Keppel has revealed their first-half 2022 earnings, which are as follows:

- Net profit rose 66% year on year to S$498 million.

- Increase in interim dividend to $0.15 per share from $0.12 per share in the first half of 202

- Annualised ROE increased from 5.5% in 1H21 to 8.4% in 1H22.

Looking at the headline, the stars appear to be aligning favourably for Keppel Corp. Is it, however, as amazing as it sounds? Is Keppel Corp’s restructuring and Vision 2030 going as planned?

As usual, let us review its financial report to discover more about its operations.

But before that, here’s a rundown of what Keppel Corporation does for a refresher.

Financial Overview

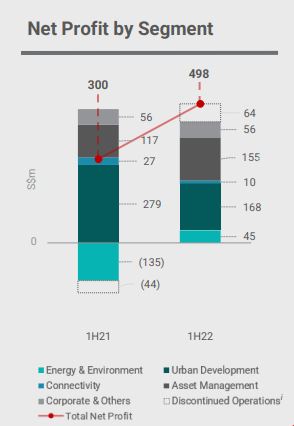

Keppel Corp announced an overall net profit of S$498 million for the first half of 2022, a 66% jump year on year. This comes as all of its segments, including its discontinued offshore & marine operations, have turned profitable.

*Discontinued operations include Keppel Offshore & Marine (excluding some out-of-scope assets), which is being divested to Sembcorp Marine.

After excluding these discontinued operations, Keppel Corp’s net profit from continuing operations was S$434 million in 1H 2022, a 26% rise year on year.

It is still fantastic and shows a solid comeback for the company, but if you only looked at the headline, you would be misled because it does not account for the planned divestment.

A simple overview of its earnings:

- Energy & Environment (Increased)

- Asset Management (Increased)

- Urban Development (Decreased)

- Connectivity (Decreased)

Energy & Environment and Asset Management were the two segments that grew in net profit.

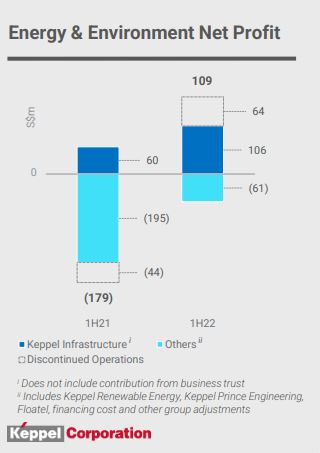

This growth in Energy & Environment comes as it reverses the previous year’s loss, going from a net loss of S$179 million to a net profit of S$109 million. However, of the S$109 million in net profit, less than half is from ongoing operations (S$45 million), with the remainder coming from discontinued operations.

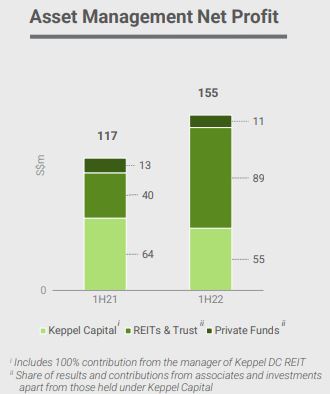

Its Asset Management gain, on the other hand, is due to higher fee income from successful acquisitions by the REITs & Trust, as well as larger fair value gains on investment properties and data centres under Keppel REIT and Alpha Data Centre Fund. This development bodes well for Keppel’s 2030 ambition, which we shall discuss further later.

Nevertheless, there were two segments that did not perform well.

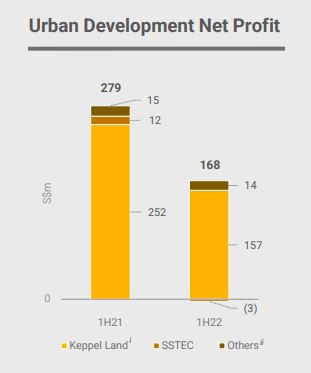

Urban development performed poorly due to fewer contributions from China trading projects and lower fair value gains on investment properties.

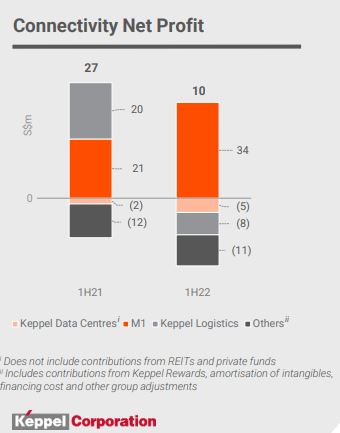

Connectivity likewise did not do that well though it contributed minimally to overall profit.

You may have noted that M1 increased by 62 % under Connectivity, but this is purely financial engineering. While revenue had increased, it had only increased by 6% as a result of M1’s improved operations. The reason for such a significant increase was the transfer of its network assets to Keppel DC REIT. As a result, M1 is now more asset-light and no longer records the depreciation of network assets as it used to.

