When we mention about investing in bonds, most investors’ eyes start glazing over and they stop processing the information.

However, as central banks around the world raise interest rates to combat inflation, SGS and T-bills are becoming more attractive, and as a result, it has received a lot of attention lately.

With the impending recession, many are considering bonds as a safe haven for liquid cash. Of course, we do not recommend that you time the market, but it is understandable why investors are hesitant to put money into the stock market right now.

All of this makes Singapore government bonds (SGS bonds and T-bills) more appealing as a near-risk-free haven to park your cash while you wait for opportunities.

This article will provide you with an in-depth guide to what these government bonds are all about. Everything from its essential features to purchasing it is covered, so continue reading to learn more!

What are Singapore Government Securities (SGS)?

“Securities” are basically government bonds issued by Monetary Authority of Singapore (MAS) on behalf of well….the Singapore Government!

Singapore being a politically stable and economically healthy country, poses as an attractive investment avenue for both local and international investors.

The government issues bonds to investors and are known as Singapore Government Securities (SGS).

With good governance and proper budgeting, Singapore Government does not need to meet budget deficits by selling SGS. This was mentioned by the MAS previously:

“In general, governments in most countries issue debt securities to raise funds needed to pay off maturing debt and finance their operations and development expenditure. However, since the Singapore Government conducts a prudent fiscal policy and has consistently run budget surpluses over the years, it does not need to borrow to finance its expenditure.”

Hence, the risk of Singapore Government defaulting the loan is much lower than countries who raise money through issuance of bonds.

In fact, SGS bonds at this moment are rated AAA (the highest rating available) by S&P, Moody’s and several other rating agencies. All SGS bonds pay coupons semi-annually.

As of June 2012, the MAS has decided to do away with 3 month SGS issuances and issue 1 month and 3 month MAS bills instead.The MAS bills are issued in the name of MAS and not the Government of Singapore. Retail investors cannot participate in the auctions as these bills are used as monetary management tools and as such, are available to the wholesale market instead.SGS bills will be limited to 6 months and 1 year. The 6 month SGS treasury bills will be issued fortnightly and made available to the public through the ATM networks and banking counters.

There are 2 types of SGS offered:

- Treasury Bills

Less than 1 year to maturity: T-bills typically have a maturity of 6 or 12 months.

- Treasury Bonds

More than 1 year to maturity – T-bonds can have a maturity of 2, 5, 10, 15, 20 or 30 years.

5 Quick Facts About Singapore Government Securities

- Everyone can buy them. Yes. It is a constitutional right. Do not let the bankers tell you otherwise.

- They are available on auction days with a newspaper announcement preceding, usually in the Finance section of the papers. For easy references, refer to MAS’ issuance calendar instead.

- The buying process is pretty much like an IPO application through the ATM. You can also approach banking counters of primary dealer banks to apply for the securities and/or, sell your securities.

- The Central Provident Fund (CPF) does not buy SGS, although the return on your savings is pegged to the higher of 2.5% or the average yield of the 10Y bond. The Ministry of Finance issues special bonds to the CPF for them to deliver returns to the citizens.

- SGS is NOT the same as the Singapore Savings Bonds, although SSB pegs its interest rate to SGS. To find out the difference, you can read our guide over here: Singapore Savings Bonds: Your Complete Guide.

What are SGS Bonds and T-bills?

SGS and T-bills are initially created to address the needs of banks for risk-free assets in their liquid asset portfolios. Today, these bonds serve three functions:

- Create a liquid SGS market to provide a stable government yield curve that can be used as a benchmark in the corporate debt market.

- Develop an active secondary market for both cash transactions and derivatives in order to facilitate effective risk management.

- Encourage domestic and international issuers and investors to participate in the Singapore bond market.

Retail investors can access three types of Singapore Government Securities. The most common is the Singapore savings bond, while the other two are SGS bonds and T-bills, which we shall focus on.

These bonds, while identical in that they are all backed by the Singapore Government, have some differences in terms of their mechanics and investment horizon. As such, they will appeal to a spectrum of investors. The following are the main characteristics of SGS Bonds and T-bills:

- A fixed interest rate with maturities ranging from 6 months to 50 years.

- The ability to trade on the Secondary market. However, if you sell before maturity, the price may be higher or lower than what you paid.

- The ability to invest higher sums with no overall limit. S$1,000 is the minimum amount (capped at the limits for each auction).

- The ability to purchase with cash, SRS, or CPF money.

