Recently, there’s been a surge of discount brokers entering the Singapore market.

We have seen something similar happened before in the music and book industries. Let me refresh your memory.

#1 – Music

My first exposure to pop music was through radio and cassette tapes. Not sure how many of you can relate to the latter.

Soon, music albums were sold in compact discs (CDs) which offer higher audio fidelity. Remember those portable CD players – Discman, anybody?

Stores like Popular’s CD-Rama, Sembawang Music, Gramophone, HMV and Tower Records were a staple at shopping malls. They were key distribution nodes for the sale of music records, fans patronise these stores and monetarily support their idols mostly through the sales of CDs.

Then iTunes came along.

It disrupted the original distribution system which had 2 major flaws;

- Cost ineffectiveness: Music albums are often a bundle of chart-topping hit songs with several other mediocre ones. You had to buy the entire album even if you loved just one song from it. It isn’t cost effective.

- Piracy: Digitalisation of music (CDs) resulted in piracy. Songs were shared illegally and downloaded in the mp3 format.

iTunes saw the opportunity to solve both issues. It un-bundled the music album, allowing consumers to buy specific songs that they want at just $1.99 each. This allowed the masses to personalise their music and capture value for the music industry. These were delivered as encrypted files that were relatively more difficult to share.

Not to forget the cool iPod that you can slip into your pocket and “bring all the songs you love wherever you go”. iTunes enhanced the value proposition of the iPod and vertical integration has always been Apple’s strategy.

iTunes was launched in 2001 but users in Singapore were not allowed to buy music through it until 11 years later. iTunes was only made available to Singapore and 11 other Asian countries in 2012.

I believe Apple was trying to solve the licensing issue, which is usually defined by geographic boundaries. Record companies could have been able to generate more revenue by selling the entire albums in the stores, hence they may not grant iTunes the rights to sell in Asia.

It could also have been a case of government’s protectionism of the home-grown companies. Allowing these disruptive businesses to offer the services could result in the death of local enterprises and loss of jobs – especially when such services are provided over the internet.

The downfall of the CD stores came pretty quickly.

I don’t think it is solely an effort by iTunes but also the rife piracy that killed the stores.

Today, these stores live only in our memories.

CD Shops -> iTunes -> Spotify

Just as we thought that dust had settled, subscription-based music streaming services (think Spotify) entered the scene aggressively and swiftly unseated pay-per-song services to become the dominant business model.

Thanks to music streaming, the industry finally cracked down on the piracy problem.

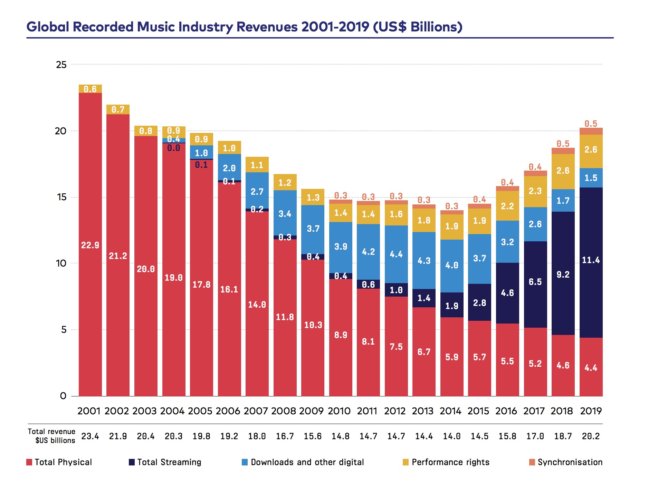

The industry experienced a revenue increase from 2015 onwards, after suffering declining revenue over the preceding years.

#2 – Books

Printed books are now facing threats from digitisation – ebooks.

Amazon ventured into the book business and became the largest book retailer in the world. In 2007, Amazon started to offer ebooks via its flagship ebook reader, Kindle. It took just 3 years for Amazon to sell more ebooks than print.

