You’ve worked hard for your monthly paycheck. While you save up, you want your money to grow faster with little risks while still being accessible whenever you might need it.

High interest saving accounts are a good way for you to store your funds and earn an extra interest on them. Here, I compared the best savings accounts offered by Singapore banks:

Best Bank Saving Accounts in Singapore

| Bank | Saving Account | Achievable interest rates* (p.a.) | (Lowest) Base Interest (p.a.) | Max interest rate (p.a.) | Minimum Deposit | Minimum balance | Who should use it? |

|---|---|---|---|---|---|---|---|

| Standard Chartered | Bonus$aver | 3.8% | 0.01% | 7.88% | $0 | S$3,000. Fall below fee: $5 | High Earners and Spenders who don’t mind investing in unit trusts |

| UOB | UOB ONE | 3.85% | 0.05% | 7.8% (EIR ~5%) | S$1,000 | S$1,000. Fall below fee: $5 | Folks who don’t receive regular salary crediting, but makes at least 3 GIRO transactions |

| OCBC | 360 Account | 4.65% | 0.05% | 7.65% | S$1,000 | S$3,000. Fall below fee: $2 | Savers who don’t mind investing in unit trusts or buying insurance with OCBC |

| CIMB | FastSaver | 3.5% | 0.8% | 3.5% (promotion is till 30 Sep 2023, rates are only available for the first 6 months from account opening) | S$1,000 | S$1,000 to earn interest. No fall below fee. | Savers who want all their finances with 1 bank |

| Bank of China | SmartSaver | 2.8% | 0.1% | 7% | S$1,500 | S$1,500. Fall below fee: $3 | High Earners and Spenders |

| DBS | Multiplier | 1.8% | 0.05% | 4.1% | $0 | S$3,000. Fall below fee: $5 | High Earners and Spenders |

| Maybank | Save Up | 1.25% | 0.25% | 3% | S$500 | S$1,000. Fall below fee: $2 | Folks who don’t receive regular salary crediting & are considering a loan |

*this is based off Xiao Qiang’s example

For the ease of comparison, I calculated the estimated achievable interest rate for each bank savings account using Xiao Qiang’s financials as our case study:

Xiao Qiang is a hardworking 30 year old white collared employee in Singapore. He is looking for the best bank saving account that’ll help him grow his money faster as he saves. He has:

- A lump sum saving of $50,000,

- Gross income of $4,500, which is about $3,600 take home, and

- spends about $1,000 per month on his credit card

For the sake of my sanity, I’ll assume his insurance payments, investments and other loans will not be transferred to his brand new bank savings account.

Quick note: with exception of CIMB, the high interest rates bank accounts listed here are hurdle accounts, which means you’ll need to fulfill certain banking tasks every month to unlock the higher interest.

Some of the interest rates are allocated on certain balance tiers, so you’ll need to work out the effective interest rates (EIR) separately!

Now that we’re on the same page, let’s take a look at what each savings account offers:

Standard Chartered Bank’s Bonus$aver Account

The Standard Chartered Bonus$aver account helps users grow their money with higher interest rates through 5 different options – salary credit, bill payments, investments and insurance.

Standard Chartered’s Bonus$aver account interest rates

Here, you add the base interest rate with the eligible interest rate based on the criteria you qualify for:

| Base Interest Rate | Credit salary (at least S$3,000) through GIRO | Spend on Bonus$aver Credit Card | Purchase eligible unit trust | Purchase eligible insurance product | Pay 3 unique bills online or via GIRO | |

| First S$100,000 | 0.05% | 2.5% | 1.3% (min S$500) 2.05% (min S$2,000) | 1.5% | 1.5% | 0.33% |

| Above S$100,000 | 0.05% | – | – | – | – | – |

Balances above S$100,000 are not eligible for bonus interest, but will receive prevailing interest rates.

How much would Xiao Qiang get with Bonus$aver programme?

