CapitaLand China Trust (CLCT), formerly known as CapitaLand Retail China Trust*, is Singapore’s largest China-focused real estate investment trust (REIT) with a market cap of S$2.09 Billion.

*The name was changed from 26 January 2021 following the expansion of its investment strategy, from a pure retail REIT to one that holds offices and industrial properties.

Like most Retail REITs, CLCT was beaten down during the pandemic as economies went into lockdown. During the lockdown, retail sales fell sharply as citizens reduced unnecessary trip to the malls. In the case of China, a complete lockdown was implemented to curb the spread of COVID-19 which has affected malls severely during this period. As a result, CLCT share price plummet 36% from its peak in Feb 2020 last year.

While CLCT share price has yet to recover to its pre-pandemic level, there are positive signs which signals the worst are behind the REIT now. (CLCT dropped slightly after the news of Phase 2 Heightened Alert was released last week. Fundamentals remain unchanged.)

Due to the decisive actions taken by the Chinese government to contain the spread of COVID-19, China was the first country to reopen in 2020. While some restrictions are still in place, the pandemic is well under controlled there. According to the Ministry of Commerce, about 80% of restaurants and 90% of commercial facilities have resumed business across China since May 2020.

With the resumption of economic activities, China’s economy expanded 2.3% last year while the rest of the world suffered negative economic growth. Moving ahead, analysts even expect China to grow by more than 8% for 2021, which is why I am bullish on China’s growth ahead.

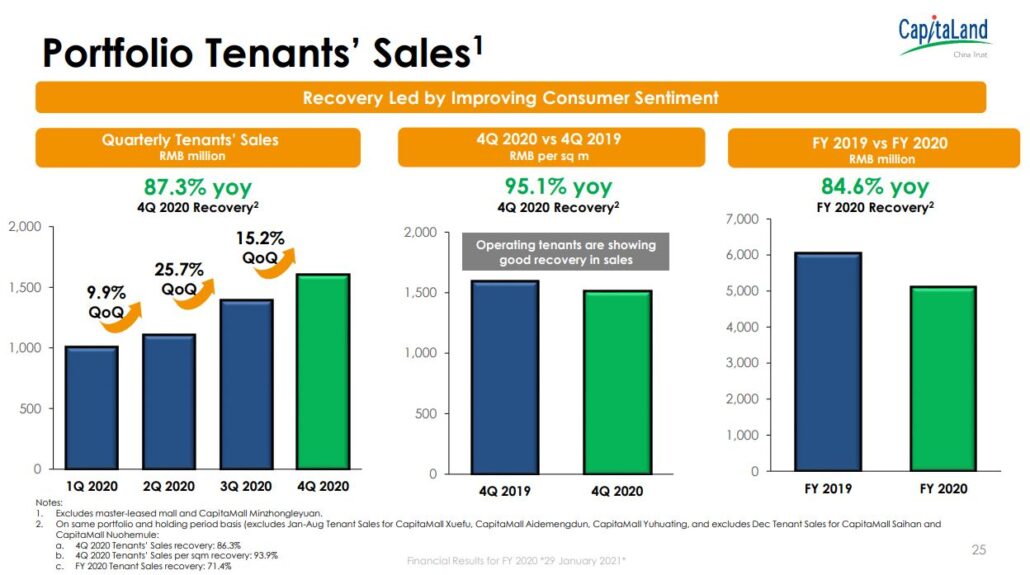

CLCT reports that its retail malls are seeing an increase in footfall quarter on quarter as consumer sentiments improve. CLCT’s business parks seemed barely affected by the Work-From-Home trend. By mid-Q2 2020, the percentage of workforce reporting back to work had already returned to pre-COVID-19 levels as companies prefer the collaborative, campus-style environment that business parks offer.

With that, it does seem like CLCT has the potential to grow ahead as such, in this article, we shall analyse its opportunities and its risk. Thereafter, we will determine if it is a good buy today.