To emphasize, the mechanisms of T-bills and SGS bonds differ slightly. SGS bonds will pay you a fixed coupon. T-bills, on the other hand, are not paid with coupons. Instead, you would purchase this T-bill at a discount to its face value, and when the time comes to redeem it, you would receive the full face value.

As an example, if you were to buy a $1,000 6-month T-bill at a 3.32% yield, you would only have to invest $983.45 upfront. After 6 months, you would receive $1,000, which would account for the interest inside.

Raising rates

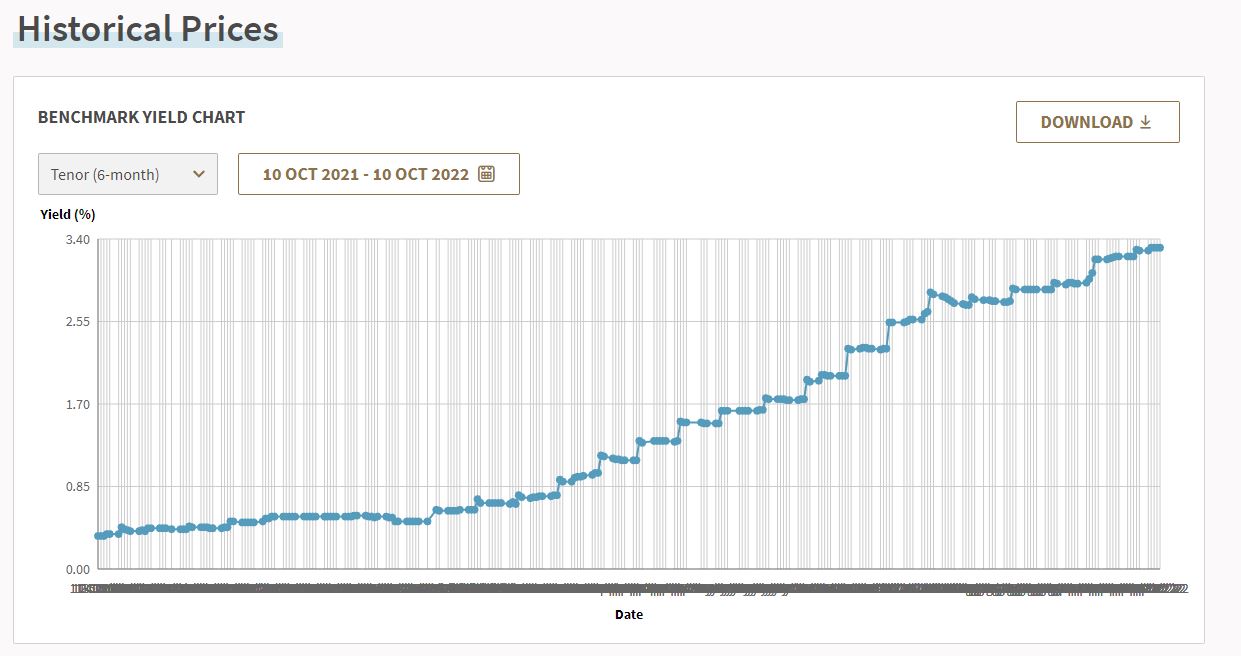

The chart and table below show that short-term (T-bills) and long-term (SGS bonds) interest rates have been continuously rising over the last year.

In fact, the current yield on 6-month T-bills remains an attractive investment for those wishing to stash their extra cash. This is why SGS and T-bills continue to receive much attention.

June 2023 T-Bills and SGS Bond Rates

As of 5 Jun 2023, the estimated yields of the 6-month and 1 year T-bills are as follows:

| Benchmark | Price | Yield |

|---|---|---|

| 6-month T-Bill | 98.121 | 3.81% |

| 1-year T-Bill | 96.766 | 3.61% |

You can find the latest upcoming T-Bills and SGS Bonds on MAS’ Website here.

SGS bonds vs Singapore Savings Bonds

If you’re looking into SGS or T-bills, you’ve certainly thought about Singapore Savings bonds as well, so how do they compare?

