(first published on 16 Oct 2018, updated 20 Dec 2021 for 2022)

Singtel, Starhub, and M1 are just a few blue-chip stocks that Singaporeans are familiar with. They were extremely popular due to their stable market share and sound financial standing.

However, times have changed, and the industry now faces larger obstacles. Not only do these incumbents face more competition, but the pandemic has also wreaked havoc on their financials. Given its depressed price now, is it wise for investors to invest in Telco now? Which of the three telcos is the most attractive to investors?

Today, I’ll discuss the current situation of these three companies and present some metrics on their funadmanetals.

What happened to M1 stocks?

M1 was delisted from the Singapore Exchange in 2019 when local conglomerates Keppel Corporation and Singapore Press Holdings (SPH) bought out Malaysian telecommunications Axiata Group’s stake in M1, giving them majority control. Nonetheless, buying into Keppel Corporation, M1’s parent company, is one option to invest in the company.

A Little History on Singapore’s Telecommunications Industry

The Singapore Telephone Board was established in 1955 as a statutory body with sole authority to run a telephone service in Singapore. After a series of mergers over the next few years, the firm went public and was renamed SingTel in 1993.

When SingTel went public in 1993, Singaporeans were allowed to purchase shares at a discount. This was part of the government’s aim to encourage us to invest in our country ’s economic development, and it’s also why the majority of our parents and grandparents still own Singtel stock.

As a telecommunications conglomerate, SingTel not only has operations in Singapore but also in Australia, India, Indonesia, and the Philippines. At its peak in 2015, SingTel had a market capitalisation of S$70 billion and was Singapore’s largest public listed company. Its success was widely celebrated and had been praised by many.

Who would have guessed that, despite its success, SingTel was already on its way out when the government chose to deregulate the telecommunications business in 1997 and ended SingTel’s monopoly? Very soon, M1 entered Singapore’s mobile telecommunications market in 1997, breaking Singtel’s previous monopoly. Starhub entered the scene later, debuting in April 2000 with prominent stakeholders including ST Telemedia, Singapore Power, BT Group, and Nippon Telegraph and Telephone (NTT).

Where Is The Telco Industry At Now?

For the most basic phone plans, the average user in Singapore currently pays between 20 and 50 cents per gigabyte, which is up to 25 times cost effective than it was five years ago. This dramatic drop in prices was prompted not due to any technological breakthrough but by the increased competition brought on by the introduction of Singapore’s fourth Telco, TPG, and the emergence of virtual network operators in the last five years (MVNOs).

Fun fact: Rather than managing their cell network infrastructure, there are currently 9 MVNOs that lease network capacity from Singtel, M1 and StarHub. These operators were launched by incumbent telcos to undercut TPG, which need to develop its network from scratch. However, as shown in recent years, this method has also contributed to the downward pressure on Telco revenue.

Telcos have cut numerous costs as a result of market liberalisation, which may or may not be desirable. In order to lower the cost of mobile plans, some sacrifices may have to be made in terms of innovation and customer service quality which you may have felt. However, as the industry moves toward the usage of 5G networks, we may be at a crossroads.

Singtel and a joint venture entity between Starhub and M1 were granted the deployment of 5G network infrastructure by IMDA last year. Since just two licenses have been issued thus far, other operators, including TPG, would have to lease from these incumbers. This, according to analysts, would reset the ongoing pricing rivalry, putting a stop to the price war. In fact, we’re already witnessing price increases in the 5G plan compared to the 4G plan.

SingTel

Singapore Telecommunications Limited (SGX:Z74), the largest of the three Telcos, is one of Asia’s largest telecommunications corporations, with operations in several countries. Group Consumer, Group Enterprise, and Group Digital Life are its three main segments.

The Group Consumer segment refers to its phone plan, pay-TV, fibre broadband and mobile payments. In this segment, we also have GOMO, SingTel’s all digital mobile product that comes with generous data allowances. This segment also includes Singtel subsidiary Optus (Australia’s second largest wireless carrier), as well as regional partners Telkomsel (Indonesia), Airtel (India), Globe (Philippines), and AIS (Thailand), all of which are well-known in their respective countries.