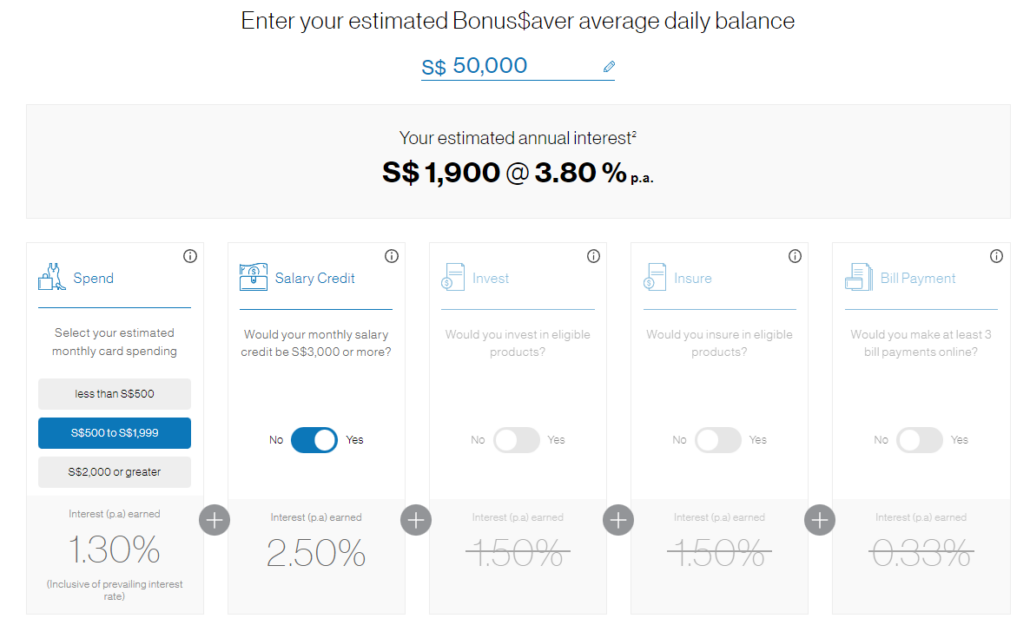

Using the calculator provided by Standard Chartered, Xiao Qiang would enjoy an effective interest rate of about 3.8% p.a. interest.

If he chooses to invest or insure using Standard Chartered’s products, he could unlock another 1.5% quickly:

Standard Chartered’s Bonus$aver account eligibility

You need to be at least 21 years old to be eligible for Bonus$aver. There is no minimum deposit, however you’ll need to apply for the Bonus$aver credit card.

How to open a Bonus$aver account?

Existing customers can apply online by logging into Standard Chartered account.

New customers can apply online using Singpass to retrieve their information via MyInfo or visit a branch. Foreigners can either apply through SingPass or visit a branch with their passport, proof of residential address and supporting documents such as a proof of employment, long term visit pass, or proof of study in Singapore.

Additional Costs / Fees to note

- Fall below fee: $5 monthly if average daily balance falls below $3,000.

- Early account closure fee: $30 (if you close within 6 months of opening)

- Cheque book: $10 (upon request)

- Credit card annual fee: $214 (waived for first 2 years)

UOB One

[update] UOB One’s rates will be revised from 1 May 2024, here’s how the revisions will affect your effective interest rates.

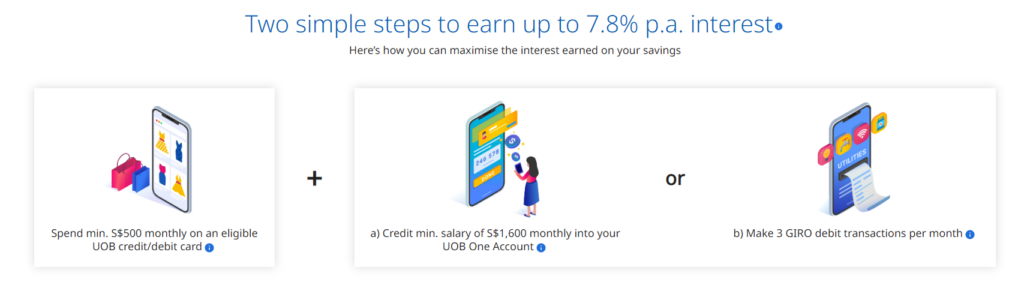

UOB One allows you to earn higher interest rates either by coupling your credit card expenses with your salary or with GIRO transactions:

Hold your horses…let’s take a look at the breakdown:

UOB One account interest rates

| UOB One Balance Tiers | Spend at least $500 on eligible UOB card | Spend min. S$500 (calendar month) on eligible UOB Card + make 3 GIRO debit transactions | Spend at least $500 on eligible UOB card + credit Salary via GIRO |

|---|---|---|---|

| First S$30,000 | 0.65% | 2.5% | 3.85% |

| Next S$30,000 | 0.65% | 3% | 3.9% |

| Next S$15,000 | 0.65% | 4% | 4.85% |

| Next S$25,000 | 0.05% | 0.05% | 7.8% |

| Above S$100,000 | 0.05% | 0.05% | 0.05% |

As the interest is calculated by tiers, even if you fulfill the criteria of having S$100,000, spend $$500 on UOB card and credit your Salary via Giro, your effective interest rate is about 5%:

