Stock index performances can be misleading because of the power law – a small proportion of the stocks determine majority of the index performance.

Our brains are not good at deciphering non-linear math and would easily assume that a stock was up 5% on average when an index was up by 5%. This is very far from reality.

The first power law effect we see is that, the largest 500 out of 4,000 stocks represent 80% of the U.S. stock market capitalisation.

The second observable power law is that, just 5 stocks in S&P 500 took up ~20% of the index weight (~4% each), while 495 stocks share the remaining 79% (~0.16% each).

The S&P 500 index is down -13% year-to-date (as of 6 May 2022) but it isn’t indicative of how the 500 component stocks have performed. Even at the sector level, you can see a large disparity between IT (lost 19%) and energy (gained 49%). It might also be interesting to note that in the current market rotation, winning sectors from 2 years ago are now the key losers.

The devils are in the details.

I dived deeper into the S&P 500 sectors and identified the top 5 and bottom 5 performers. There were more diverse stock performances among them. This list should give you a better sense how the overall stock market has been doing year-to-date than merely a S&P 500 index.

Top 5 Gainers and Losers in Each of the 10 S&P 500 Sectors

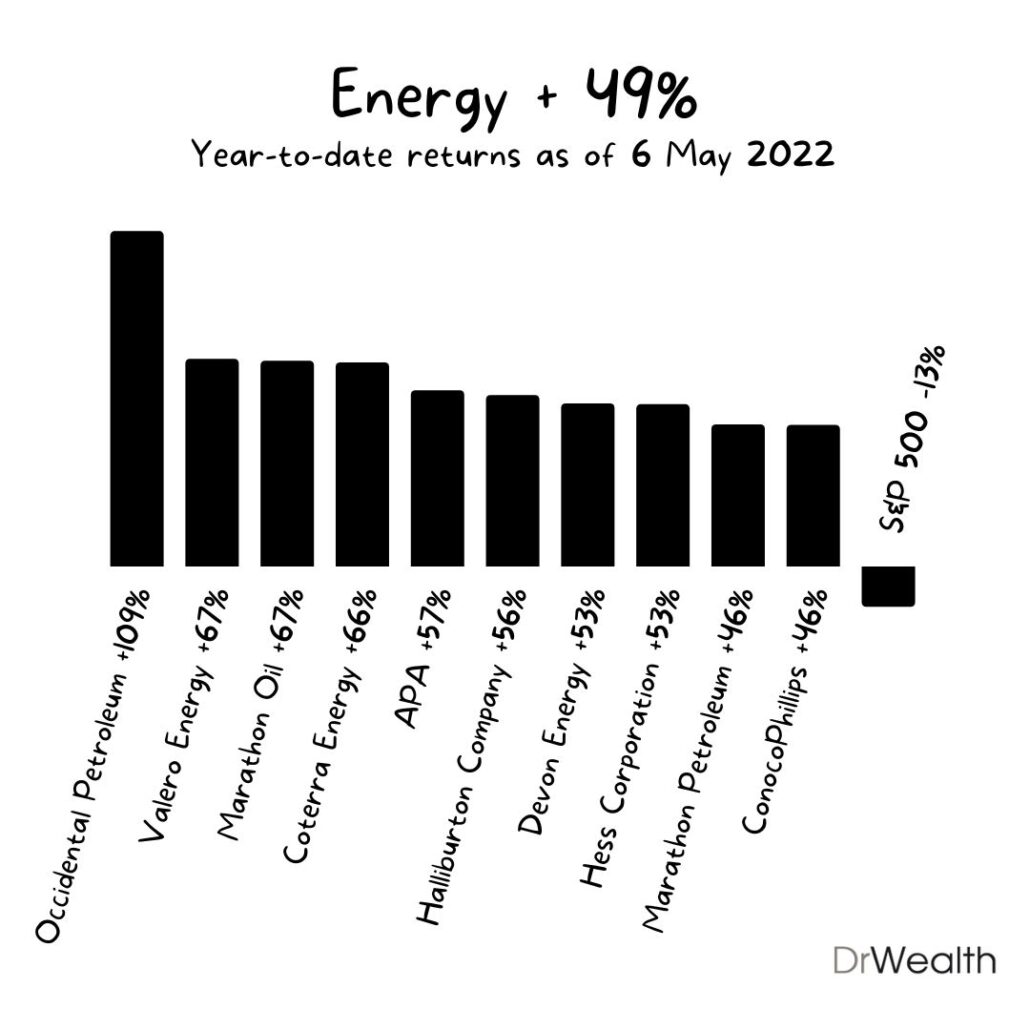

1) Energy +49% YTD

There were no losers in this sector year-to-date.

The top 5 gainers were Occidental Petroleum, Valero Energy, Marathon Oil, Coterra Energy and APA Corp. They are all in the oil & gas exploration business.

