Results announcement has typically been viewed as a gamble as there are many data points such as the actual earnings, key metrics and forecasts, and while we may have a general idea from data points such as analyst consensus or other market data, we do not actually know what the actual data will be. If any single one of these three data points turn out to be unfavourable, the market may take it as an opportunity to dump the stock.

In this table, we have identified 8 stocks that have taken a more than 20% hit after earnings and will dive into the reasons why.

Surprise! Surprise! Many stocks such as stocks like Peloton, Novavax and Amazon didn’t make the cut as they fell more than 10% but less than 20%.

8 US stocks that crashed >20% after releasing results

| Company | Sector | Drawdown |

| Upstart Holdings Inc (NASDAQ:UPST) | Financial | -56% |

| Unity Software Inc (NYSE:U) | Technology | -29% |

| Palantir Technologies Inc (NYSE:PLTR) | Technology | -21% |

| Netflix Inc (NASDAQ:NFLX) | Communication services | -35% |

| Lyft Inc (NASDAQ:LYFT) | Technology | -30% |

| Teladoc Health Inc (NYSE:TDOC) | Healthcare | -40% |

| Coinbase Global Inc (NASDAQ:COIN) | Technology | -26% |

| Under Armour Inc (NYSE:UAA) | Consumer discretionary | -26% |

1) Upstart Holdings Inc (NASDAQ:UPST)

We start the article rolling with one of the biggest post earnings drawdown ever, with Upstart which plunged 56%, even more than Teladoc which we will talk about later in the article.

Upstart delivered its seventh consecutive profitable quarter and fourth straight quarter with triple-digit year-on-year revenue growth but guided that the year is shaping up to be a challenging one.

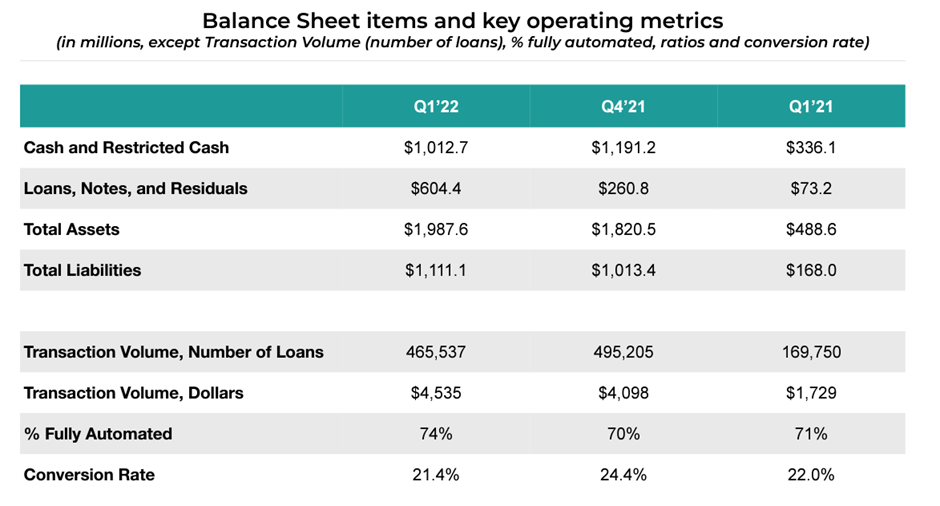

Total fee revenue was $314 million, an increase of 170% YoY. Bank partners originated 465,537 loans, totaling $4.5 billion, across its platform in the first quarter, up 174% YoY. Conversion on rate requests was 21% in 1Q22, down from 22% YoY.

GAAP net income was $32.7 million, up YoY from $10.1 million. Adjusted EBITDA was $62.6 million, up YoY from $21.0 million. 1Q22 adjusted EBITDA margin was 20%, up from 17% in 1Q21.

Key operating metrics such as number of loans and conversion rates also declined from the previous quarter.

Its financial outlook for 2Q22 was terrible as it guided for a revenue of $295 to $305 million, a QoQ decline. Similarly, net income is expected to decline to a range of a loss of $4 million to breakeven.

