SPDR S&P 500 Trust ETF (SPY), Vanguard S&P 500 ETF (VOO) and iShares S&P 500 ETF (IVV) are three of the largest S&P500 index funds available. They track the same index using the same strategy and have similar holdings and performance. The main difference that investors should note is in the expense ratios where SPY costs 0.09% while VOO and IVV cost 0.03%.

Data provided below is accurate as of 12 July 2023.

SPY vs VOO vs IVV

| SPY | VOO | IVV | |

|---|---|---|---|

| Name | SPDR S&P 500 Trust ETF | Vanguard S&P 500 ETF | iShares S&P 500 ETF |

| Expense Ratio | 0.0945% | 0.03% | 0.03% |

| AUM | $418.9B | $323.4B | $336.5B |

| Fund Manager | State Street Global Advisors | Vanguard | Blackrock |

SPY vs VOO vs IVV – Differences

Expense Ratio

The key difference between these three ETFs is their expense ratio – SPY has an annual expense ratio of 0.0945% while VOO and IVV charges 0.03%.

Although insignificant, the 0.06% difference can directly affect your overall returns. Overtime, this could add up.

Liquidity

Ideally you want to invest in an index fund with good liquidity so that you can buy and sell at your desired price (i.e. low spreads), without having to wait for your order to be fulfilled.

On this front, SPY has the advantage as one of the oldest ETFs in the market. Here’s a quick comparison:

| SPY | VOO | IVV | |

|---|---|---|---|

| Assets Under Management (AUM) | $418.9B | $323.4B | $336.5B |

| Average daily volume | $27.18B | $1.29B | $1.14B |

| Average Spread | 0.00% | 0.01% | 0.01% |

Fund Manager

Each of these ETFs are offered by different managers:

- SPY: State Street Global Advisors

- VOO: Vanguard

- IVV: Blackrock

All three managers have been in the game for decades. SSGA was founded in 1978, Vanguard in 1975 and Blackrock in 1988.

It is interesting to note that John Bogle, the founder of Vanguard group created the first index fund and was a pivotal role in the push for index funds as an investment vehicle.

That said, all three fund managers have been around for ages and do not pose any unforeseen risks of folding in the short term.

Now that we’ve taken a look at their differences, let’s take a look at their similarities and try to discern if there are subtle differences to note among these S&P500 index funds.

SPY vs VOO vs IVV – Similarities

Strategy

All three ETFs track the performance of the S&P 500 index passively. This means that they give you exposure to 500 largest companies listed on US stock exchanges.

Returns

Overall, SPY, VOO and IVV provide very similar returns, with IVV providing the closest returns as compared to the S&P500 Index.

Here’s a comparison of their average 1, 3, 5, and 10-year annual returns against the actual S&P500 Index, accurate as of 31 Mar 2023:

| S&P500 ETFs | 1-Year Return | 3-Year Return | 5-Year Return | 10-Year Return | Since Inception |

|---|---|---|---|---|---|

| SPY | 19.46% | 14.47% | 12.16% | 12.72% | 9.93% (22 Jan 1993) |

| VOO | 19.47% | 14.55% | 12.25% | 12.82% | 13.76% (7 Sep 2010) |

| IVV | 19.57% | 14.56% | 12.27% | 12.82% | 6.61% (15 May 2000) |

| S&P 500 Index (Benchmark) | 19.59% | 14.6% | 12.31% | 12.86% | – |

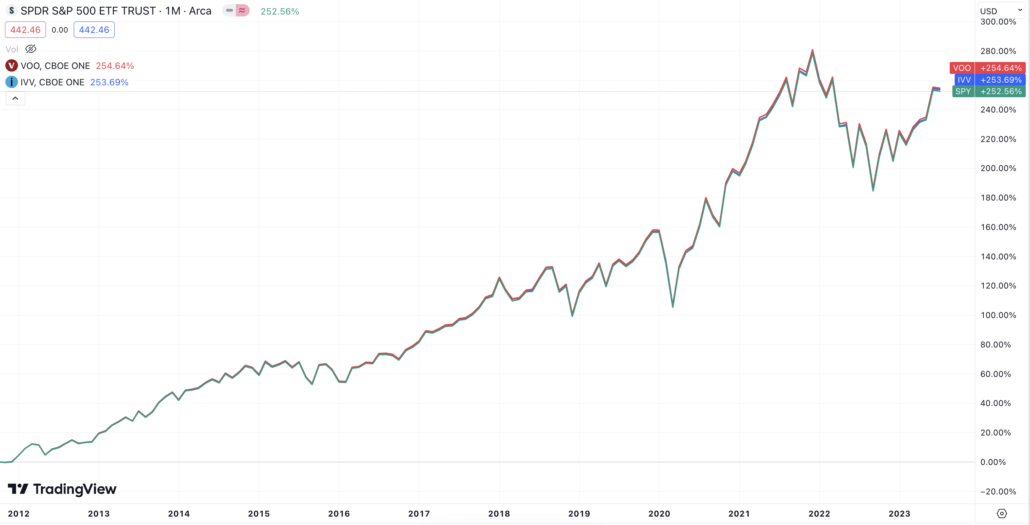

If we compared their price performance over the past 10 years, you’ll see that they are pretty similar, except for small fluctuations during times when the market moved drastically:

Holdings

As these ETFs follow the same strategy, we would expect them to hold the same stocks, with slight variance in the weightage. At the point of update, both SPY,IVV have 503 holdings in their portfolios while VOO has 505.

