Call me conservative, but FAANG stocks (or should I say MANGA or MAMAA stocks now that Facebook has changed its name to Meta) are among my favourites. FAANG stands for Facebook, Apple, Amazon, Netflix, and Google. These are large-cap corporations with a proven track record and positive cash flow. Today, we’ll talk about one of them: Google (aka Alphabet).

Given the dominance of its search engine, the word Google is now a verb in the English dictionary to describe the action of searching the internet for information. How many companies are there with such dominance?

The company currently has a market share of 91.4% of the global search engine market. Even its next closest competition, Bing, which Microsoft owns, is far behind with only 3.14% of the market. In fact, for the past ten years, this number hasn’t changed much, demonstrating how strong of a moat Google has.

Over the last five years, this moat that Google has is reflected in its share price performance. Alphabet Inc, the parent company of Google, has outperformed the broad-based S&P500 index.

How does Google make money?

Advertising accounts for the majority of Google’s revenue. However, the company has expanded its services to include mail, productivity tools, enterprise products, mobile devices, and other ventures.

All these can be divided into three segments: Google Services, Google Cloud and other bets.

Google Services

Google Services’ core products and platforms include Android, Chrome, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

This segment also includes hardware items such as the Google Pixel phone, Chromecast, and the Google Nest Hub smart display to integrate the entire digital experiences provided by Google software.

Such products work hand in hand to generate revenues from advertising, sales of apps, in-app purchases, digital content products, and fees received for subscription-based products such as YouTube Premium and YouTube TV.

Google Cloud

Considering that Google was established on the cloud, it was only logical for it to broaden its offerings to include cloud services. Google Cloud Platform and Google Workspace (formerly known as G Suite) are two of the company’s enterprise-ready cloud services.

On Google Cloud Platform’s, developers can build, test, and deploy applications.

On the other hand, Google Workspace is a set of collaboration tools that includes Gmail, Docs, Drive, Calendar, Meet, and other apps to aid in real-time communication.

Google Cloud then makes money through fees charged to its users by providing these platforms.

At the point of writing, Statista reports that Google has a market share of 8% in the Cloud Infrastructure space compared to Amazon Web Services (32%) and Microsoft Azure (21%).

Other bets, aka Google’s Moonshots

One challenge for such a big organisation is its ability to expand through mergers and acquisitions. Legislators would almost certainly scrutinise their moves, posing difficulty for any successful implementation.

Nonetheless, Alphabet continues to make bold bets on new technology in-house. Bets that ranges in various development stages, from research and development through the early stages of commercialisation.

Waymo, which launched its public, commercial, fully autonomous ride-hailing service in Phoenix, Arizona last year, is working to make transportation safer and easier for everyone.

Verily, is developing tools and platforms to improve health outcomes. One of which has recently been used in the fight against Covid 19.

Finally, Google’s investment in DeepMind, an AI system that has achieved a huge AI-powered breakthrough in overcoming a 50-year-old protein folding challenge, potentially speeding up biological research.

Of course, these are early-stage ventures, so there is a lot of uncertainty. That said, if the gamble pays out, it might help propel the company forward.

Google’s (aka Alphabet) Financial Performance

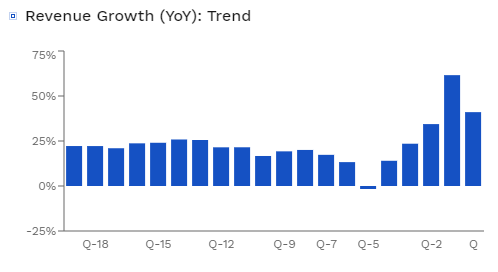

Alphabet’s revenue has been growing steadily for the past five years.

Total revenues for the fiscal year ending in 2020 were $182.5 billion, up 13% year over year, owing to the increases in:

- Google Services segment revenues of $16.8 billion, or 11%, and

- Google Cloud segment revenues of $4.1 billion, or 46%.

The US, EMEA, APAC, and Other Americas brought in $85.0 billion, $55.4 billion, $32.6 billion, and $9.4 billion in revenue, respectively.

In the most recent quarter, revenue increased by 41%, and the operating margin improved from 23% in FY2020 to 32% currently.

This margin puts Alphabet near the top of the list among its Big Tech peers.

Google’s Revenue Breakdown

Let us look at the revenue breakdown, namely Google Services, Google Cloud and other Bets.

- Google Service

The majority of the company’s revenue comes from Google Services, which include Google Search and other, Youtube advertisements, Google Network Members’ properties and Google other.

From 2019 to 2020, Google Search & other revenues climbed $5,947 million. It was mostly due to increased search inquiries from continued growth in user adoption and usage, particularly on mobile devices. There were greater advertiser expenditure and improvements in improvements ad formats and delivery.

YouTube’s ad income also climbed by $4,623 million in the same period.

Finally, Google’s other revenue increased by $4,697 million from 2019 to 2020, which includes revenue from Google Play; Google Nest home products, Pixelbooks, Pixel phones and YouTube non-advertising, which includes YouTube Premium and YouTube TV subscriptions, as well as other services.

These are excellent developments, which have been reinforced in recent quarters. As companies emerge from the pandemic, more are spending on advertising.

Search advertising revenue increased by more than 40% in the latest quarter, which is a fantastic return. Youtube’s ad revenue has also increased by 57% so far this year, as the company continues to benefit from the shift of customers away from cable television and toward platforms like Youtube.

- Google Cloud

Alphabet’s up-and-coming segment would be Google Cloud. From 2019 to 2020, Google Cloud revenues climbed by $4,141 million, totalling $13,059 million in 2020.

