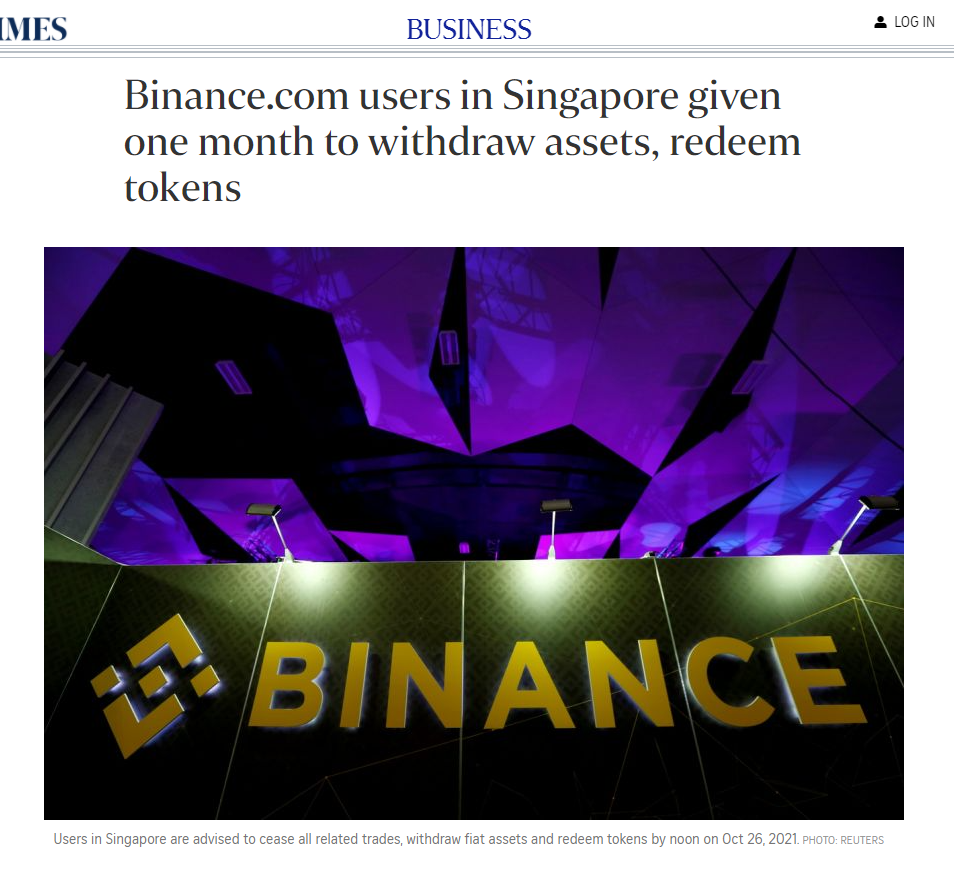

If you’re not in the loop, Binance.com users in Singapore have to “withdraw fiat assets and redeem tokens by noon on 26 Oct 2021”.

The topic of Binance being “banned” in Singapore is one that has upset me greatly as I consider myself a really loyal customer of the platform. Though many may argue that there are far better brokerages out there, I’ve always been loyal to Binance as it was on this brokerage where I made my first entry into BTC at approx $9000 back in early 2021. I consider Binance to be my “lucky” brokerage as I did sit on some healthy gains by the time BTC reached $50,000 and beyond.

However with the recent news coverage, I feel that it is no longer wise to go against the tide and as of today, have pulled all my holdings out of Binance and shifted them into other brokerages.

I believe that some readers here may also be in the same situation, so do allow me to share how I approached this situation.

Disclaimer – By no means am I endorsing any of the alternative cryptocurrency exchanges listed below. There is no such thing as a “best” crypto-exchange and the ones which I have listed below are ones that I have chosen out of convenience more than anything else. Each trader has different goals and these platforms simply fit my goals as a “HODL-er”.

My way is definitely not the best way but it worked well for me so for readers who would like to share their thoughts on how they did it, do feel free to share in the comments below.