Here’s the breakdown of the weightage of their top 10 holdings:

Top 10 Holdings in SPY, VOO and IVV by weight

| Top 10 holdings | SPY | VOO | IVV | S&P 500 Index |

|---|---|---|---|---|

| Apple Inc. | 7.57% | 7.50% | 7.56% | 7.57% |

| Microsoft Corp. | 6.7% | 6.96% | 6.69% | 6.7% |

| Amazon.com Inc. | 3.08% | 3.06% | 3.08% | 3.08% |

| Nvidia Corp | 2.83% | 2.65% | 2.83% | 2.83% |

| Tesla Inc | 1.97% | 1.56% | 1.97% | 1.97% |

| Alphabet Inc. Class A | 1.88% | 2.08% | 1.88% | 1.88% |

| Meta Platforms | 1.77% | 1.68% | 1.76% | 1.77% |

| Berkshire Hathaway Inc. Class B | 1.65% | 1.65% | 1.65% | 1.65% |

| Alphabet Inc. Class C | 1.62% | 1.82% | 1.62% | 1.62% |

| UnitedHealth Group Inc. | 1.17% | 1.3% | 1.17% | 1.17% |

The top 10 holdings in accounts for 30.24% of SPY’s total net assets, 30.26% of VOO’s total net assets and 30.21% of IVV’s total net assets.

You would notice that SPY and IVV‘s top holdings are more similar. This is because they report their holdings on a daily basis whereas VOO only reports holding updates on a monthly basis. You may also want to note that IVV attempts to closely replicate the S&P 500 index weightage.

Likewise for their sector breakdown:

Sector Diversification

| Sectors | SPY | VOO | IVV | S&P 500 Index |

|---|---|---|---|---|

| Information Technology | 28.11% | 28.1% | 27.92% | 28.11% |

| Health Care | 13.26% | 13.7% | 13.57% | 13.26% |

| Financials | 12.54% | 12.4% | 12.51% | 12.53% |

| Consumer Discretionary | 10.73% | 10.2% | 10.08% | 10.73% |

| Industrials | 8.6% | 8.2% | 8.3% | 8.6% |

| Communication Services | 8.37% | 8.8% | 8.69% | 8.37% |

| Consumer Staples | 6.65% | 6.9% | 6.9% | 6.66% |

| Energy | 4.16% | 4.2% | 4.26% | 4.15% |

| Utilities | 2.58% | 2.7% | 2.64% | 2.58% |

| Real Estate | 2.53% | 2.4% | 2.37% | 2.53% |

| Materials | 2.47% | 2.4% | 2.43% | 2.47% |

IVV holdings are not up to date as data isn’t reflected on website at point of update.

Dividend Yield

SPY, VOO and IVV distribute dividends from their holdings to you quarterly.

At the point of update, here’s their distribution yield:

| SPY | VOO | IVV | S&P 500 Index | |

|---|---|---|---|---|

| Dividend yield (annual) | 1.48% | 1.54% | 1.56% | 1.58% |

Although their yields are nothing to celebrate, its better than nothing. However, do note that foreign investors are subjected to a 30% dividend withholding tax, which means that your meagre dividend pay out will become even smaller.

Here’s a full list of S&P500 index funds for your consideration if you prefer to reduce the dividend withholding tax.

SPY vs VOO vs IVV: which is the best?

If you’re thinking of investing in the S&P500 index for the long term, IVV is the most enticing option for investors at the point of writing. It has lower expense ratio and delivers the closest returns of the three ETFs, as compared to the S&P 500 index.

That said, the differences are quite insignificant. It is more important to start investing rather than spend too much time comparing between these three S&P 500 index funds.

A popular investing strategy is to invest in an index fund on a month basis, Alvin has shared the best brokers for regular investment plans if that’s what you’re planning to do.

However, if you’re thinking of buying or selling options on the S&P500 index, SPY is your best option (pun intended) due to its superior liquidity compared to VOO and IVV. This means that you’ll find a wider range of expiry dates and spreads.

Of course, if you wish to push the envelop and grow your money faster, you could do better by picking stocks that can outperform the S&P 500 index. Alvin shares how we pick such stocks to grow the Dr Wealth portfolio at his live webinar, join him at the next session.

Great sharing about the different ETF, thank you! I feel SPY has another benefit in that it is listed in SGX.

very helpful…thank you – January 2023 seems like VOO is behind by 50 bps !!