While this article is being written, the Chinese stock market continues to fall. As a result, the Chinese market is becoming an attractive destination for investors seeking huge profits. That isn’t to suggest that all Chinese equities are worth investing in.

Today we’ll look at Ping An Insurance, another Chinese monster. This company is well-known worldwide, and it was ranked 21st on the Fortune 500 list in 2020. It has multiple listings on the Shanghai stock exchange under SHA:601318, Hong Kong stock exchange under HKEX:2318 and NASDAQ under the ticker PNGAY.

Ping An Insurance at its core, is an insurance company. However, unlike others, Ping An Insurance provides much more for investors. With several technological initiatives, Ping An has created an entire ecosystem that includes various financial products and services. As a result, investing in Ping An Insurance provides access to a whole ecosystem other than an insurance business.

However, it’s worth noting that its stock price has been falling in recent years, which may be perplexing to some.

So, is it a good idea to put money into Ping An, which has been on the decline?

Let’s take a look at its business fundamentals, its recent financial results and evaluate whether Ping An is a good investment or not today.

What is Ping An Insurance? – more than means the eye

Ping An Insurance is a leading insurance company in China in terms of revenue.

Apart from insurances, the company provide a wide range of services ranging from financial services, health care, auto services and smart city services.

This is done through its wide range of subsidiaries, associates and jointly controlled entities which include Ping An Life, Ping An Property & Casualty, Ping An Annuity, Ping An Health, Ping An Bank, Ping An Trust, Ping An Securities, Ping An Asset Management, Ping An Financial Leasing, Autohome, Lufax Holding, OneConnect, Ping An Good Doctor, and Ping An HealthKonnect. (A mouthful yes, Ping An is not a small company)

As of 31 December 2020, Ping An has 598 million internet users and 218 million retail customers.

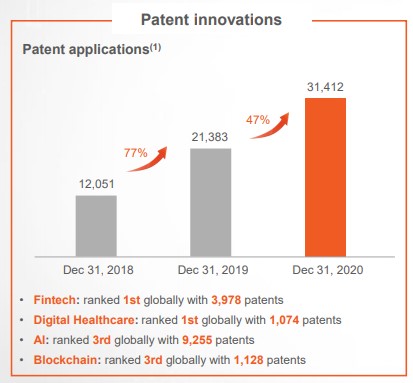

Being highly focused on technology, it has recruited over 3,700 scientists and amassed 31,412 technology patent applications as of 31 December 2020. With that, Ping An scored first for fintech and digital healthcare and third for AI and blockchain on global patent application lists.

Ping An Insurance’s real business(es)

Now let’s break down Ping An Insurance into its different business segments. In total, they have five segments, namely:

- Life & Health Insurance Business

- Property and Casualty Insurance Business

- Banking Business

- Asset Management

- Technology

Life & Health Insurance Business

Ping An Insurances’ Life and Health insurance make up the main bulk of its revenue at 66.4% for the last financial year. Through Ping An Life, Ping An Annuity and Ping An health, the company engage in the sales of insurances ranging from traditional life insurance, participating insurance, universal insurance, long-term health insurance, accident & short-term health insurance, annuity and also Investment-linked insurances.

Going big on AI, Ping An also offers a smart personal assistant, AskBob, which provides its agents with a range of tools to improve productivity and improve sales conversion.

Property & Casualty Business

Ping An Property & Casualty covers all lawful property and casualty insurance businesses, including auto insurance, corporate property and casualty insurance, engineering insurance, cargo insurance, liability insurance, guarantee insurance, credit insurance, home contents insurance, accident and health insurance and international reinsurance.

As of 2020, this segment makes up 11.5% of the company’s total revenue.

And likewise, Ping An has proactively used AI to automate its entire claim processing procedure, including claim submission, instant inspection and settlement, appraisal and roadside assistance, and auto parts sourcing. With that, the company can determine the appropriate compensations within seconds while also reducing insurance fraud.

Banking Business

Ping An Insurance has a banking business that serves both retail and corporate clients. As of last financial year, this segment makes up 12% of Ping An Insurance overall revenue.

