Not too long ago, the commonly known FAANG was “rebranded” into MATANA. While such acronyms don’t necessarily add conviction to the stocks which form them, they give investors an idea of what should be on their watchlist. As such, when the big tech focused acronym FAANG was initially conceptualized, the central idea was to highlight stocks which possessed the following qualities,

- Good historical track record (Price action generally an uptrend over 5-10 year period)

- Outperformed the Market (Beat the S&P 500 Index)

- Market Leaders – They lead the way for others to follow in the industry.

- Significant Presence in our daily lives – Commands high % of market share in the industries that they operate in.

As we moved into the post-pandemic world (approx. 2022 onwards), analysts at Constellation Research “upgraded” FAANG to MATANA dropping both Facebook & Netflix and adding Microsoft, Tesla, and Nvidia.

Why drop Facebook (Meta) and Netflix?

While I personally remain bullish on Facebook in the longer term, analyst have found Facebook to be irrelevant at present in the sense that their current suite of social services are no longer appealing to users. This is further emphasized in a leaked internal report where “Reels engagement is also in decline, dropping 13.6% in recent months – while ‘most Reels users have no engagement whatsoever.’ “

In the case of Netflix, investors are finding it hard to see them as a market leader moving forward given how other streaming platforms have now entered the market and are slowly eating into their existing market share. Furthermore, it is uncertain if their subscriber count can continue to increase even with the introduction of their new ad-based subscription model.

Which MATANA stock I’m buying now?

With the inflation report yesterday, stocks are once again on sale as investors brace themselves for more hawkish actions from the Federal Reserve. While its never wise to time the market, such sell-offs are indeed an opportune time for any investors who believe in dollar-cost averaging such as myself.

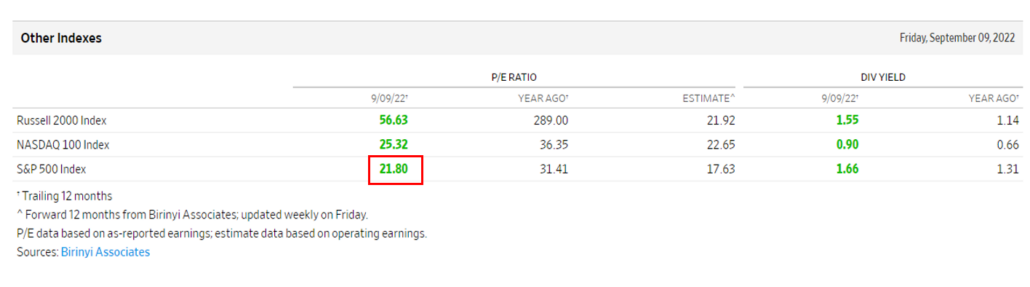

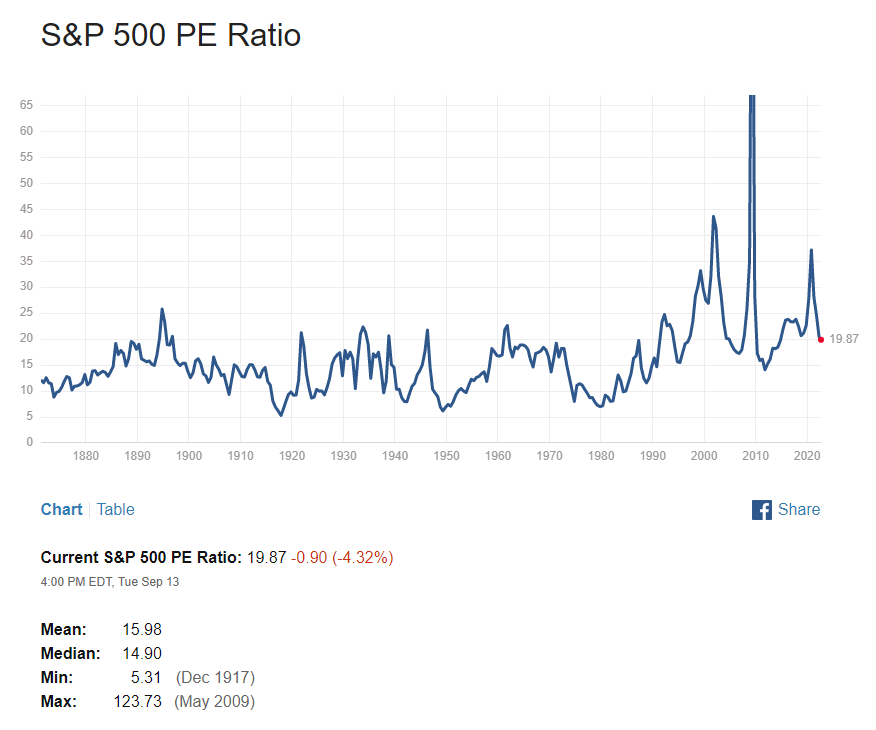

To help narrow down my choices, I’ve decided to refer to the PE Ratio of the S&P500 Index as a benchmark to determine which of the MATANA stocks are closest to the area of value.

Note that while US stocks are not necessarily cheap at present, they are also not expensive relative to the same time last year where the index was trading as above 30 PE. In addition to this, the average PE for the S&P500 sits at around 15 hence where we are at (currently 21.8) can be considered as somewhat of a middle ground.