CapitaLand China Trust REIT’s Portfolio Overview

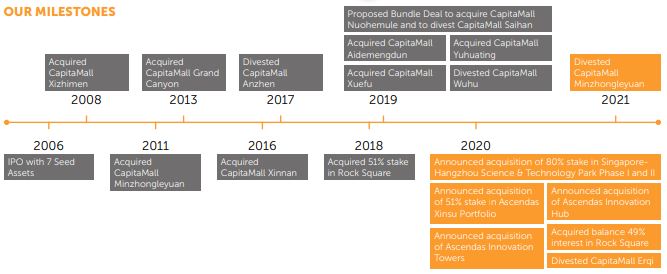

CLCT’s portfolio contains 13 shopping malls and 5 business park properties located across 11 leading Chinese cities with a mix of tier 1 and tier 2. The acquisition of Singapore-Hangzhou Science & Technology Park Phase I and Phase II is expected to be completed by 2Q 2021.

CLCT’s retail properties are strategically located in densely populated areas with good connectivity to public transport. These malls are positioned as one-stop family-oriented destinations that offer essential services and a wide range of lifestyle offerings that cater to different consumers.

CLCT’s business parks on the other hand, are situated in high growth economic zones with proximity to transportation hubs. These buildings house high quality and reputable domestic and multinational corporations across different sectors.

More recently, due to the expansion of its investment strategy, CLCT’s asset class is much more diversified.

Going forward, we can expect more diversification as CLCT’s continues to acquire more properties.

Across its portfolio, CLCT’s tenants are also well-diversified into various sectors. This allows CLCT to capture future growth in certain industries while reducing the impact from a declining one.

Financial Performance

Revenue

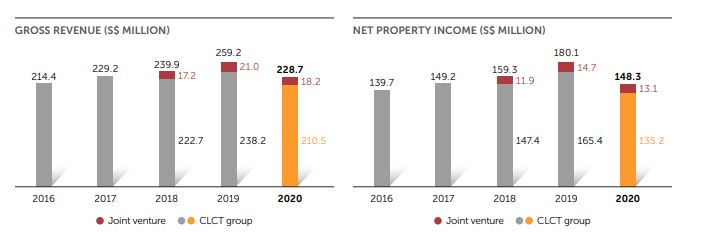

Looking at the 5-year trend of CLCT financial performance, we can see a general uptrend with growing gross revenue and net property income increasing year on year except for FY2020 which had been impacted by the pandemic.

Including its joint venture, CLCT’s gross revenue and net property income drop 11.8% and 17.6% respectively in FY2020 due to rental rebates and other Covid related costs.

Nonetheless, the growing revenue over the past years is a positive sign that CLCT will continue to do well in years to come, especially as more revenue comes in from its newly acquired properties.

Occupancy and Lease Expiry

During the pandemic, CLCT’s retail occupancy drop by 4%. Nonetheless, with a vacancy rate of 6%, it is still better than the average of 7-8% for China retail malls. (All of CLCT’s malls, excluding CapitaMall Shuangjing, are multi-tenanted which is why you can see CapitaMall Shuangjing occupancy has been rather stable)

Its Business Park was recently acquired; hence we do not have much data about it.

However, we can see a healthy portfolio occupancy of 92.1%, which is above the average of China Tier I and Tier II cities.