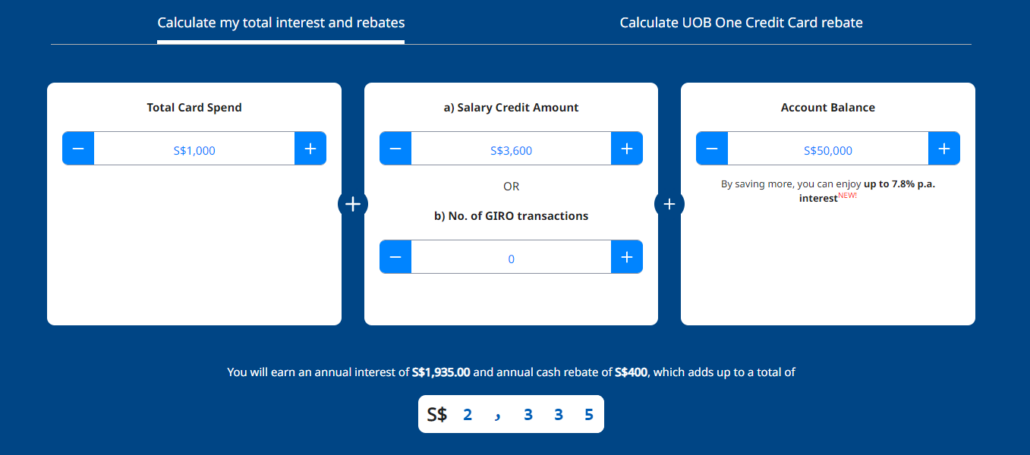

How much would Xiao Qiang get with UOB One?

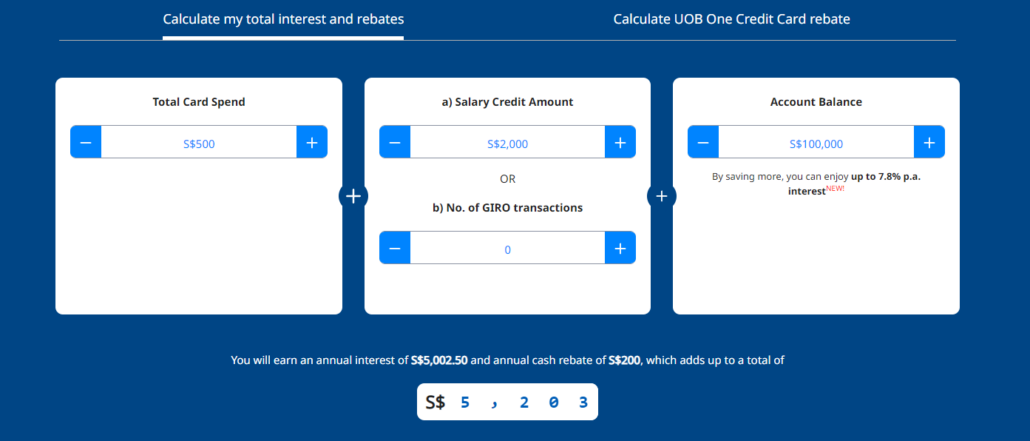

Using the One Account calculator, Xiao Qiang would enjoy an effective interest rate of about 3.87% p.a. interest. If we include the additional cash rebates on the transactions made on his UOB One credit card as part of the interest, it would be about 4.67%.

UOB One account eligibility

You need to be at least 18 years old to open a UOB One account and will require a minimum deposit of S$1,000.

How to open a UOB One account?

Existing UOB customers can apply online by logging into their UOB personal banking account.

New customers can apply online using Singpass to retrieve their information via MyInfo. Foreigners will need to visit a UOB branch with their passport, proof of residential address and supporting documents such as a proof of employment, long term visit pass, or proof of study in Singapore.

Additional Costs / Fees to note

- Fall below fee: $5 monthly if average daily balance falls below $1,000. Waived for 1st 6 months if you open the account online.