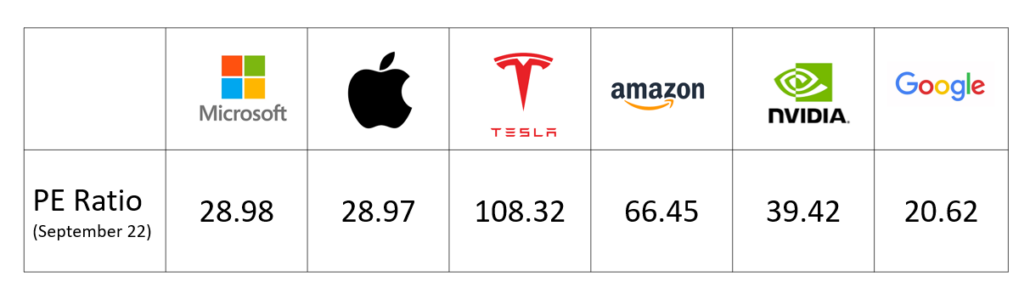

How does MATANA compare in terms of PE?

At face value, it would appear that Tesla is the most “expensive” with Google/Alphabet being the cheapest. However, the PE Ratio of the S&P is one of the easiest forms of valuation hence based on this indicator, it is accurate to say that Google is trading at a fair valuation as compared that of the index.

In comparison with Nvdia which is trading at almost twice the PE of the index, this could be the reason why we often see Nvdia falling much harder than all other large-cap stocks on bearish trading days.

Tesla is an exception where we find the PE ratio to be highly inaccurate as more than anything else, Tesla trades on momentum, which explains why the move up or down are usually more drastic.

So…what did I buy and why?

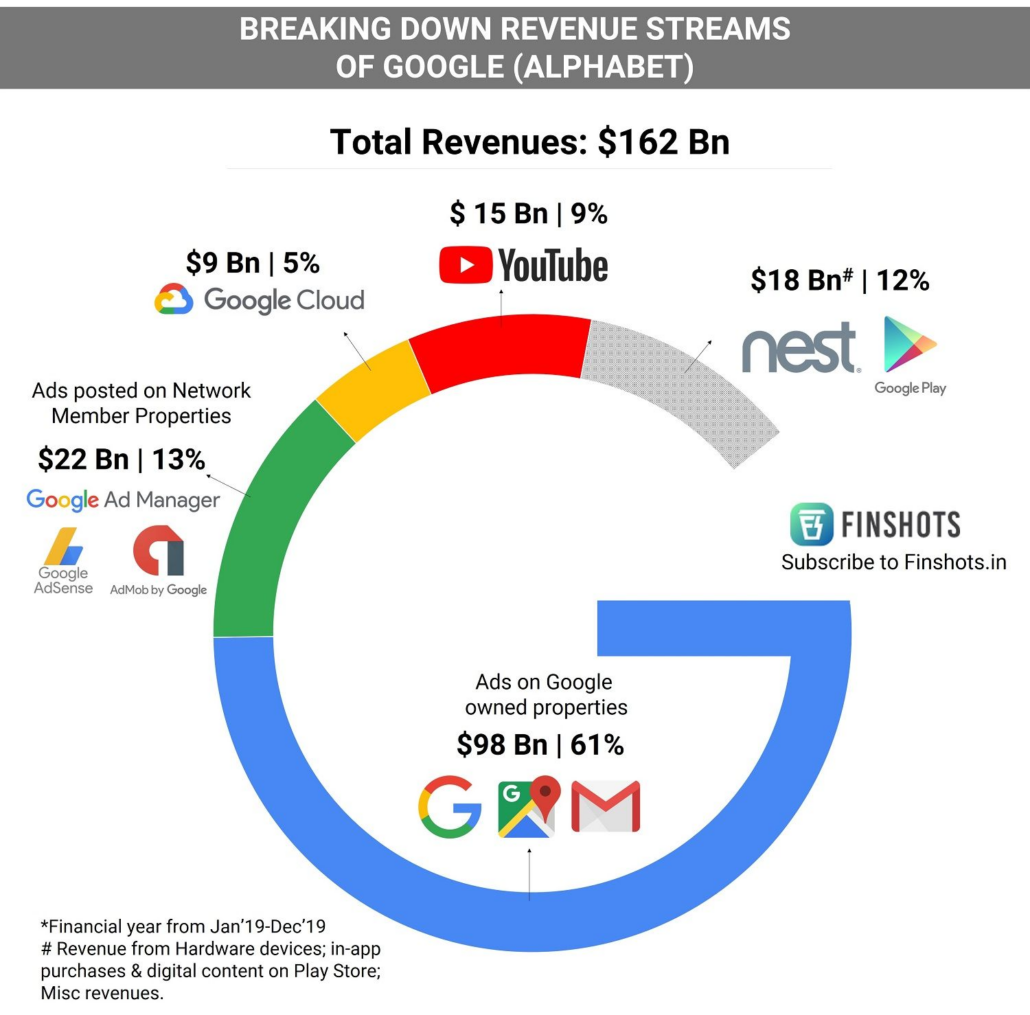

For me, I find Google to be trading at a fair value and I do like how they have positioned themselves in this bear market hence I DCA-ed into it. It is difficult to see a world without Google and its entire suite of services ranging from Youtube to Waymo, Android and even G-Suite. With steady top-line growth + constant share buybacks, this company does indeed give me confidence as an investor to hold it on a longer-term horizon.