Many investors are worried that Singapore listed REITs (SREITS) are being impacted by a trifecta of higher interest rate and inflationary costs coupled with a slowing global economy.

Here we picked 5 SREITS to watch in 2023 as we think they would likely fare better than their peer group.

1) CapitaLand China Trust (SGX: AU8U)

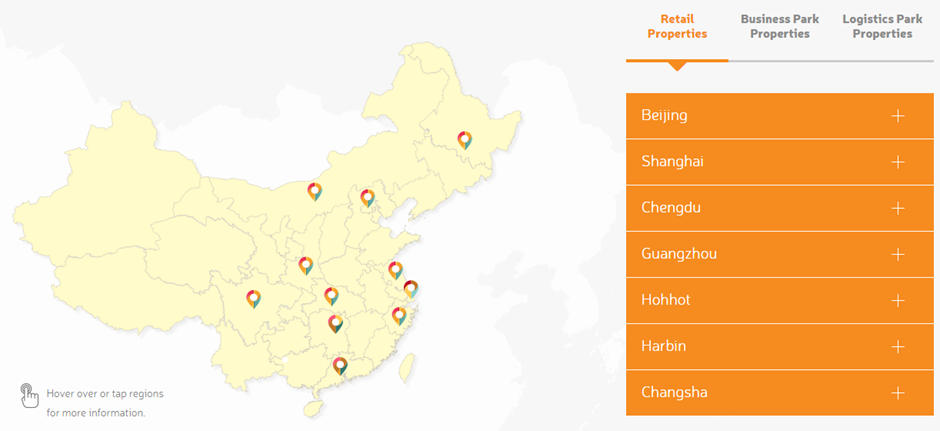

CLCT has a has a portfolio that constitutes 11 shopping malls, five business parks and four logistics parks. The portfolio is located across 12 Chinese cities with its business parks in Suzhou, Xi’an and Hangzhou while the portfolio’s logistics parks assets are in Kunshan, Shanghai, Wuhan and Chengdu. Occupancies for the retail, business park and logistics park were between 91.4% and 96.4% which provides for potential upside from higher occupancies.

In FY22, CLCT faced headwinds from the stringent pandemic controls in China and had to provide rental relief during prolonged lockdown. It took the opportunity to embark on Asset Enhancement Initiatives (AEIs) as well as acquired business parks and logistics parks to diversify away from the retail segment.

The Chinese economy is expect to expand between 5.2% and 5.8% in 2023, underpinned by the country’s reopening and technological innovation drive. CLCT’s well located retail assets will likely benefit from increased spend from the vast middle income population.

Its business park has exposure to tech companies and will benefit from China’s investment in technology while the logistics park segment will capture China’s domestic consumption flows.

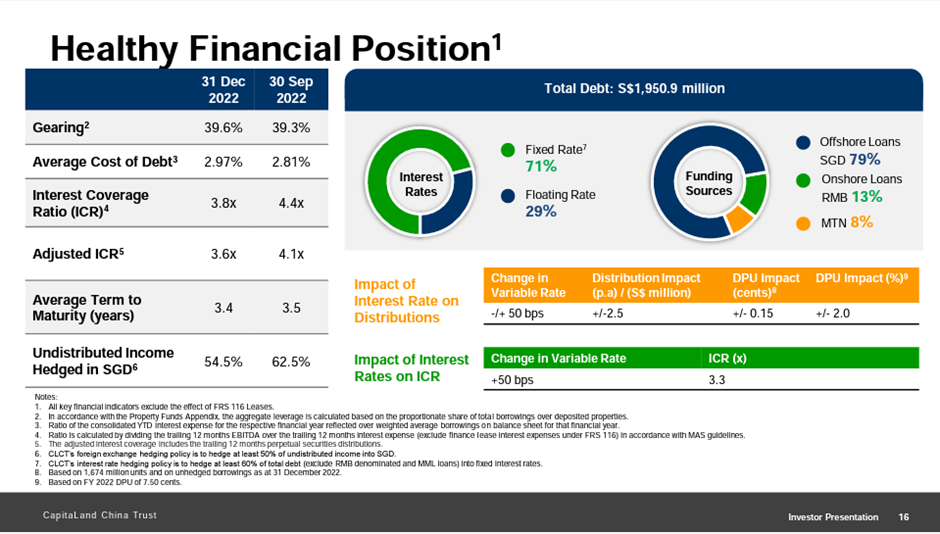

CLCT also has a robust capital management in place with a gearing of just under 40%, cost of debt of just under 3% and both interest and income hedges in place to mitigate against volatility.

2) Mapletree Logistics Trust (SGX: M44U)

In March 2023, MLT announced plans to acquire eight logistics properties in Japan, Australia and South Korea for a combined value of about $914 million. All eight properties are priced at a slight discount to their actual value as derived from an independent valuation and were accretive to the distribution (DPU) and net asset value per unit.

The acquisitions were funded by a private placement which allowed MLT to quickly raise funds and keep its leverage ratio just below 40%.

