[Update] 7 June 2023 – Cash offer raised from $0.56 to $0.60! Now a Final offer!

Four years ago in March 2019, the controlling Loo family of Challenger (SGX:573) tried to delist the company with the support of Dymon Asia Private Equity at an offer price of $0.56 and was not successful.

Now in 2023, they are trying to delist the company again at the same offer price. (Update on 7 June 2023 – Offer revised to $0.60)

The same offeror, DigiTech Holding, is the bid vehicle of a consortium formed by Challenger’s majority shareholders, the Loo Family & Dymon Asia.

As we all know, if the offeror is able to obtain at least 90% of the total number of issued shares, they will be able to delist the company.

Including the irrevocable undertakings provided by the Loo family and the substantial shareholder to sell their shares, the offeror has 85.44% shares secured at the point of the offer:

- Dymon Asia Private Equity: 17.44%

- the Loo Family: 47.32%

- held by a substantial shareholder: 20.68%

When will we know if Challenger successfully delist?

Although the timeline is not yet published yet, what we know is a formal offer document of acceptance will be dispatched to shareholders not later than 21 days from the date of announcement (30 May 2023).

This means if you own Challenger (SGX:573) shares, you’ll get the offer document of acceptance latest by 20 June 2023.

The Offer will remain open for acceptances for a period of at least 28 days from the date of posting of the Offer Document.

If the offer is revised, the revised offer must be kept open for at least 14 days.

Why delist Challenger?

1) Challenging Retail Environment

The offeror has explained that they are seeking to delist challenger because the Company operates in a challenging electrical and electronics retail business environment in Singapore, where the market is saturated and competitive pressures may increase margin pressure.

Coupled with weak retail sentiment and industry disruption resulting from the rise in e-commerce, Challenger has experienced a decline in revenue over the last five years.

In order to navigate the challenging business environment, the offeror believes that the Company may have to implement changes to its business, which will require management commitment and allocation of resources in the near to mid-term in the face of rising operating costs.

During such time, dividends from the Company could be affected.

2) Low Trading Volume

Also highlighted in both delisting attempts now and 4 years ago is the low trading volume.

Therefore, the offeror believes that this privatisation offer provides shareholders with a clean cash exit opportunity to realise their investment at a premium, something that might otherwise not be available given the low trading liquidity of the shares.

Is Challenger’s delist offer fair?

Let’s take a look at Challenger’s latest business performance to find out:

1) Too quick to write off hope?

In the face of macroeconomic and industry uncertainty, no company would sit still and let themselves be ruined by the broader conditions. Hence the offeror is attempting to delist the company and turn it around.

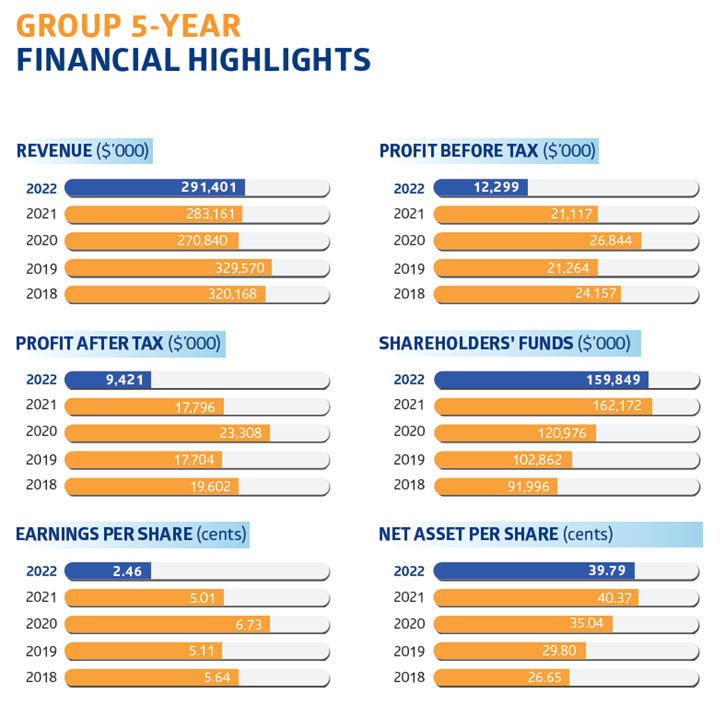

Looking at their financials, there is a revenue decline since 2019 which the company has not been able to reverse post pandemic.