First up, here is a table by MAS:

| SGS bonds | T-bills | Singapore Savings Bonds | |

|---|---|---|---|

| Available tenor | 2, 5, 10, 15, 20, 30 or 50 years | 6 months or 1 year | Up to 10 years |

| Method of sale | Auction: Uniform price auction – competitive or non-competitive bids Syndication: Public Offer – fixed price and yield as determined in the Placement Tranche. MAS will seek to allocate the bonds in the Public Offer to as many individuals as possible, taking into account the distribution of applications | Uniform price auction – competitive or non-competitive bids | Quantity ceiling format |

| Frequency of issuance | Auction: Monthly, according to the issuance calendar Syndication: From time to time, according to indicative timeframe as announced by MAS | Fortnightly or quarterly, according to the issuance calendar | Monthly |

| Minimum investment amount | S$1,000, and in multiples of S$1,000 | S$1,000, and in multiples of S$1,000 | S$500, and in multiples of S$500 |

| Maximum investment amount | Auction: up to allotment limit for auctionsSyndication: None | None; up to the allotment limit for auctions | S$200,000 overall |

| Buy using SRS and CPF funds? | Auction: YesSyndication: No | Yes | SRS: Yes;CPF: No |

| Type of interest rate payment | Fixed coupon | No coupon; issued and traded at a discount to the face (par) value | Fixed coupon, steps up each year |

| How often interest is paid | Every 6 months, starting from the month of issue | At maturity | Every 6 months, starting from the month of issue |

| Secondary market trading | At DBS, OCBC or UOB main branches; on SGX through brokers | At DBS, OCBC or UOB main branches | No |

| Maturity and redemption | No early redemption. Investors receive the face (par) value at maturity (i.e. price of S$100). | No early redemption. Investors receive the face (par) value at maturity (i.e. price of S$100). | Can be redeemed in any month, with no penalty. Investors receive the face (par) value plus accrued interest upon redemption. |

2 key differences you must consider before buying SGS bonds or SSB

1) Liquidity

The first and most important consideration is liquidity. The current spread between the first year return on SSB and the six-month T-bills is approximately 0.7%. In other words, investors who purchase T-bills would receive an additional 0.7% over SSB. This disparity is primarily due to the way Singapore Savings Bonds are structured, which requires interest rates to be stepped up, making it ineffective to benefit from the current high short-term interest rates.

Aside from that, the lack of liquidity in 6-month T-bills is another element contributing to this disparity.

Don’t get me wrong: you can still sell your T-bills whenever you want (albeit more troublesome).

However, when compared to SSB, one can notice its shortcomings. While SSBs have a 10-year term, investors can redeem them earlier to get their principal amount as well as any accrued interest. As a result, whenever you need cash, you can sell your SSB without fear of losing anything.

Conversely, T-bills are difficult to redeem before maturity, and it is generally preferable to keep until maturity. This is due to the fact that T-bills are not listed. You must visit one of the three local bank branches to sell it.

Second, bond prices fluctuate in response to the interest rate environment. If interest rates continue to rise, previous issues of bonds will be less attractive since subsequent ones will provide investors with a higher yield. In such circumstances, selling early would result in a lower return on investment. Overall, the optimum strategy for investors holding T-bills is to retain them until maturity.

The same is true for SGS, which are longer term in that the market determines your selling price. However, they are slightly better in that SGS are traded on SGX, so you may sell them without going to one of the three local banks.

Of course, this does not discount the advantages of SGS as well. Likewise, you may be able to obtain a greater yield from the market, and if timed appropriately, you may be able to lock in capital gain when the general interest environment start to drop. Of course, additional skill is needed, and timing the market is difficult.

2) Limit

Following that is the subscription limit.

In this situation, SGS and T-bills beat SSB. SSB currently has a total holdings cap of $200,000 per individual. So, while you can apply for as many SSB as you want, the total amount you can apply for cannot exceed $200,000. This is not the case for SGS and T-bills, which have no such limit. (Of course, unless you are really wealthy and can bid more than the auction amount.)

In conclusion, if liquidity is important to you, choose SSB. T-bills and SGS bonds may be better options for higher yield if you know you will not use the cash in the short term or even long term for longer-term bonds.

How Safe are Singapore Government Securities? (AAA Credit Rating)

These securities are backed by the Singapore Government, which maintains a AAA credit rating (the highest rating available) by S&P, Moody’s and several other rating agencies.

The AAA credit rating is basically the top rating for debt in the world. It means that they are safest borrowers in the world and lenders should feel comfortable lending to them.

It also means that Singapore government will be able to borrow at very low rates as compared to other governments.

According to Moody’s, Singapore gets the top rating due to 3 main reasons.

1. Strong Fiscal Position

The fiscal strength of Singapore is basically supported by prudent policies and the large size of the government assets. Singapore also consistently generates a budget surplus. Singapore continued to enjoy a budget surplus until 2020 when the Covid pandemic hit.

The fact that Singapore has a fully funded compulsory pension system, i.e. the CPF, means less strain on the government. The CPF system where everybody is responsible for themselves also helps to mitigate the problems associated with an aging population.

