Keppel Corp’s share price has more than doubled since its low in 2020. This comes as we witnessed an improvement in the company’s financial results resulting from a rise in oil prices.

Nevertheless, it may no longer be the case, as Keppel’s recent reports showed that its second half of the year experienced poorer performance, resulting in a 9% year-on-year decline in net profit.

As Keppel Corp investors or potential investors, you may now wonder if the company’s honeymoon has ended. Has Keppel’s strategy failed, and is it time to sell?

In this report, we analyse Keppel Corp’s business, latest financial year results, current price valuation and discuss if Keppel Corporation is still a good Singapore blue chip stock that you should invest in.

P.S. we plan to keep this page updated, so bookmark it and checkback whenever you need to review your portfolio.

Last Updated: 6 Feb 2023

What does Keppel Corporation (BN4) do?

Keppel Corporation (SGX: BN4) was founded in 1968 as a local shipyard, and it was subsequently listed on the Singapore Stock Exchange on 24 October 1980. The company now focuses on four key areas: energy & environment, urban development, connectivity, and asset management, to provide solutions for sustainable urbanisation.

Keppel Corporation’s 4 main business units

Keppel Corporation (SGX: BN4) is quite diverse and can be divided into four main categories:

1) Energy & Environment

Keppel offers a variety of energy and environmental solutions for cities and ships in this segment. Keppel Offshore & Marine, Keppel Infrastructure, and Keppel Renewable Energy are among the company’s sub-segments.

- Keppel Offshore & Marine is a full-service offshore, marine, and energy solutions provider. The company has extensive expertise in design and engineering, new rigs construction, conversions & repairs, and rig & vessel support services.

- Keppel Infrastructure is responsible for the group’s strategy of investing in, owning, and operating energy and infrastructure solutions and services. Keppel Infrastructure has expertise in developing, owning, and operating power plants in Brazil, China, the Philippines, and Nicaragua, among other countries. On Jurong Island in Singapore, it operates a 1,300-megawatt gas-fired combined cycle power plant. Aside from that, this subsegment offers solutions for managing solid waste, wastewater, drinking water, and process water. In fact, the Keppel Marina East Desalination Plant, Singapore’s fourth desalination plant, was designed and is operated by Keppel Infrastructure.

- Keppel Renewable Energy concentrates on renewable energy infrastructure opportunities. This includes, but is not limited to, utility-scale wind and solar project development, as well as integrating energy storage systems and digital platforms for asset management.

2) Urban Development

Keppel’s goal in this segment is to develop quality residences, offices, integrated developments, as well as smart and sustainable cities to create highly liveable cities. Keppel Land, Keppel Urban Solution, and Sino-Singapore Tianjin Eco-City (SSTEC) are among its subsegments.

- Keppel Land provides multi-faceted and unique urban space solutions. Residential developments, investment-grade commercial properties, and integrated development are all part of its portfolio. In Asia, Keppel Land is geographically diversified, with China, Singapore, and Vietnam as key markets, while other regions such as India and Indonesia continue to grow.

- Keppel Urban Solution is a full-service master developer of urban developments, combining the company’s diverse capabilities in energy and environment, urban development, connectivity, and asset management to build highly livable, smart, and sustainable communities. As part of its solution, Keppel offers master planning and urban design, together with the development and operation of sustainable infrastructure such as smart utilities.

- Sino-Singapore Tianjin Eco-City (SSTEC) is a government-to-government project led by Keppel that aims to find solutions to make Tianjin a smart and sustainable city.

3) Connectivity

Keppel Telecommunication and Transportation, which includes M1 telecom, various logistics facilities, and data centres, falls under this section.

- Keppel Data Centres owns, develops, and manages data centre facilities across the Asia Pacific and Europe’s key data centre hubs.

- Keppel Logistics provides omnichannel logistics and multi-channel commerce solutions, as well as tailored integrated logistics solutions. This subsegment currently operates logistics facilities in China, Malaysia, Indonesia, Vietnam, and Australia.

- M1 is Singapore’s network operator, serving over two million clients with various communications services such as mobile, fixed line, and fibre. M1 was also awarded one of Singapore’s two nationwide 5G standalone network licences and is now expanding its 5G network coverage throughout the country.

4) Asset Management

Keppel is also a fund manager of private and publicly traded real estate investment and business trusts.

- Keppel Capital has a diverse portfolio that includes real estate, infrastructure, data centres, and alternative assets. Keppel REIT Management Limited, Keppel Infrastructure Fund Management Pte Ltd, Keppel DC REIT Management Pte Ltd, Keppel Pacific Oak US REIT Management Pte Ltd, Alpha Investment Partners Limited, and Keppel Capital Alternative Asset Pte Ltd are among the asset managers under Keppel Capital.

