January is shaping up to be a really eventful month for me. For starters, I become a first-time Dad and can now relate to the stories of sleepless night, pee fountains and unyielding standards on hygiene and sterilization.

Speaking of sterilization, something interesting happened to me when I wanted to purchase hand sanitizers a few weeks back. I assumed it was a fairly easy item to purchase but the Watsons near my house, was sold out on sanitizers. This evolved into a journey which took me to 5 different pharmacies and supermarkets, but it was all sold out. I realized then, that the Wuhan Virus was creating all sorts of worry, and Singaporeans are not just panic-purchasing masks, but hand sanitizers also.

We are still looking to see how the markets play out, but on the 31st of Jan 2020, the Dow plummeted 2.1% after the coronavirus was declared a public health emergency within the country. When China reopened the stock market on 3rd Feb, the CSI 300 plummeted 8% which is the biggest drop since the bursting of a stock market bubble in 2015.

Despite China’s central bank making its biggest cash injection to the financial system since 2004 , it did little to curb selling.

I thought it’d be interesting to compare how Bitcoin performed in the midst of this corona virus outbreak, which coincides with the start of 2020.

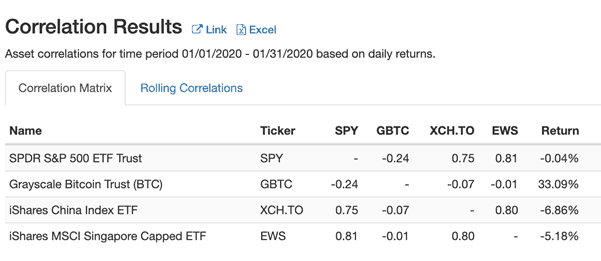

Let’s compare the YTD returns of Grayscale Bitcoin Trust (BTC), SPDR S&P 500 ETF Trust, iShares China Index ETF, iShares MSCI Singapore Capped ETF. This article is written at the start of Feb, and we shall be looking at the 1 month return for Jan 20

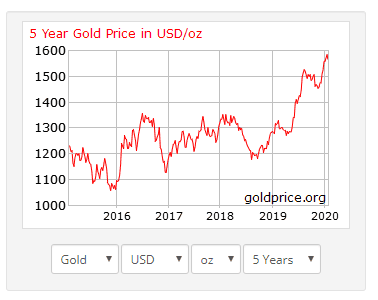

Something else that is noteworthy, is the return of US Treasuries and Gold. They are up 3.74% and 5.9% respectively. Both outperforming equities. This supports our thesis that Bitcoin is increasingly seen as “safe haven”. But more than that, the low (in fact negative) correlation of Bitcoin to any asset class, make it a must-have for diversification and wealth preservation of your portfolio.

I’ve spoken on diversification before, so I should look into another aspect of Cryptocurrencies today. Aside from Bitcoin, my cryptocurrency portfolio consists of other smaller digital currencies such as Zilliqa or Litecoin. I would like to share 3 of them which have done exceedingly well, in light of the Wuhan virus situation. The returns I share are for roughly 1 month – from the start of Jan 2020 till start of Feb 2020.

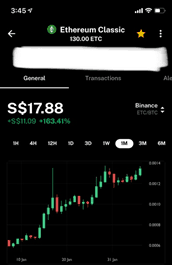

Firstly, ETC (Ethereum Classic), +163% Year to Date

Described as “…an open-source, public, blockchain-based distributed computing platform featuring smart contract (scripting) functionality. It provides a decentralized Turing-complete virtual machine, the Ethereum Virtual Machine (EVM), which can execute scripts using an international network of public nodes.”

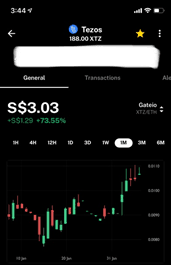

XTZ ( Tezos ), +73.55% year to date

Tezos is a cryptocurrency developed in the USA by former Morgan Stanley analyst Arthur Breitman. Similar to other protocols, Tezos is a blockchain that hosts dApps and smart contracts. Its native token, XTZ, is popularly-known as the Tezzie. Flaws are improved via a community input to create a secure, fast and efficient blockchain platform.

Designed to be a “self-amending”, permissionless, distributed, and peer-to-peer network based on smart contracts. The platform emphasizes on providing a decentralized democracy utilizing proof of stake consensus. All stakeholders can participate in an on-chain governance protocol and influence the direction of the network.