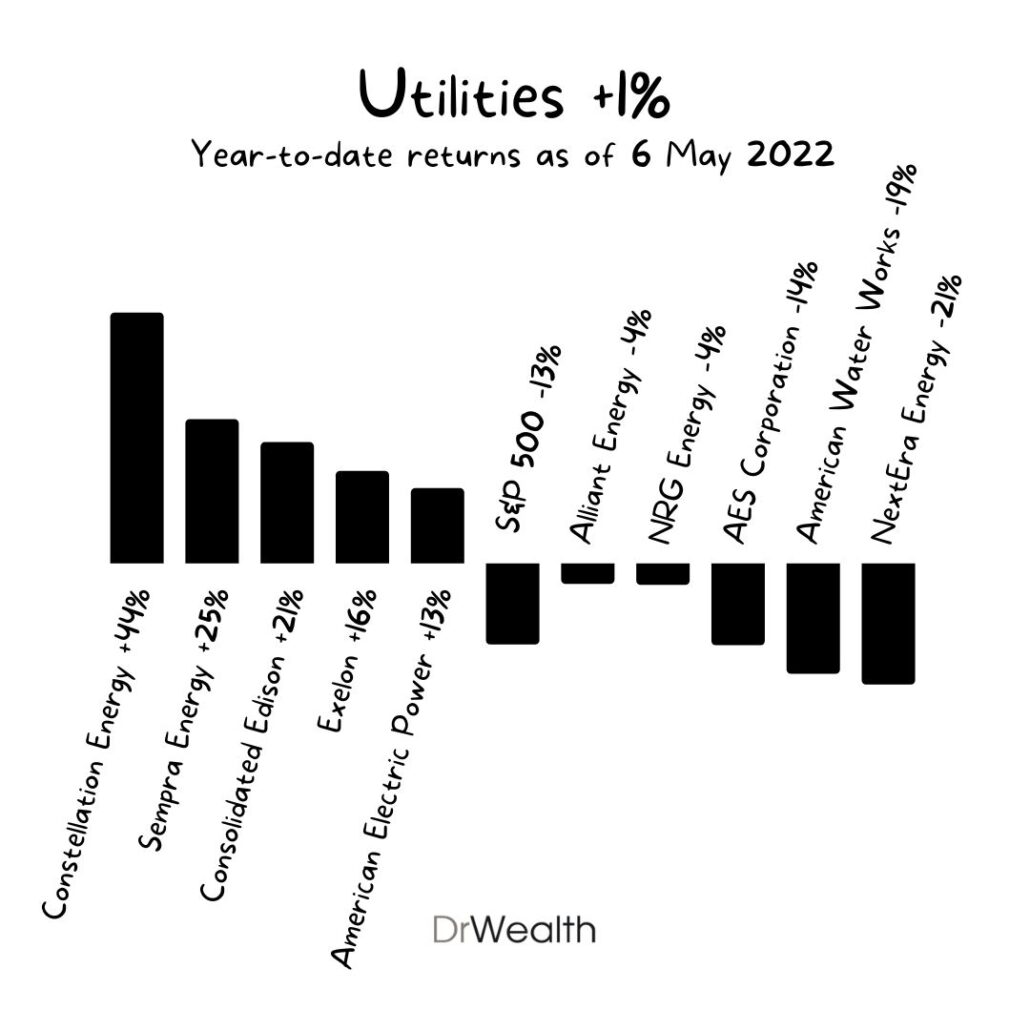

2) Utilities +1% YTD

There were 22 gainers and 7 losers in this sector.

Top five gainers were Constellation Energy (electricity and natural gas utility), Sempra Energy (electricity and natural gas utility), Consolidated Edison (electric, gas and steam utility), Exelon Corporation (energy) and American Electric Power Company (electricity utility).

The top 5 losers were NextEra Energy (electric power), American Water Works Company , AES Corp (electric power), American Water Works Company (water), NRG Energy Inc. (electric utility) and Alliant Energy Corp ( (electricity and natural gas utility).

