The stock market has been prospering but not every industry is booming.

Covid-19 has given tech companies a boost. If you examined closely, tech stocks are the ones that have recovered and even prospered since the pandemic happened.

It is easy to understand why – we have to distance ourselves physically. Hence, we turn to the use of technology to communicate.

The rise in the share prices of tech stocks are backed by real increase in their revenue and profits. Whether investors are over extending their optimism is a question I ask myself too.

On the other hand, you may conclude that the stock market is not doing well at all, if you look at the conventional industries such as oil & gas, finance and hospitality.

Hence, we have to be mindful not to assume all stocks did well, just because the indices did well. It has been pretty divisive – tech vs the rest.

Robin shared his views about two stocks last week;

- Alibaba, a beneficiary of Covid-19 and

- Sembcorp Industries, a victim of low oil prices in recent years.

It can’t be more contrasting about that.

Alibaba to gain from Ant Financial IPO

We previously covered about Ant Financial being the most succesful fintech in the world. It is nearing a record-breaking IPO as we speak – US$225 billon valuation, raising US$30 billion in both Hong Kong and Shanghai stock markets.

Robin opined that it would be very difficult to subscribe to Ant’s IPO because of the overwhelming response.

A better play is to buy Alibaba. Alibaba has a 33% stake in Ant Financial, a spin-off like this could unlock the value for Alibaba.

Robin noted that Alibaba’s share price has gapped up on two occasions since the IPO news was official. He believes the uptrend would continue and that holding on to Alibaba shares would see greater upside.

So far his call has been right as the share price rose to $286 (at the time of writing) from the time he posted the chart below (price was around $265).

He believes that Alibaba has the potential to hit $290.

Sembcorp Industries and Sembcorp Marine – overly depressed share prices about to rebound

Sembcorp Marine share price was almost $4 during its peak but today, it is a shadow of its former self.

Just when shareholders thought that the share price cannot go any lower, their rights issue sank it to $0.20, even lower than the 2008 financial crisis trading price of $0.79.

Oil and gas has not recovered and there’s no end in sight. No one can tell if companies like Sembcorp Marine will ever regain some, if not all, of its previous glory.

Even its parent company, Sembcorp Ind, decided to ditch Sembcorp Marine through a demerger.

However, Robin sees this as a good trading opportunity because the share prices for both Sembcorp Ind and Sembcorp Marine are very depressed – shareholders do not want to put more money to subscribe to Sembcorp Marine rights.

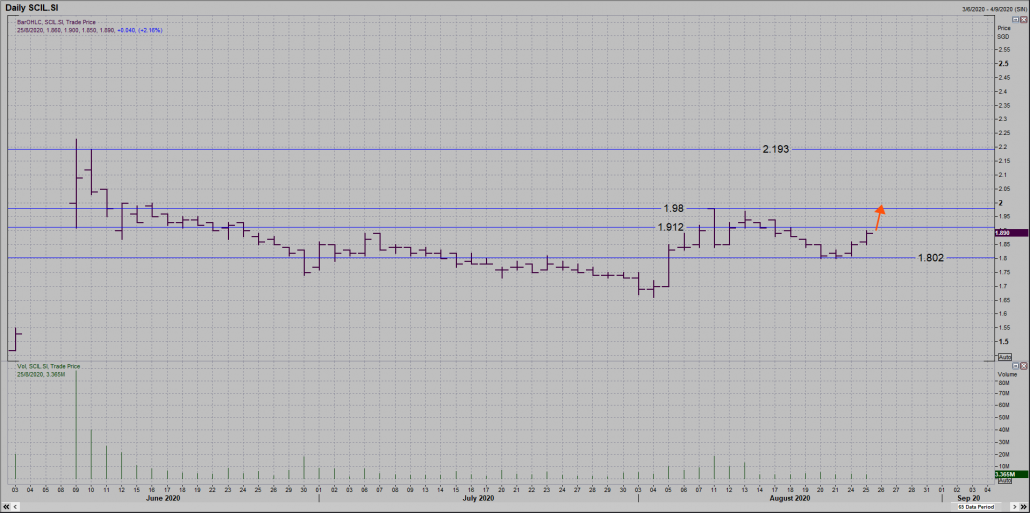

He expects a rebound by Sembcorp Ind, with the immediate price objectives being $1.91 and $1.98 (it is hovering at ~$1.87 at the time of writing). Robin thinks it could rise further to $2.19, if the previous two levels are surpassed.

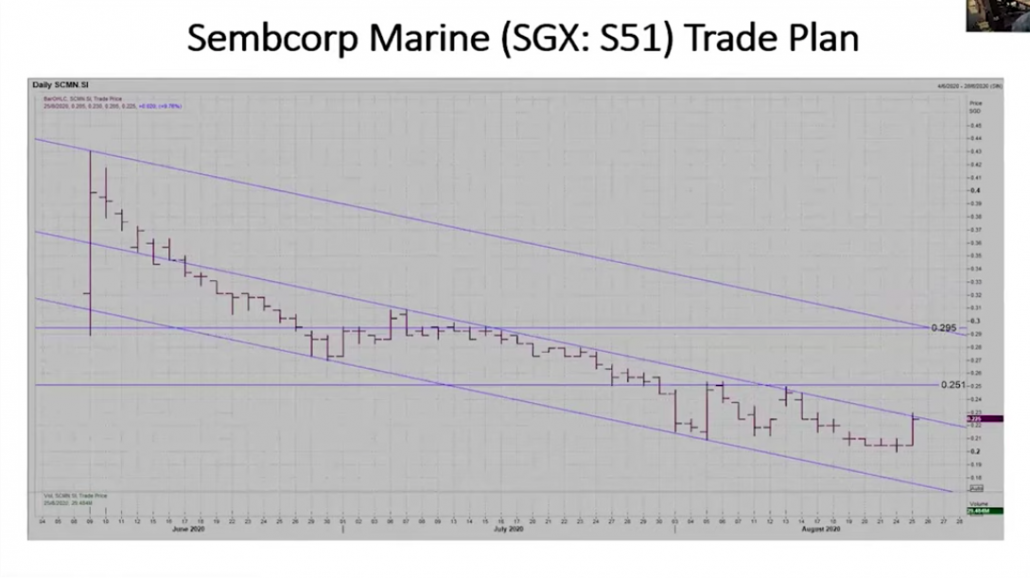

As for Sembcorp Marine, Robin believes that if the share price can break $0.225, it could go up to $0.25. The most optimistic price target would be $0.29, but Robin hardly think that’s possible given the selling pressure.

Tech stocks are hot but every dog will have its day

Currently, tech stocks are the ones lifting the index returns.

Alibaba is capitalising on the positive sentiments to list Ant Financial for a record-breaking valuation. If not now, when? Definitely not when the market goes into a bear run.

That said, most other sectors are in the doldrums. One of them is definitely the oil & gas sector.

Sembcorp Marine is undergoing a rights issue and its parent, Sembcorp Ind, is ditching it via a demerger. Every dog has its day and Robin thinks there could be some short term rebounds as he felt most investors were too pessimistic about it.