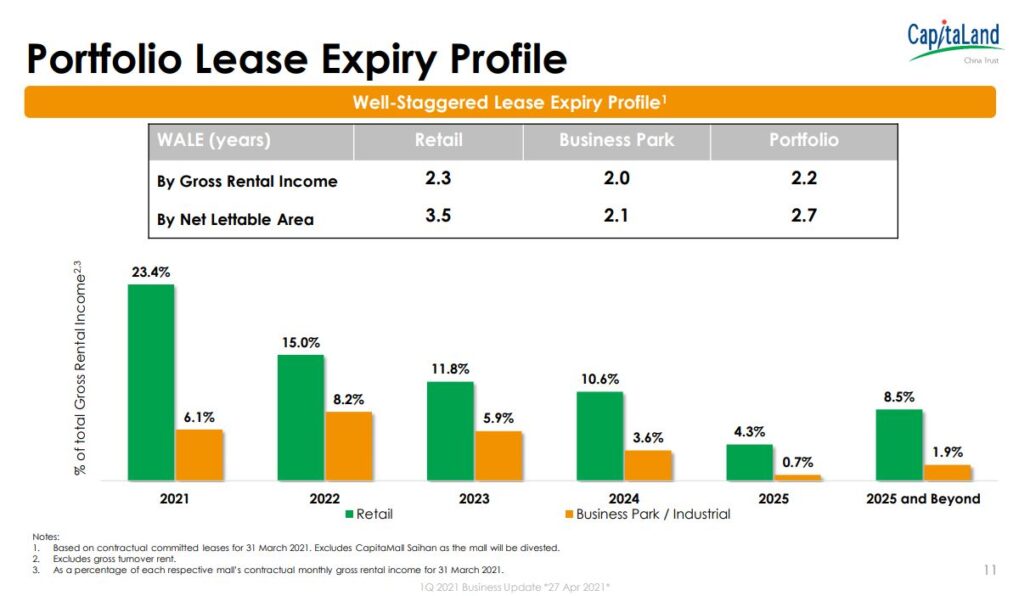

Next up, CLCT’s portfolio lease expiry is well spread out over the years with slightly more expiring in the coming years.

To note, it has a Weighted Average Lease Expiry (WALE) by Gross Rental Income and Net Lettable Area at 2.2 years and 2.7 years respectively. This is relatively low compared to the industry average (image below) but understandable due to the pandemic.

During this period many tenants were unsure if they want to continue their lease, as such, CLCT reduced the lease period for new and renewed lease in FY2020 so that tenants have more time to assess their situation before committing to a new lease. This not only ensures CLCT’s occupancy remains high, it also allows possible rental escalation in the coming years as the rental scene recovers.

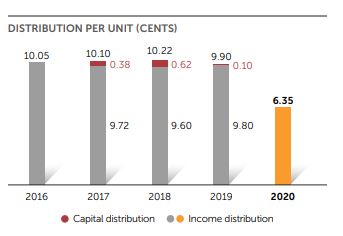

Distribution Per Unit

Due to a string of divestment and acquisitions over the years, CLCT earnings per share hasn’t been consistent. FY2020 was the pandemic year that had affected CLCT earnings due to rental rebates given to its tenants, as such EPS for that year was negative.

However, I am not too worried about this as the easing of restriction in China has been great CLCT.

With inconsistent earnings together with an increase in the number of shares from preferential offering and private placement done over the years, it ultimately led to a fluctuating dividend per unit (excluding capital distribution from divestment) over the past 4 years, even if we discount the pandemic year.

While this may not be as ideal since we usually look out for REITs that consistently grow their DPU, I do not believe this is a big issue in the long run as income from its newly acquired properties starts to trickle in.

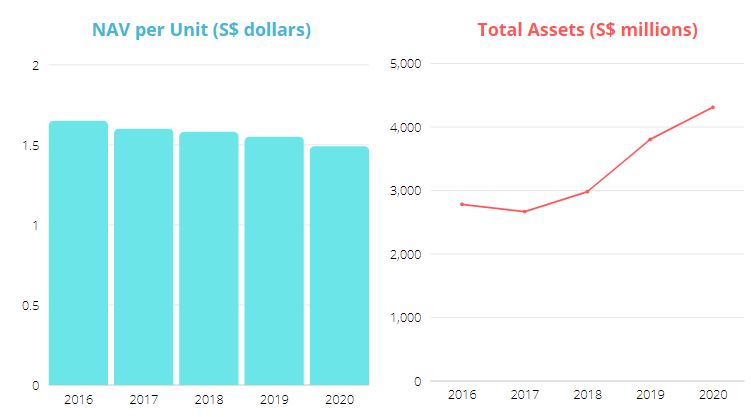

Net Asset Value

The growing outstanding shares has also affected its Net Asset Value (NAV) per share for the past 5 years.

After looking through its financial report, I believe these are the reasons for dropping NAV.