Asset Management

Another financial service the company provides is in asset management through a range of companies including Ping An Trust, Ping An Securities, Ping An Financial Leasing, and Ping An Asset Management. Examples of services this segment provides include securities brokerage, investment banking, asset management and financial advisory services.

At the moment, this segment provides a total of 8% to overall revenue.

Technology

Last but not least, the technology business represents the range of subsidiaries, associates, and jointly controlled entities under Ping An Insurance, which comprises Autohome, Lufax Holding, OneConnect, Ping An Good Doctor, and Ping An Insurance HealthKonnect.

Ping An’s technological industry grew rapidly over the years:

- Lufax Holding went public on the New York Stock Exchange in 2020.

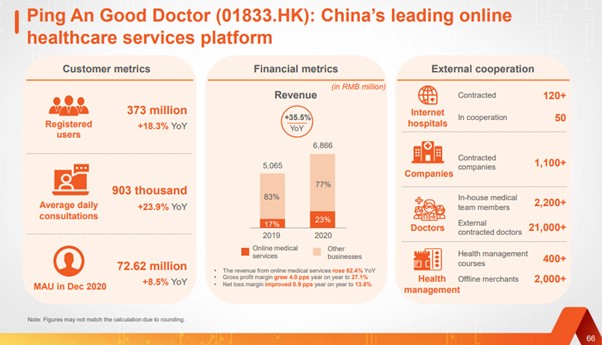

- Ping An Good Doctor’s online medical services revenue grew by 82.4% year over year in 2020.

- Autohome’s income from the online marketplace and other businesses rose by 34.4% year over year, despite a weak automobile market.

- OneConnect’s revenue grew by 42.3% to RMB3,312 million in 2020, compared to the previous year.

This is an up and coming segment for Ping An.

While this segment currently makes up only 4.8% of total revenue, if executed well, it could help drive Ping An Insurance future profits.

Lufax is one of Chinese largest online wealth management platforms, with over 12.88 million active investors. As of 2020, it had more than RMB426 billion in client assets, which is still growing.

Ping An’s OneConnect open platform provides financial service stakeholders with comprehensive, end-to-end business technology services like auto fraud checks and credit. Its customers include all of China major banks and also 98% of all city commercial banks.

Ping An has created a comprehensive health care ecosystem of patients, providers, and payers, with its Ping An Good Doctor as one of the system’s components. With a total of 373 million registered users, Ping An Good Doctor is a healthcare service platform that provides services ranging from 24/7 online consultation, referral, registration, online drug purchase, and even one-hour drug delivery.

As we continue to battle the pandemic, such telemedicine companies are bound to benefit, and I am sure Ping An Good Doctor would continue to grow.

Lastly, Ping An Autohome provides automakers, dealers and auto repair shops a comprehensive auto service ecosystem covering everything from auto showcasing, purchase and use.

As of December 2020, Autohome had an average of 42.11 million daily active users on its mobile app, many of whom were auto insurance customers of Ping An Property & Casualty. This is an example of how Ping An huge ecosystem benefited the whole company as it serves as a one-stop service for many of its customers in both the health and finance segment.

To get an idea of where each of Ping An technology subsidiaries are, the image below shows the various stages.

Ping An’s Ecosystem

The collaboration across Ping An’s many segments allows the company to maintain its clients within its ecosystem while also keeping the cash within it.

Ping An’s cross-selling revenue has been increasing year over year, indicating that its diverse divisions could substantially boost Ping An’s overall revenue.

Ping An Insurance’s Financials

Ping An Insurance has a good business model, but how does this translate to its financials?

Revenue

Ping An Insurance’s revenue and profits have been growing steadily over the past three years, albeit at a slower rate than a typical growth firm. The number of retail customers in the group increased by 9% year over year to over 218 million, and contracts per customer increased by 4.5% to 2.76 compared to a year before.

Nonetheless, the pandemic has slowed Ping An’s expansion because many of its agents are unable to have face to face meetups. As such, the company’s revenue and operating profits grew by only 3.8% and 4.9% year over year in 2020, respectively.

