Housing and Development Board (HDB) will change how it classifies Build-to-Order (BTO) projects, starting in the second half of 2024.

The policy changes intend to ensure that HDB policies continue to remain relevant in Singapore’s current social and economic construct.

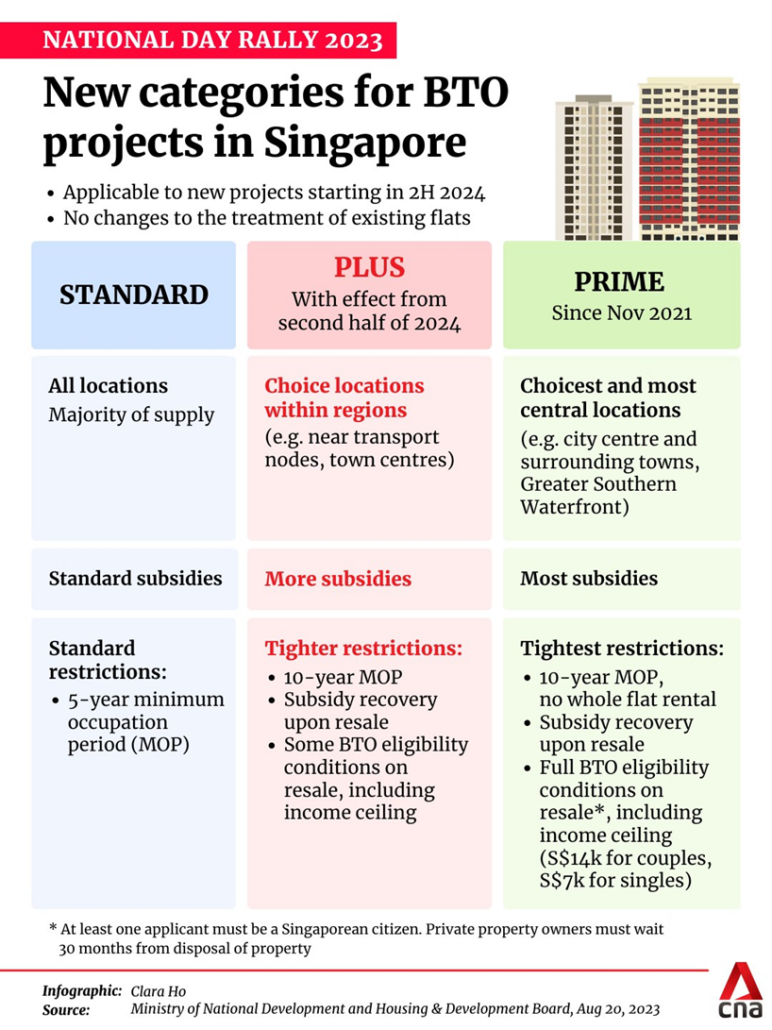

The classification will be revised to the following three new categories – Standard, Plus and Prime – instead of the mature and non-mature framework that has been around since the early 1990s.

These latest policies do not serve to increase the supply of new flats as this has already been a top most priority for HDB.

These policies also do not directly attempt to control the current supply or prices of resale housing.

However, these policies will help Singles, as current policies catering to these group of people tend to be limited. These new policies will also shape the availability as well as prices of resale housing for the next generation.

In 2021, HDB launched a new Prime Location Housing (Prime) Model for new BTOs in prime locations with a 10 year Minimum Occupancy Period (MOP) and a subsidy recovery upon resale via a 6% clawback of the resale price or valuation (whichever is higher). When these Prime BTOs hit their MOP, they can also only be sold in the resale market to buyers that meet the income ceiling of $14k for couples and $7k for singles.

During the National Day Rally 2023, a new “Plus” category was launched.

These Plus flats will be located in choice locations within regions such as near transport nodes or town centres and will also have tighter resale conditions. While details have not yet been announced, resale conditions will include an income ceiling for resale buyers, as well as a subsidy recovery upon resale. The clawback for Plus flats is expected to be lower than for Prime flats as the additional subsidies should typically be less.

Standard flats will form the bulk of the BTO supply and will be subjected to standard restrictions such as the 5 year MOP. These Standard flats would not be subject to subsidy recovery upon resale.

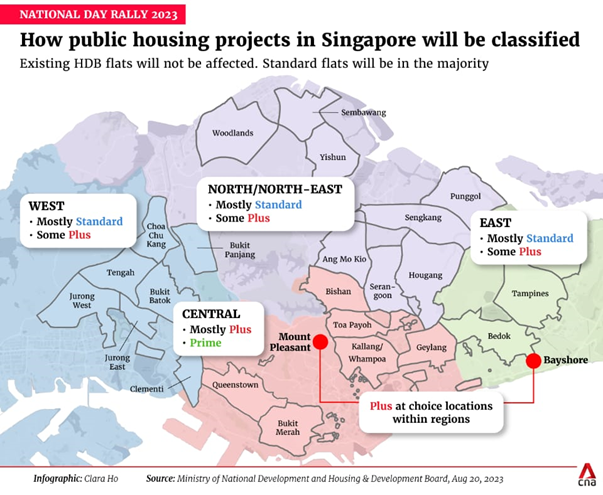

Essentially, all new flats located in the Central region will either be Plus or Prime while all flats located in the other 3 regions will either be Plus or Standard.

