing into the protocol, which contributes and participates in its projects and supports its growth.

3) The Ethereum Killer? – Solana vs Ethereum

One of the top reasons Solana became extremely attractive is because it was dubbed as a key competitor and potential successor against Ethereum. However, many other projects such as Cardano have also been dubbed as an “Ethereum Killer”. Let us see the comparison between these two powerhouses.

Solana claimed to be able to support 24,000 transactions per second, which is significantly higher than Ethereum’s 30 transactions per second. Having a faster speed does not increase Solana’s transaction fees, which are only around $0.00025, while Ethereum’s fees are around $2.15. It all boils down to the foundation of the system, and Solana is built on POH while Ethereum recently moved to Proof of Stake (POS). This might still be limiting Ethereum even if it just upgraded from Proof of Work (POW).

However, Ethereum has been around since 2015, giving it a 7-year headstart compared to Solana. With first-mover and network advantages, Solana has the largest and most comprehensive smart contract network because many talented developers are already familiar with Solidity – Ethereum’s primary coding language. This large amount of activity is the contributing reason for its high transaction fees.

Since Solana is a much younger protocol with a smaller network, it must continue to attract talent to build on its platform. Currently, Solana’s market cap ($42B) is only 11% of Ethereum’s cap ($351B). Solana will only have a fighting chance against the goliath if it has strong projects, partners and capital.

Conclusion

Having a strong foundation of extremely low cost and fast transaction speeds and coupled with fresh funding, Solana seems to be positioned for further rapid growth. Because of its scalability advantages, it will not be surprising if more projects and partners join its ecosystem.

If you’re new to cryptocurrency, get your fundamentals right in an evening with Chris and AK. And remember, like any other crypto project, only time will tell if Solana will be here to stay. What do you think? Share your thoughts below!Disclaimer:

This is not financial advice. Any action you take is solely your own responsibility. Cryptocurrencies are extremely volatile, thus only invest money that you can afford to lose.