- REITs & Trust + Private Funds include those not held under Keppel Capital.

Keppel Corporation’s 2H & FY22 Financial Performance

Keppel Corporation released its 2H & FY2022 financial results on 2 Feb 2023. Here’s a review of its performance and, more crucially, its most recent second half, which was just reported.

Revenue and Net Profit

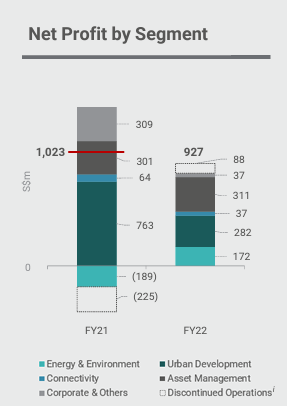

Keppel recorded a net profit of $927 million for the fiscal year ending 31 December 2022, a 9% decrease from the previous year.

This decline is mostly attributable to decreased Urban Development earnings. The company faces headwinds, particularly in China, where it observed fewer contributions from China property trading initiatives, lower fair value gains from investment properties, and lower gains from en-bloc sales.

As you are aware, these arose mainly due to the Chinese economy slowing and China’s zero COVID policy, which impacted home sales, unit completion and handover, and asset monetisation.

As a result, the company’s net profit fell despite improved performance in its Energy & Environment and Asset Management segments.

Next, let’s take a look at the performance by segment.

Energy & Environment segment

Keppel’s Energy & Environment’s net profit for the year was $260 million, a significant improvement from the net loss of $414 million in 2021, as it continues to benefit from the opening economies and rising oil prices.

While it is a positive news for the company, moving forward, we should see a change in the revenue made up in this category as Keppel continues to divest more of its O&M assets while also tripling its efforts in renewable energy assets.

In the short term we could also be expecting the income loss from its soon-to-be-divest O&M assets to outweigh any revenue gain from its renewable energy holdings.

Urban Development segment

Keppel Urban Development segment’s profit is down $282 million year on year, causing the group’s profit to fall, causing the share price to fall.

This follows lower contributions from China property trading projects and smaller fair value gains from investment properties and en-bloc transactions.

Nonetheless, market sentiment has improved since COVID-related restrictions were lifted. With the reopening of the China border, domestic demand and growth should improve. Aside from that, the Chinese government has announced favorable plans that should help the real estate market.

Considering all of this, we may see an improvement in 2023 for this segment.

Connectivity segment

The final segment is Connectivity, which made a net profit of $37 million. Considering the previous year’s profit was $64 million, the Connectivity segment’s bottom line has significantly reduced.

Nonetheless, this was not due to an adverse influence on its core business. Instead, the prior year experienced a more significant profit due to gains from the sale of Keppel Logistics and Wuhu Sanshan Port stakes. As a result, this was a one-time gain.

In reality, M1 has been increasing both its subscriber base and its ARPU. Granted, revenue did not climb as rapidly due to the growing desire for SIM-only plans, this segment did not perform as severely.

Asset Management segment

Keppel Asset Management division increased revenue by 20%, owing to higher fee income from acquisitions made by Keppel Corp throughout the year.

The company’s net profit also increased by $10 million, representing a 3% rise. Summing up, it contributed the most to the group’s net profit.

Unfortunately, this did not correspond with revenue growth, as seen by a 20% increase in revenue but only a 3% increase in profit. This is due to lower fair value gains on data centers under Keppel DC REIT and our private funds, as well as mark-to-market losses on investments.

Moving forward, we are likely to see more development in this segment as it aims to achieve a $200 billion AUM ambition, up from its $50 billion target in 2022.

Additional takeaways from the annual meeting

Aside from the results above, here are 3 significant takeaways from the meeting.

- To date, over S$4.6 billion in asset monetisation has been announced, with a target of S$5 billion by end-2023.

- The proposed merger of Keppel Offshore & Marine and Sembcorp Marine (SCM) is nearing completion; hence investors will soon see the end of this restructuring.

- A final dividend of 18 cents was also declared, bringing the total cash dividend for FY2022 to 33 cents.

While the total dividend is the same as the previous year, the proposed final dividend is lower. This makes sense, given that Keppel’s net profit has decreased. In fact, it is nice that management did not reduce the final dividend further.

