Time flies. After the hype of high interest bank savings account back in Dec 2022, interest rates have tapered down. Does it still make sense to go for a high interest savings account today?

Here, we’ll compare two popular options – OCBC 360 vs DBS Multiplier. (We had covered UOB One vs OCBC 360 previously too)

OCBC 360 Account

OCBC 360 raised their rates in November, making headlines for offering up to 7.65% p.a.

Good news, they are still offering the same rates at the point of update.

But before you get too excited, heads up – you’ll need to have a $100,000 account balance and fulfil 5 categories (Salary + Save + Spend + Insure + Invest) to unlock the full 7.65%.

How to earn higher interest in OCBC 360 Account:

OCBC 360 has identified five categories which you can choose to fulfill (the ‘Grow’ category is only suitable for a smaller group of account holders). Each category unlocks its own interest rate which you can add up to get the effective interest rate (EIR) that you can unlock. Your account balance is also taken into consideration.

OCBC 360 has identified five categories which you can choose to fulfill (the ‘Grow’ category is only suitable for a smaller group of account holders). Each category unlocks its own interest rate which you can add up to get the effective interest rate (EIR) that you can unlock. Your account balance is also taken into consideration.

You will earn a base interest of 0.05% a year on your entire account balance regardless of whether you fulfil the above categories.

For maximum EIR illustration purposes for your first S$100,000:

Salary + Save: You will earn a maximum EIR of 4.05% a year.

Salary + Save + Spend: You will earn a maximum EIR of 4.65% a year.

Salary + Save + Spend + Insure / Invest: You will earn a maximum EIR of 6.15% a year.

Salary + Save + Spend + Insure + Invest: You will earn a maximum EIR of 7.65% a year.

If, like me, you’re too lazy to calculate your potential interest, you can use OCBC’s interest calculator to come up with an estimate based on your circumstances.

Here’re the details of each category:

Salary

- Credit at least S$1,800 of Salary

- Only salary credit through GIRO with the transaction description “GIRO – SALARY” will qualify for this bonus. You’ll need to update your details with your employer’s HR department if you’re switching over from a different bank or account.

Save

- Increase your average daily balance by at least S$500 monthly.

Spend

- Spend at least S$500 on your eligible OCBC Credit Cards (OCBC 365, OCBC NXT, OCBC 90°N or OCBC Titanium Rewards Credit Card).

Insure

- Purchase an eligible insurance product from OCBC:

- Regular Premium (Protection/Legacy): Min S$2,000

- Regular Premium (Endowment/Retirement): Min S$4,000

- Single Premium Insurance: Min S$20,000

- This bonus interest is accorded for 12 months after the effective date of purchase, post the free look/cancellation period or 14 days, whichever is longer.

Invest

- Purchase an eligible investment product from OCBC:

- Unit Trust: Min S$20,000

- Structured Deposit: Min S$20,000

- Bond & Structured Products: Min S$200,000

- This bonus interest is accorded for 12 months after the effective date of purchase, post the free look/cancellation period or 14 days, whichever is longer.

Grow

- Maintain an average daily balance of at least S$200,000.

You should note that the Insure and Invest categories will only accord bonus interest for 12 months after the effective date of purchase which means you’ll likely need to get a new eligible Insure and Invest product every 12 months.

Most folks who only fulfil the Salary, Save and Spend criteria would unlock a maximum EIR of 4.65% p.a.

Eligibility and fees:

- Age: 18 years old and above

- Minimum average daily balance: $3,000

- Fall below fee: $2 (waived for the first year)

- Minimum Initial Deposit: $1,000

- Bonus Interest Cap: First S$100,000

Current Promotions:

If you’re looking for a place to park your money with higher returns, OCBC is offering S$50 when you open a new OCBC360 account and credit your salary via GIRO within 2 months. Promotion is valid till 31 May 2023.