Firstly, it would be the decrease in properties valuation. Due to shorter land lease in China, I believe that CapitaMall properties value decay is much faster. (The majority of CapitaMall property land use right expire in 2040-2050 which is only 30 more years.)

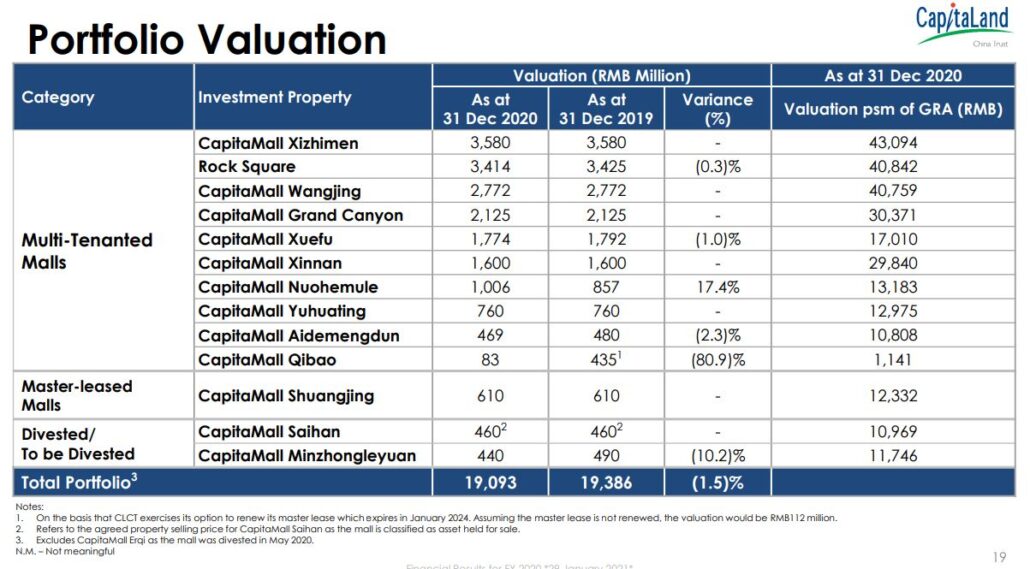

In addition, during the pandemic, retail malls did not bring in much revenue, hence they were valued much lower as compared to the previous year. The image below shows you the valuation of CLCT property in 2019 and 2020.

In total, its property valuation had dropped by 1.5%.

That’s not all, since NAV per unit dropped by 3.87% from 1.55 to 1.49 between FY2019 and FY2020, there must be more factors contributing to the drop in NAV.

The second reason is the acquisition of non-NAV accretive assets.

To understand this, we need to know that there are 2 ways a REIT can increase its NAV per unit.

- Firstly, it is to increase the net asset value of its portfolio (which has not been the case as mentioned above).

- Secondly, it can reduce its number of outstanding shares (which also have not been the case as it raises equity from the capital market).

This does not mean CLCT cannot raise equity by issuing new shares to acquire more properties that are beneficial to the REIT. The REIT can still raise equity from the market but for to maintain its NAV per share, its current properties valuation must increase or it must acquire property at a price above its current NAV per unit.

In another word, if the current NAV per unit is 1.55, the property CLCT should acquire should be worth at least $1.55 for every $1 paid/raised from the capital market.

With this explanation, we can see why its NAV per unit has been falling. Back in 1Q 2019, CLCT acquired CaitaMall Xuefu, CapitaMall Aidemengdun, CapitaMall Yuhuating at S$505.4 million when their valuation was S$589.2 million.

Based on the NAV per unit this is only 1.17, which is below its NAV of 1.55. As a result, CLCT net asset increase by 19.8% from 1,874 million to 2,245 million. Comparatively, the number of units increased more by 24.6% from 1,209,067 units to 1,506,433 units.

With a greater increase in outstanding shares, it is not surprising that its NAV per share dropped.