- Early account closure fee: $30 (if you close within 6 months of opening)

- Cheque Book: S$10 per cheque book (upon request)

- Bonus interest rates are only applicable to first S$100,000

OCBC 360 Account

OCBC 360 Account encourages its users to save by rewarding them with higher interest rates for growing their average daily balance each month. You can also unlock higher interest rates by fulfilling the following criteria:

OCBC 360 account interest rates

OCBC offers a 0.05% base interest rate for all balances. You can unlock additional bonus interest depending on the criteria you qualify for, with varying rates for different balance tiers:

| OCBC 360 Balance Tiers | Base Interest Rate | Credit salary (at least S$1,800) through GIRO | Increase average daily balance by at least S$500 every month | Spend at least S$500 with OCBC Credit Cards | Purchase eligible insurance product from OCBC | Invest in eligible investment product from OCBC | Maintain average daily balance of at least S$200,000 |

|---|---|---|---|---|---|---|---|

| First S$75,000 | 0.05% | 2% | 1.2% | 0.6% | 1.2% | 1.2% | 2.4% |

| Next S$25,000 | 0.05% | 4% | 2.4% | 0.6% | 2.4% | 2.4% | 2.4% |

| Effective interest rates | 0.05% | 2.5% | 1.5% | 0.6% | 1.5% | 1.5% | 2.4% |

How much would Xiao Qiang get with OCBC 360?

In Xiao Qiang’s case, he should be able to get an effective interest rate of up to 4.65% with his $50,000 savings, salary crediting and monthly credit card spend of $1,000.

OCBC 360 account eligibility

You need to be at least 18 years old to open an OCBC 360 account and will require a minimum deposit of S$1,000.

How to open an OCBC 360 account?

Existing customers can apply online by logging into their OCBC Internet Banking account.

New customers can apply online using Singpass to retrieve their information via MyInfo. Foreigners will need to visit an OCBC branch with their passport, proof of residential address and supporting documents such as a proof of employment, long term visit pass, or proof of study in Singapore.

Additional Costs / Fees to note

- Fall below fee: $2 monthly if average daily balance falls below $3,000. Waived for 1st year.

- Early account closure fee: $30 (if you close within 6 months of opening)

- Cheque Book: S$10 per cheque book (upon request)

- The interest rates are only applicable to the first $100,000

if you can’t decide between UOB One and OCBC 360, read Zhi Rong shared a deeper comparison and the different profiles of savers who would benefit by using them.

CIMB FastSaver

CIMB FastSaver is a no frills savings account – all you need to do is deposit your cash for higher interest rates. There’s no need to fret over overly confusing tiers or checkpoints to unlock higher rates.

That said, do note that account balances >$75,000 will be entitled to lower 0.15% interest.

CIMB FastSaver savings account interest rates

| FastSaver Balance Tiers | FastSaver Promo Rate (for new-to-Bank customers only) | Prevailing Rates |

|---|---|---|

| First S$25,000 | 3.5% | 1.5% |

| Next S$25,000 | 3.5% | 2.5% |

| Next S$25,000 | 3.5% | 3.5% |

| Above S$75,000 | 3.5% | 0.8% |

How much would Xiao Qiang get with CIMB FastSaver?

In Xiao Qiang’s case, he would unlock an interest rate of about 3.5% based on his circumstances.

CIMB FastSaver eligibility

You need to be at least 16 years old to open a CIMB FastSaver account, and would require to deposit a minimum of S$1,000.

How to open a CIMB FastSaver account?

Existing CIMB customers can apply by logging into their customer portal.

New customers will need to prepare a copy of their NRIC or Passport (for foreigners), a proof of residential address (such as your latest telephone bill, bank statement or government issued letter). Foreigners also need to provide supporting documents such as an employment pass, work permit, dependent’s pass or student pass.

You can either apply for a CIMB FastSaver account online using your Singpass or visit a branch.

Additional Costs / Fees to note

- Fall below fee: none

- Counter Transactions: $5

- Linking of CIMB ATM to FastSaver account: $10

- Early account closure fee: $50 (if you close within 6 months of opening)

BOC SmartSaver

Bank of China’s SmartSaver is a multi-currency savings account where you can earn a high base interest of 0.1% and additional bonus interest when you fulfil additional criteria.

As of 1 Jan 2023, they have revised their rates to make it more attractive.