Full year 2022 revenue forecast was revised downwards from its first guidance of $1.4 billion during FY21’s results announcement to S$ 1.25 billion. Adjusted EBITDA was revised down from 17% to 15% which is lower even than 1Q21’s 17%, FY21’s 27% and just a tad higher than FY20’s 13%.

2) Unity Software Inc (NYSE:U)

Unity’s stock price fell 29% in after-hours trading after the company reported earnings that met analyst expectations but fell short on the outlook.

Unity reported a loss of 8 cents a share (adjusted) on sales of $320.1 million which was up 36% YoY. These numbers met expectations on the loss and fell slightly short on sales. But Unity said that second-quarter sales would be $290 million to $295 million, well below estimates for $360.97 million and a QoQ decline.

The company also lowered its full-year revenue guidance to $1.35 billion to $1.425 billion, down from its earlier estimate of $1.485 billion to $1.50 billion. With the lowered revenue guidance, Unity also guided for a widened loss position of -$60m to -$75m or -4% to -6% which is poorer than its 2021 performance.

3) Palantir Technologies Inc (NYSE:PLTR)

Palantir missed profits estimates and provided an outlook that fell short of expectations although the company said that it saw a wide range of potential upside.

Total revenue grew 31% YoY to $446m, mainly due to its commercial revenue segment which grew 54% YoY of which its US commercial subsegment did exceptionally well with a 136% growth. However, government revenues slowed significantly to a 16% YoY growth. Adjusted operating margins was 26% and overall customer count increased 86% YoY.

Palantir is guiding to a base case of $470M in Q2 revenue, a measly 5.4% QoQ growth, with a wide range of potential upside above its base case driven by its role in responding to developing geological events. However, Palantir’s Chief Operating Officer Shyam Sankar said the Ukraine war had no incremental impact on its 1Q22 results, although the company has been working and investing in anticipation of contract awards from governments and expects marginal impact in the second quarter and more growth beyond that.

Palantir also guided for 2Q22 and FY22 adjusted operating margin of 20% and 27% respectively which implies that 2Q22’s lower guided margin is a blip rather than a norm. Palantir also reiterated its long term revenue growth guidance through 2025 of 30% or more.

4) Netflix Inc (NASDAQ:NFLX)

Netflix has fallen post results announcement for two quarters in a row, we previously covered Netflix’s 4Q21’s results here.

For 1Q22, Netflix reported a 200k decrease to subscribers in 1Q22, partly due to its decision to withdraw from Russia, resulting in a loss of 700k subscribers. Excluding the impact from the Russia withdrawal, Netflix would have gained 500k subscribers in 1Q22. Netflix also provided a forecast of a 2 million subscriber decrease for 2Q22 which likely came as a surprise to many investors.

Netflix also spoke about a naturally slowing revenue growth after its strong performance during the pandemic and forecasted a 2Q22 YoY growth of 9.7% while operating margin is expected to decline to 21.5% from 25.1% in 1Q22 and 25.2% in 2Q21.

Competition has been intense and is expected to continue to be so, with players like Alphabet’s YouTube, Disney plus, Disney’s Hulu, Amazon Prime and the newly merged WarnerMedia and Discovery who owns HBO Max and Discovery plus in the picture.

5) Lyft Inc (NASDAQ:LYFT)

Lyft said that Q1 was better than expected and rideshare ride volumes reached a new COVID high, with Q1 results meaningfully exceeding their outlook, driven by increased demand and resilient driver levels.

Lyft reported 1Q22 revenue of $875.6 million versus $609.0 million in 1Q21, an increase of 44% YoY, and versus $969.9 million in the fourth quarter of 2021, a decrease of 10% QoQ.

Active riders declined QoQ from 18.7 million to 17.8 million. Revenue per active rider also declined QoQ from $51.79 to $49.18.

Lyft said it expects revenue of as much as $1 billion in the second quarter, and sees EBITDA of $10 million to $20 million in the period. Both were lower than analysts expected.

