The HSTech index fell from an all time high of 11,002 points on 17 February 2021 and touched an intraday low of 3,463 on 15 March 2022 just thirteen months later.

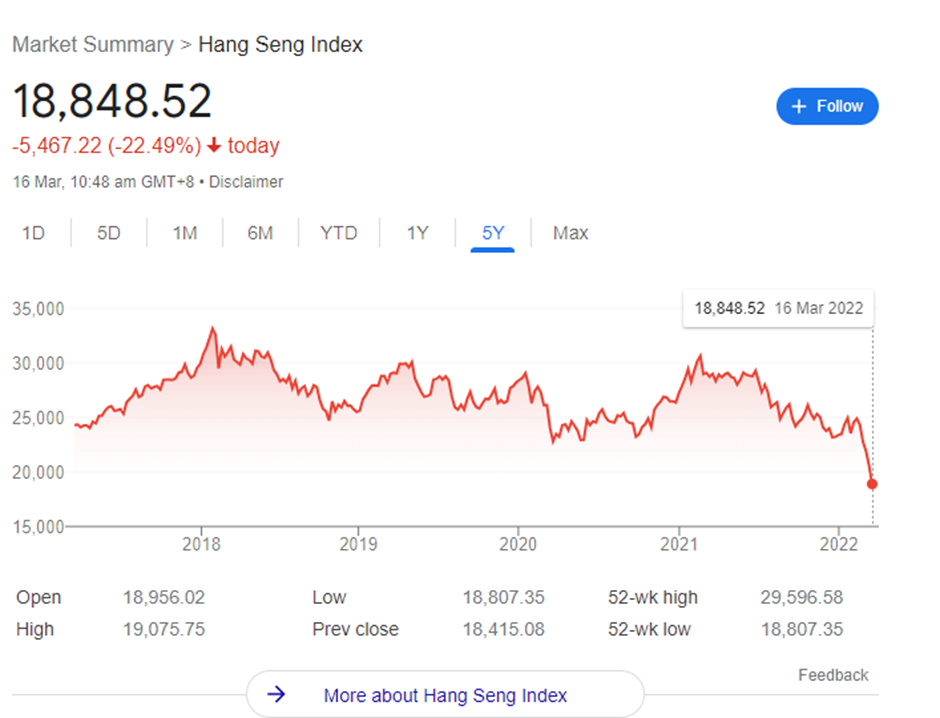

Similarly, the Hang Seng Index (HSI) recorded highs of approximately 33,600 in January 2018 and 30,600 in February 2021 before plunging to a low of 18,415 which was the lowest closing since February 2016.

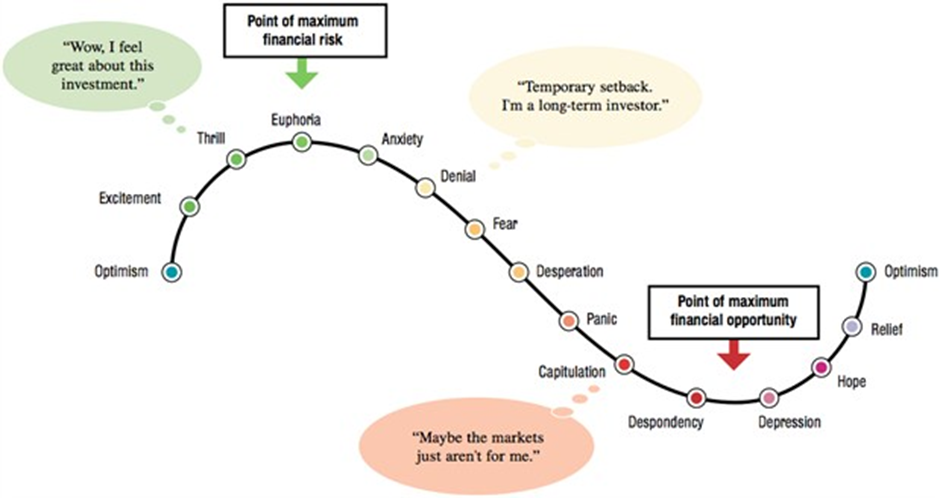

This means that stocks that are part of these two indices and other stocks in a similar space have mostly moved from being overvalued to becoming undervalued stocks as market sentiments hit rock bottom.

On 16 March 2022, The HSI went up by 9% while the HSTech went up by 22%. The indices continued its recovery on 17 March 2022 with the preopening indicating a 7% and 12% gain respectively for the opening bell. This was the highest gain in more than a decade for the index, fuelled by a relief rally and also positive news flow. However, stocks are still significantly lower as compared to almost any other time in this last one year.

We previously covered 10 HK stocks that were trading below COVID-19 lows. In this article, we identify ten China stocks that have become value plays and some may even look like deep value stocks.

We look at criteria such as P/E ratios, P/S ratios, P/B ratios, cash as a percentage of market capitalisation and the Benjamin Graham’s net-net value investing technique which values a stock solely on a revised and more conservative net current asset position by discounting certain non-monetary current assets and including all liabilities into this computation.