BOC SmartSaver interest rates

Here, you add the base interest rate with the eligible interest rate based on the criteria you qualify for:

| BOC Balance Tiers | Base Interest Rate | Credit salary (at least S$2,000) through GIRO | Purchase BOC’s Insurance products for 12 consecutive months | Eligible monthly Spend on BOC Credit / Debit Cards | Pay 3 unique bills (of at least S$30) online or via GIRO | Have >S$100,000 balance and fulfill any one of the requirements |

|---|---|---|---|---|---|---|

| First $100,000 | 0.4% | 1.9% (S$2,000 – <S$6,000) 2.5% (S$6,000 and more) | 2.4% | 0.5% (S$500 – < S$1,500) 0.8% (S$1,500 and more) | 0.9% | – |

| $S100,000 and above | 0.4% | – | – | – | – | 0.6% |

You can check BOC’s latest base or prevailing interest rates here.

How much would Xiao Qiang get with the BOC SmartSaver?

In Xiao Qiang’s case, he gets:

- the prevailing rate of 0.4% on his lump sum S$50,000 deposit,

- 1.9% for crediting his salary and another

- 0.5% for spending $1,000 on his BOC credit card each month.

If he were to get a pay raise or increase his spending in the future, he could unlock another 0.6%.

BOC SmartSaver account eligibility

You need to be at least 18 years old to be eligible for Bonus$aver. You’ll require a minimum initial deposit of S$200.

How to open a BOC SmartSaver account?

You can either apply online via Singpass or visit a branch.

If you’re visiting BOC’s branch, do bring along your ID. Foreigners will need to bring their passport, proof of residential address and supporting documents such as a proof of employment, long term visit pass, or proof of study in Singapore.

Additional Costs / Fees to note

- Minimum monthly average effective balance to enjoy the bonus interest: S$1,500

- Fall below fee: $3 monthly if average daily balance falls below $200

DBS Multiplier

The DBS Multiplier offers a low entry of barrier while rewarding high earners and spenders.

An interesting feature of the DBS Multiplier is if you do not wish to have your salary credited to the account, you can choose to connect your DBS Multiplier account to SGFinDex on the DBS NAV Planner and sync it once a month instead.

SGFinDex is an MAS initiative that lets you view all your financial information in 1 portal.

DBS Multiplier savings account interest rates

In their attempt to provide max flexibility for consumers, the DBS Multiplier account comes with a wide range of ways you can unlock higher interest rates:

DBS Multiplier Balance Tiers

| Value of Eligible Transactions | >$499 to < S$15,000 | >$14,999 – <S$30,000 | S$30,000 and more |

| First S$50,000 (Salary + Transaction in 1 category) | 1.8% | 1.9% | 2.2% |

| First S$100,000 (Salary + Transaction in 2 categories) | 2.1% | 2.2% | 3% |

| First S$100,000 (Salary + Transaction in 3 categories) | 2.4% | 2.5% | 4.1% |

The interest rate you get are based of two tiers that you need to take note of here;

- Balance Tier

- Total value of your eligible transactions

To estimate your possible interest rate, you can use the interest calculator provided by DBS here.

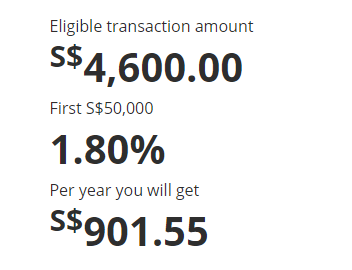

How much would Xiao Qiang get with DBS Multiplier?

Based on the DBS interest calculator, Xiao Qiang would unlock 1.8% p.a. interest with his initial deposit of S$50,000, salary crediting of S$3,600 and monthly credit card spend of S$1,000.

DBS Multiplier account eligibility

You need to be at least 18 years old to open a DBS Multiplier account.

There is no minimum initial deposit.

How to open a DBS Multiplier account?

Existing DBS customers can apply by logging into their iBanking account.

New customers will need to prepare a copy of their NRIC or Passport (for foreigners), a proof of residential address (such as the back of your NRIC, latest telephone bill, bank statement or government issued letter). Foreigners also need to provide supporting documents such as a proof of employment, long term visit pass, or proof of study in Singapore.

You can either apply for a DBS Multiplier account online or visit a branch.