2. Low Debt

With the huge size of government assets and large budget surplus, the Singapore government does not actually need to borrow from external creditors.

The primary reason for debt issuance by the government is to set a benchmark for corporate debt issuers, as well as encourage the development of a fixed income skill set in Singapore.

Hence, the risk of the Singapore Government defaulting on the loan is much lower than countries who raise money through the issuance of bonds.

3. Positive Growth Outlook

As of August 2022, the Ministry of Trade and Industry has estimated the growth forecast for Singapore to be between 3-4%.

How To Buy Singapore Government Bonds?

SGS bonds and T-bills can be purchased on the primary or secondary markets through a primary dealer (For Retail Investors you can approach DBS, OCBC and UOB)

The contact and branch details are as follows:

| Bank | Contact | Branch address | SGS info |

| DBS | 1800-111 1111 | 12 Marina Boulevard Level 3 | Website |

| OCBC | 1800-363 3333 | 65 Chulia Street | Website |

| UOB | 1800-222 2121 | 80 Raffles Place | Website |

Let us cover each market.

1) Buying SGS Bonds and T-bills at Auction

SGS bonds and T-bills can be purchased with cash, Supplementary Retirement Scheme (SRS) funds, or CPF Investment Scheme (CPFIS) funds.

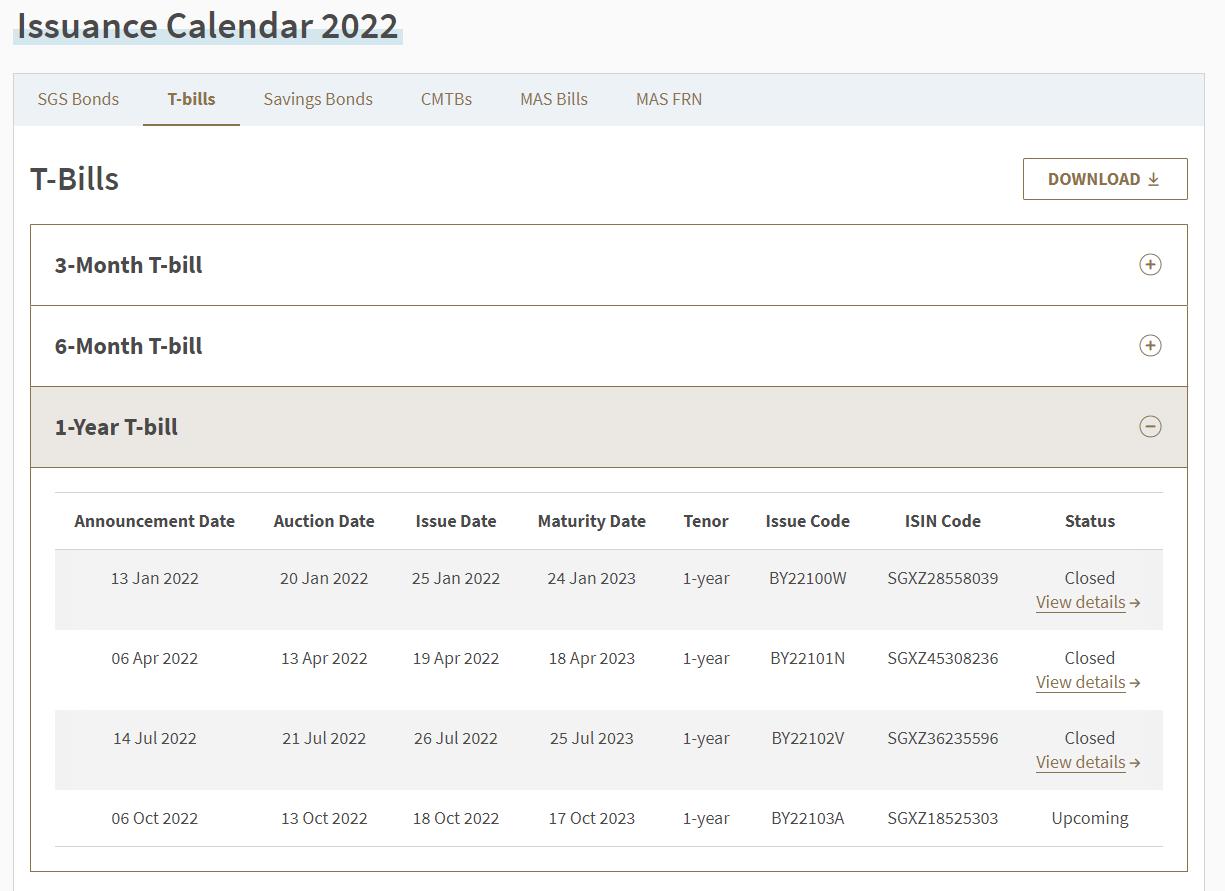

Below is a snapshot of T-Bills, showing the announcement date (the day you can start submitting bids) as well as the auction date on the MAS website.