We can also see a similar trend with its latest transaction to acquire office property in FY2020. With a total acquisition cost of S$822 million for office properties valued at S$1,006 (based on effective stake), the NAV per unit is 1.22. Better than the previous acquisition but still below its NAV.

*Note that for simplicity, I did not include the proportion of financing via equity fundraising, perpetual securities, debt financing and internal cash resources which would change its NAV per share.

This trend did not go unnoticed and was raised during the latest acquisition of five business parks located in Suzhou, Xi’an and Hangzhou, together with the balance 49% interest of Rock Square in Guangzhou.

Did you consider the NAV dilution to unitholders when proposing this deal?

An optimal funding mix comprising of an equity fund raising exercise, issuance of perpetual securities, debt financing and internal cash resources was structured to ensure that the deal was DPU accretive to unitholders, while ensuring that the gearing level would be maintained at acceptable level that will be accommodative to future organic and inorganic growth. While the transaction was NAV dilutive on pro-forma basis, it significantly enhanced CLCT’s portfolio strength and resilience through diversification and improvement in scale, as well as improved the unitholder base and trading liquidity. It was also a good opportunity for CLCT to grow and diversify with the promising outlook for business parks in China as the country moves towards the tertiary sector, where the focus will be on innovation and R&D, thereby driving demand for these assets. The NAV dilution was also managed to a minimal level and could potentially be reduced through future valuation. On the whole, we believe that this DPU-accretive deal has been beneficial to unitholders.

Capitaland china trust

As investors, we should take note of this trend and continue monitoring it as a dropping NAV per unit is dilutive in nature (Our share is worth lesser with dilution).

Nonetheless, we should not worry that much as it is normal for NAV per unit to decrease especially since CLCT has been doing multiple acquisitions over the years. As mentioned in the CLCT’s response above, this would be a great opportunity for CLCT to enhance their portfolio strength by diversifying into other sectors like business parks. To add on, it is reassuring that the manager ensures that such deals are DPU accretive to unitholders before proceeding with it.

Financial Strength

CLCT has a strong balance sheet. As of 27 April 2021, CLCT’s gearing ratio is at 35.1% well below the 50% regulatory limit.

Apart from that, they have an interest coverage ratio of 3.7x which is relatively lower than its past 5 years which hovered around 5-6x. However, since the drop in interest coverage ratio is due to the drop in earnings caused by the pandemic, I am not that concerned as this would recover over time.

As seen from the figure above, CLCT debt maturity is also well spread out with a healthy average term to maturity of about 3 years.

In total, 70% of its debt are on fixed interest rates which provide a certainty of interest expenses and also lessen the impact of rising interest rate. For these reasons, I do not foresee any cash flow problem for CLCT.