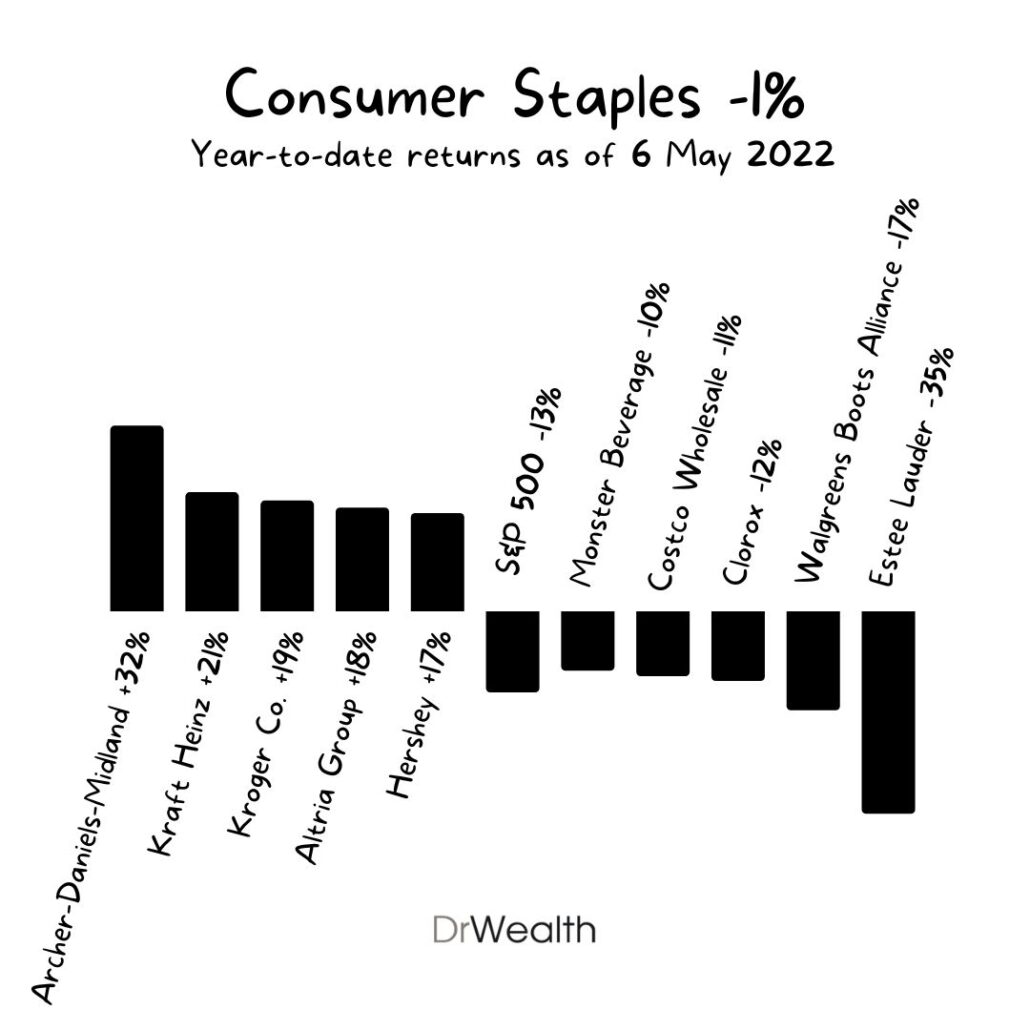

3) Consumer Staples -1% YTD

There were 18 gainers and 14 losers in this sector.

The top 5 gainers were Archer-Daniels-Midland (commodities), Kraft Heinz (food brands), Kroger (supermarkets), Altria Group (tobacco) and Hershey (food brands).

The top 5 losers were Estee Lauder (beauty), Walgreens (pharmacy), Costco (wholesale supermarts), Clorox (cleaning products), and Monster Beverage (beverages).