Step 1: Identify the bond you are interested in

SGS Bonds, T-bills, and Savings Bonds are issued in accordance to the issuance calendar published in October/November of the previous year. To keep up to current on the latest bonds, see the Issuance calendar.

If you are thinking of buying a bond, you will most likely want to know the interest rate. As a result, current SGS bonds and T-bills information can be used to estimate this.

Step 2: Choose your mode of application, which will determine how you can apply

Individual investors can bid for SGS using ATMs and internet banking platforms of specific institutions. These channels may close applications 1 to 2 business days before the auction, so check the exact cut-off time with your banks.

- For cash application: DBS/POSB, OCBC and UOB ATMs and internet banking portal.

- For SRS application: Internet banking portal of your SRS Operator (DBS/POSB, OCBC, or UOB).

- For CPFIS Application: You will need to submit an application in person at any branch of the CPF Investment Scheme (CPFIS) bond dealers (DBS/POSB, OCBC, or UOB).

Step 3: Decide on your investment amount

SGS bonds and T-bills have a minimum bid of S$1,000. Decide how much you want to invest in S$1,000 increments.

At each auction, there are also allotment restrictions for competitive and non-competitive bids.

If your offer is rejected or deemed invalid, the funds will be reimbursed to the account used to submit the application. The refund will be credited to your account one to two business days after the auction closes.

Step 4: Check the results

After an auction concludes, you can view the auction’s summary results on the issuance calendar roughly an hour later.

Three business days after the results are revealed, SGS bonds or T-bills will be issued to your accounts.

- For cash applications: You can check your CDP statement

- For SRS application: You can check the statements from your SRS Operator (DBS/POSB, OCBC and UOB are SRS operators)

- For CPFIS-OA application: You can check the CPFIS statement sent by your agent bank (DBS/POSB, OCBC and UOB are CPFIS agent banks)

- For CPFIS-SA application: You can check your CPF statement

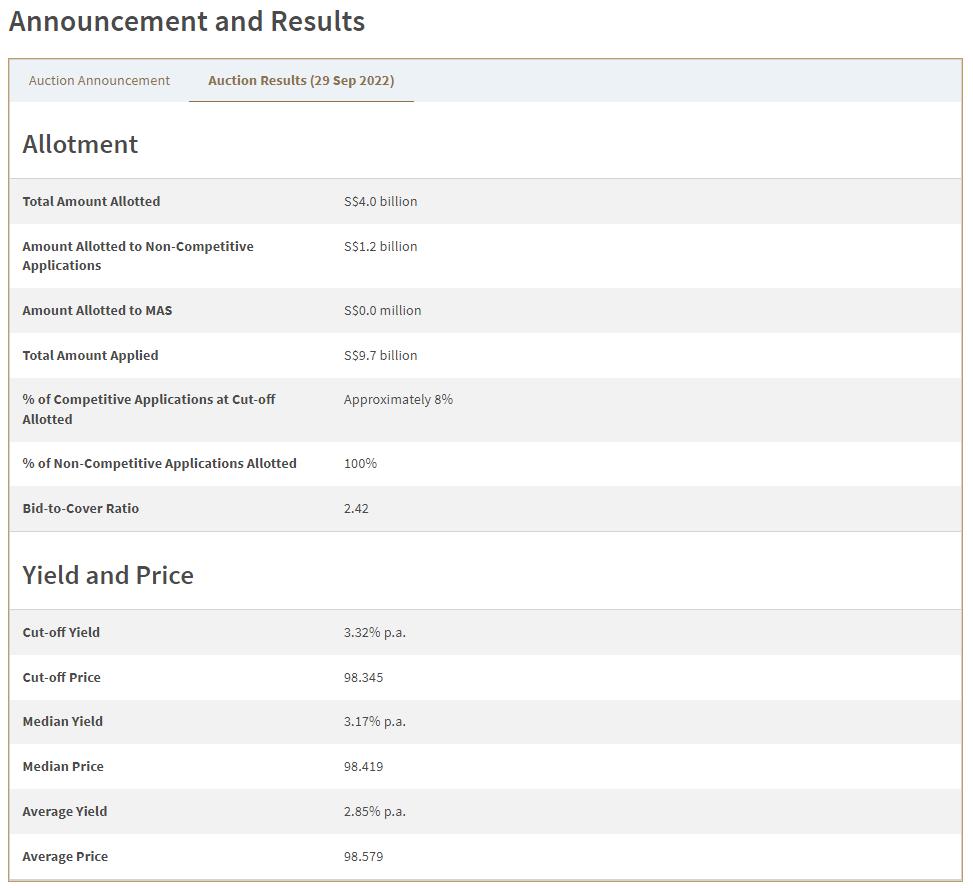

An example of the auction result of a 6-month T-bill is shown below.