For the sake of this article, I’ll be referencing the following exchanges:

- Kucoin

- Coinhako

Alvin wrote about other cryptocurrency exchanges previously as well.

3 Factors to consider when choosing a cryptocurrency exchange

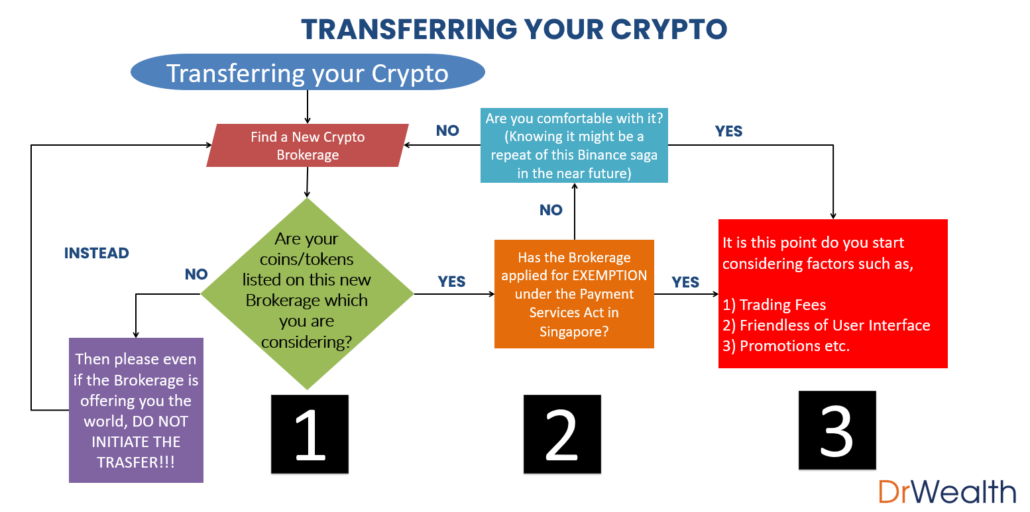

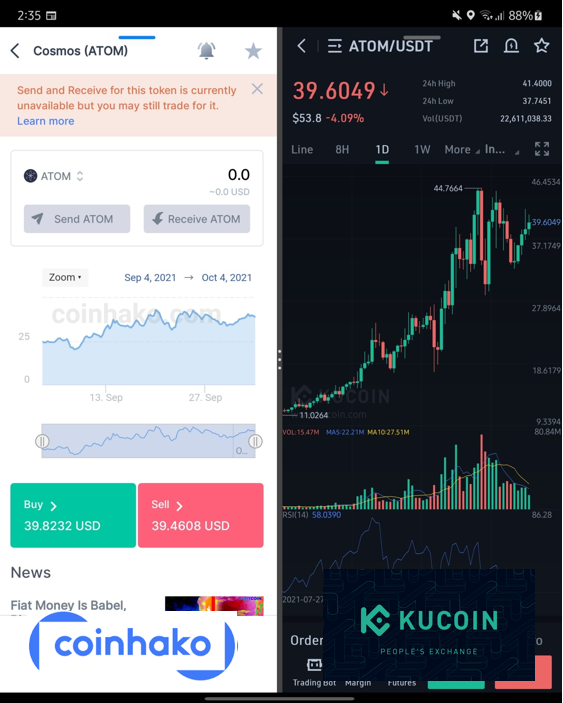

1) Ensure that the exchange accepts the coins/token that you intend to transfer

For a start, I think that the most important factor to consider is IF the new brokerage that you are considering even accepts the coin or token that you are holding. To put it bluntly, don’t be ignorant and do your due diligence.

In most cases, you can determine the coin offerings of any cryptocurrency exchange by doing a quick search on their main page.