DBS Multiplier Account

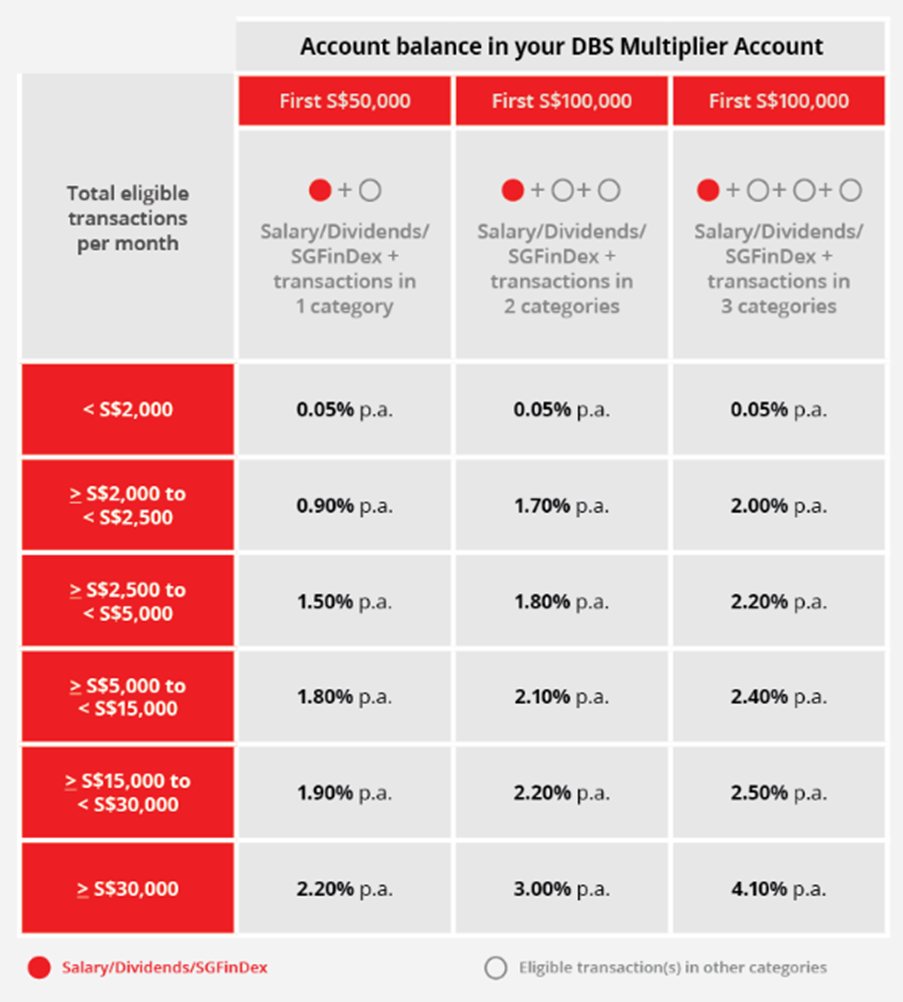

DBS is also offering the same bonus interest rates in the DBS Multiplier – up to 4.1% p.a. Although it doesn’t seem as eye-catching as OCBC 360’s max rate, DBS Multiplier doesn’t set a minimum amount on individual categories, which could offer greater flexibility to suit your financial needs.

How to earn higher interest in DBS Multiplier?

DBS Multiplier offers 4 categories (Credit Card Spend, Insurance, Investment, and Home Loan) through which you can unlock higher interest rates.

The bonus interest you’ll receive is based on your account balance, the total dollar value of (eligible) transactions, and the number of categories you fulfil.

Again, if you’re too lazy to calculate your potential interest, you can use DBS’ interest calculator to come up with an estimate based on your circumstances.

Here’re the details of each category:

- Salary / Dividends / SGFinDex

Any of the following actions will qualify you for this category:

- Salary Credit into your DBS/POSB account via GIRA with transaction code ‘SAL’ or ‘PAY’. Main transaction description is ‘Salary’ or “GIRO SALARY”.

- Dividend Credit into your DBS/POSB account, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) Account or CPF Investment Account (CPFIA). Eligible dividends include Central Depository Pte Ltd (CDP), DBS Vickers Securities, DBS Online Equity Trading (OET), DBS Unit Trusts, DBS Online Funds Investing and DBS Invest-Saver.

- Connect to SGFinDex: share your financial information across banks, SGX CDP and government accounts via SGFinDex + request for information retrieval of the linked accounts through DBS NAV Planner monthly.

- Credit Card Spend

Spend with any DBS/POSB personal credit cards like the POSB Everyday card that gives cash rebates. Transactions are calculated based on the posting date within the calendar month.

Do note that only posted retail and cash advance transactions are recognised as eligible credit card spends. Payment plans and fees or charges by the bank are not eligible. More information here.

- Home Loan Instament

Valid for new and existing DBS/POSB home loan(s), for new home purchase or refinancing from another bank/HDB. Monthly instalment due (both cash and CPF included) on your DBS/POSB home loan(s) are included in the eligible transaction.

