Data centres are an asset class that is highly essential as they are required to store data and provide connectivity. All companies with a digital footprint would require data centres to store and manage their data.

Data centres are highly sought after as investments due to their high occupancy rates and companies have been adding new supply across the world to meet an ever increasing demand.

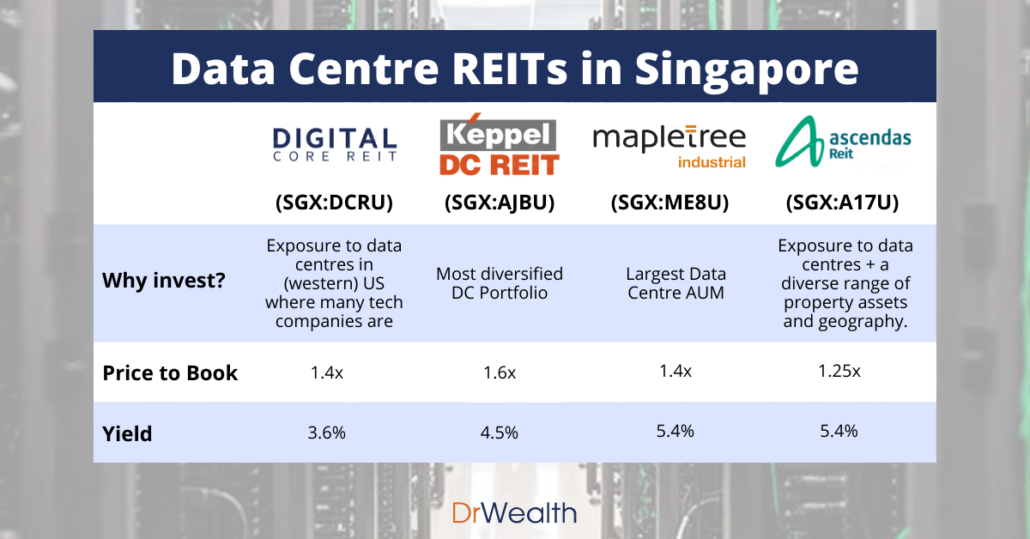

In Singapore, Data centre REITs are a relatively new subclass in the REITs space with:

- 2 pure play data centre REITs:

- Digital Core REIT (SGX:DCRU),

- Keppel Data Centre REIT (SGX:AJBU)

- 2 other REITs that have expanded into data centre assets:

- Mapletree Industrial Trust (SGX:ME8U),

- Ascendas REIT (SGX:A17U)

Valuation of 4 Data Centre REITs in Singapore

| Digital Core REIT | Keppel Data Centre REIT | Mapletree Industrial Trust | Ascendas REIT | |

|---|---|---|---|---|

| Stock Code | DCRU | AJBU | ME8U | A17U |

| Sponsor | Digital Realty | Keppel T&T | Mapletree Investments | Capitaland Investment |

| Why Invest? | Exposure to Data Centres in (western) US where tech companies are | Most diversified DC Portfolio | Largest Data Centre AUM | Exposure to Data Centres and a diverse range of property assets and geography. |

| Properties | 10 | 19 | 143 | 217 |

| Portfolio Value | US$1,440m | S$3,401m | S$8,600m | S$16,100m |

| Data Centre Portfolio | 100% | 100% | 53% | 9% |

| Occupancy | 100.0% | 98.3% | 93.7% | 91.7% |

| WALE | 6.2 yrs | 7.5 yrs | 4.2 yrs | 3.8 yrs |

| Gearing | 27.0% | 34.6% | 39.9% | 37.4% |

| Market Cap | US$1,320m | S$3,760m | S$6,890m | S$11,880m |

| P/B | 1.4x | 1.6x | 1.4x | 1.25x |

| Yield | 3.6% | 4.5% | 5.4% | 5.4% |

1) Digital Core REIT

Digital Core REIT (DC Reit) is the newest listed REIT in Singapore and the only data centre REIT with 100% of its AUM situated in the US. It is currently at 100% occupancy and its top 5 tenants account for 97.4% of its rental income.

With US being the home of countless tech giants, DC Reit has the benefit of being in the home base of where many of these tech giants reside.

DC Reit has the smallest AUM base and provides the lowest yield at the point of writing. It also has the lowest leverage which could indicate market expectations of acquisitions to bump up the yield.

2) Keppel Data Centre REIT

Keppel Data Centre REIT (KDCR) was the first pure data centre play to list in Singapore and was highly sought after, with share prices reaching a high of S$3.04, implying a price to book value of more than 2.0x at its peak.

At the same time, it is the only data centre REIT play with meaningful geographical diversification, with data centres spread over Europe, Australia, Asia and China. Unlike the other three, KDCR does not have data centres in the US.