For Q1 2021, Ping An revenue has seen an improvement across its business segments. Its Q1 2021 operating profit rose by 9% to RMB39,120 million. Assuming that Ping An can maintain its earnings at this pace, the group would generate RMB156,480 million in 2021, which is 12% higher than 2020, which does seem great for the company.

However, its Q1 2021 net profit came in at RMB27,223. While this is a 4.5% improvement compared to the same quarter a year ago, it is much lower than the past few quarters. As a result, if we assume Ping An can maintain its net profit growth rate for 2021, it will come in at RMB108,892, a 24% drop from 2020 net profit.

Return on Equity

Ping An’s return on equity fell to 19.5% in 2020 as a result of the pandemic.

While there are hints of recovery in Q1 2021, with the ROE rising to 20%, we can’t be sure how things will pan out in 2021, especially because China is dealing with yet another natural disaster.

Apart from that, Ping An’s Life and Health Insurance continues to be the most profitable for the company, with a 35% ROE.

Dividends

Ping An’s dividend payout has been steadily increasing over time.

Ping An’s dividend per share came in at RMB2.20 in 2020, up 7.3% from the previous year. The dividend payout ratio based on operating profit is similarly respectable at 28.7%, indicating that these distributions are likely to continue in the future.

Ping An’s Debt Levels

With Ping An’s excellent balance sheet, investors can be reassured.

Ping An’s current ratio was 0.34 at the end of 2020, this ratio is lower than its peers, indicating that the company may have some difficulties dealing with its short-term obligations.

However, the company has a relatively high-interest coverage of 9.8, indicating that it is well-capitalized and would have no trouble servicing its debt as such investors should not worry much.

Ping An’s Cashflow

For 2020, Ping An’s net cash flow from operating activities was RMB312,075. Net cash flows spent in investing operations, on the other hand, totalled RMB447,138, exceeding Ping An’s net cash flow from operating activities.

However, because it was able to raise capital from the market and generate RMB260,641 in net cash flows from financing activities, its cash and cash equivalents at the end of the year were positive at RMB424,748.

While Ping An’s cash flow is robust, I would feel more at ease if its operating cash flow exceeded the amount spent on investing activities. Of course, if Ping An can properly utilize these resources and grow the company at a faster rate, there should be no problems in the future.

4 Reasons for dropping share price

After looking at its business model and financial statements, Ping An doesn’t seem to be as bad as what its share price is depicting.

So what are the reason for this persistent decline?

1 – Covid 19 Pandemic

The first and most obvious reason is the pandemic.

Large-scale offline events were prohibited, and face-to-face meetings declined. As a result of its agents’ inability to make visits, the company’s long-term protection business suffered. To add insult to injury, companies that aren’t doing well amid the pandemic have also decided not to be insured.

Furthermore, as an insurance company, Ping An may have to deal with an increase in hospitalization and death claims. While this is true, some investors may have overlooked the reality that the claims are likely to be limited, as the Chinese government has already covered the costs of infected and suspected patients.

Ping An has also sought to migrate online throughout the years so that sales may be conducted digitally rather than in person, which has helped to mitigate some of the company’s downturn.

Finally, as many individuals resorted to internet options for diagnosis and treatment during the pandemic, Ping An’s online health services Ping An Good Doctor witnessed considerable growth. As a result of this pandemic, Ping An Good Doctor has profited.

2 – Deterioration of its Life and Health segment

As part of a quality-focused agent development strategy to eliminate low-productivity agents, Ping An has been appraising agents to eliminate low productivity ones. As of 31 December 2020, Ping An’s sales agents has decreased by 12.3%. Ping An Life also maintained strict agent recruitment requirements, improved agent selection through the use of AI and other technologies, and increased fundamental agent management.

While this may benefit Ping An in the long run by creating a more productive workforce, the company’s short-term results have been hampered.

Because Ping An’s core business is acquiring customers through its extensive agent network, reducing the number of agents has resulted in a decrease in new insurance premiums.

Whether or if this method is effective remains to be seen.

