Many people ask me, “Cheng, your portfolio is mainly made up of SaaS/Technology stocks, isn’t that risky and too concentrated?”. Well, I don’t think so. In fact, all market sectors use technology and it is impossible to find a sector that does not use it. Software technology is essential to our daily lives and more so for business operations. Technology helps businesses save money and time, and greatly increase their productivity and profits.

11 Stock Market Sectors to choose from

There are 11 different stock market sectors, according to the Global Industry Classification Standard (GICS). Because technology is so universal, you will find technology companies serving customers in all these sectors.

Below are some examples of technology companies in each sector.

1) Energy (Oil & Gas)

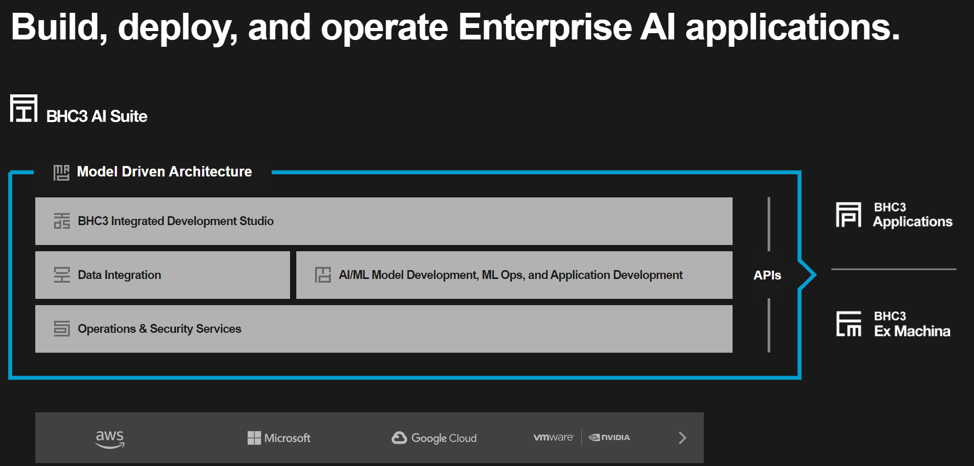

Baker Hughes (BKR) is an energy technology company that provides solutions to energy and industrial companies worldwide. Meanwhile, C3.ai (AI) is a leading AI software provider aimed at accelerating digital transformation. Both form a strategic alliance called BakerHughesC3.ai, whose goal is the digital transformation of the oil and gas industry.

2) Materials (Chemical)

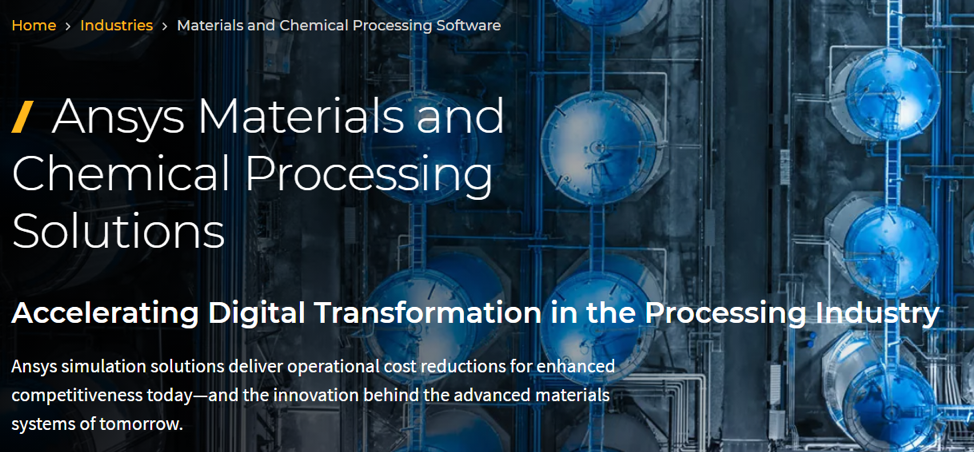

Ansys (ANSS) develops and markets engineering simulation software and offers its services and products worldwide. They have software solutions that serve almost every industry sector, including the Materials sector.