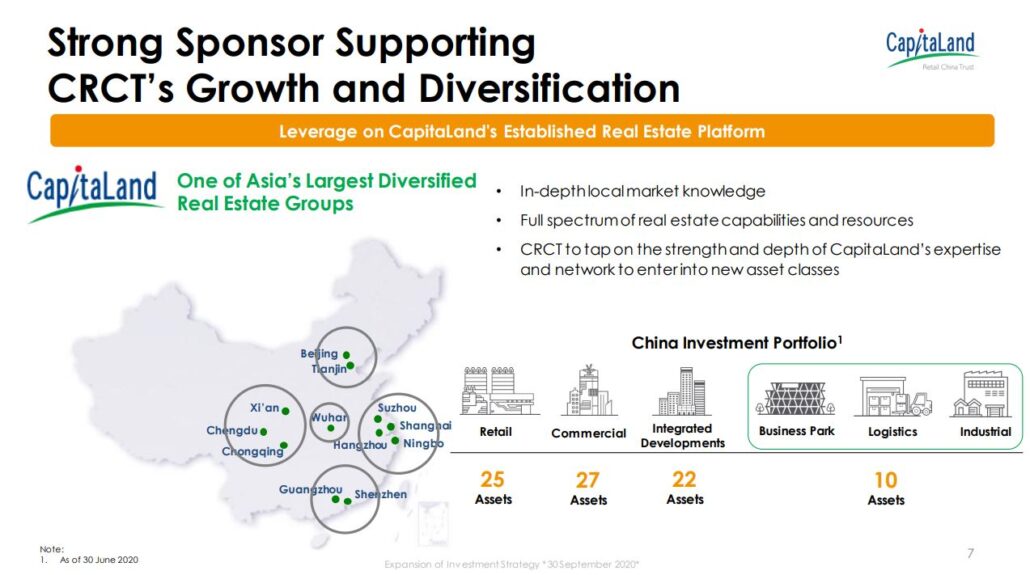

Strong sponsor

Good REITs usually have good backing, and CLCT is no exception. CLCT is managed by CapitaLand China Trust Management Limited, a wholly-owned subsidiary of Singapore-listed CapitaLand Limited, one of Asia’s largest diversified real estate groups.

By having a strong sponsor like CapitaLand, CLCT can potentially access lower interest rate on loans from financial institutions due to its reputation.

Apart from that, it also ensures a pipeline of assets that CLCT could acquire from CapitaLand. This is great news, especially after CLCT expanded its investment strategy which opens up more opportunities to acquire different kinds of asset class CapitaLand might have in China.

*Typically, there is usually a right of first refusal agreement between the REIT and its sponsor. As such, when the sponsor wants to sell its property, the REIT will be offered the right to purchase it before it is being offered in the open market.

Expansion of Investment Strategy

Previously, CLCT could only invest in retail properties. However, after the announcement in September 2020, CLCT could now acquire a diversified portfolio of real estate namely retail, office and industrial properties (including business parks, logistics facilities, data centres and integrated developments).

With this, there will be a larger pool of investment targets as CLCT will be the dedicated Singapore-listed REIT for CapitaLand’s non-lodging China Business, with acquisition pipeline access to CapitaLand China’s assets. The expansion would allow CLCT to capture opportunities in the broader market that are aligned with China’s latest 14th Five-Year Plan which aims to strengthen its domestic base.

This expansion of investment strategy also provides sector, revenue stream, asset and tenant diversification which enhances the ability of CLCT to deliver stable and sustainable distributions to shareholders in the longer term.

The following shows the various types of assets CapitaLand Retail China Trust can acquire from its sponsor which is 3x more than the initial.

*To note, while CLCT is planning to diversify its assets, its sponsor still does not have a pipeline for logistic assets and data centre in China though it has recently announced the acquisition of its first hyper scale data centre campus in China from AVIC Trust which is expected to be completed by 3Q 2021.

Raffles City Chongqing (one of the retail property held by CapitaLand)

Check here for the full list of property owned by CapitaLand as of 31 Dec 2020.

With the expansion of its investment strategy, CLCT aims to increase their exposure in the new economy sectors. This includes business parks, logistics, data centres and industrial assets. In the long term, the management hopes to achieve a mix of assets class of around 40% integrated development, 30% new economy assets and 30% retail.

Risk

Declining NAV per unit

This has been elaborated above. If NAV per unit continues to drop, CLCT share price might follow a similar trend since each share is worth lesser.

Growing online shopping trend

With the rise of low-cost delivery platforms like Taobao and Pinduoduo, online transactions have been growing steadily in China over the year. This growth was also boosted thanks to the pandemic that happened last year.

For 2021, research firm eMarketer expects 52.1% of China’s total retail sales to come from e-commerce transactions, increasing from 44.8% last year.

This is the first time where most retail sales will be done via e-commerce. South Korea comes in second with only 28.9% of its retail market based online. To put things into perspective, online sales in the US only make up 15% of all retail sales, while the average among Western European countries is 12.8%.

eMarketer has also reported that in 2021, bricks-and-mortar sales would likely fall by 9.8%, after an 18.6% drop last year.

If this trend continues, CLCT having majority of its portfolio concentrate in retail malls will surely be affected and is definitely something CLCT investors should look out for.

This could be one of the reasons why CLCT has decided to expand its investment portfolio to other assets classes instead of relying solely on retail.