New policy to benefit Singles

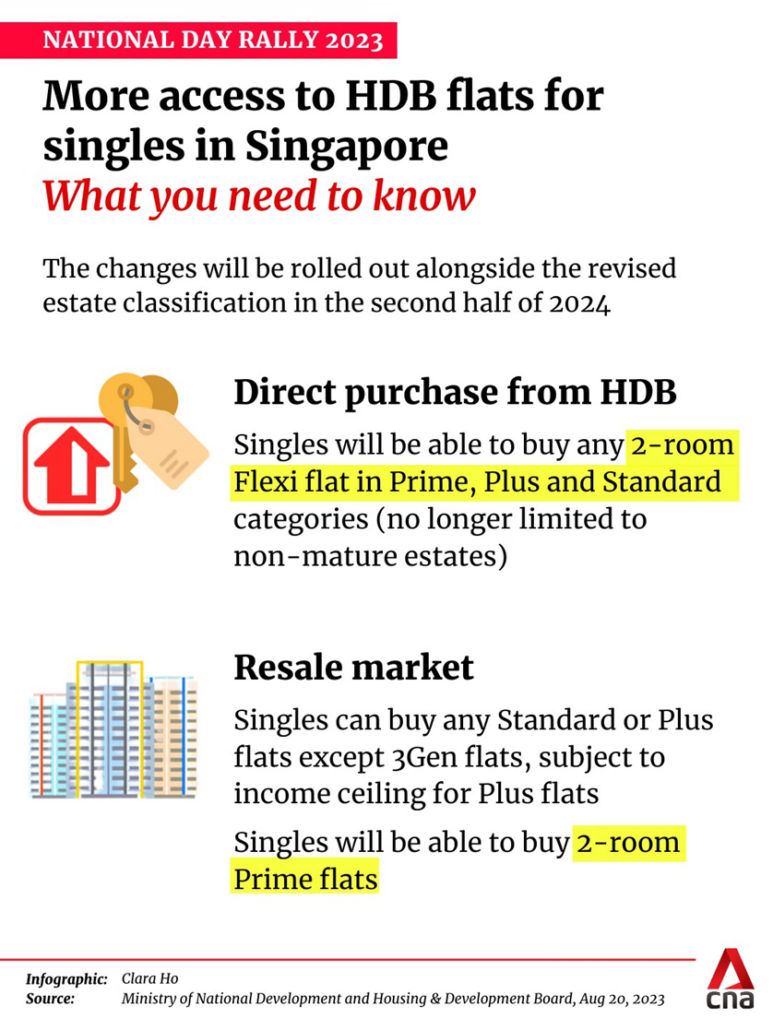

With more Singaporeans choosing not to get married, singles will have more housing choices when the new BTO classification kicks in.

Currently, first-timer singles aged 35 or above are only allowed to apply for new two-room Flexi flats in non-mature estates should they fall within the salary ceiling of $7,000.

With the new classification, these eligible single first-timers have the following options:

- Apply for two-room Flexi BTO flats in all locations across the three categories

- Buy a Standard or Plus resale flat of any size, except Three-Generation flats

- Buy a two-room Prime resale flat

Singles aged 35 or above who do not meet the salary ceiling can buy resale flats in any estate, with the exception of BTO flats under the Prime Location Public Housing model.

As many young adults in Singapore do not intend or have not yet registered a civil marriage, the policy changes would provide these group of people with a wider range of options.

Housing for the next generation

With the new classification in place, the next generation of homeowners in the decades to come will have to plan ahead and secure their home early, should they expect to exceed the income ceiling.

Keen market observers would note that historically the income ceiling tends to range between 1.5x to 2x of the median household income.

Couples and Singles alike will have to purchase a Standard resale flat should they exceed the salary ceiling for HDBs and are not able to afford a condominium. (Note there is always an option to purchase an Executive Condominium, which itself comes with a unique landscape to navigate).

In time to come, a standard resale flat would either be in a less attractive location or an older flat that is built before these policies came into place.

Purchasing an older flat also comes with its own set of policies such as limitation of the use of funds from CPF.

For these group of people, this means that they may either not be able to purchase a flat near their parents or have to fork out a larger downpayment.

Which housing policies didn’t change?

1) Income Ceiling

In 2019, the income ceiling was increased to $14k for couples (from $12k) and $7k (from $6k) for singles. Before this, a similar increase was announced for in 2011.

In effect, the last 3 increment to the income ceiling were carried out every 4 years. Many potential home buyers have been keenly watching the 2023 National Day Rally in hopes of another increase to the income ceiling.

The income ceiling takes into consideration the median income and it is worth noting that the previous increases were announced after the median income rose between 15% to 22% in the preceding 4 years.

In the preceding 3 years from 2019 to 2022, the median income already rose about 11%. With analysts expecting the median salary increase in Singapore to range between 3% to 5%, this would have brought the 4 year increase in line with preceding periods.

One would venture to guess that the reason to not increase is clear. There is already insufficient new housing for currently eligible applicants.

2) Wait-out period for downgraders

Similarly, as the government just increased the wait-out period from 3 months to 15 months for homeowners who are downgrading from private properties and would like to purchase HDBs so as to manage current resale prices.

The 15-month wait-out period was announced as a temporary measure to moderate demand for resale flats and help to prioritise access to affordable public housing for Singaporeans with more urgent housing needs, such as first-time home buyers.,

Sandwiched class may continue to struggle despite new HDB policy

The housing situation of Singapore had deteriorated in the last 5 years, as resale prices has risen substantially. This was in part due to delays in new housing because of the pandemic as well as a perception that the HDB was not building flats ahead of demand.

In summary, these policies benefit the Singles of today as well as attempt to secure a future for the homebuyers of tomorrow. However, for the sandwiched class of the future, they may be put in a situation akin to threading a needle to secure a home.