1) Baozun Inc (Nasdaq: Baozun) (-83% vs 52week high)

Baozun is the market leading brand e-commerce solutions provider in China with solutions in all aspects of the e-commerce value chain covering IT solutions, store operations, digital marketing, customer services, warehousing and fulfilment. Baozun helps brands like Philips, Nike and Microsoft execute their e-commerce strategies in China by selling their goods directly to customers online or by providing services to assist with their E-commerce operations. It supports these brands on all major online shopping platforms and apps such as Tmall and JD.COM.

The share price hit a high US$54 in February 2021 off the back of strategic acquisitions carried out by Baozun to increase it capabilities but subsequently fell to a low of $5.4 recently.

Total revenues increased 6.2% YoY to RMB9.4 billion while 4Q21’s revenues decreased by 5.2% YoY despite a 13.7% increase in GMV to RMB 26 billion for 4Q21.

The company made a per share loss of $1.02 in FY21 compared to a profit of $2.27 in FY20. This was attributable to higher operational investments, share based compensation and an unrealised investment loss. The Non-GAAP income for FY21 was $2.77 while FY20 was $8.57.

FY21 equity was at RMB6.0 billion. Baozun also carries cash of RMB4.7 billion with RMB2.3 billion in borrowings which represents a net cash position of RMB2.4 billion. The market cap is currently US$415 million or RMB 2.6 billion which means that Baozun is almost at liquidation value. Baozun is also a net-net value stock.

2) HUYA Inc (NYSE: HUYA) (-80% from 52-week high)

Huya and Douyu entered into a merger agreement in October 2020 with the intention of creating a video game streaming behemoth. However it was the first ever merger deal blocked in the Chinese technology sector when the State Administration for Market Regulation (SAMR) reviewed the merger and subsequently blocked the plan in July 2021.

Despite the failed merger, Huya is still going strong as it recorded continued revenue growth in 3Q21 and YTD 3Q21. The company also recorded higher per share earnings of US$0.58 in YTD3Q21 as compared to US$0.43 in YTD3Q20.

The company also has cash on hand of US$1.7 billion with an equity base of US$1.7 billion and a market capitalisation of US$861 million on a share price of US$3.64. This means that its liquidation value is worth nearly 2x its market capitalisation and is almost never heard of for a company with a profitable and continuing business. Huya is also a net-net value stock.

3) Douyu International (Nasdaq: DOYU) (-83% from 52-week high)

The Huya and Douyu merger would have seen investors in Douyu issued 0.73 shares of Huya for each share of Douyu. Since the merger broke down, Douyu now trades at a market capitalisation of US$461 million which nearly half of Huya’s value and 25% lower than the potential merger value.

Similar to Huya, Douyu has cash on hand of US$740 million with an equity base of US$1 billion on a share price of US$1.42. This means that its liquidation value is 1.6x of its market capitalisation. Douyu is also profitable with a continuing business. Douyu is also net-net value stock.

As both Huya and Douyu are relatively small companies despite having a significant combined market share, it is possible that their common major shareholder, Tencent may try to merge these two companies again by addressing the concerns by the SAMR.

4) Tencent (HSI: 0700) (-35% from 52-week high)

Tencent is the bellwether stock of the Chinese tech sector being the largest Chinese tech company currently. The company is currently trading at a P/E of 13x compared to an average P/E of more than 20x. Its valuation also pale in comparison to most of the US MAMAA stocks.

Tencent is a fast growing company that is well positioned to capture not only China’s macroeconomic tailwinds but also global structural tailwinds with significant investments across the world in numerous sectors in stocks like Meituan, Sea ltd, Pinduoduo, Tesla, Epic games, Snapchat and Webank.

It has also started taking profit on its mature investments to invest in new growth opportunities and reward its shareholders with dividends.

There is no doubt if the macroeconomic and structural tailwinds both play out, Tencent will benefit from it and will reward its shareholders accordingly.

5) Yum China (HSI: 9987) (-30% from 52-week high)

Yum China operates China’s leading restaurant concepts, including KFC and Pizza Hut brands, as well as brands such as East Dawning, Little Sheep, Huang Ji Huang, Taco Bell and COFFii & JOY. It also partnered with Lavazza to develop the Lavazza coffee shops in China.

Yum China was hit by severe restrictions implemented by Chinese government to combat multiple waves of COVID-19 outbreaks of different variants, but despite these restrictions, Yum China grew revenues 19% YoY to US$9 billion and profits 5% YoY to nearly US$ 1 billion. The company currently has a strong balance sheet of with US$4 billion of cash and no debt on an US$18 billion market capitalisation which means that it is trading at its cheapest ever valuation.

With China also gradually relaxing its COVID-19 measures, Yum China could see a strong 2022 performance as a reopening play.

6) KE Holdings (NYSE: BEKE) (-78% from 52-week high)

KE Holdings, being the leading platform for housing transactions and services no doubt took a significant hit as a result of the China property credit crisis. 4Q21 revenues fell 21.5% due to a 34.6% decline in gross transaction value (GTV). FY21 revenues increased by 14.6% to US$ 12.7 billion as GTV for the year increased by 10.1% YoY to US $605 billion. This was enabled by an overall increase of 5.3% of residential sales in China in 2021 as residential sales were relatively robust in the first half of 2021 but began a downward spiral in July 2021.