Earnings per share also declined significantly in 2022 from prior years (Note: pandemic years income buffeted by rental and government grants) and there are concerns that this is the start of a new phase rather than a one-off performance.

2) Limited growth in Singapore

Challenger currently has a total of 47 stores (including 2 newly opened in 1Q23). This is slightly higher than the 42 stores as at 2022. The mix of stores have varied as Challenger has tried to right size each store in each location. Challenger has also had to open and close stores either due to weak performance or other issues with the location.

Fundamentally, with 47 stores in Singapore, it is clear to most that growth with the current business model is limited.

Challenger will have to either diversify its business model or expand overseas, both which comes with a new set of risks and uncertainty.

3) Offer premium does not mean anything

Although the offer is a premium over traded prices, it is worthwhile noting that Challenger has traded in a very tight range since the previous offer in March 2019 aside from the COVID-19 crash in March 2020.

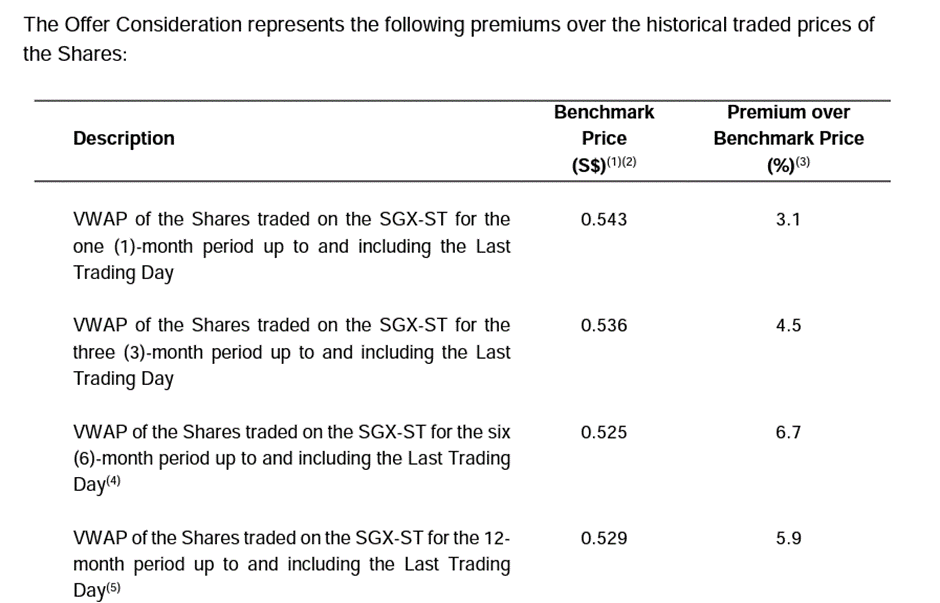

This could be due to an expectation of another delisting offer since 4 years ago. The table below reflects the premiums based on the original offer consideration of $0.56

It is worthwhile noting that the share price currently trades at $0.58, 2 cents above the offer, an indication that shareholders are hoping for a revised offer to seal the deal.

Challenger’s Net Asset Value

Challenger’s current NAV is 39.79 cents per share, which is approximately $159.8 million in equity.

As at FY22, the company held cash and investments worth $143.2 million, equivalent to 35.64 cents per share.

This means that the offeror is paying 21 cents per share for the core business that generated earnings of 5~6 cents per share in previous years based on the original offer of $0.56.

Can Challenger increase their delist offer?

Delistings in SGX occur frequently when the share price is suppressed due to broader market conditions.

Fundamentally, being in a tough industry is not a reason to delist the company as shareholders who are concerned about implications to the share price in the short term can choose to sell out.

However, where companies have to diversify to stem a decline, the hurdles required to seek shareholders support or official approval as well as the change in the business model may mean that it is better for shareholders to reassess if they are still keen to invest in this company.

It seems like the management has made up its mind to delist the company and there is no reason for both the majority and minority shareholders to hold on to each other.

We thought that Challenger could have sweetened the deal a little bit as the net asset value of the company has risen rather than offer the same price as 4 years ago. Perhaps, this is a case where current investors should just take the money and go gently into the night.