Similar to the music industry, Amazon was not allowed to sell Kindle and its associated ebooks to Singapore because of licensing issues.

It was only when Amazon.sg was set up in 2019, that Kindle was officially permitted for sale in Singapore. Previously, fanatic Kindle supporters had to find creative ways to circumvent the restrictions. Now, anyone in Singapore can purchase a Kindle within a few clicks.

The statistics for book sales are not as comprehensive as other industries.

Conclusions remain mixed. For example, auditing firm PricewaterhouseCoopers PwC, reported that ebooks outsold print and audiobooks in 2017:

But there were conflicting reports that suggest print is experiencing a resurgence, and ebook sales had actually declined in 2018, 2019 and 2020.

I guess printed books still have their supporters whereas CDs were really passé.

This could be the reason why we still have physical bookstores around – Kinokuniya, Times, MPH and Popular (maybe surviving more on assessment books).

I used to prefer printed books but I have shifted to the ebook camp several years ago. Ebooks presented two clear advantages for me:

- saves space

- easier and faster to take and save notes

At least three major book stores have exited the Singapore book scene – PageOne (my favourite), Borders (my second favourite) and Harris.

#3 – Stock brokers…?

Interactive Brokers (IB) opened its Singapore office last month. Prior to that, I already have an account with them because of their cheap commissions and the wide array of products they offered.

Lately, I have seen many investors showing the screenshots of IB accounts on the social media. It really seem to have gained popularity.

Tiger Brokers is also new to Singapore. It is operated by a China-based company listed in NASDAQ, and IB has a stake in it.

For the longest time, local brokers have kept the commissions to about 0.28% or a S$25+++ minimum for Singapore-listed stocks. One would need to invest at least $2,800 to make the commission worthwhile (~1% of the investment).

One classic example is the ongoing Sembcorp Marine rights that are trading at $0.001. It is not worth it for anyone with less than 28,000 rights to sell them, simply because of the commission. Investors are stuck with these renounceable rights for no good reason.

The minimum commission also discourages younger investors from investing in stocks, as they often do not want to risk a big amount in something new to them.

Both IB and Tiger offers very low commissions in comparison to the local brokers. IB charges 0.08% and minimum S$2.50 for Singapore stocks. And now Tiger charges just 0.08% with no minimum!

This is 3.5 times cheaper than what local brokers are offering.

I understand that there’re costs to be bore by the brokerage – administrative, technological, compliance, sales and probably more.

IMO, their major cost is their commissions for remisiers. Remisiers play a crucial role in generating sales for brokerage firms. They are essentially the sales force and need to be rewarded well, so that they can get more clients to trade.

In contrast, discount brokers like IB and Tiger do not rely on remisiers at all. Their lean organisation setup allows them save on a lot of sales commission and manpower costs.

Remisiers are worth paying for if you need the personal touch or if they are value adding to your investments. However, if you speak to enough investors, you’ll notice that this is not the case – most would say their remisiers are invisible.

This is as good as having no remisiers at all. The discount brokers have managed to capitalised on this phenomenon, by passing on the savings to their customers.

We learned that CD stores and book stores had to close because their business models could no longer keep up with the new economics and consumer preferences.

I think this might just be the start of the decline of our local brokerage firms.

I have absolutely no idea what “my” remisier actually does, apart from costing me money.

The costs of dealing (which include the IMO large tick spread for stocks under SGD 1) certainly reduce the number of trades I make. It is not just the lower value trades. For example dealing in the US through Schwab will cost USD 0.0%.

https://www.schwab.com/pricing-page

When I trade online SGX I pay 0.3% buy and then another 0.3% sell. Each trade incurs at least 0.6% costs. I don’t comprehend why this should even be a % of the trade value. It doesn’t cost the broker a cent more to put SGD 1,000,000 through an online deal than an SGD 2,000 deal.

SGX is, IMO, a decent place to buy and hold for income with REITS and a couple of other higher yield companies. Otherwise it is, as your graph shows, so utterly meeeeeh.