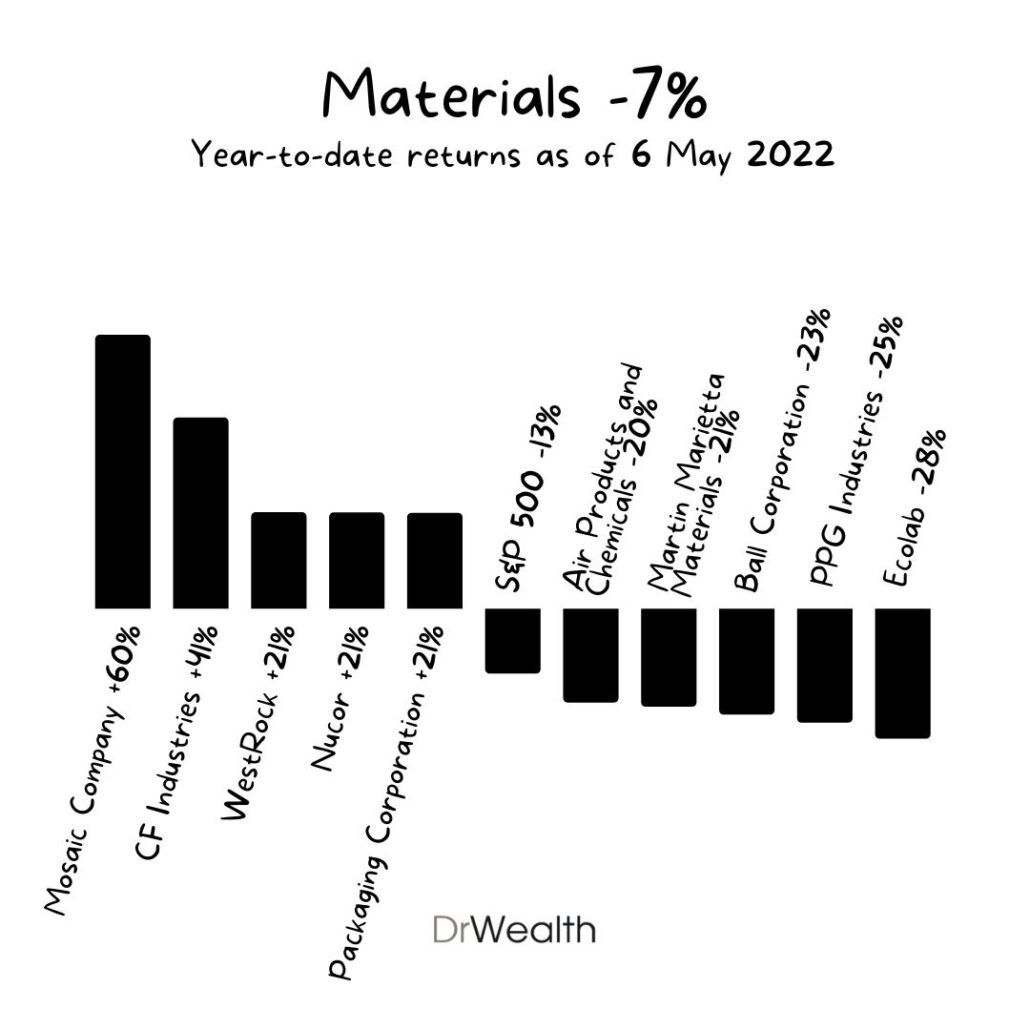

4) Materials -7% YTD

There were 13 gainers and 15 losers in this sector.

The 5 gainers were Mosaic Co (phosphates and potash mining), CF Industries (fertilizers), WestRock (corrugated packaging), Nucor (steel) and Packaging Corporation (paper).

The top 5 losers were Ecolab (water, hygiene and energy technologies), Martin Marietta Materials (building materials), Ball Corporation (glass), PPG Industries (paints) and Air Products (gases and chemicals).

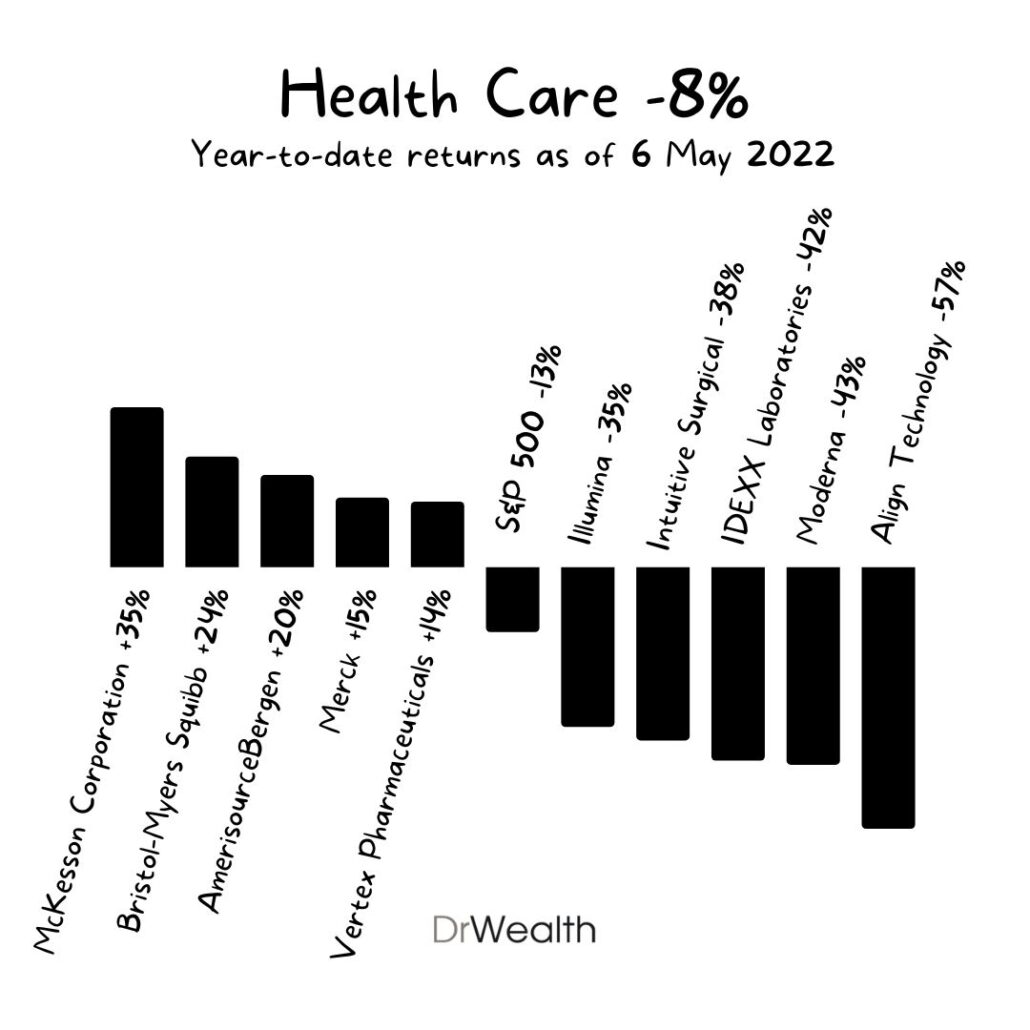

5) Health Care -8% YTD

There were 19 gainers and 46 losers in this sector.

The top 5 gainers were McKesson Corporation, Bristol-Myers Squibb, AmerisourceBergen, Merck and Vertex Pharmaceuticals. They are all pharmaceutical companies.

