Singapore Savings Bonds have recently been oversubscribed by over 3.4 times, with each person receiving only a $9000 allocation. Well, if you were extremely fortunate, you would have received $9500 instead. This month’s SSB is likely to draw the same amount of attention, particularly from short-term investors, due to higher near-term interest rates than the July issue, so investors hoping for more may be disappointed.

However, there is good news: a new sovereign bond offering has been launched. The Green Singapore Government Securities (Infrastructure) bond is set to be issued, with $50 million set aside for retail investors.

So, what is the significance of this bond? Is this bond good enough to compete with and replace the Singapore Savings Bond?

First, let’s talk about SINGA.

Significant Infrastructure Government Loan Act (SINGA)

This Green SGS bond is part of the larger Significant Infrastructure Government Loan Act (SINGA), which allows the Singapore Government to borrow up to S$90 billion to finance major, long-term infrastructure investments.

Some examples of nationally significant infrastructure projects include new Mass Rapid Transit lines such as the Cross Island Line and Jurong Region Line, which will further connect and enhance urban developments across Singapore. Another such example is the Deep Tunnel Sewerage System, which will provide Singapore with the long-term needs for used water collection, treatment, reclamation, and disposal in order to improve Singapore’s water resilience. Along with this, we can anticipate spending on major highways to reduce congestion and coastal protection infrastructure to shield the island from the effects of climate change-related sea level rise.

The first SGS (Infrastructure) with a tenor of 30 years was already issued on 1 October 2021, through an auction, under the SINGA act. However, what sets this offering apart is that it will be the first series of green bonds to be issued under the Singapore Green Bond framework and that it will be sold via syndication (a different way of computing coupon rate). This framework would focus infrastructure spending on environmentally friendly areas such as clean transportation, wastewater management, and climate change adaptation. Basically, spending that could assist Singapore in achieving its 2030 Green Plan

Source: Ministry of Finance

The future Cross Island Line and Jurong Region Line are two examples of qualifying green SINGA projects. With the extension of our rail network, it would improve connectivity and motivate more commuters to use mass transit which is the most environmentally friendly mode of transportation.

What is the 50-year Green SGS (Infra)?

As announced, Singapore will offer between S$1.9 billion and S$2.4 billion of 50-year green bonds, the longest ever tenor bond by the government.

The bond, which will mature on 1 August 2072, will be open to retail investors. However, the offering is only S$50 million (around 2-3% of the total offering), while the rest would be for institutional investors.

Key Information 50-year Green SGS (Infra) (Aug-72 bond)

| Issue Code | NC22300W |

| Tenor | 50 Years |

| Public Offer | S$50 million (The rest are for institutional investors) |

| Minimum Investment Amount | $1,000, and in multiples of S$1000 |

| Issue Date | 15 August 2022 |

| Price | S$98.976 per $100 in principal amount of the Bonds (or 1 application unit) |

| Maturity Date | 1 August 2072 |

| Coupon Rate | 3.0% Fixed rate |

| Yield | 3.04% per annum |

| Coupon Payment Dates | Semi-annual coupon. 1 February and 1 August of each year up to and including the Maturity Date |

Note the difference between the coupon rate and the yield. The coupon rate would be the amount you receive every year, so if you invested $1,000, you would expect to get $30 annually. The additional 0.04% is in the form of capital gain if you hold till maturity, given that the bond’s price is set at S$98.976 per S$100 in principal amount.

With this effective yield of 3.04%, it is higher than the average return of the August issue of SSB (2.8%). That said, it is not without risk, as I shall discuss in the following section.

Better than SSB?

SGS Bonds and SSB are fully backed by the Singapore Government, which has a sovereign credit rating of AAA, indicating good creditworthiness and a low risk of default. But that’s where the similarities end.

Green SGS bond vs SSB

| Green SGS bonds | Singapore Savings Bond | |

| Tenor | 50 years | 10 years |

| Minimum investment amount | S$1,000, and in multiples of S$1,000 | S$500, and in multiples of S$500 |

| Maximum investment amount | Auction: up to allotment limit for auctions Syndication: None | S$200,000 overall |

| Buy using SRS and CPF funds? | SRS: No; CPF: No | SRS: Yes; CPF: No |

| Type of interest rate payment | Fixed coupon | Fixed coupon, steps up each year |

| How often interest is paid | Every 6 months, starting from the month of issue | Every 6 months, starting from the month of issue |

| Secondary market trading | At DBS, OCBC or UOB main branches; on SGX through brokers | No |

| Maturity and redemption | No early redemption. Investors receive the face (par) value at maturity (i.e. price of S$100) | Can be redeemed in any month, with no penalty. Investors receive the face (par) value plus accrued interest upon redemption. |

The most notable distinction between the Green SGS bond and the SBS is that the former does not allow for early redemption. Green SGS bond investors will not be able to redeem their bonds from the government early; instead, they will have to sell in the secondary market if they choose to dispose of the bond.