- Other Bets

This section is made up of a number of operating segments that aren’t all that important as of now, including Alphabet moonshots. Revenue from this segment is small, but it doesn’t mean it won’t grow if Alphabet can commercialise it successfully.

The big numbers are impressive, but more importantly…

Are these segments profitable?

Only the Google Service segment is profitable at the moment.

While Google Cloud revenue has been growing rapidly and accounts for 7% of total revenue in 2020, the segment is still losing money. Nonetheless, given the enormous addressable market for cloud services, it will almost certainly become another hugely profitable venture for Alphabet if it continues to grow.

In fact, the most recent quarter’s results below suggest that the company’s losses are shrinking, which is a good sign.

Operating income has also significantly improved in the recent quarter.

Google’s Challenges

There will be several hurdles ahead for Alphabet.

The ability of Alphabet to continue capturing the attention of its users, in my opinion, is the biggest threat in the immediate term. Losing these users would cause Alphabet to lose a significant portion of its advertising revenue.

In the long term, the development of the Metaverse could pose a challenge for Alphabet. The Metaverse could be the next step in the evolution of advertising. More corporations may advertise in the Metaverse in the future, which might be a significant risk for Alphabet if they do not join that arena.

However, this is not going to happen anytime soon, and Alphabet is still in a comfortable position. They can’t, however, let their guard down. If they don’t innovate, they’d better be prepared to get disrupted.

Google’s Competitors

Alphabet is not the only one in the advertising business. We have giants like Meta (Facebook) competing for consumers’ eyeball all the time.

The management understands these challenges and has listed their competitors below.

- General purpose search engines and information services, such as Baidu, Microsoft’s Bing, Naver, Seznam, Verizon’s Yahoo, and Yandex.

- Vertical search engines and e-commerce websites, such as Amazon and eBay (e-commerce), Booking’s Kayak (travel queries), Microsoft’s LinkedIn (job queries), and WebMD (health queries). Some users will navigate directly to such content, websites, and apps rather than go through Google.

- Social networks, such as Facebook, Snapchat, and Twitter. Some users increasingly rely on social networks for product or service referrals rather than seeking information through traditional search engines.

- Other forms of advertising, such as billboards, magazines, newspapers, radio, and television. Our advertisers typically advertise in multiple media, both online and offline.

- Other online advertising platforms and networks, including Amazon, AppNexus, Criteo, and Facebook, that compete for advertisers that use Google Ads, our primary auction-based advertising platform.

- Providers of digital video services, such as Amazon, Apple, AT&T, Disney, Facebook, Hulu, Netflix and TikTok.

Apart from its advertising business, Alphabet also faces competition from:

- Other digital content and application platform providers, such as Amazon and Apple.

- Companies that design, manufacture, and market consumer hardware products, including businesses that have developed proprietary platforms.

- Providers of enterprise cloud services, including Alibaba, Amazon, and Microsoft.

- Digital assistant providers, such as Amazon and Apple.

Google’s Valuation: Is it a good time to buy Alphabet stocks?

Alphabet’s PE ratio is at 28.09, which is close to its five-year average.

Compared to big tech rivals like Microsoft and Amazon, which have a PE ratio of 36.13 and 66.31, respectively, Alphabet’s present valuation appears to be fair or even discounted.

PEG ratio allows us to price in a company’s growth, and firms with a PEG ratio of 1 or less are often considered inexpensive.

Alphabet currently has a PEG ratio of 1.07, lower than the industry average of 3.51. With that, Alphabet appears to be a good bargain for investors at this price.

Class Matters

If you’re convinced that Alphabet is a good investment, you’ll need to decide which class of shares to buy. Alphabet’s shares are divided into three categories: Class A, B, and C.

Such division was done to preserve decision making control for the founders. Here’s a summary of the class structures:

- Class A – Held by regular investors with regular voting rights (GOOGL)

- Class B – Held by the founders and has 10 times the voting power compared to Class A

- Class C – Held by regular investors with no voting rights (GOOG)

Only Class A and Class C are traded in the market, and prices generally move in lockstep. However, Class A, is usually traded at a premium because it has voting rights.

Conclusion

Alphabet will continue to benefit as more users transition from offline to online, and I have no doubt that this company will continue to thrive.

In 2021, Alphabet’s stock has soared due to favourable earnings and growing margins. Given its strong fundamentals, its current price may appear to be an excellent time to buy. Nonetheless, Investors should be cautious should Alphabet not keep up with its growth trajectory or maintain its margin.

P.S. If you are looking for high growth tech stocks to grow your portfolio at a faster rate, Google might be too slow for you. Cheng, our hypergrowth SaaS trainer shares how he picks high growth tech stocks to grow his portfolio at >20% CAGR. Stay tuned for his live webinars.

Disclosure: The author does not own any shares of the above-mentioned stock.

Hi,

Didn’t know there are 2 classes of Google/Alphabet shares.

I have some shares, and realize mine are Class A (GOOGL) shares.

Just checked the price, and the Class A share is actually about US$22 less than the Class C (GOOG) shares.

I do plan to buy some more Alphabet shares, so will it make any difference which one I get (in terms of dividends, tax etc)?

Thanks

Hello there. Regardless of whether you purchased a Class A or Class C stock, the same dividend and tax regulations apply. However, as Class A is now less expensive than Class C, it may be preferable to purchase Class A instead, as they are usually traded at a slight premium due to their voting rights.

A possible reason to explain why Class C is now more expensive could be due to demand. Alphabet repurchase its class C stock, not class A, so if everything was equal, this could have pushed its stock price up.