Clearly, KE Holdings has benefited from the tailwinds of digitalisation as the total GTV transacted outperformed the total sector growth.

The company also has US $8.8 billion in cash with and insignificant level of debt on $12 billion market capitalisation. This means that nearly 75% of the market capitalisation is backed by cash. Similarly to other companies in this list, KE Holdings is also a net-net value stock.

7) Alibaba (HSI: 9988) (-55% from 52-week high)

If there is a stock that has been talked about too many times, Alibaba is it. Readers can refer here, here and here for our past Alibaba coverages.

Although Alibaba’s GAAP P/E ratio is slightly high at 22.5x, Alibaba is a value play once taking into consideration its Non-GAAP P/E ratio of 13x as the Non-GAAP ratio excludes non-cash. expenses such as impairments of goodwill and loss of investment.

Alibaba has RMB $518 billion (~HK$637 billion) in cash with minimal borrowings on a market capitalisation of HK$2 Trillion which represents a market capitalisation that’s back by 32% of cash. The company also has a strong operating cashflow of RMB $80 billion and its operating cashflow is already more than sufficient to fund its operational expansion plans. This leaves Alibaba with the potential to either carry out sizeable acquisitions to further drive growth or return capital to shareholders.

8) Ping An Insurance (HSI: 2318) (-48% from all time high)

Ping An has been affected by multiple issues, such as the clamp down on the internet industry as it held investments in companies such as Lufax (NYSE:LU) and OneConnect (NYSE:OCFT). Ping An was also affected when the online insurance sector was also impacted by regulatory action against improper marketing and pricing practices.

The China property market credit crisis and a regulatory probe on Ping An’s property portfolio exposure over concerns of systemic risks after Ping An wrote down its investments in certain property developers due to the looming China property market debt crisis pushed Ping An’s share price even lower.

After concerns of economic stability were allayed when the Chinese government stepped into manage the reorganisation process of the major property developers, Ping An’s share price bottomed in October 2021 and made a nearly 35% rebound to HK$69 in February 2022.

It has since fallen to HK$56 due to the broader market sentiments. At a current P/E valuation of 6x and dividend yield of more than 5%, Ping An is attractive as a value play and also a dividend play.

9) JD.COM (HKG: 9618) (-30% from 52-week high)

JD.COM is the strongest performer on this list as the company gained market share with a FY21 revenue growth of 28%. While its operating profit declined as cost of revenues and marketing expenses outpaced the increase of revenue, a portion of this increase is attributable to meaningful investments made at the end of 2020.

JD.COM is one that does not rest on its laurels as it continuously grows not only organically but by collaborations and acquisitions. The company entered into a strategic partnership in January 2022 which would enable Shopify merchants worldwide to access JD’s network. Before the ink was even dry, JD.COM through JD Logistics followed up with the acquisition of Deppon Logistics for RMB13.5 billion, a company with a full suite of logistics services, to expand its logistics capabilities.

JD.COM has RMB 191 billion (~HK$234 billion) in cash with minimal debt. With a market capitalisation of HK$687 billion, the cash accounts for 34% of its market capitalisation.

Similarly to Alibaba, JD.COM has strong operating cashflows which is adequate to fund its operational expansion. The company has also been investing heavily in logistics assets such as warehouses as it aims to build a massive warehouse network.

The stock is currently trading at a P/S of 0.7x which is at the low end of its historical range. With a high revenue growth rate, this is one clear value stock.

10) Lufax Holding (NYSE: LU) (-59% from 52-week high)

Lufax is closely linked to Ping An, with more than 80% of shares held by Ping An and its insiders such as senior management and directors.

Its revenue for 4Q21 and FY21 grew by 19% YoY, net profit for 4Q21 grew by 1.7% while the FY21 net profit increased by 36%. FY21 earnings per share is US$1.12, 27% higher than FY20. This translates into a P/E ratio of 6x.

Both core segments grew significantly despite numerous headwinds. The solid financial results in the were due to stable unit economics, steady loan volume growth, high loan portfolio quality, and improved wealth management take rates. Its retail credit facilitation business saw loan book increase 21% to RMB 661 billion while its wealth management business saw total registered users grow 12% to 51.6 million.

The market capitalisation is currently at US$ 15.5 billion with an equity base of $15 billion, hence the company is now trading at a P/B valuation of 1.0x which makes it a value play.

Would you invest in China Value Plays?

More than a year of market weakness has led to many Chinese stocks trading at all time lows with many starting to believe that China is uninvestable. When comparing to US companies, Chinese companies are valued far below US companies.

Alvin has shared in the snapshot below that Amazon’s market capitalisation is larger than the entire HSTech index with 30 stocks while Tesla’s market capitalisation is equals to 5 large Chinese tech companies.

While all ten Chinese companies mentioned have made significant recoveries in the last 2 days, they are still value plays with potential to even become multi baggers as they are still below very much below 52-week highs.