As a result, the price at which you sell will be determined by market conditions, and its value may rise or decline.

Which brings us to the risks of investing in the SGS bond.

Risk #1: Market condition affects your SGS bond price

How does the market condition affect the bond?

The primary one would be the interest rate. Bondholders may face unexpected losses as interest rates fluctuate. In general, as interest rates rise, prospective purchasers of Bonds in the trading market may have opportunities to instead invest in newly issued bonds with higher interest rates, which may cause a decline in demand for Bonds and a fall in Bond price. Conversely, when interest rates fall, the price of the Bonds and the price at which the Bonds trade may rise.

Of course, if you intend to hold to maturity, this has no bearing on you. However, you can never predict what will happen in the following 50 years.

This is what occurred to the first SGS (Infrastructure) issued on 1 October 2021, when interest rates were quite low.

The coupon rate was chosen to be 1.875% at the time, but when interest rates rise, we notice that its market price suffers greatly.

As a result, determining whether this Green SGS bond is a wise investment today is highly dependent on your expectations for future interest rates. Would it rise to the levels seen in the 1990s? Or will interest rates peak in a year or two before falling down to 2010 levels? This is the risk you must accept for the additional gain.

What are my thoughts?

Singapore does not control its domestic interest rates or money supply. Instead, interest rates in Singapore are mostly driven by overseas rates, particularly those in the United States, as well as market expectations of Singapore dollar fluctuations.

I think interest rates might go below 1%, but I doubt it will happen in the next 1-2 years, given the inflationary pressures, tighter supply chains, and the Ukraine issue that is affecting every country.

Risk #2: Liquidity

Another consideration for investors is the liquidity risk.

While there are primary dealers appointed under Singapore’s Government Securities (Debt Market and Investment) Act 1992 (“GSA”) who are required to trade with you if no one else does, there is no guarantee as to the prices and/or volumes at which the Bonds may trade. As a result, bondholders may be unable to sell bonds at the desired price, volume, or at all.

Should you invest in the SGS or SSB?

Overall, if you desire the flexibility of receiving your entire investment back in any given month, Singapore Savings Bonds are a better option.

On the other hand, for investors who have a longer time horizon, the SGS bond may be a better option for its higher yield.

And, assuming that interest rates do not continue to climb indefinitely, the Green SGS Bond may be an appealing option because we may potentially realize some capital gain if interest rates fall a few years from now. (Of course, this is a big if)

How to apply?

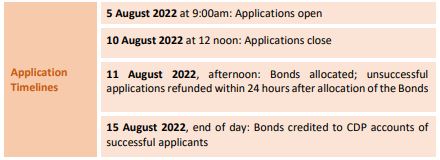

Investors can begin applying for the bonds from 9 a.m. on 5 August through 12 p.m. on 10 August.

Similar to SSB, you can apply for it through ATMs, Internet Banking, or Mobile Banking, with a $2 administrative fee imposed at the time of application.

Aside from the opening and closing times, here are some other events to keep in mind.

Oh and lastly, because this round of bond process is done by syndication, you will not be allowed to apply for the initial offer if you plan to invest using CPF or SRS fund. If you are still interested in the bond after it has been listed, you can contact the relevant bank or brokerage for information on how to purchase it.

Conclusion

Overall, the Green SGS bond is an excellent addition to our selection of government bonds.

However, whether this is a good option for you is dependent on your time horizon and how you see the macroeconomy developing. If interest rates fall in the next 1-2 years, you will benefit not just from the higher coupon rate but also from capital gains. Of course, the converse can occur if interest rates continue to rise, lowering the market value of your bond.

For more information, refer to the offering circular here or the factsheet here.

If i invest in the Green SGS (Infra) using my SRS funds and my SRS 10 year withdrawal period ends before the maturity of the SGS funds, what happen then? Am i able to keep my SRS funds in the SGS bonds until maturity or they will force me to sell my SGS bonds in the secondary market?

Hi there!

From the IRAS webpage, SRS members can apply for withdrawals in the form of investments without having to liquidate their investments. If you do it during your 10-year withdrawal period, this would be penalty-free (subjected to tax on 50% of withdrawal sum)

Regarding if you can keep your SGS bonds, I believe it is possible as you are not obligated to withdraw all your SRS funds by the end of the 10-year withdrawal period. Instead, what would happen in the 10th year is that 50% of the balance remaining in your SRS account will be subject to income tax.