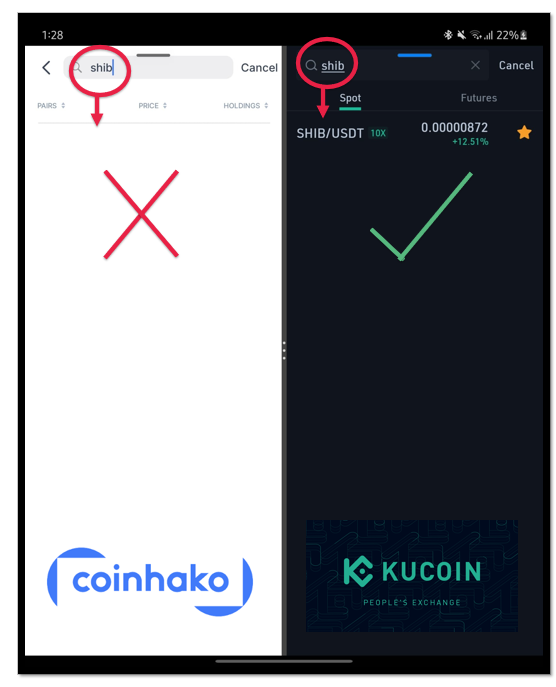

At the point of writing, almost all exchanges would accept the “blue chip” cryptos like BTC and ETH, but when it comes to other trending cryptos such as CAKE, ATOM, AUDIO, SHIB, etc, every exchange’s offering varies:

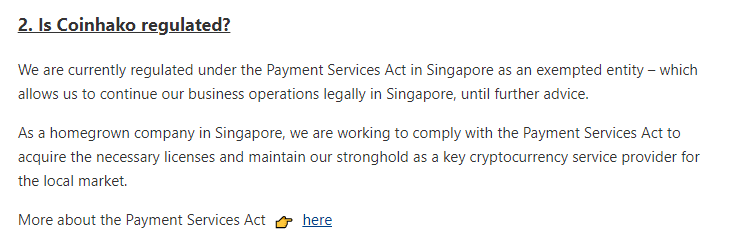

2) Make sure the exchange is exempted under the Payment Services Act

This whole Binance saga happened because they did not apply for an exemption under the Payment Services Act. So, if you don’t want history to repeat itself, do ensure that the exchange you are considering has applied for an EXEMPTION under the Payment Services Act.

I’m no expert on the intricacies of what MAS does on a daily basis but what I do know is that the crypto space is one that is still relatively new to Singapore. While its framework/laws are still being developed, companies that want to dabble in this space can apply for an Exemption.

Think of it as raising your hand up in class to ask the teacher if you can go toilet. If the teacher say can then you go, if the teacher say cannot then don’t go. If you’re urgent and never ask teacher, but just chiong to the toilet then obviously you bear the consequences.

I can’t say for certain if the regulations will change in future but at present, it seems that all MAS wants is for companies to apply for this exemption and be compliant.

In most cases, if you want to check if an exchange does have this exemption, you can do so in 2 ways:

- Do a manual search for the brokerage at “Entities that have notified MAS pursuant to the Payment Services (Exemption for Specified Period) Regulations 2019”.

This is the official MAS list of every company which is exempted. However, do note that more often than not, the name of the exchange is not the same REGISTERED NAME of the company which possesses this exclusion.

Hence, if you don’t find an exchange on the list, you may need to proceed to step 2:

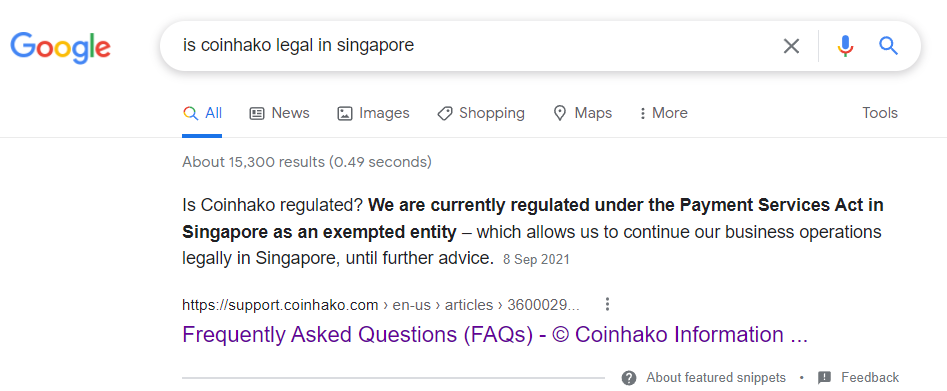

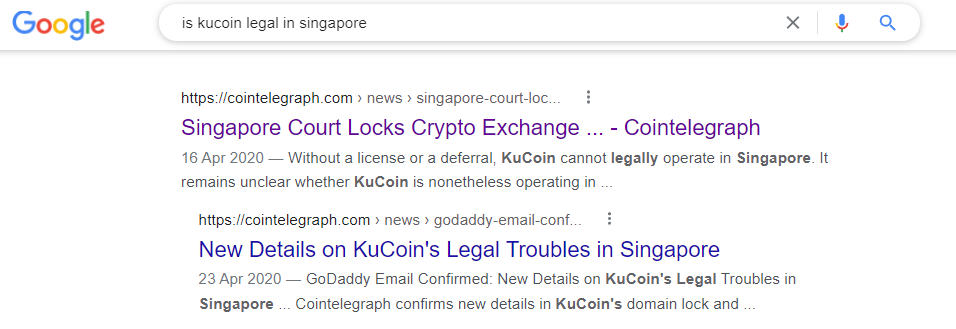

- Do a manual search of the brokerage on Google for “Is XXXX legal in Singapore”.

As layman as this method is, it is something which I highly recommend for 2 reasons.

Firstly, if enough people search for it, Google would tend to make the result appear at the top.

Secondly, if the brokerage knows that people are searching for it, they themselves would publish this in their FAQ section as it is something that they should be proud of.

3) Don’t be swayed by unimportant features like UI or even promotions

There are plenty of promotions from other crypto exchanges out there right now because they know that Binance users are seeking alternatives.

However, there’s no point to be on a platform that charges a 0% transfer fee but does not accept your tokens/coins, amirite?

At the same time, even with the attractive promotions, should the company not be on the exclusion list, then you are opening yourself to the risk of having to face the same “Binance issue” in the future. Is the hassle of scrambling to transfer your coins again worth it?

Of course, depending on your own trading goals and risk tolerance, the rules which I have stated above may or may not apply.

Which exchange did I choose?

By means of convenience more than anything else, I have chosen to park most of my holdings with Coinhako.

The reason I have done so is mostly due to the fact that above all else, I like their transparency when it comes to the MAS exemptions. As a HODL-er, it gives me the confidence that what would happen to Binance is unlikely to happen to Coinhako.

However, I cannot comment much about transactions fees as I am not an investor who does trading on a daily basis so such fees really do not matter to me.

That said, there are a few drawbacks to using Coinhako, with the main one being the limited amount of coin/token that trades on the brokerage. As shown in the image above, SHIB is not being traded on Coinhako and it is for this reason that I have chosen Kucoin as my secondary crypto exchange. (Alvin introduced this brokerage to me so I decided to give it a try)

I like Kucoin as a secondary exchange for 2 reasons:

- It offers a wider range of coins/tokens on its platform

- Its UI is more similar to Binance, where I am able to view technical indicators on the chart #TA4eva

However as much as Kucoin does have its advantages, it also has major disadvantages, much of it revolves around their legal woes with our authorities.

I am also unable to find any information pertaining to the status of their exclusion license application.

What matters most…to you?

The discussion on crypto exchanges is long and we haven’t even gone into promotion or commission comparisons!

I hope that the 3 factors shared above would give you a sense of direction when it comes to the consideration of the various brokerage.

Personally, I give more weight to compliant crypto exchanges in my decisions, because it suits my investment style. It is important for you to know your investment style. If you are someone who trades by the hour, then definitely a low-commission brokerage would be more suitable for you.

Before I end off, as always with cryptocurrencies, only put on the table what you are willing to lose. And don’t jump on the hype if you don’t know how it works. Learn the fundamentals with Chris and AK in an evening instead.