In general, people who chose the non-competitive application are more likely to receive the full allocation.

So, what exactly are competitive and non-competitive bids?

A competitive bid is one in which you specify the yield you are willing to accept (in terms of percentage, up to 2 decimal places). You should only do this if you want to invest in the bond if its yield exceeds a specified threshold. However, depending on how your bid compares to the cut-off yield, you may not receive the full amount that you requested for.

A non-competitive offer, on the other hand, just requires you to specify the amount you want to invest rather than the yield. Choose this if you want to invest in the bond regardless of the return or if you’re not sure what yield to bid. Another advantage is that non-competitive bids will be allocated first, up to 40% of the total issue amount. The remaining amount of the issuance will be given to competitive bids with the lowest to highest yields.

Note: You would not lose out since you would receive the bond at the cut-off yield, which is the highest accepted yield of successful competing bids.

2) Buying and Selling SGS bonds and T-bills on the Secondary Market

Individuals can also buy and sell Singapore Government Securities (SGS) bonds and Treasury Bills (T-bills) on the secondary market at any time before the maturity date. SGS bonds can be traded on the Singapore Exchange (SGX) through your securities broker. SGS bonds and T-bills can also be purchased or sold at any dealer bank.

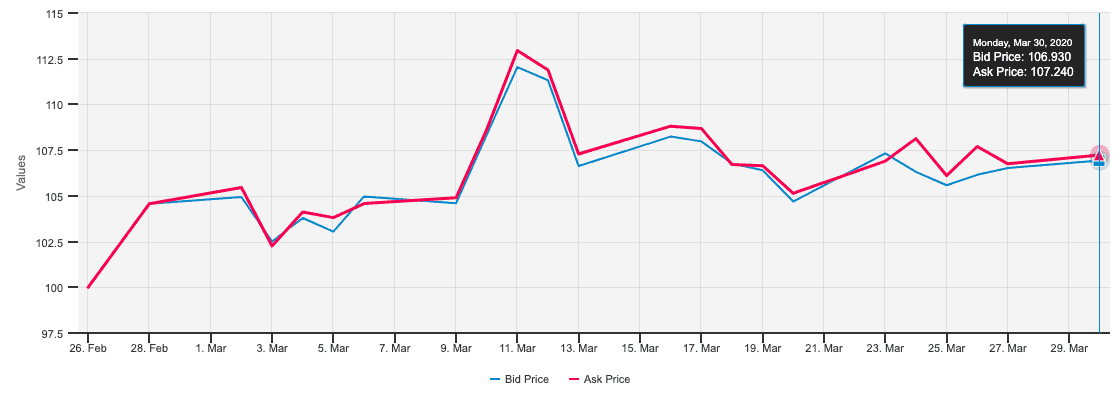

Of course, trading SGS bonds on SGX or at dealer banks would incur the usual transaction and brokerage costs. It should also be noted that secondary market pricing can fluctuate daily, depending on market conditions. If you sell your SGS before maturity, the price may be greater or lower than what you paid for them.

Method 1: On SGX, for SGS Bonds only

You can trade SGS bonds on the SGX through your securities broker if they are kept in your CDP or SRS account. SGS bonds can also be purchased on the SGX with cash or SRS funds. You may view the available SGS bonds traded on SGX here.

Please keep in mind that the SGS bond prices displayed on SGX are market prices that include accrued interest (known as the “dirty price“).

Method 2: At Dealer banks for both SGS Bonds and T-bills

You can also visit the main branches of DBS, OCBC, or UOB to purchase or sell SGS bonds or T-bills.

It should be noted that if you have T-bills, you can only sell them at the main branches of either of the three local banks.

How to select a Treasury Bill/Bond in the Secondary Market

1 – Years to maturity

The first thing you want to note is the years to maturity of the SGS. The longer the years to maturity, the higher the yield the SGS generally has.