Additional Costs / Fees to note

- Fall below fee: $5 monthly if average daily balance falls below $3,000

- Early account closure fee: $30 (if you close within 6 months of opening)

Maybank Save Up

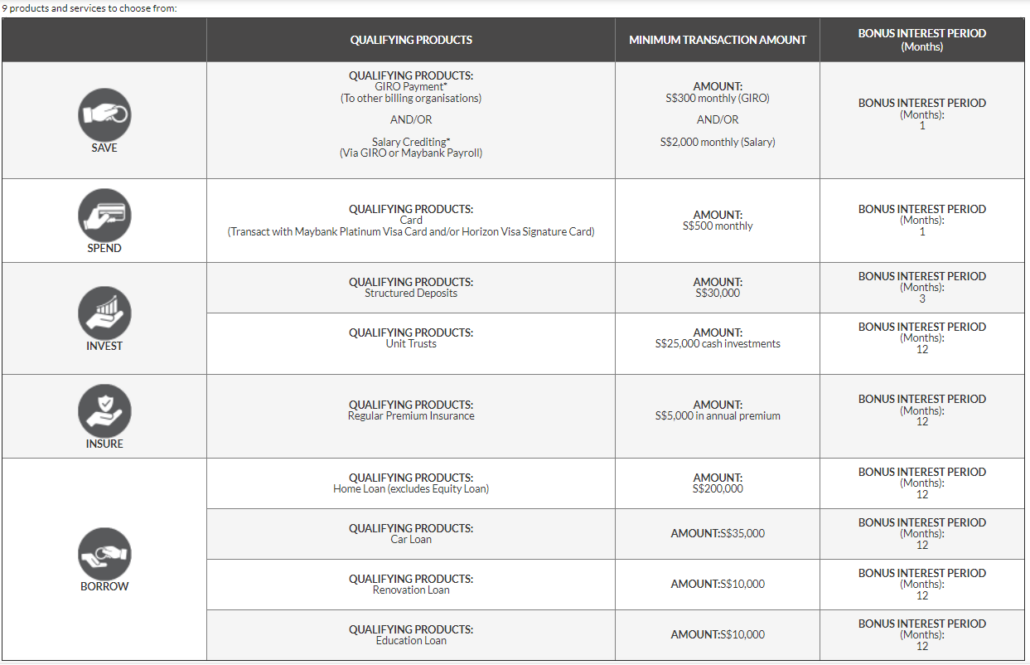

Maybank’s Save Up program rewards users for banking with them – the more Maybank products you use, the higher interest rates you’ll get.

Maybank Save Up programme interest rates

Here, you add the corresponding base interest rate with the eligible interest rate based on the criteria you qualify for:

| Maybank Save Up Balance Tiers | Base Interest Rate | Use 1 Maybank product / service | Use 2 Maybank product / service | Use 3 Maybank product / service |

|---|---|---|---|---|

| First S$50,000 | 0.25% | 0.1% | 0.7% | 2.75% |

| Next S$25,000 | 0.25% | 1% | 1.5% | 3.75% |

| Max Effective Interest Rate | 0.25% | 0.53% | 1.17% | 3.08% |

How much would Xiao Qiang get with Maybank’s Save Up programme?

In Xiao Qiang’s case, he gets 0.25% for his lump sum S$50,000 deposit and an additional 0.7% for his salary crediting and credit card spend.

However, the bonus interest will only be paid for the first $50,000. For amounts above $50,000, he’ll only earn the base rate of 0.25%.

To unlock the full 3%, Xiao Qiang can consider the following qualifying Maybank products:

Maybank Save Up account eligibility

You need to be at least 18 years old to open a Maybank Save Up account and will require a minimum deposit of S$500.

How to open a Maybank Save Up account?

Existing customers can apply online by logging into their Maybank2u SG app or their Maybank account.

New customers can apply online using Singpass to retrieve their information via MyInfo or visit a branch. Foreigners will need to visit a UOB branch with their passport, proof of residential address and supporting documents such as a proof of employment, long term visit pass, or proof of study in Singapore.

Additional Costs / Fees to note

- Fall below fee: $2 monthly if average daily balance falls below $1,000. Waived for 1st year.

- Early account closure fee: $30 (if you close within 6 months of opening)

Which bank has the best interest rate in Singapore?

In Xiao Qiang’s case, currently OCBC 360 offers the best interest rate at ~4.65% p.a.

If your financial situation is similar to Xiao Qiang’s, you may want to refer to the achievable interest rate provided in the table above to narrow your selection.

To get a better estimate of your possible interest rates, you can also use the interest calculator provided by each bank (with exception of BOC and CIMB).

Thinking of capturing the best bank saving account rates?

Depending on your financial situation, some of the bank saving accounts would provide higher interest rates which are easily accessible.

In the face of rising interest rates, banks are starting to offer higher rates on their saving accounts. You should note that there may be criteria you need to fulfil before you can unlock the high interest rates as advertised.