The top 5 losers were Align Technology (medical devices), Moderna (pharmaceutical), IDEXX Laboratories (veterinary diagnostics), Intuitive Surgical (robotic surgical systems), and Illumina (analysis).

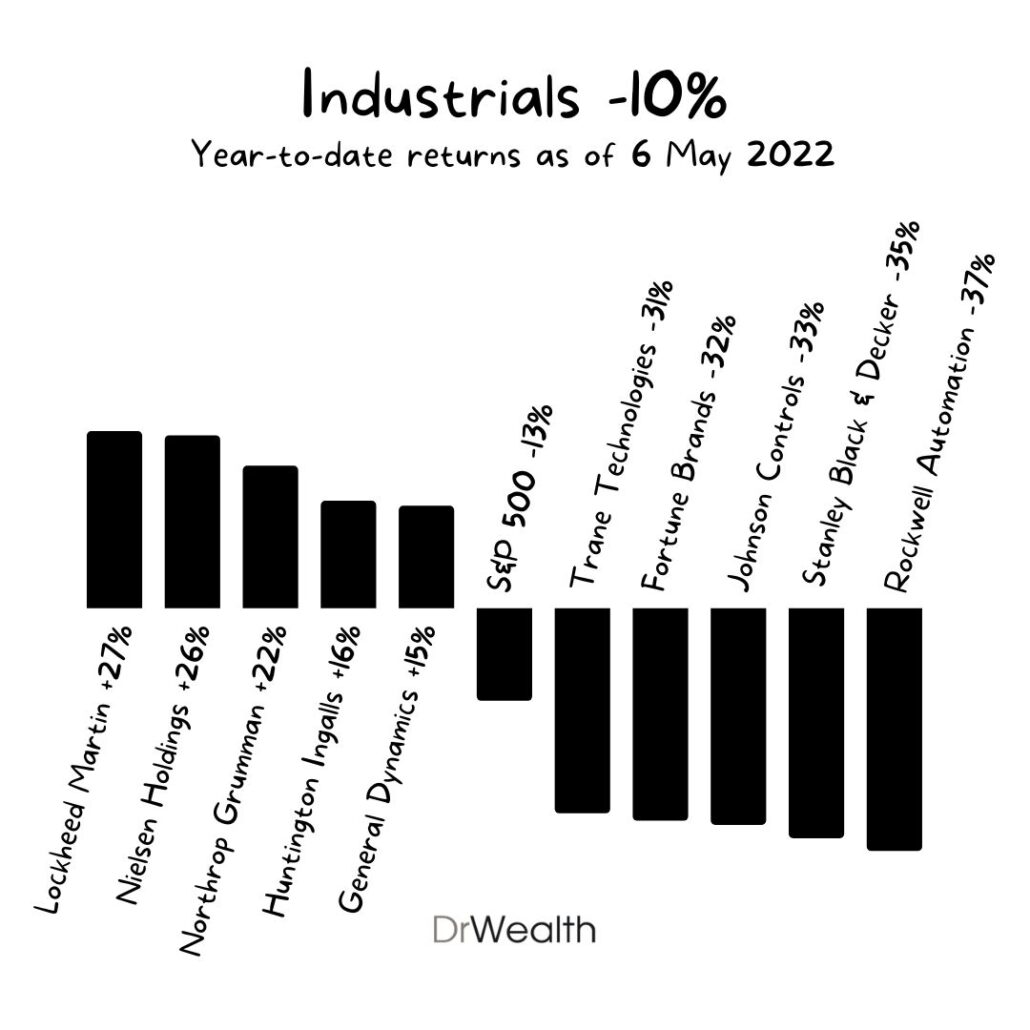

6) Industrials -10% YTD

There were 17 gainers and 54 losers in this sector.

The top 5 gainers were Lockheed Martin (aircraft components), Nielsen Holdings (media analytics), Northrop Grumman (aerospace), Huntington Ingalls (shipbuilding) and General Dynamics (aerospace).

The top 5 losers were Rockwell (automation), Stanley Black and Decker (tools), Johnson Controls (automation), Fortune Brands (home security) and Trane Technologies (industrial manufacturing).