If you want to hold until maturity, the SGS you buy should mature within your investment horizon. If you expect bond prices to increase, you may not be restricted by it as you would sell it before it matures.

2 – Yield to maturity

The second parameter to note is the yield to maturity – this is the actual interest that you will be gaining each year, based on the price of the SGS you paid. You must understand that bond price changes while its coupon rate remains constant.

For example, a bond is first issued at $1000 with a coupon rate of 1%. Over time, the bond price became cheaper to $950 while the coupon rate remains at 1%. You actually get a discount if you buy it now. Your yield to maturity (per annum) is 1.05% (1000/950 x 1%). Hence, by looking at the yield to maturity, you can tell whether your investment is a bang for your buck.

How to Read Singapore Government Bond Names?

NA12100N 420401 10

This is not some product serial code or a WWII encrypted message. This is the SGS bond name which appeared on SGX website.

What does it even mean?

I believed it wasn’t some random alphanumeric code that was generated by MAS so I dropped a mail to them and they were efficient in getting back to me.

Let’s break the name into 3 parts.

The left set = NA12100N. The middle set = 420401. The right set = 10.

The Left Set

The table below is the Code Breaker.

| N | A | 12 | 100 | N |

|---|---|---|---|---|

| N means that this security is a SGS Bond. | A refers to the original maturity of the security, in this case 30 years. | 12 refers to the year the security was issued, in this case 2012. | 100 means that this was the first 30-year security issued in the year 2012. | The last alphabet is analogous to the last alphabet of the NRIC, and serves a similar function. This letter is used to validate the issue code. |

| Additional information: B means the security is a SGS Treasury Bill. | The following explains what other alphabets/numbers stand for, in the case of SGS bonds: – Z: original maturity of 20 years – Y: original maturity of 15 years – X: original maturity of 10 years – 7: original maturity of 7 years – 2: original maturity of 2 years | |||

| For SGS Treasury bills: – S: original maturity of 6 months – Y: original maturity of 1 year | ||||

MAS said that the other two sets of numbers were not in their records. I suspected it was SGX who tagged them for easy reference.

The Middle Set

The middle set of numbers shows the maturity date of the bond in this sequence, YYMMDD. In our example, the middle set is 420401, and it means this bond matures in 1st Apr 2042.

The Right Set

So far, the right set has always been 10. I have not seen other numbers for SGS bonds. This means that 1 standard ‘lot’ size is 10 bonds. So a $100 bond will require a minimum investment of 10 x $100 = $1,000.

Frequently Asked Questions

#1 Why do bond prices differ between SGS website and SGX?

The price quoted on SGS website is the “clean price”. The price quoted on SGX is the “dirty price”.

Dirty price consists of clean price + accrued interest.

Dirty price is a fair price because someone who has held the bond for 5 months should be compensated for part of the interest that is going to be given out in the 6th month.

#2 How to buy SGS Bond using SRS money?

You need to link your SRS account with your broker. Then, you can indicate on the broker platform to deduct the money from SRS account when you buy the bonds.

#3 “I would also like to know whether it is advisable for seniors like me over 70 years of age to take part in investments as our life expectancy is very unpredictable”

Bonds are unfamiliar territory for many investors and people tend to shun the unknown. I admire your willingness to learn and embrace the unknown.Your are right to point out that investing strategies for someone over 70 would be very different from someone in his 20s. Seniors would do well by taking lesser risk and opting for more stable returns. A general rule of thumb that many financial advisors recommend is to balance your portfolio by keeping your age’s worth of percentage in bonds (less risky asset) and the rest in stocks (more risky). Eg. for your case now, majority (70%) of your investments should be in bonds.Having said that, trading and investing is really very personal. Do you require the income stream? Are your mortgages paid up? Do you have cash stashed away and enjoy stock picking as a retirement activity? What is your risk appetite?

All these and much more are questions that only yourself can answer!

Conclusion

We hope you find this guide informative and useful. No doubt the SGS’s interest rate is not high compared to other investment classes. But you should not simply ignore it as it could provide certainty that you would not find in other investments like stocks.

Feel free to let us know what do you think!

Thanks for the info.

I have just been to look at the SGS bonds as I would like to have bonds in my portfolio.

They seem to be totally illiquid and have bid/ask spreads of 10% plus for those that even have an offer price.

It is a pity the number of company bonds offered to retail investors is less than 20. All the rest are for the big boys with thick wallets who can buy them at SGD 250,000 each.

I don’t understand it, as I am sure there is a potential market.

Roman is right and how are bonds to be sold once bought ?

Agree with Roman. the Sgs secondary market is very illiquid. How we can enter?

