Have you ever dined at Haidilao and loved their service? Well, these may be rare experiences considering how expensive their food is. But did you know that you can purchase the restaurant’s hotpot condiments and prepare your very own Haidilao hotpot at home?

Yihai International (HKG:1579) is Haidilao’s sole hotpot condiments supplier, sells a variety of Haidilao condiments to retail customers!

When Haidilao’s share rose to an all-time high in 2020, so did Yihai International’s shares due to how both businesses are correlated. But just as fast as the share price rose last year, it also dropped very quickly in the early part of 2021. So, what happened to Yihai International? Were its shares overhyped, which drove up its prices last year? Or did its fundamentals change since the start of this year?

Yihai International’s Business overview

Yihai International offers a wide range of hotpot condiments, Chinese-style compound flavouring, and convenient ready-to-eat food products. Yihai products are sold in 11 countries in North America, Europe, and Asia, yet its revenue primarily comes from China (approximately 95%), and consists of two consumer segments.

- The first segment is related-party customers, mainly Haidilao. As Haidilao’s sole supplier of hot pot flavouring, we can see why the restaurants’ success has greatly increased Yihai’s revenue.

- The second segment is the third-party customers, which consist of distributors, online consumers, and catering service providers.

Given that Yihai has exclusive rights to use the Haidilao brand to sell its condiment on a royalty-free basis for a perpetual term, this segment has also been doing well.

Aside from Haidilao condiments, Yihai also offers a wide range of other products. In 2020, it developed a total of 55 new products. This brings its total to 56 hot pot condiment products, 45 Chinese-style compound flavourings, and 24 convenient ready-to-eat food products as of the first half of 2021.

Below is a sample of some of the products they sell on their website. There are different options to cater to everyone’s tastebuds.

Yihai International’s Financials

So how did Yihai performed over the years?

Well, I have just one word to describe it: tremendous.

Revenue

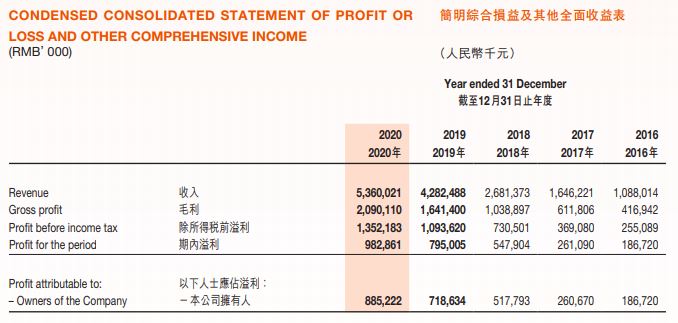

The company’s revenue rose at a rapid pace in the previous years. Starting at RMB1 billion in 2016, it has grown to RMB5.3 billion in just five years. By the end of 2020, Yihai’s revenue came in at RMB5.3 billion, and its net profit was at RMB982.9 million, which was 23.6% higher than the previous year.

However, while 2020 was a terrific year for Yihai due to the increase in demand for retail products domestically, growth was significantly lower at 25.2%, compared to previous years‘ growth which ranged between 50% and 70%. This was mainly due to the Covid-19 pandemic which resulted in a decline in sales, particularly from related party customers such as Haidilao.

In the first half of 2021, we could see China gradually opening up businesses and consumers’ habits returning to normal. The demand for household retail products caused by the pandemic has subsided, while the demand for catering products is now recovering. Because of this, Yihai experienced an increase in revenue. Revenue was RMB2,630.8 million in the first half of 2021, which is an 18.6% increase from RMB2,218.1 million in the first half of 2020.

That being said, Yihai’s net profit saw a 12.6% decrease, from RMB348.8 million to RMB398.9 million in the first half of the year. This is primarily due to the lower margin, which we will discuss in the following sections.

Revenue Breakdown

Breaking down their revenue into individual products, sales from hot pot condiments accounts for the majority of the company’s revenue, followed by ready-to-eat food and finally Chinese-style compound flavourings.

Profit margin

In 2020, Yihai’s profit margin went up slightly to 39%. This is because its third-party customer segment (distributors, online consumers, and catering service providers) has generally a higher margin than the related party segment.

Due to the lockdown in 2020, there was a significant increase in the percentage of total revenue from third-party sales, which led to Yihai’s higher profit margin.