Keppel Corporation Dividend History

Keppel Corp pays out dividends regularly. Here’s their dividend yield and payout history for the past 10 years:

| Year | Dividend Yield | Dividend Per Share |

|---|---|---|

| 2022 | 4.54% | $0.33 |

| 2021 | 3.15% | $0.33 |

| 2020 | 2.48% | $0.10 |

| 2019 | 3.81% | $0.20 |

| 2018 | 4.81% | $0.30 |

| 2017 | 3.31% | $0.21 |

| 2016 | 4.97% | $0.20 |

| 2015 | 7.95% | $0.34 |

| 2014 | 6.95% | $0.42 |

| 2013 | 12.43% | $0.44 |

| 2012 | 7.28% | $0.43 |

Keppel Corp Dividend Yield 2022

Keppel has declared a final dividend of 18 cents, bringing the total cash dividend for FY2022 to 33 cents.

Based on the company’s last transacted share price of S$7.26 as of 30 December 2022, this amounts to a 4.55% gross dividend yield in 2022.

Is the honeymoon period for Keppel Corp over?

With all of this information, you can pretty much tell if Keppel Corporation’s honeymoon phase has ended.

Certainly, the corporation has encountered a hiccup, but its restructuring and Vision 2030 appear to be on track.

In 2022, the company made tremendous progress toward its Vision 2030 transformation by streamlining and focusing its businesses and implementing an asset-light strategy.

They successfully sold Keppel Logistics and are in the final stages of completing the proposed O&M deals with Keppel shareholders’ approval in December 2022.

In addition, Keppel has announced over S$4.6 billion in asset monetization, amassing S$3.6 billion in cash so far, to enhance its asset-light business. These efforts have already paid off, with recurring income doubling to S$560 million in FY 2022, excluding discontinued activities.

Author’s take

In conclusion, Keppel Corp’s latest results were not stellar and may have shocked some. However, based on its financial records, the decline is primarily attributable to one-off factors such as the disposition of Keppel Logistics the previous year, which causes the connectivity segment to appear to have dropped significantly.

Similar reasoning can be said for the reduction caused by lower earnings due to lower contributions from trading projects in China and lower gains from enbloc sales.

In fact, with the Chinese economy anticipated to rebound in the coming months due to the relaxation of COVID restrictions and the introduction of support programs aimed at both property developers and homebuyers, market sentiment should improve, as should this segment for Keppel.

Overall, Keppel Corporation investors have nothing to worry about with the company delivering well on its promises.

What are your thoughts on Keppel?

Frequently Asked Questions (FAQ)

Keppel Corporation’s major stakeholders

Temasek Holdings Pte Ltd, which owns 20.40% of Keppel Corporation, is the main shareholder and hence Keppel Corp is often seen as a stable blue-chip company in Singapore. Nevertheless, this does not rule out the possibility of Keppel Corporation being a poor investment, as with the case of Sembcorp Marine.

Here’re the top 10 shareholders of Keppel Corp, as declared on their website (Updated 6 Feb 2023):

| Top 10 Shareholders of Keppel Corp (BN4) | No of Shares | % |

|---|---|---|

| Temasek Holdings (Private) Limited | 371,408,292 | 20.40 |

| Citibank Nominees Singapore Pte Ltd | 273,266,250 | 15.01 |

| DBS Nominees (Private) Limited | 251,781,203 | 13.83 |

| DBSN Services Pte. Ltd. | 82,143,394 | 4.51 |

| HSBC (Singapore) Nominees Pte Ltd | 79,785,231 | 4.38 |

| Raffles Nominees (Pte.) Limited | 60,927,964 | 3.35 |

| United Overseas Bank Nominees (Private) Limited | 50,064,822 | 2.75 |

| OCBC Nominees Singapore Private Limited | 15,287,403 | 0.84 |

| BPSS Nominees Singapore (Pte.) Ltd. | 14,693,696 | 0.81 |

| DB Nominees (Singapore) Pte Ltd | 13,391,517 | 0.74 |

How to buy Keppel Corporation?

Keppel Corporation (SGX:BN4) is listed on the SGX and can be bought through a stock broker.

It is also good to note that at the point of writing, Keppel Corp is a stock under CPFIS. This means that retail investors in Singapore can also choose to invest in Keppel Corp via the CPF Investment Scheme.

More Resources

To help you with your evaluation of Keppel Corporation (SGX:BN4), here are some useful resources:

- Download: Keppel Corporation’s Latest Annual Reports

- Learn about investing using these resources: How to start investing

- Learn 2 approaches to Value Investing: Dr Wealth’s Value Investing Guide

- Learn a complete, functional investing strategy that brings 10 – 15 % returns every year.

Disclaimer: Not financial advice, all information provided is purely for educational purposes.