Overall, Keppel corp has done well. At last, we are seeing all its segments in black.

Even after excluding its discontinued operations, it still reports a year-on-year rise of 26%, which is not bad.

Growing dividend

Reflecting the confidence in the group’s vision and strategy, Keppel has increased the interim dividend to 15.0 cents per share for 1H 2022. This interim dividend is 25% higher than the interim dividend of 12.0 cents per share for the first half of 2021, and annualising it gives us 5.23% yield, which is not bad.

The next question then, is whether Keppel can continue this payout. Well, given its historical range of 40% to 50%, I believe so.

Is Keppel Corp’s restructuring working?

Now that we have the most recent results and are emerging from the pandamic, let us examine if the Keppel restructuring is working, or, in other words, whether the restructuring has benefited Keppel.

To refresh your memory, part of this restructuring involves divesting of its Offshore & Marine segment.

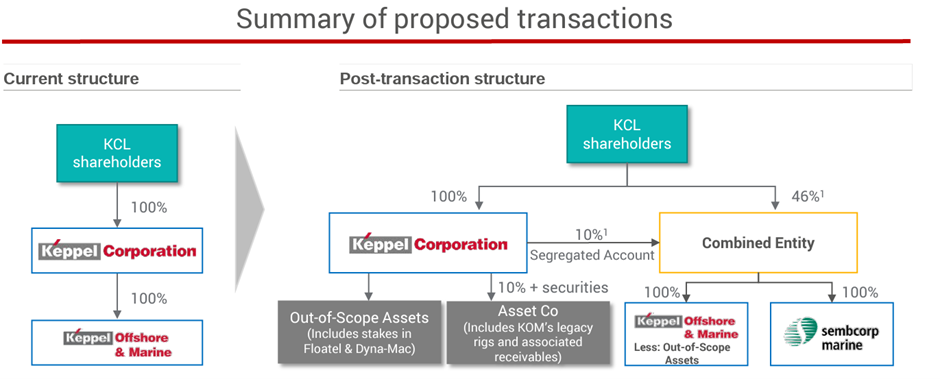

As a brief summary:

- Keppel Corp’s Offshore & Marine segment will be merged with Sembcorp Marine (excluding KOM’s legacy rigs and associated receivables, as well as some Out-of-Scope assets such as Floatel and Dyna-Mac).

- Keppel Corp would then get a 56% stake in the Combined Entity as well as S$0.5 billion in cash.

- Keppel Corp would distribute 46% of the Combined Entity to its shareholders while keeping 10% as a contingent liability.

- Keppel legacy rigs and associated receivables will be transferred to Asset Co and monetised over the next three to five years.

The reason why we are bringing this up is because the merger has yet to take place. It must still get anti-trust approval and hold extraordinary general meetings for both parties to vote on the proposed deal. Ultimately, it is only expected to be completed in the fourth quarter.

This brings about the concern that the deal will be detrimental to Keppel Corp shareholders, who may have sold at a low price as we see the improving sentiments in the O&M industry.

Well, not really. The good news is that the actual net disposal gain will be determined by the last trading price of the Combined Entity’s shares on the first market day following the conclusion of the transaction, allowing Keppel Corp shareholders to sort of dispose when the market is high. (Kind off)

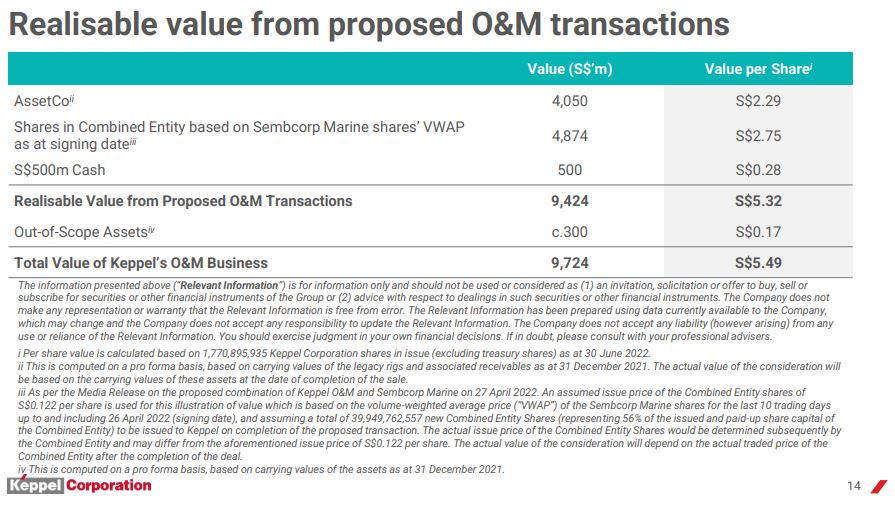

According to the media release on the proposed merger of Keppel O&M and Sembcorp Marine on April 27, 2022, an assumed issue price of S$0.122 per share of the Combined Entity shares is used for this illustration of value, which is based on the volume-weighted average price (“VWAP”) of the Sembcorp Marine shares for the last 10 trading days up to and including April 26, 2022. (signing date)