The Group Enterprise segment provides business clients with information and communication technology solutions such as cloud, Internet of Things, cybersecurity, and smart city solutions.

Finally, there’s Group Digital Life, which is the smallest but fastest growing segment. This segment is involved in digital marketing and data analytics which aims to provide businesses with deeper insights on potential customers. Amobee is a crucial business in this segment which Singtel bought over in 2021 for S$428 million. As an advertising platform, Amobee helps companies execute campaigns for specific audience segments across traditional and digital TV.

As economic and business activity resumed across the region, Singtel’s profitability improved for the first half of the year. Increased mobile service revenue in Australia, as well as robust ICT growth from higher digital services revenue for NCS and data centre income, boosted operating revenue by 3% to S$7.65 billion.

Singtel has also revealed intentions to launch a regional data centre business in October, saying it is in talks with partners to build new data centres in Thailand, Indonesia, and the region to meet the growing demand for critical infrastructure.

StarHub

Next up, we have StarHub Limited (SGX:CC3). Its business is split into Mobile, Pay TV, Broadband and Enterprise.

The first segments are self-explanatory. It essentially offers a full range of mobile services, including giga!, StarHub’s SIM-only digital brand, Starhub TV+, which provides consumers with a variety of international and local TV channels, as well as Wifi. On the other hand, the enterprise segment includes Cybersecurity services and Regional ICT services.

For the third quarter ending 30 September 2021, Starhub reported a 5.6% increase in revenue to $517.2 million and a 5.1% increase in Net Profit to $40 million. For the nine months ended 30 September 2021, Starhub’s revenue increased by 2.9% to $1.49 billion, while its net profit increased by 6% to $107.4 million.

Other interesting developments include Starhub being granted the 5G network license in a bid with M1. Starhub has also acquired a 50.1% stake in MyRepublic’s Broadband business in Singapore, which currently holds a 6% share of the Singapore broadband market, bringing its market share to 40%.

M1

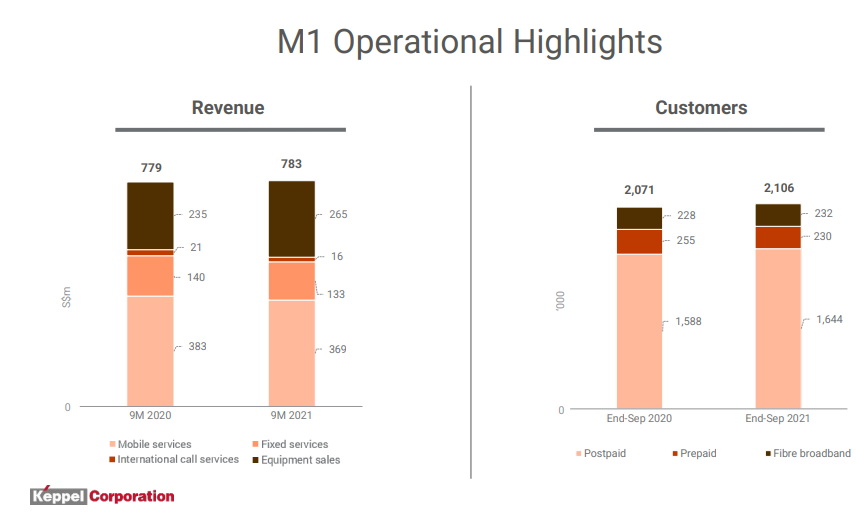

Finally, M1 is the smallest of the three telcos. Handset sales, Fixed services, International call services, and Mobile services account for the majority of the company’s revenue.

M1 revenue for the first nine months of 2021 was $783 million, up marginally from the same period last year.

Other developments for M1 are listed below.

- Finalisation of a network asset monetisation contract with Keppel DC REIT, freeing $580 million in value.

- The Infocomm Media Development Authority has awarded M1 together with Starhub the 5G network license.

- Expansion of 5G use cases, including a partnership with Keppel Land at Keppel Bay Marina.