ZEC ( Zcash ), +123.49% year to date

Described by Investopedia as “ …a cryptocurrency with a decentralized blockchain that provides anonymity for its users and their transactions. As a digital currency, ZCash is similar to Bitcoin in a lot of ways including the open-source feature, but their major differences lie in the level of privacy and fungibility that each provides. “

These are “altcoins”, affectionately known as any coin that is Not Bitcoin. Currently there’s 5093 of them listed and this number continues to grow over time. Most of the coins are “Degenerators” (first coined by Willy Woo), with their price chart looking similar to that of radioactive decay. Here’s an example of one

However, a handful of altcoins have SoV (Store of value) properties.

These are the altcoins that will keep up with BTCUSD gains. In other words, when BTC grows in price , these are the altcoins that will increase in USD value as well – usually with a higher Beta. ETC, XTZ and ZEC are examples of such. While Bitcoin gained 33% in one month, these altcoins have gained more than 50%. In my portfolio structuring for Cryptocurrencies, I always include such Altcoins to enhance the overall return of my Crypto-portfolio. These very same altcoins, are the ones that created young millionaires in 2017.

While the world searches for face masks and sterilizers, a new world of digital assets is developing in plain sight.

I wonder if people would notice, or would they only come in after the bubble forms yet again?

Perhaps Bitcoin had been a speculative instrument over the last 5 years. However, the longer it survives, the stronger the idea begins to hold. That is known as the Lindy effect, and I’d like to talk about it in the next article.

Till then, keep your eyes peeled towards Bitcoin, I believe 2020 will be an exciting year.

Editor’s Notes

When the market zigs, I prefer to have a percentage of my portfolio that zags. In contrast to the many happy gains above, the markets have generally been a shitshow for most equity investors. China continues to get beaten like a dusty carpet and the various sectors are all being hammered by the novel corona virus regardless of the Federal Reserve and China’s liquidity injections.

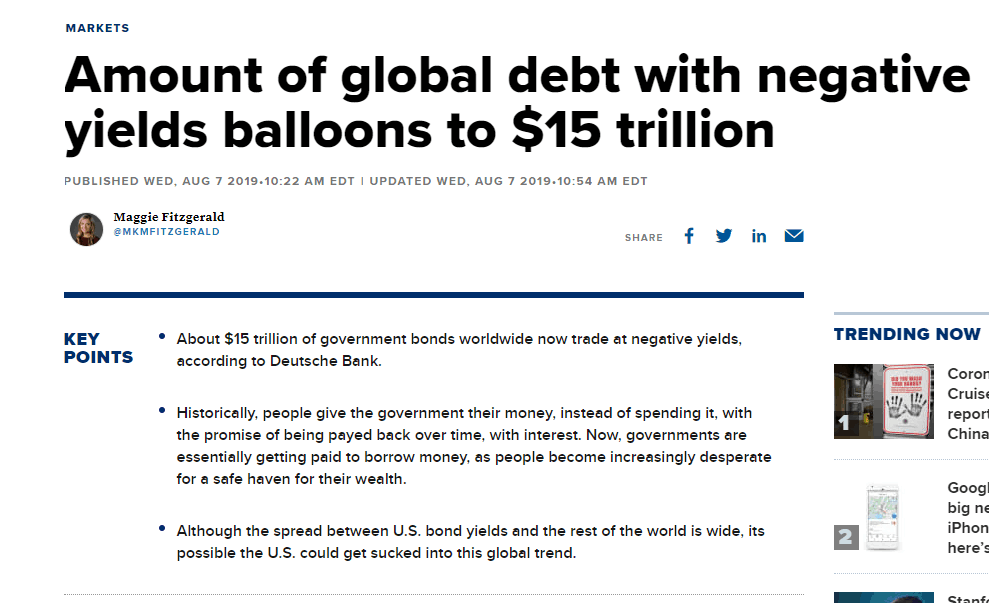

As the virus presses on and as the two mega powers in China and the US continue to try and hold onto the rapidly derailing growth train with massive money printing, gold and other safe haven assets such as bonds have grown in price (which is a major reason why we have negative yielding bonds because people are just willing to pay you more than what you’re paying BACK) and which is why gold has also been on a run.

I include tiny bitcoin positions in my portfolio mainly because I believe the world of the future will need to be decentralised and be fully independent of market forces such as the Federal Reserve or a major bank, and that the decentralisation in effect protects and enables everyone more than it holds back.

Now, that stance has not just gained greater strength is this massive Quantitative Easing world, I think that beyond Gold, safe haven assets will continue to rise in value as the USD continues to drop in value thanks to extensive printing.

Bitcoin is just one among them that I believe enables far greater upside than what can be achieved with typically safe assets.

Christopher Long gives periodic talks for beginners who are interested in the potential of bitcoin. If you’d like to find out more, you can register for a seat here.