3) Industrials (Construction & Engineering)

Autodesk (ADSK) creates software for people who makes things. They are the global leader in design and provide software for engineering, architecture, manufacturing, construction, media, and entertainment industries.

4) Utilities

Oracle (ORCL) Utilities provides best-in-class solutions to improve the reliability, service, and safety of electricity, natural gas, and water utilities worldwide. The Utilities sector is only one part of Oracle’s customer base. The company also sells database software and technology across all sectors.

5) Healthcare

Teladoc Health (TDOC) is a global virtual healthcare provider that connects patients to doctors who can provide consultation and monitor their health through a virtual platform.

6) Financials

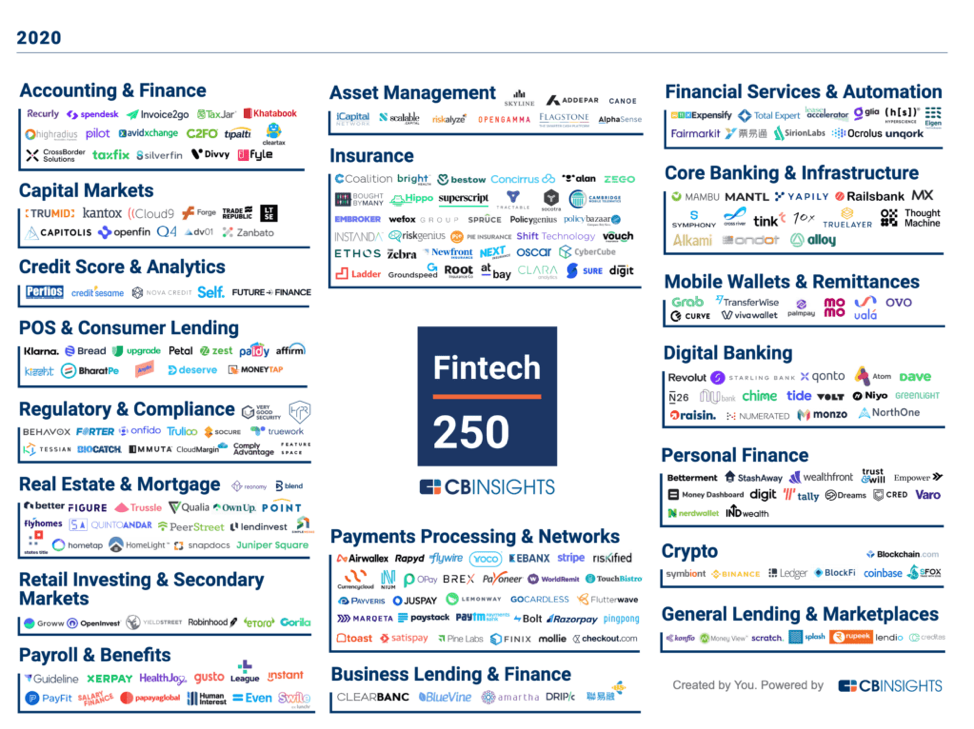

The financial services industry tends to attract innovative technology companies that transform how businesses and consumers spend, save, borrow and invest money. As you can see, there are plenty of financial companies to choose from.

An example is $UPST (Upstart Holdings), an AI lending platform for financial institutions.