Of course, good times don’t last forever. As mentioned above, Yihai’s gross profit margin decreased from 39.7% to 32.7%, leading to a drop in net profit in the first half of 2021. This happened as the economy began to open up, signalling a shift in the circumstances. Compared to the same period in 2020, the percentage of total sales revenue derived from related party sales has increased significantly, resulting in a reduced profit margin.

Cashflow

Cash flows from operating activities came in at RMB1.2 billion, which is much higher than the net cash used in investing (RMB72 million) and financing activities (RMB210 million). This is an indication that Yihai’s business is sustainable and will not likely experience liquidity problems.

To give you more assurance, as of 30 June 2021, Yihai’s cash and cash equivalents amounted to approximately RMB1.2 billion, which is equivalent to one year of net cash generated from operating activities.

Debt

Surprisingly, Yihai does not have any bank debt as of 30 June 2021. Its Debt to Equity ratio, calculated by dividing total debt with the total equity, was only 3.1%, which is very low.

Its quick ratio, which measures a company’s capacity to pay its short-term liabilities, is also only at 3.44%, which shows how healthy the company is.

Moving forward

Yihai’s rise has been spectacular, to say the least. Hotpot continues to grow in popularity in China, and it is now one of the most popular specialty segments. In fact, in 2017, it already accounted for over 13.7% of the market share.

Before the pandemic happened, China had over 516,000 hotpot restaurants with an annual growth rate of 11.%.

Moving forward, I believe the hotpot industry will continue to grow, as hotpot is strongly ingrained in Chinese society. Hotpots are typically used during social gatherings, such as get-togethers with friends and family reunions, where everyone gathers around the table to eat and converse for hours.

The question now is whether Yihai can sustain its rapid growth. While the company is in a good position to profit from an increase in domestic spending, as Chinese consumers’ per capita income rises, Yihai’s growth may not be as strong as it has been in the past.

For starters, Haidilao accounts for a significant portion of Yihai’s revenue; as a result, Haidilao’s performance will directly impact Yihai’s bottom line. Yes, the hotpot sector will unlikely die out, but Haidilao takes pride in providing excellent services at a slightly higher cost. This strategy worked successfully in top tier cities like Beijing, due to the population’s higher standard of living. But once these places become saturated, Yihai will have to start penetrating lower-tier cities. This will prove to be a challenge due to consumers’ lower spending power and the fact that these areas are less populated. Haidilao has indeed attempted to expand to lower-tier cities but has received mixed results. As a result, Haidilao’s growth may soon decrease to match that of the country’s overall GDP.

Second, as stated in the company’s financial report, the condiment market has low entry barriers. Yihai’s only competitive edge is its status as Haidilao’s sole supplier. Yihai believes selling under the Haidilao brand gives them an advantage over competitors because Haidilao is a trusted and safe brand that provides high-quality food and a great customer experience. Do you think this makes a good moat? In my opinion, a products’ taste is the ultimate factor.

Valuation: is Yihai International cheap?

At its peak, the PE ratio was 128, which shows that Yihai stock was indeed overhyped since its price increased faster than its earnings. Its current PE ratio of 40.6 simply shows that Yihai’s share price has reverted to its means and is now fairly priced.

Even though its PE ratio is roughly the same as it was two years ago, we need to take note that its growth has slowed. After accounting for its growth rate of 11% (projected growth rate of the hotpot industry), Yihai’s PEG is at 3.69, which is high. As a comparison, Tesla’s current PEG ratio is 5.15.

Let’s say my assumption is wrong and Yihai will continue to grow faster than the industry average at 25% (its growth rate in the first half of 2020), its PEG is still high at 1.62.

Conclusion

Yihai has experienced a tremendous rise in the last five years, and I believe it will continue to do so. In light of the Chinese market’s pessimism, I believe Yihai is now reasonably priced. It could be a good investment if you believe the hotpot business (particularly Haidilao) will continue to thrive, especially as the Chinese government promotes consumption-led growth.

Personally, I am not a fan of Yihai’s stocks since I believe the company lacks a significant competitive advantage. In addition, I believe Yihai will no longer be able to grow as quickly as it once did and it has now far outpaced China’s general GDP growth.

P.S. looking to capitalise on China’s future growth? Read our Guide to investing in China Stocks.