Nonetheless, the management understands this challenge and has been working with its tenants to onboard them onto CapitaLand’s e-commerce platform. This enables CLCT to adopt trending marketing approaches such as organising Livestream sales and group-buy promotions for its retail partners.

The data collected from these online portals could also provide insights on consumer preferences and behaviour for its tenants to better meet consumer needs by adapting their products and service offerings.

Other than the omnichannel retail strategy, CLCT also hopes to position its retail malls as a lifestyle destination, where people gather to hang out and have fun together during the weekends.

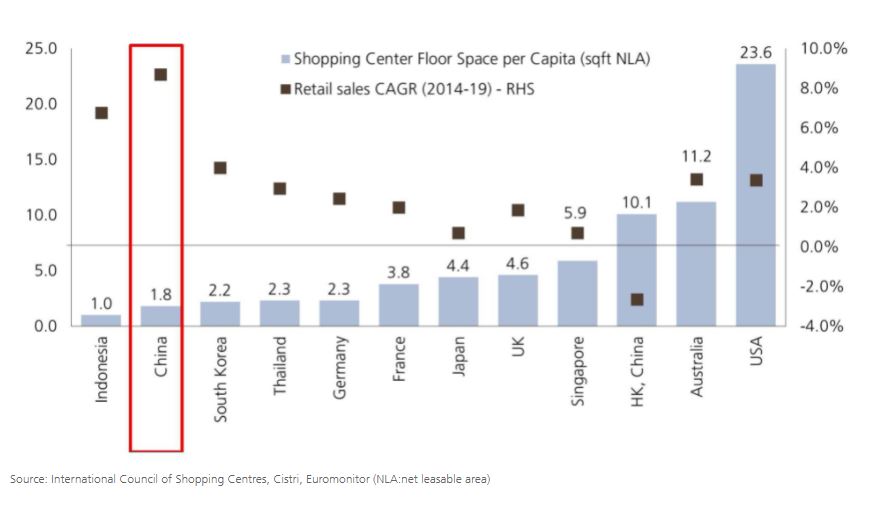

According to UBS, China also has a much lower retail space per capita than other developed markets. With the underpenetrated retail scene and a growing income level of Chinese citizens, I believe retail malls could thrive over the next decade.

As part of the study, UBS also believes that partnership with online giants and a move towards ‘experience or convenience’ will be the key drivers of success for these malls. These are aspect which I believe CLCT has or is working towards to.

Moving forward as CLCT diversify from the expansion of its investment portfolio to other assets, the impact from this e-commerce trend would not be as significant as now. Nonetheless, we should take note of this risk.

CLCT’s Valuation

So, is CLCT at a good price now? Let us look at its valuations.

Price to book

CLCT’s current PB Ratio is around 0.89. Compared to its historical average of around 1.0, I would say CLCT is slightly undervalued as of now.

Comparatively, the PB ratio of its peers Sasseur REIT, BHG Retail REIT and Dasin Retail Trust are at 1.01, 0.63 and 0.52 respectively. CLCT’s PB ratio does seem in line with the sector.

Dividend yield

With an annualized dividend yield of 4.67% currently, CLCT does seem overvalued as compared to its average return of 8%.

That being said, if we used FY2019 dividend (9.8 cents per share) instead of FY2020 where its earning was impacted by the pandemic, CLCT could potentially yield 7.2% at current share price which provides great value for investor.

Will I consider?

As the largest and oldest China-focused S-REIT, CapitaLand China Trust is a good proxy for China domestic growth. As such CLCT is a buy for me. Moving forward, I may consider adding this REIT into my portfolio if all goes well.

That being said, we should continue to monitor its dropping NAV per share and given that CLCT’s investment mandate has recently expanded, I believe they would continue on their acquisition spree for the short term. This could mean more preferential offering and private placement in the coming years to raise equity from the capital market.

As a student, I am still limited by my capital and failure to participate in such offerings could dilute my holdings substantially. These are the reasons why I am still holding back, but if you believe in the growth of CLCT and China, and do not have limited investment capital, CLCT might be a counter you’d want to look into.