7) Consumer Discretionary (Automobiles)

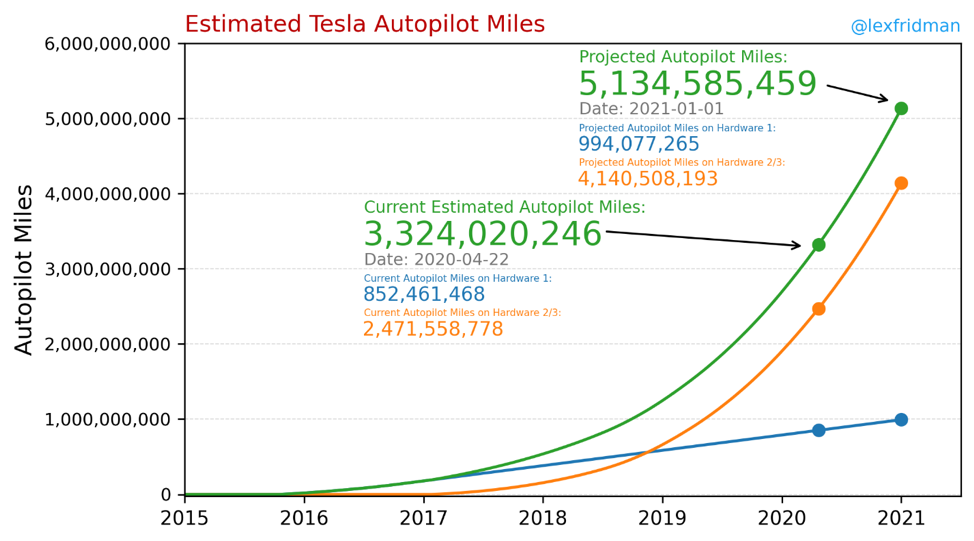

Tesla (TSLA) needs no introduction. They are well-known for designing, developing, manufacturing, and selling electric vehicles. They also offer energy generation and storage systems globally. Currently, they have billions of autopilot miles of driving data and they are considering licensing their autopilot software to other auto manufacturers, which can be another potential revenue stream for the company.

8) Consumer Staples (Food & Staples Retailing)