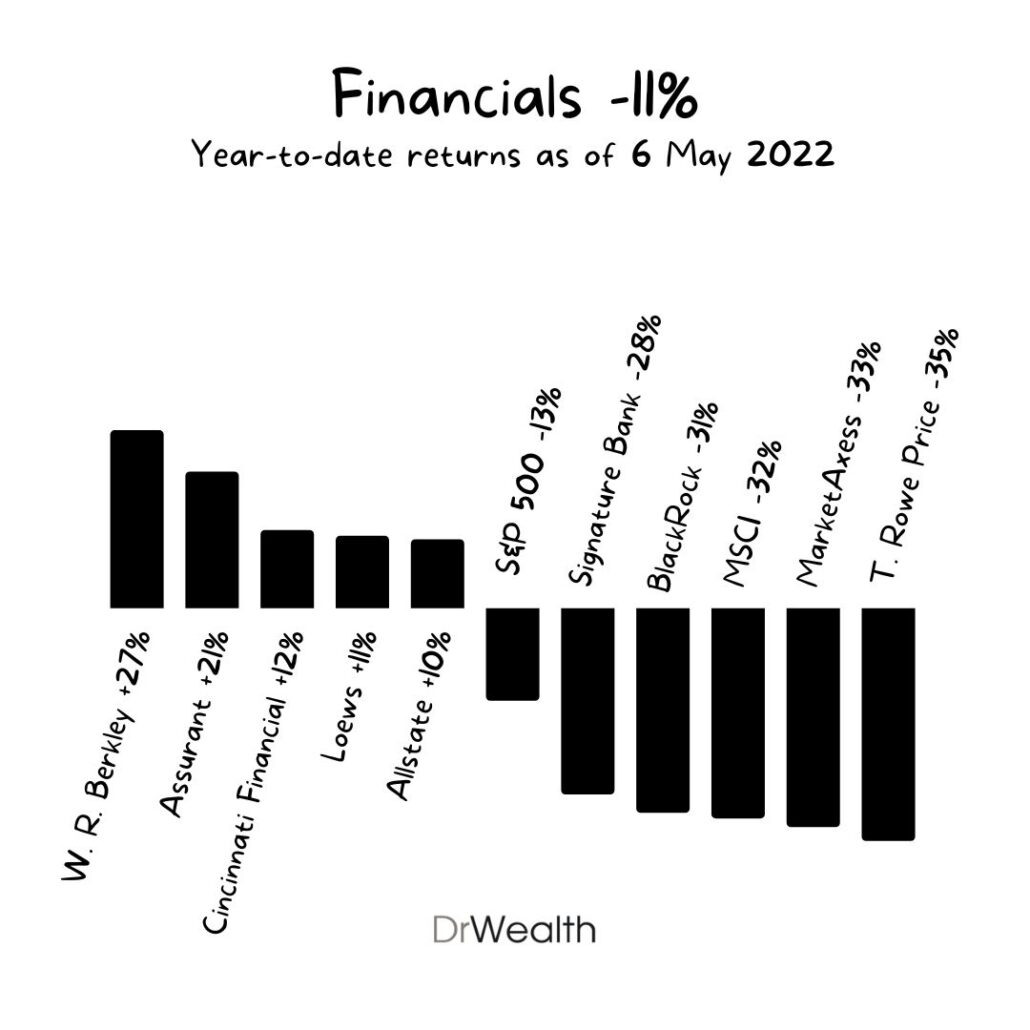

7) Financials -11% YTD

There were 15 gainers and 51 losers in this sector.

The top 5 gainers were W.R. Berkley, Assurant, Cincinnati Financial, Loews Corporation and Allstate corporation. They are all in the insurance industry.

The top 5 losers were Signature Bank (commercial bank), BlackRock (investment management), MSCI (indexes), MarketAxess (fintech), T. Rowe Price (investment management).