- Insurance

All Manulife Regular and Single Premium insurance policies distributed by DBS/POSB are recognised. Recognition starts 1 month after policy inception and lasts for 12 consecutive months, unless policy is terminated. Monthly premium amount will be calculated by dividing the single premium amount by 120.

- Investments

Any of the following investments done after Multiplier account is opened, are eligible:

- Unit Trust (lump-sum) investment

- DBS Invest-Saver: Monthly investment amount will be recognised for the first 12 consecutive months per fund

- digiPortfolio: Minimum qualifying amount for this is S$1,000 per transaction. Investment amount will be recognised post settlement date

- Online Equities Trades: ‘BUY’ trades made via cash, CPF or SRS via DBS Vickers Online trading or DBS Online Equity Trading.

- Bonds & Structured Products

Although DBS Multiplier’s interest rate isn’t eye-catching, it offers greater flexibility as it doesn’t enforce a minimum spend on its categories (with exception to the min qualifying amount on digiPortfolio).

That said, to hit the full 4.1%, you’ll need to have a $100,000 account balance and at least $30,000 worth of eligible transactions across any 3 categories.

Eligibility and fees:

- Age: 18 years old and above

- Minimum average daily balance: $3,000

- Fall below fee: $5 (waived for those under 30 years old, or if DBS Multiplier is your first DBS/POSB account)

- Minimum Initial Deposit: Nil

- Bonus Interest Cap: First S$100,000

OCBC 360 vs DBS Multiplier: Which savings account is best for you?

Your circumstances are unique.

These high interest savings accounts come with hurdles that could benefit different individuals due to their structure. Hence you’ll need to assess your own situation to figure out whether OCBC 360 or DBS Multiplier can provide you with better rates.

Here’re some typical cases to consider:

Student with savings and a part-time job

Working part-time while studying is a great way to build up your initial investment capital. With some cash on-hand, you may be thinking of optimising the interest rates you can get your hands on in the current high rates environment.

| Practical Interest Rate | Criteria | |

| OCBC 360 | 1.2% | Increase your average daily balance by at least S$500 monthly |

| DBS Multiplier | 0.4% (only on the 1st $10,000) | Connect with SGFinDex on Nav Planner + Monthly spend using PayLah! |

Freelancer with no monthly income salary credited:

| Practical Interest Rate | Criteria | |

| OCBC 360 | 1.80% (First $75,000 account balance.Interest will increase with higher account monthly balance.) | Increase average daily balance by at least S$500 monthly + Charge at least S$500 to selected OCBC Credit Cards each month. |

| DBS Multiplier | 1.70% (Assuming total transactions at $2,000, interest rate will increase with total eligible transactions) | Connect with SGFinDex on Nav Planner + Credit Card Spend |

If you’re a woke freelancer who buys the Nikko AM STI ETF (or any eligible investment) religiously each month, you could qualify for a 2nd category under ‘Investment’ and bump up your practical interest rate to 2% using DBS Multiplier. The downside is that you have to do it manually each month and this is #NFA. (This was verified via a call to DBS’ customer service)

However, assuming you match the conditions in the table, OCBC 360 appears to be the superior option for freelancers.

Individuals with a Salary of $2,500 and minimum credit card spending of $500:

| Practical Interest Rate | Criteria | |

| OCBC 360 | 2.60%(First $75,000 account balance) | Credit your Salary + S$500 Credit Card Spend |

| DBS Multiplier | 1.5%(First $50,000 account balance) | Credit your Salary + S$500 Credit Card Spend |

If you’ve just stepped into the workforce, OCBC 360 looks like a better option.

Retirees with good cash flow from dividends and $100,000 cash on hand

| Practical Interest Rate | Criteria | |

| OCBC 360 | 2.1% | S$500 Credit Card Spend + Insure |

| DBS Multiplier | 4.1% | Credit your Dividend + Credit Card Spend + Home Loan + Insurance (transactions > $30,000) |

If you don’t have an official salary credit but rake up higher amounts of transactions, DBS Multiplier may be for you.

It may also make sense for dividend investors to earn a little more on your dividends as it allows you to use your dividend credit alongside your Salary component (although it may be too much hassle to shift your dividend credit to DBS if you are not already doing so).

Conclusion

I hope the comparison between OCBC 360 vs DBS Multiplier here has given you a better idea of which is a better high interest savings account for you.

At the point of writing, it appears that OCBC 360 is leading for salaried employees like myself. (You should also read our comparison of UOB One vs OCBC 360)