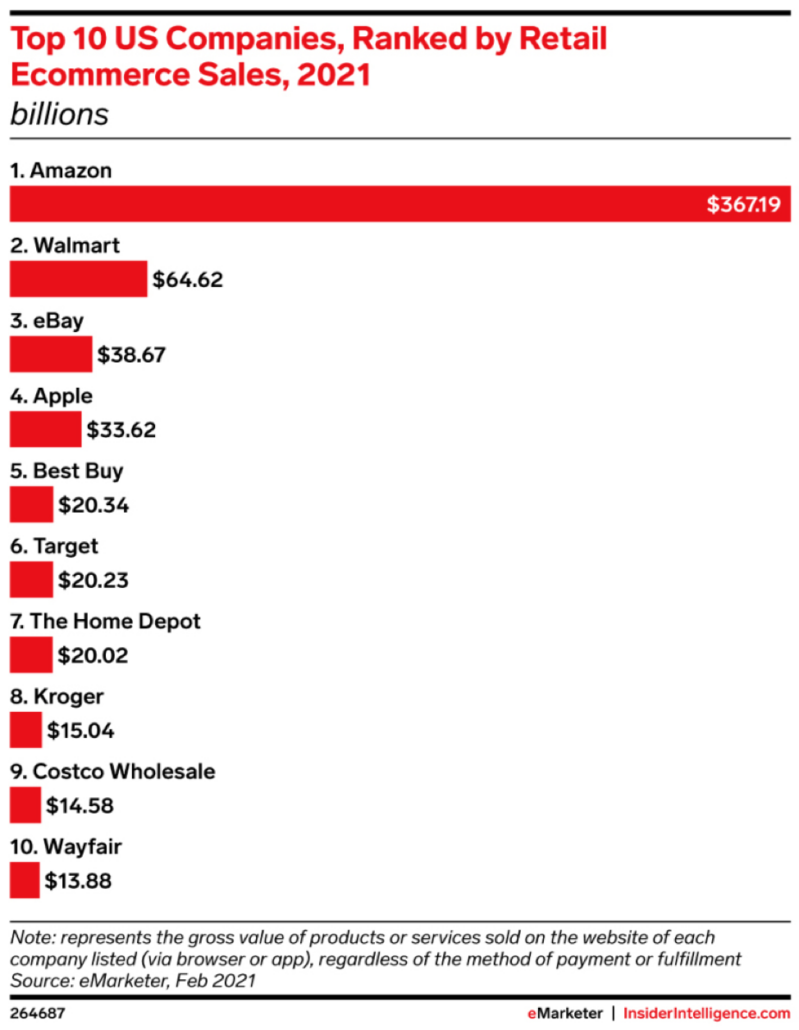

Amazon (AMZN) is another company that needs no introduction. They are a global multinational company and have business segments in eCommerce, digital devices and streaming, as well as cloud computing. Amazon is currently the eCommerce leader in the US.

9) Information Technology (Software & Services)

These companies offer Software-as-a-Service (SaaS) to their customers, allowing them to enjoy recurring revenues from customers who either pay monthly or yearly for their services.

The reason why I like SaaS businesses is that it is Subscription-as-a-Service (SaaS), which gives these businesses more predictability when it comes to their future revenue streams.

10) Communication Services

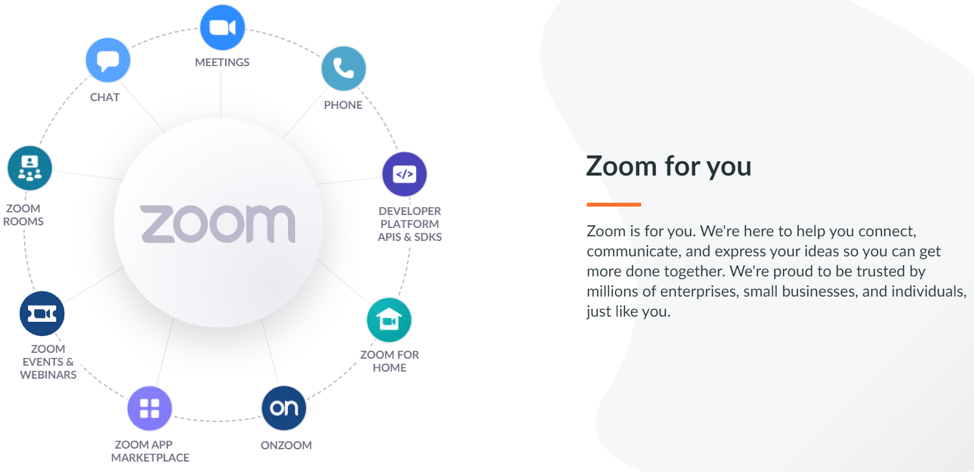

Zoom Video Communications (ZM) provides a video-first communications platform to connect users globally. They offer video conferencing services, mass virtual events hosting and cloud phone system, and cloud contact center platform for enterprises.

11) Real Estate

Zillow (Z) is the leading real estate website in the US. Millions of people now sell, buy, rent, and finance their properties through Zillow.

Conclusion

In conclusion, software and technology providers are prevalent across all industry sectors.

The best companies usually have customers across all industries so that when one sector is affected, it will not significantly affect the company’s revenue base. Hence, these software companies are more resilient to industry shocks and downturns.

Additionally, they are more resilient to recession because software is mission-critical to their client’s business operations. For instance, no company in their right mind would decide to stop their software payments system or their cybersecurity if they would like to cut costs. This is the reason software and technology companies make up a huge portion of my portfolio.

Moreover, compared to traditional revenue-generating companies, most software companies have a recurring revenue-generating model. Traditional companies have to start from zero revenues every year for their products and services; in contrast, SaaS companies start at a high revenue base. This is because if customers continue to enjoy using the SaaS company’s software, they will renew their subscription to these services yearly.

Thus, I believe SaaS businesses are safer and more predictable compared to other businesses.

However, I am picky when it comes to SaaS businesses for my portfolio, I only want those with hypergrowth potential. Join me to learn how I pick such stocks.