Comparisons

Now that we’ve covered the business of each Telco, let’s examine the three telco stocks using some common metrics. Before we begin, note that because M1 is now a subsidiary of Keppel Corporation, certain metrics are unavailable for comparison.

Which Telco is the Most Profitable?

Due to the impact of Covid 19 on all three telcos’ earnings in 2020, we’ll instead use the first nine months of FY2021 for each company. Furthermore, because the Singtel Q3 results have yet to be released, thus we need to estimate from its 1H 2021 earnings. Given the slight variation in the time period, we will also have to bear this statistic in mind. Regardless, I think it’s still a decent representation of the company.

| Singtel (SGX:Z74) | M1 | Starhub (SGX:CC3) | |

|---|---|---|---|

| Revenue | $11,479.5m (est) | $783m | $1,491m |

| EBITDA | $2,893.5m (est) | $175m | $378.8m |

| EBITDA margins | 25.2% | 22.3% | 25.4% |

Earnings before interest, taxes, depreciation and amortisation are referred to as EBITDA. Because it excludes the effects of finance and accounting decisions, this indicator allows investors to focus solely on operational performance. Starhub has the best margin of the three, with 25.4%, followed by Singtel with 25.2%. This could partly be due to Singtel and Starhub’s operations in enterprise ICT and cybersecurity solutions, which may have pushed its margin up.

Which Telco Pays the Highest Dividend Yield?

Given that the growth rate of these companies has slowed down a lot, their dividend yields would play a big part in determining if it is a good investment.

| Singtel (SGX:Z74) | M1 | Starhub (SGX:CC3) | |

| Dividend per share | $0.069 | Not Applicable | $0.05 |

| Dividend Yield | 2.91% | Not Applicable | 3.65% |

At present, these companies’ dividends aren’t as appealing as they once were.

When comparing Singtel and Starhub, Starhub offers a greater yield of 3.65%.

Which Telco has the highest payout?

| Singtel (SGX:Z74) | M1 | Starhub (SGX:CC3) | |

| Payout Ratio (TTM) | 119.2% | Not Applicable | 61.7% |

Investors in blue chip dividend stocks should pay attention to the dividend payment ratio.

Any number greater than one is unsustainable for a business because it suggests the organisation is giving out more money than it is earning. When comparing Singtel to Starhub, assuming both maintain their current dividends, Singtel’s payout may be unsustainable due to declining earnings. That being said, Singtel’s has a dividend policy in that it will distribute 60% to 80% of its underlying net profit as dividend, therefore if Singtel’s earnings do not improve, the payout could be reduced in the following quarters to ensure sustainability.

Concluding thoughts

Our local telcos are currently facing numerous challenges, which has been reflected in their stock price performance in recent years. Telcos are not just experiencing growing competition from new entrants; streaming service providers such as Netflix are also eating into their profits.

In my previous article, I discussed how Singtel, the largest of the three, has seen poor financial metrics due to declining revenue, falling profit margins, rising debt, and diminishing cash flow.

That said, there may be a ray of hope for this industry, and if I had to bet on one of these telcos’ comeback, I would pick Singtel over Starhub or M1. To begin with, Singtel is the largest and has the most diverse revenue source from its overseas operations. Because it is larger, the company has greater opportunities and capital to invest in future growth, including 5G infrastructure.

Speaking about 5G, it’s worth remembering that it’s more than just high download speeds for consumers. 5G has a wide range of applications for industries and enterprises, and these telcos have already begun working with several industry leaders as well as government agencies to perform 5G trials that will assist Singapore to achieve its smart nation goals. As mentioned at the start, with 5G, we could also see a ‘restart’ in pricing, given that only the incumbents have the license. Finally, Singtel has formed a joint venture with Grab to establish a digital bank, which might be quite successful.

That said, I’m still not going to invest in our local telcos for the time being because I believe there are greater opportunities out there.

P.S. Want to learn how to evaluate and research your own stocks in 2022? Join Alvin at his live webinar to learn how you can DIY your investments and make your money work harder for you.