Since Alibaba (9988.HK) announced its FY2021 results on 24 February 2022 and reiterated some of the plans shared during the investor day as part of its immediate term focus, its share price has been on a downtrend, affected by slowing revenue growth and increased costs.

It was not helped by the challenging broader macro conditions with events such as the continued China tech regulatory actions and the escalating Russia-Ukraine conflict taking place in quick succession.

In this post, we provide a few possible reasons why Alibaba went below $99.88 (its ticker code) and why it may take a long time before the stock recovers.

5 reasons why Alibaba is not doing so well

1) Near term challenges causing slowing revenue growth

Alibaba recorded its slowest growth ever with a 10% YoY increase.

While most segments performed decently, its core segments such as China e-commerce and the digital media and entertainment segment which consists mainly of Youku and AliPictures both underperformed. In addition, its cloud segment which provided strong growth for Alibaba in the last few quarters has seen its growth trajectory slow significantly with a decline to both its QoQ revenue and EBITDA.

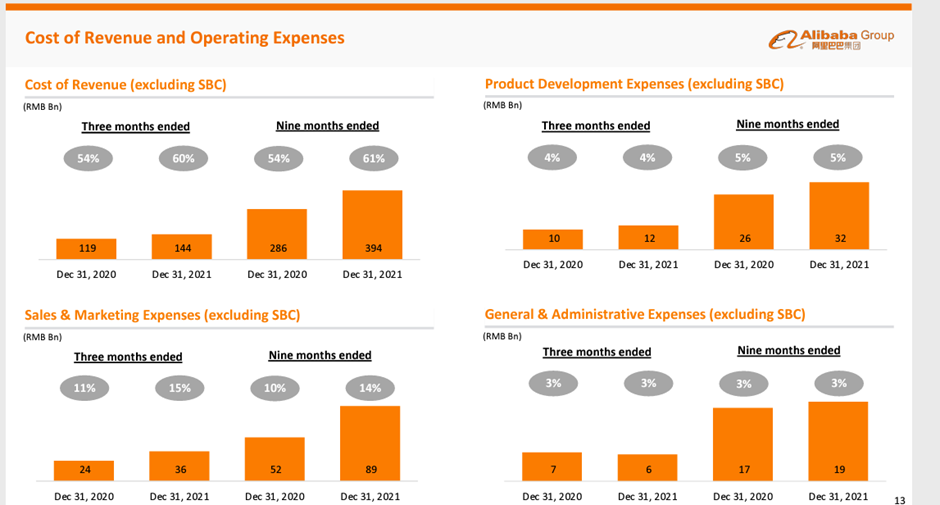

2) Costs and investments have increased

Alibaba continued reinvestment as part of its common prosperity driven social responsibility and spending on user growth as part of its longer term plan to drive growth has led to declining margins and has been a constant theme since the commencement of the regulatory crackdown on the tech sector in November 2020.

In previous years, Alibaba relied on the higher margin revenue from its domestic e-commerce to support the expansion of its unprofitable divisions, however it may now be in a situation where its future investments cannot be fully covered by its domestic e-commerce growth. This means that margins will likely continue to be on the decline.

In addition, Alibaba continues to face pressures from keen competition by close rivals such as JD.com and a continued zero-COVID policy in China. Alibaba is also unable to forecast a recovery trajectory, nor are they able to forecast when such spend will slow or cease.

Negative macro environment

3) Continued tech sector regulatory actions in China

On 1 Mar 2022, China issued a regulatory guidance to food delivery companies such as Meituan to cut its merchant food delivery fee to support merchants who are facing operational difficulties. This led to a sharp plunge in the shares of Meituan and other internet platform companies.

In addition, Tencent’s Tenpay lowered handling fee for small and micro merchants while WeChat pay offered a 10% discount on service fee to small-to-micro merchants and individual businesses.

There was also another reminder of the continued emphasis on regulatory monitoring as China’s Ministry of Industry and Information Technology (MIIT) reiterated its requirements for internet firms to operate compliantly, maintain fair competition, open up its ecosystem and most importantly fulfil social responsibilities.

4) Challenges faced in a direct HKSE listing

Due to China’s regulatory concerns over data security, it has been challenging for tech companies to list directly on HKSE or other exchanges. After many delays, Alibaba-backed beauty tech firm Perfect Corporation, which provides software to beauty and fashion companies, is finally set to go public in the US via $1b SPAC deal.

Similarly, Tencent’s WeDoctor has cut jobs after multiple listing delays and is currently looking at a SPAC listing on HKSE instead of a direct listing. The company is still also facing queries about its data governance.

While progress can be made after overcoming hurdles and delays, this further indicates that the regulatory environment has continued to tighten and after more than one year, it is likely to become a new normal.

5) Russia-Ukraine conflict

Further escalation of the conflict as the Zaporizhzhia nuclear power plant, situated in the province of Zaporizhzhia in Southeastern Ukraine near the Dnieper River endured heavy shelling from Russian troops. The shells had set fire to one of the facility’s six reactors, raising fears that radiation could leak from the damaged power station. The unit is under renovation and not operating but has nuclear fuel inside. The site was initially inaccessible to firefighters because they’re being shot at by Russian forces.

The attack renewed fears that the invasion could result in damage to one of Ukraine’s 15 nuclear reactors and trigger another emergency like the 1986 Chernobyl accident, the world’s worst nuclear disaster.

This attack occurred after a second round of talks reached an understanding on a joint provision of humanitarian corridors for evacuating civilians and an agreement to hold a third round of talks.

Brace in for a long ride

In summary, Alibaba is not doing great, Alibaba’s FY2021 results was underwhelming with near term challenges impacting revenue growth. Earnings were doubly impacted from an increased spend and investments.

The broader macro environment continues to be negative with continued regulatory controls on the Chinese tech sector as China pushes the internet platform to reduce its fees for merchants who are facing difficulties as a result of the zero-covid policy.

Companies looking to raise funds via a stock exchange listing have also seen multiple setbacks to its plans as they continue to face delays stemming from heightened regulatory compliance requirements.

Finally, the Russia-Ukraine conflict continues to escalate and it is anyone’s guess as to when it would be resolved and what would be the economic impact from the post-conflict resolution.

Since the start of 2022, many stocks including Alibaba have continued to make new 52-week lows and with no immediate signs of a turnaround, investors could have a long ride ahead before they see the light at the end of the tunnel.

Looking for other opportunities in the China stock markets? Read our Investing in China guide first.