Keppel Corporation which has indirect control over KDCR through its sponsor Keppel T&T, has identified data centre as a growth business for the group. In its Vision 2030 route map, it has stated its focus on connectivity and energy.

With the acquisition of M1 in 2019, Keppel is also building synergies between Keppel’s data centres and M1. Keppel also placed emphasis on building its capabilities in sustainable energy and are in the midst of developing infrastructure for liquified hydrogen supply for Keppel’s data centres in Singapore.

It has a relatively low gearing of 34.6% which provides for plenty of headroom to seize opportunities to grow its AUM.

3) Mapletree Industrial Trust

Mapletree Industrial Trust (“MIT”) has the largest data centre AUM among the 4 REITs with S$4.5 billion.

Most of its data centres are located in the eastern side of America whereas DC Reit has a larger proportion on the western side of US where more tech companies reside.

It has a sponsor with one of the strongest track record among all the REIT sponsors in Singapore with 4 REITs that were all able to produce long term double digit annualised total returns.

Although it has the highest gearing at 39.6%, it also has the second highest yield at 5.3%.

However, even though MIT’s acquisitions has been accretive and regarded positively by investors thus far, MIT has carried out an equity fund raising every single year for the past three years. This means that it may not be able to carry out a large equity fund raising, if at all in 2022.

Hence, MIT has resumed its distribution reinvestment plan from the period ended 31 December 2021. With an amount of about S$90 million available for distribution each quarter, should half of its unitholder base elect to receive their distribution in units, this will allow MIT to reduce its leverage by 0.6% each quarter or 2.4% each year and provide MIT with an additional S$180 million of funds to finance progressive funding needs of development projects and pursue growth opportunities.

We also previously analysed MIT here.

4) Ascendas REIT

Ascendas REIT (AREIT) was the one of the first few REITs to be listed in Singapore in November 2002.

It has grown and evolved significantly since then from a business park and light industrial play into a multi segment REIT with assets such as logistics, commercial and data centres.

AREIT has the smallest data centre portfolio of about S$1.5 billion with S$1 billion from 11 properties in Europe acquired from Digital Realty (the sponsor for DC Reit) and S$0.5 billion for 2 properties in Singapore which are both substantially leased to Singtel.

While AREIT has its merits, one of which is its diversification by asset class and geographical region, with its small exposure to data centres, it would be hard pressed for investors to consider AREIT as a data centre play at this point in time.

Overall Performance of Data Centre REITs in Singapore

These REITs have all performed well, with respective three year annualised total returns of:

- 28.1% p.a. for KDCR,

- 18.1% p.a. for MIT and ,

- 10.2% p.a. for AReit.

DC Reit has already seen a 30% increase in its share price since it commenced trading on 6 December 2021.

Total data centre AUM in Singapore

The four REITs have a combined market capitalisation of approximately S$22.5 billion as at 25 January 2022 and an approximate portfolio value of S$30 billion.

However, as only two of the REITs are pure data centre REITs, the total AUM of this asset class for these four REITs adds up only to about S$11.3 billion.

This is a substantial increase as these 4 REITs have added more than S$4.8 billion in 2021 to the total data centre asset under management by Singapore REITs with the following transactions:

- KDCR acquires 3 data centres in Netherlands for S$108m and in Guangdong for S$132m

- AReit acquires 11 data centres in Europe for S$905m

- MIT acquires 29 data centres in US for S$1,782m

- DC REIT’s IPO of 10 data centres in US for US$1,440m

It is worth noting that none of the data centres acquired in 2021 are in Singapore.

Data Centre moratorium in Singapore

The number of data centres in Singapore is limited due to a moratorium in place since 2019 to moderate the growth of data centres due to concerns by the Singapore government over issues such as environmental sustainability caused by excessive energy consumption a data centres accounted for 7% of total electricity consumption in Singapore in 2020.

Companies such as Keppel Corporation have taken on the Singapore government’s concerns and have been exploring the possibility of developing a floating data centre park which would be cooled directly by the sea, thus not only reducing electricity consumption but also free up land for other use.

In January 2022, Singapore lifted the moratorium after completing an industry review, welcoming new data centre investments, albeit with new and stricter rules such as a maximum electricity load.

Industry watchers believe that despite the lifting of the moratorium, immediate term adverse impact to valuations are unlikely for data centre assets in Singapore as time is required to construct new data centres.

Data Centre REITs in Singapore are growing strong

Data centre REITs have a track record of providing strong returns to investors. The 4 data centre REITs mentioned here have also grown their AUMs substantially in 2021, and are poised to grow further in 2022 fuelled by the ever increasing demand for data centres.

Each REIT has its own unique points and investors can gain exposure into the data centre sector through one of these four REITs.

If you’re looking for REITs ideas, here’re the best REITs in Singapore!

By the way, if you’re looking for a strategy that lets you build a sustainable dividend income, join Chris Ng at his next webinar to learn how he retired on dividends at 39.