3 – Acquisition of Founder Group

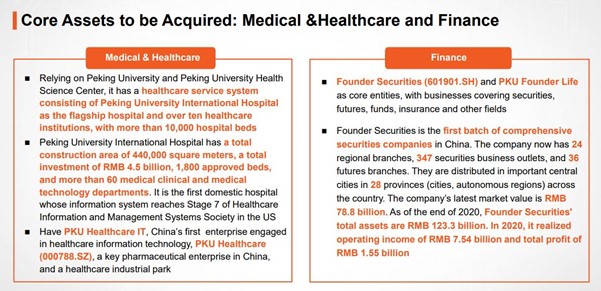

Finally, Ping An’s acquisition of a controlling share in the newly formed Founder Group, which has struggled with poor operations and insolvency due to various causes, could be a factor.

To begin with, Founder Group is a state-controlled corporation formed by Peking University, but it has recently defaulted on US$3 billion in bonds and RMB 34.5 billion in onshore notes, forcing it to go through a debt restructuring plan.

Ping An Life and a few other companies have agreed to save it as a result. Ping An will pay RMB37 billion to RMB50.75 billion for a 51.1% to 70.0% share in New Founder Group.

Many investors were concerned when this announcement was made that Ping An was under government pressure to save Founder Group and that this could happen again in the future. Many people also questioned how this deal would benefit Ping An. As a result of the uncertainty, the company’s stock price plummeted.

On the other hand, some may regard this acquisition as a way for Ping An to expand its securities company while also accelerating its growth in the healthcare market. The following is a list of assets that will be purchased:

Most of these sectors are not new to Ping An, who is already in the finance and healthcare sectors. As you can see, Ping An’s acquisitions will benefit four major industries:

- medical and healthcare,

- finance,

- information technology,

- and education (not sure how much the government crackdown on the education sector would affect this sector).

With that, Ping An’s ecosystem, which is already significant, has the potential to expand.

Of course, it’s difficult to predict how these deals will turn out at this time. While there are a lot of synergies, Founder Group is ultimately doing poorly. Again, this transaction is minor compared to Ping An’s balance sheet, so even if it fails, the consequences will be negligible.

4 – Henan Floods

Prolonged rainfall on 19th and 20th July 2021 lead to the devastating Henan Floods where dams and reservoirs are reportedly overwhelmed. Floodwaters had breached subways, taking lives and damaging property.

As of 27th Jul 2021, it was reported that Ping An and PICC had received over 250,000 claims and total insurance claims are estimated to hit US$1.7 million. At the point of writing, the actual aftermath and details of the actual claims from Ping An have not been made known.

However, investors have reacted, leading to a drop of ~9.8% between 21st to 27th July 2021.

Valuation – Is Ping An worth the money?

Ping An Insurance has a Price to Book ratio of 1.36, which is low compared to its historical average. Its Price to Earnings is also much lower at 7.54 as compared to the historical average of 11. With that, this could be a signal that Ping An Insurance is undervalued.

On the other hand, if we compared Ping An with China Life, another major insurance company in China, China Life’s Price to Book of 0.69 and Price to Earning of 6.520 indicates that Ping An Insurance current share price is justified or even overvalued.

That being said, I believe Ping An Insurance has better fundamentals and prospects. Thus, China Life may not be an excellent apple to apple comparison.

iFast has also recently done up a valuation of Ping An and has estimated Ping An’s share price at RMB112.8. At this valuation, Ping An is way undervalued by over 100%, which is quite substantial.

Author’s Opinion

Ping An insurance is one of the largest insurance companies globally and having a lot of growth prospects in various segments makes it a compelling buy.

We can expect growth in China’s life insurance market, which is now below the world average, as China’s household income rises in tandem with its economic growth.

While there are risks, such as the Founder Group acquisitions, the fall in growth due to the reduced workforce, and the general China market risk, Ping An gives investors an excellent risk-to-reward ratio.

Nonetheless, given the company’s downward trajectory in its share price, you may want to wait for a reversal before taking a position in it.

Disclosure: At the time of writing, I have a position in Ping An Insurance

A great read, thank you. I wonder how far it can fall.

BTW the saying is “more than meets the eye”