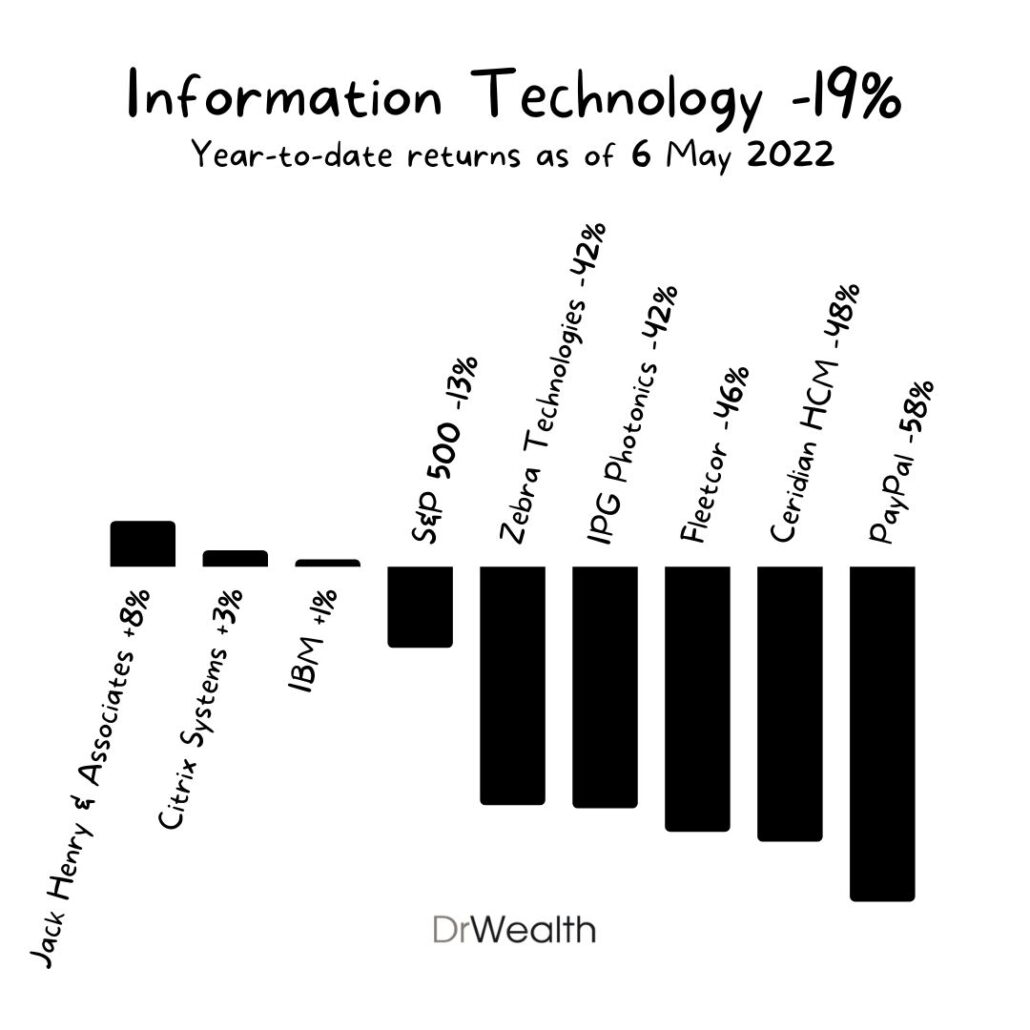

8) Information Technology -19% YTD

There were 3 gainers and 73 losers in this sector.

Top three gainers were Jack Henry & Associate (payment services), Citrix Systems (cloud computing) and IBM.

Top 5 losers were Paypal (payments), Ceridian HCM (HR management), Fleetcor (accounting software), and IPG Photonics (fibre lasers) and Zebra Technologies (mobile computing).

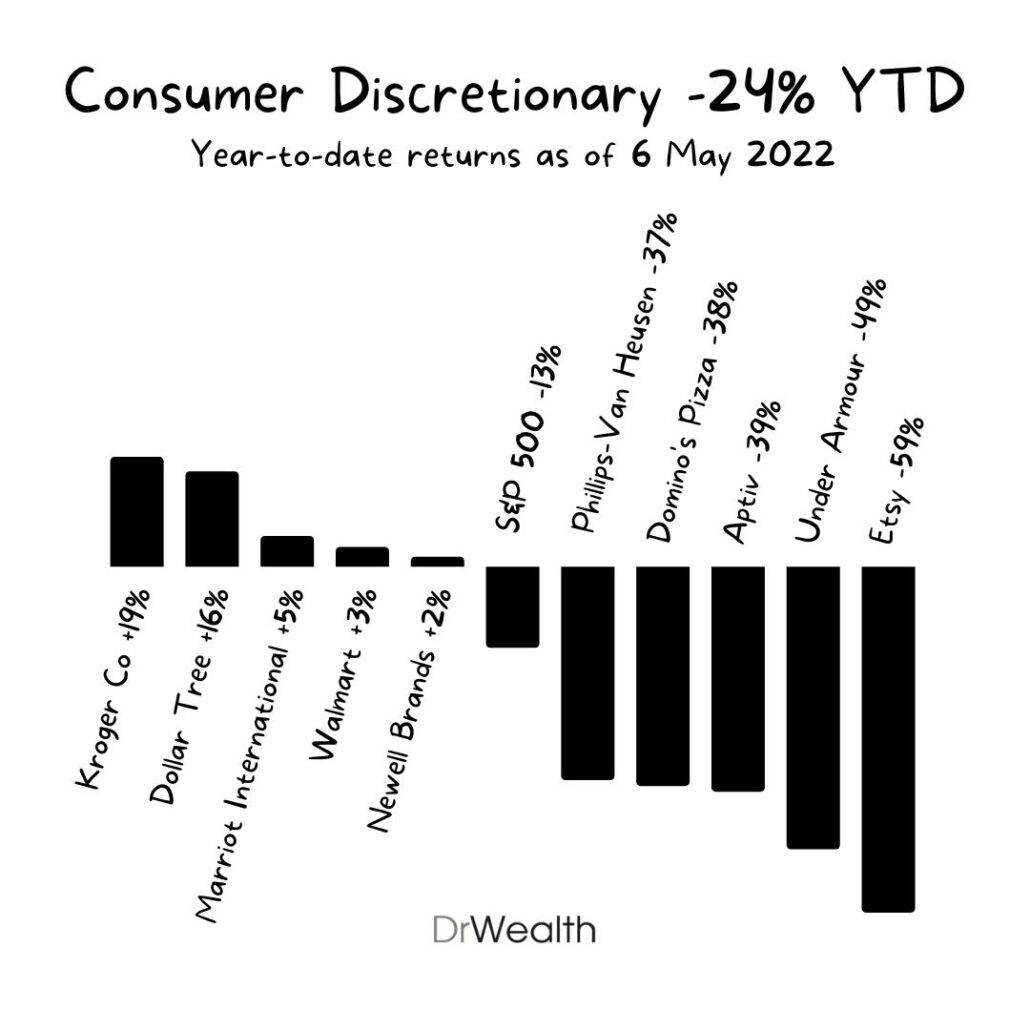

9) Consumer Discretionary -24% YTD

There were 5 gainers and 52 losers in this sector.