At the same time, MLT is also in talks to acquire two properties in Jiaxing, China, for an estimated 1.08 billion yuan (S$208 million), while looking at a potential divestment of a non-core property in Hong Kong for about HK$590 million (S$99.8 million). This will likely lead to further DPU accretion as well as rejuvenate and strengthen its portfolio.

3) Sasseur REIT (SGX: CRPU)

Sasseur REIT is a Chinese outlet retail mall REIT with a portfolio of four retail mall assets located in Chongqing, Kunming and Hefei.

In FY22, operations were impacted by sporadic COVID-19 lockdowns in China and China’s opening is expected to spur economic activities towards normalisation in 2023.

Despite the operational challenges faced in 2022, Sasseur’s portfolio occupancy exceeded pre-COVID levels and currently stands at 97.2%. This was because Sasseur also took the opportunity to carry out AEIs in Chongqing Bishan which led to occupancy increasing by 5.8%.

Sasseur has a low gearing of 27.6%, which provides for ample firepower for future acquisitions. The REIT was also able to successfully refinance all of its debt which was previously due in Mar 2023 and Sasseur currently has an average debt to maturity profile of 3.6 years.

4) Suntec REIT (SGX: T82U)

Suntec REIT owns offices in Singapore and Australia as well as the Suntec City Mall and Suntec Convention Centre.

Revenue performance from Suntec City Mall is expected to improve, underpinned by higher occupancy, rent and marketing communications revenue. The rebound of Meetings, Incentives, Conventions and Exhibitions (“MICE”) events and the return of tourists will help boost tenant sales and mall traffic.

The recovery of Suntec Convention Centre is expected to be driven by a strong pipeline of international MICE events and the return of larger-scale consumer and corporate events. The easing of China’s travel restrictions will have a positive impact on the convention business from the second half of 2023. Full recovery of the convention business is expected in 2024.

However, investors who are keen on Suntec have to look out for its gearing which stands at 42.4%. Suntec also has a relatively low percentage of interest rate hedges in place and a high financing cost. Hence, Suntec is looking at divesting mature assets to strengthen its balance sheet.

Should Suntec be able to manage this overhang well, it will likely record stronger earnings from its mall and convention businesses.

5) Frasers Logistics & Commercial Trust (SGX: BUOU)

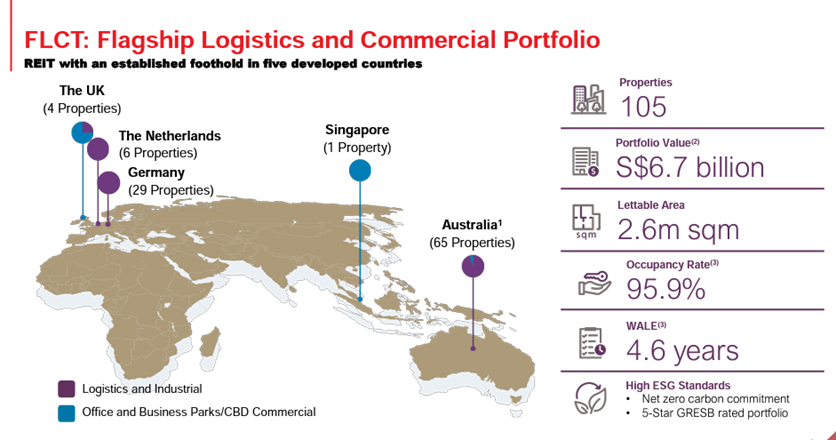

FLCT has a portfolio comprising 105 logistics and commercial properties worth approximately S$6.7 billion, diversified across five major developed countries – Australia, Germany, the United Kingdom, Singapore and the Netherlands.

The REIT’s portfolio also enjoyed a high occupancy rate of 95.9% with a WALE of 4.6 years. The portfolio recorded a positive rental reversion of 11% in 1QFY23.

FLCT’s gearing stood at 27.9% with a low cost of borrowings of 1.7% with 78.7% of the REIT’s borrowings on fixed rates and its interest coverage ratio was 13.6 times.

FLCT has a very significant debt headroom of S$3.1 billion that it can utilise to undertake yield-accretive acquisitions.

Closing statements

CLCT and Sasseur REIT are two SREITs to look out for as they will not only benefit from China’s reopening but also have robust balance sheet.

MLT & FLCT are logistics SREITs that will continue to be part of the broader macro tailwind. MLT has a strong track record of accretive acquisitions as well as positive rental reversions while FLCT has a very sizeable headroom for it to undertake yield accretive acquisitions and increase overall returns to investors.

Although Suntec has a weaker balance sheet as compared to the other SREITs mentioned here, the management is aware and is looking to strengthen its balance sheet as it benefits from Singapore’s position as a travel and MICE hub.

Chris Ng shares his thoughts on the current state of S-REITs and how he continues to pick the best ones that’ll pay him a dividend income. Join his live Early Retirement Masterclass to learn more.

And if you want to look beyond S-REITs, I’ve shared 5 Singapore dividend stocks worth watching here.

This article does not mention net yield from these , so it can be misleading for investors

the REITs were selected for reasons beyond yields.