This raises the possibility of Keppel Corp selling at a higher price. However, despite encouraging developments in the O&M sector, Sembcorp Marine’s share price is still hanging at 0.11 to 0.12, which is slightly lower. In essence, based on the current pricing, Keppel Corp shareholders would still receive less value back.

Nevertheless, divesting is only one aspect of Keppel Corp’s larger ambition toward Vision 2030, which is to make the company more resilient.

Apart from the proposed merger of Keppel O&M and Sembcorp Marine, as well as the disposition of Keppel O&M’s legacy rigs and associated receivables, Keppel Corp has successfully divested Keppel Logistics.

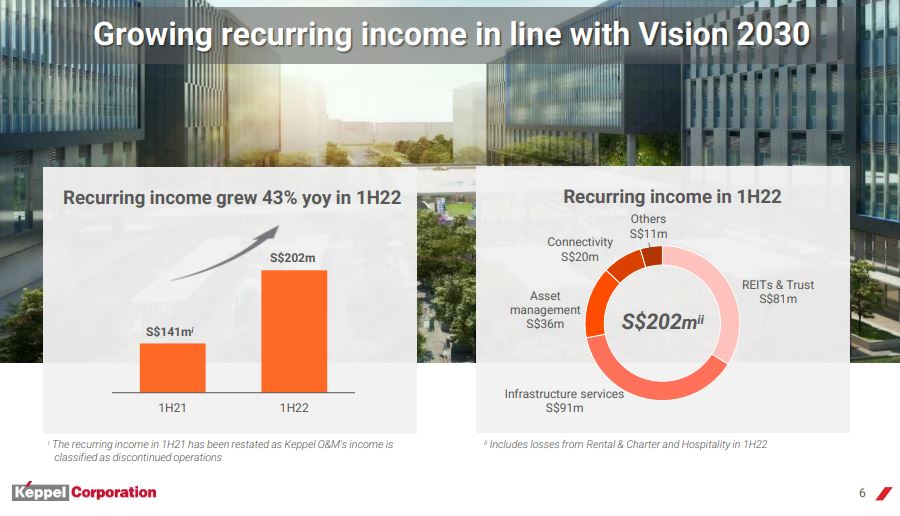

As proof that its strategy is succeeding, the group’s recurring income increased by 43% year on year to S$202 million in 1H 2022.

Overall, this restructuring has benefited Keppel Corp as its earnings begin to stabilise.

Similarly, while Keppel Corp shareholders may not receive a greater return for their O&M holding based on current market valuation, a merger would still result in synergy and benefit from improving sentiments in the O&M industry. Something that would benefit you as a shareholder.

Is Keppel Corporation a good investment now?

Keppel Corp appears to be a solid investment from a fundamental standpoint. Let us now examine its valuation.

Its current Price to Book ratio is 1.07. While it is higher than the average PB of 1, its historical figure may no longer be a good indicator because the restructured Keppel would be more stable and so warrant a price premium.

Interestingly, when compared to CapitaLand Investment Ltd (light blue), both PB have recently moved in lockstep, with Capitaland commanding a greater valuation due to its more consistent earnings. Based on this, I believe investors have already factored in Keppel’s recurring revenue. What could potentially drive its premium higher would be a higher recurring revenue percentage as well as the recovery of its China assets.

Keppel Corp’s price-to-earnings ratio has likewise increased to 12.3 since the last time we looked at it. This increase is also likely to coincide with the company’s earnings beginning to stabilise.

Overall, Keppel Corp appears to be trading at a reasonable valuation at the moment.

Conclusion

Keppel Corp’s operations have been improving since the announcement of its restructuring. (It must, of course, thank a more favourable business environment for this.)

Of course, things may not be that bright as the global economic picture has deteriorated in recent months. While certain segments, such as its O&M, may profit from higher energy prices, others may suffer from rising inflation and interest rates. Nonetheless, as of June 2022, Keppel Corp. had locked in interest rates for 75% of its loans, with an average annual cost of 2.56% and a weighted tenure of around three years, providing them with adequate buffer time to adapt.

Aside from that, as it moves closer to its Vision 2030, the company will become more future-proof, potentially increasing its earnings. All of this points to a bright future for the company and its existing investors as it continues to transform. That being said, new investors should think twice because the additional gain from now on may not be appealing, especially with so many other choices available in the market.