The top 5 gainers were Kroger Co (supermarkets), Dollar Tree (discount stores), Marriott (hotels), Walmart (wholesale and supermarkets) and Newell Brands (commercial products).

The top 5 losers were Etsy (e-commerce), Under Armour (sports wear), Aptiv (vehicle components), Domino’s Pizza (food and beverage) and Phillips-Van Heusen (apparel).

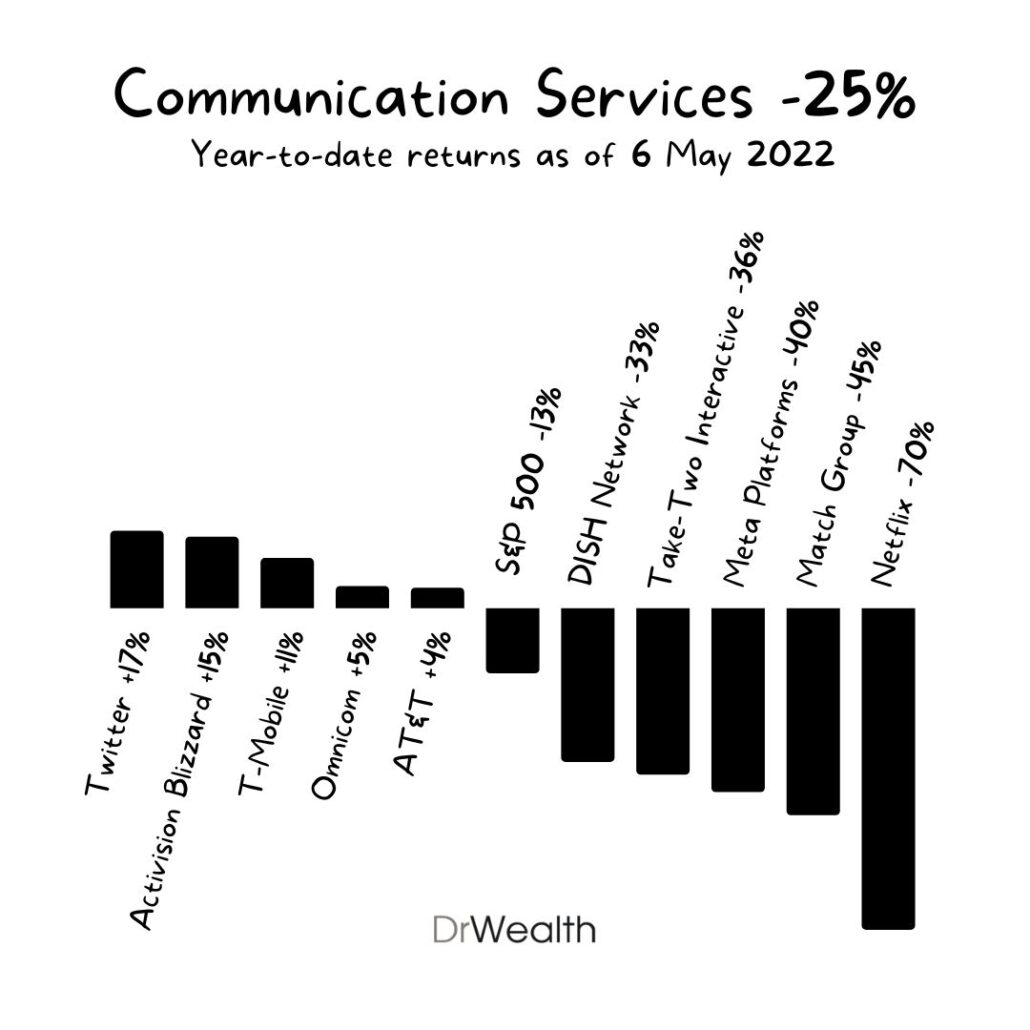

10) Communication Services -25% YTD

There were 5 gainers and 21 losers in this sector.

The top 5 gainers were Twitter (social network), Activision Blizzard (video games), T-Mobile US (mobile telecommunications), Omnicom (marketing communications) and AT&T (mobile telecommunications).

The top 5 losers were Netflix (video streaming), Match Group (online dating), Meta Platforms (social networks), Take-Two Interactive (video games) and Dish Network (broadcast).

Index Does Not Tell You The Average Return of Stocks

The performances of the index component stocks varied widely and a stock index does not do a good job in indicating the average return of its components.

This is due to the skewed weightage towards a handful of stocks. Hence, we have to break it down to their sectors and identify the top and bottom performers to get a better sense of how the stocks are doing.

I use the QMT strategy to spot sectors with strong momentum despite general market sentiments. Join me at my upcoming webinar where I’ll share how you can use the same strategy to spot opportunities in today’s markets.

thanks for the article! very informative. where do I check for the constituents of the index/sectors? S&P itself doesn’t seem to reveal this information on the site.

This should work https://www.barchart.com/stocks/indices/sp/sp500