At the same time, the company plans to increase its spending on driver incentives. This investment phase was not calibrated into investor’s initial expectations for 2022 and likely caught many off guard. Furthermore, with the current macroeconomic environment and market sentiments, investors have not treated kindly companies who try to invest in further growth which impacts the bottom line

6) Teladoc Health Inc (NYSE:TDOC)

Teladoc recorded a non-cash goodwill impairment charge of $6.6 billion or $41.11 per share in 1Q22, slicing book value by 40% in one fall swoop. It took merely seven quarters for Teladoc to determine that it overpaid by at least 1/3 for Livongo, a $18.5 billion acquisition by Teladoc in August 2020 and if the company does not quickly realise its expected benefits from the acquisition, it is likely to further impair this acquisition.

While 1Q22 revenue and adjusted EBITDA was largely in line with guidance, the company revised its FY22 guidance down and now expects full-year revenue between $2.4 billion to $2.5 billion. At the end of 2021, Teladoc projected full-year revenue between $2.55 billion and $2.65 billion.

It is forecasting a revised net loss of -$43 to -$43.50, adjusting out the non-cash goodwill impairment charge, this comes to -$1.89 to -$2.39, much higher than its previous forecast of -$1.4 to -$1.6.

This FY22 revised outlook means that Teladoc is projecting full year revenue growths of about 20% to 25% while increasing its loss per share by 41% to 48%.

Looking at the chart below, growth has slowed in key metrics such as Paid members, unique chronic care members and average revenue per member.

7) Coinbase Global Inc (NASDAQ:COIN)

Coinbase was down 26% as it reported 1Q22 results that missed analysts expectations, with revenue of $1.17 billion vs $1.48 billion expected by analysts.

However due to the current crash occurring for Luna/UST affecting the broader cryptocurrency market, Coinbase may plunge further in the days to come. Note that Luna is not available on Coinbase app or wallet.

Overall, usage on Coinbase declined from the fourth quarter. Retail monthly transaction users (MTUs) fell to 9.2 million, down from 11.4 million in the fourth quarter, while total trading volume dropped from $547 billion in Q4 to $309 billion.

Revenue fell 27% from $1.6 billion YoY and fell by more than 50% QoQ, and it also reported a net loss of $430 million in the first quarter.

We have attached Coinbase’s key metrics below which are mostly declines as well. As we are about 1.5mth into 2Q22 at the point of writing, based on the actual situation thus far, it will be challenging for Coinbase to outperform from 1Q22.

8) Under Armour Inc (NYSE:UAA)

UAA had a lacklustre quarter, Revenue was up 3 percent to $1.3 billion YoY while gross margin decreased 3.5% to 46.5%, driven primarily by elevated freight expenses. Selling, general & administrative expenses outpaced the revenue growth as it increased 16% to $594 million. Restructuring and impairment charges, part of its 2020 restructuring plan, stood at $57 million.

For the next 12 months, revenue is expected to increase 5% to 7% versus the comparable baseline period of $5.7 billion, reflecting a mid-single-digit percentage growth rate in North America and a low-teens growth rate in the international business.

The revenue weakness is in spite of inflationary pressures which pushes price of products up which means that technically should UAA be able to sell the same quantity of products, it would be in a position to increase revenue solely by inflation.

This expectation includes approximately 3% of headwinds related to UAA’s strategic decision to work with its vendors and customers to cancel orders affected by capacity issues, supply chain delays, and emergent COVID-19 impacts in China.

Gross margin is expected to be down 1.5% to 2% compared to the baseline period’s adjusted gross margin of 49.6% due to expected inflationary pressures on freight and product costs, unfavorable channel mix, and changes in foreign currency.

Operating income is expected to reach $375 to $400 million, 5.6% to 11.5% lower versus the comparable baseline period adjusted operating income of $424 million.

Does it mean that its time to buy?

Investors who have any of these stocks will have been hurt badly by the instant plunge when the results are announced. In the current market environment, as long as one significant data point is weak, the stock would likely sell down. If more than one significant data point is unfavourable, we would likely see a double digit percentage sell down.

Fundamentally, the reason is that many of these are growth stocks which the current market is re-rating to a more mature or value play. Investors will do well to take this into consideration before getting into these stocks.

If you’re looking for an investing system that helps you decide when’s a good time to buy, join Alvin at his upcoming webinar to learn how he picks stocks for the Dr Wealth portfolio.