Digital Core REIT listed at an IPO price of US$0.88 in December 2021, carrying a book value of US$0.84 and a forecasted DPU of 4.18 cents (in USD) for 2022.

DigiCore REIT came with the backing of a strong sponsor, Digital Realty (NYSE: DLR) and has well known tenants like Microsoft, Meta Platforms, IBM, Oracle, Equinix and JP Morgan. DC REIT’s gearing during the IPO was at 27%, which provided ample headroom for safety as well as acquisitions.

The REIT got off well, reaching a high of US$1.25 in January 2022. Unfortunately that was the end of the run as the REIT currently trades at US$0.43, less than half of the IPO price.

What happened to DigiCore REIT?

DigiCore’s 2nd largest tenant, Cyxtera is bankrupted.

Cyxtera filed for bankruptcy protection on 5th June 2023. It currently represents approximately 22.4% of DigiCore REIT’s rental income and 26.6% of its total portfolio value. Cyxtera occupies:

- 100% of three shell & core facilities in Silicon Valley;

- 100% of two shell & core facilities in Los Angeles; and

- 4% of the facility in Frankfurt.

For now, Cyxtera has remained current on its rental obligations through the month of May.

How will Cyxtera’s bankruptcy impact DigiCore REIT’s financials?

DigiCore REIT has estimated that if 100% of the annual revenue from Cyxterra were to be eliminated;

- the REIT’s DPU would be reduced by an estimated 2 cents (in USD),

- NAV would reduce by 9% from US$0.81 to US$0.74 ,

- gearing will increase 2.1%, from 34.4% to 36.5%.

A 22.4% reduction in rent will cause a near 50% decline of its DPU as there are fixed overhead costs and financing obligations.

DigiCore REIT’s next plan of action

DigiCore REIT has disclosed that Cyxtera’s passing rents are below market in each of the metros where Cyxterra leases capacity from the REIT. Current market conditions are tight, with vacancy rates in the low- to mid-single-digit percentages across all three metros.

DigiCore REIT also intends to leverage on its Sponsor’s operating expertise. If Cyxterra cannot fulfil any of its lease agreements, DigiCore REIT will work out agreements directly with Cyxtera’s existing end-user customers.

To ensure that DigiCore REIT is well positioned to step in, the REIT has engaged a third-party data centre engineering consultant. They will conduct extensive site visits to evaluate the property condition, identify any required upgrades (i.e., potential CapEx requirements), gauge overall site utilization and to assess the marketability of each asset. This will also allow the REIT to take actions to protect the value of the asset.

Potential impact to DigiCore REIT’s business

Accolades have to be given where merited; DigiCore REIT has communicated the impact well.

As shown in the slide above, the REIT has presented the potential impact to asset valuations, downtime, required capital expenditures and resulting leverage.

DigiCore isn’t the only ‘victim’ of Cyxtera’s bankruptcy

Mapletree Industrial REIT (MIT) also leases space to Cyxtera. Cyxtera currently occupies space in 8 Data Centres located in North America; of which, 7 are held a 50% JV with the sponsor.

For MIT, Cyxtera has met its full rental obligations for the month of April 2023 and partially fulfilled its rental obligations for the month of May 2023. Cyxtera was the third-largest tenant within the REIT’s portfolio and contributed about 3.2% of MIT’s monthly Gross Rental Income.

Upon MIT’s completion of the acquisition of the newly built data centre in Osaka, Japan, Cyxtera’s proportion of MIT’s portfolio will be diluted, relegating it to the fourth-largest tenant which account for about 3.0% of MIT’s enlarged portfolio.

After MIT disclosed this news, the REIT traded up 2 cents higher from the previous day close to an intraday high of S$2.24 and a day low of S$2.21.

Industry wide problem or a DigiCore REIT problem?

DigiCore REIT’s IPO portfolio comprised of 10 data centres in the US.

In December 2022, the REIT added a 25% stake in a data centre in Frankfurt, of which Cyxterra rents 4% of the space.

By not being well diversified, this reflects badly on the original IPO portfolio. It was disclosed in the prospectus that Cyxtera then had a credit rating of B-/B3, which means that the company is highly speculative with high credit risk. Since then, Cyxtera went through a series of downgrade and has ended up where it is today, bankruptcy filing.

MIT is clearly much more diversified with 2,300 tenants against DigiCore REIT whose top 10 tenants account for pretty much all of its income.

To put things in perspective, only 24% of DigiCore REIT’s tenants are non-investment grade. This means Cyxtera is likely to be the only non-investment grade tenant:

How about the other Data Centre REITs in Singapore?

2 other Data Centre REITs in Singapore are Keppel DC REIT a pure Data Centre play and CapitaLand Ascendas REIT which has 8% exposure to the sector.

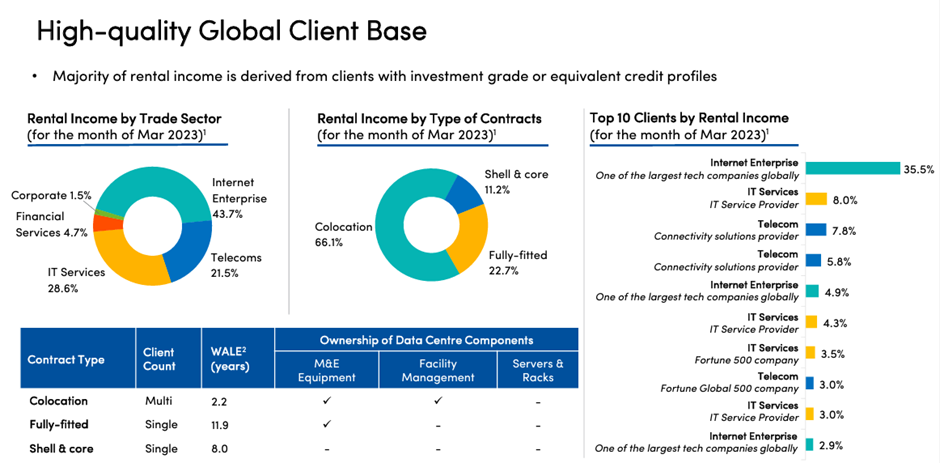

Keppel DC REIT (KDCR) has clients that are mostly investment grade and a diversified tenant base. Aside from Amazon, its largest tenant which contributes 35.5% to its rental income, all other tenants contribute much lower proportion to KDCR’s income. Hence KDCR is clearly much more stable.

Closing statements

Generally, the Data Centre REITs listed in Singapore tend to have long WALE, built in rental escalations and are well regarded as a stable investment backed by strong sponsors and stable growth.

Keppel DC REIT and Mapletree Industrial Trust both reflect many, if not all of these traits. A good REIT also tends to be diversified with high quality client base and are able to quickly mitigate against risks with a disciplined management.

Most importantly, a positive track record needs to be formed to provide confidence to investors and allow the REIT to get into a positive cycle of being able to carry out both accretive acquisitions and organic growth.

Unfortunately, we have not seen many of these factors in DigiCore REIT since its IPO in December 2021. While one may attribute it to the timing of the IPO and perhaps to the size of the REIT and rather than mismanagement, rather than spending time on speculating, it would probably be best to sell DigiCore REIT and buy other Data Centre REITs.