There are market makers employed to provide liquidity even if no other investor buy from or sell to you.

But have you seen the rates offered by the market makers ? $90 for a $100 bond (which is trading at ~$101.5 in the primary market) !!! Stuck with 20 year bonds, and no way of exiting without taking a significant hit.

hmm, so are there any instruments that can

1. keep our cash value as intact as possible while earning some % interest

2. as liquid as possible during recession?

(excluding fixed deposit and ETF)

Thank you.

Somebody help me out in understanding something, i new to this so there’ probably something i don’t get. The earning from buying bonds, (e.g. 13 years long) is really not that much, after calculating the earnings and doing a Present – Future value calculation, it is almost a compounded interest earnings of 1.2% P.A, in comparison to let’s say CPF OA’s 2.5% P.A and SA’s 4% P.A, so why would anyone buy these bonds?

Because you cannot put all your cash in CPF as there’s a limit. For those with a lot of cash but don’t want to lose their capital investing, and want AAA credit rating, SGS bonds become an option.

Also, one may not need to hold on to maturity. So there can be capital gain when you sell SGS bonds in the secondary market.

Especially in this market meltdown, money tends to rush to safe assets like SGS Bonds, pushing up their pice as a result. For e.g. the 30y SGS Bond went up 7% in just 1 month.

Hi,

If we buy SGS Treasury bills using CPF SA from primary market by engaging a primary dealer (e.g. OCBC, DBS banks), roughly how much will be the total cost (buy, sell, commission, brokerage etc.)?

(* No transaction until the maturity)

Should be lower. but currently CPF SA interest is higher than the treasury bills so doesnt make sense to do it

Thank you for your comment. Still in the midst to check with dealer the actual cost.

The intention of buying T-bills is because it is backed by Government so we can redeem the full capital if hold until maturity, and it is short-termed.

It would be great if you can share in detail how to apply for the Treasury Bill using CPFIS thru a local bank like DBS. Even the bank tellers dont seem to be familiar with it.

Let us see what we can do!

Hi,

I am a european citizen and live abroad in NZ. None of the primary dealers let me create a bank account, because I am not a singaporean citizen, are not a singaporean residence holder, have no work or student pass.

How can I invest in SGS bonds having no account?

Thanks

You can buy SGS bonds on the secondary market: https://www.mas.gov.sg/bonds-and-bills/investing-in-singapore-government-securities/Buy-and-Sell-SGS-on-the-Secondary-Market

Is this paragraph in your article correct? It clearly says that CPF Funds can be used to purchase Treasury Bills. https://www.mas.gov.sg/bonds-and-bills/Singapore-Government-T-bills-Information-for-Individuals

From 8 July 2011, SGS bonds are listed on the Singapore Exchange (SGX), allowing retail investors to buy and sell SGS bonds, the way you do with stocks. Moreover, the SGS bonds you purchased will be stored with CDP.

Of course, trading SGS bonds on SGX would incur the usual transaction and brokerage costs. You can take a look at the available SGS bonds traded on SGX here.

Besides cash, investors can use the Central Provident Fund (CPF) Ordinary and Special Accounts to purchase SGS bonds, but not Treasury bills. Like investment in stocks and funds, a CPF Investment Scheme (CPFIS) account is needed to buy/sell the bonds with CPF monies.

Error. can buy bills with CPF Funds. Thanks for highlighting

I am clueless regarding how to read the CDP statement for Singapore government treasury Bill.

I just bought the latest 6 months treasury Bill.

I put in S$10,000, got a refund discount of S$165.50.

My CDP shows only 100 units of the T Bills.

Is 1 unit of Singapore government treasury Bill equal to an amount of S$100 ?

Also, does the above means my annualised interest rate for the above treasury Bill is 3.31% ?

because treasury bills do not give interest. it is sold at a discount. the refund is technically your ‘interest’. so yes, the annualized interest is 3.31%

Hi. Thanks for all the article

s you wrote. Enjoyed many of them and learnt quite a lot from your writings and youtube.

I’m considering to invest into SGS 5Yr /10Yr using CPF-OA since SGS gives higher interest. However, I noticed the above article saying:

Fact #4 — The Central Provident Fund (CPF) does not buy SGS, although the return on your savings is pegged to the higher of 2.5% or the average yield of the 10Y bond.

Question: Does it mean CPF OA interest rate may be increased? If so, perhaps it makes no sense for me to invest my CPF-OA funds into SGS bonds.

Hi Edward, no one knows if CPF OA will be increased, so far there hasn’t been any updates from CPF.