DrWealth’s GPAD Strategy aims to buy companies with excellent growth prospects. Singapore Exchange is one of them. Curious how we find growth companies like this? You can find out more here.

Singapore’s sole stock exchange has evolved over the years into a multi-asset powerhouse. We take a deep dive into SGX’s history and also see what the future has in store for investors.

Background

Singapore Exchange Limited (SGX: S68), or SGX, is Singapore’s sole stock exchange operator. The group provides and operates a platform for investors to buy and sell securities such as fixed income, equities, derivatives and foreign exchange. SGX also provides listing, trading, clearing, settlement and data services and offers both commodities and currency derivative products.

Being the only stock exchange in Singapore, SGX enjoys a natural monopoly.

However, investors who are looking for a “sure-win” investment need to be wary of this fact, as SGX actually competes with other stock exchanges regionally and globally. With Singapore being a small country, it’s tough to attract fund flows from larger funds and institutions, but good governance and a professional management team have managed to enable the exchange to grow steadily over the years.

Looking back in history to a decade ago, SGX had just emerged from the meltdown that was the Global Financial Crisis (GFC) in 2008-2009. On 1 December 2009, Magnus Bocker was appointed as the CEO of SGX, taking over from then-CEO Hsieh Fu Hua. During his tenure till 30 June 2015, he tried but failed to raise SGX to become a best-in-class platform in Asia. Known for his savvy deal-making skills as Magnus had helped to create the Nordic Exchange Group OMX, he led an attempt to merge with ASX (the Australian Stock Exchange) in 2010, but this failed as the deal fell to political opposition in Australia.

Loh Boon Chye was appointed as CEO from FY 2016 onwards (SGX has a 30 June year-end). He was a director on SGX’s board from October 2003 till September 2012 and was an ex-banker who had worked in Deutsche Bank AG and Bank of America-Merril Lynch. He had a vision to evolve SGX into a multi-asset exchange in order to reduce reliance on equities and fixed income. This evolution continues till this day and I will be looking at some of the long-term strategies that SGX has come up with to further its growth.

But for now, let’s have a look at SGX’s history and stellar track record.

Financial Review

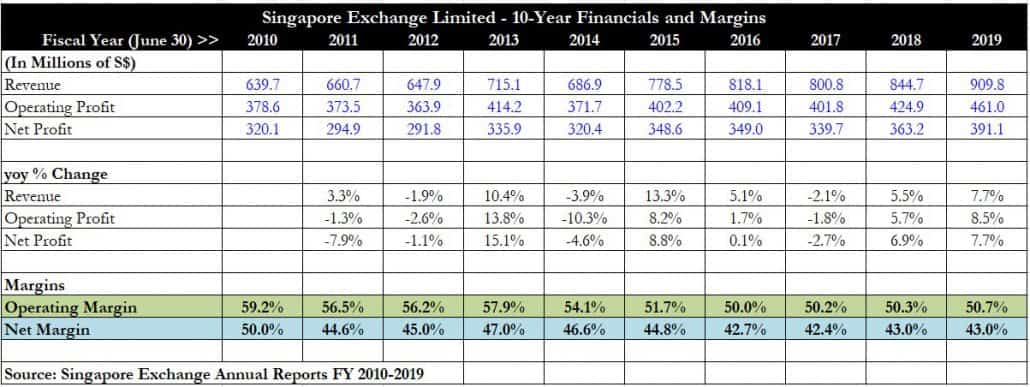

The first observation we should note from the table above is that SGX has managed to grow its revenue from FY 2016 onwards to a new 10-year high of S$909.8 million in FY 2019.

Prior to FY 2016, revenue growth was still present but was inconsistent, with a year-on-year drop of 1.9% and 3.9% clearly seen in FY 2012 and FY 2014, respectively. As we shall soon see later, SGX has been growing its derivatives revenue and volume significantly since Loh took over as CEO, and this alone has been propelling SGX’s revenue to a high.

Net profit also hit a 10-year high in FY 2019 at S$391.1 million, the result of the shift towards derivatives and having less reliance on equities and fixed income alone.

What’s also interesting here is the operating and net margins — they have both come down significantly from the highest point of 59.2% and 50% respectively in FY 2010, to the current 50.7% and 43%.

Yet, SGX has managed to grow its net profit to a new high. This decline in margins was due to the shift from a previously highly-lucrative equities-focused business to one that is now more derivatives-heavy.

As the investment landscape altered over the years, SGX has had to position itself away from equities as it was losing its lustre.

The days of high margins were over and CEO Loh knew this, which was the reason for the pivot towards derivatives instead. Derivatives offer market participants the opportunity to hedge their portfolios and to purchase options and futures as part of risk management, and make SGX a more attractive destination for both investors and traders.

For 1H FY 2020, SGX is on track for a good showing, with operating revenue up 11% year-on-year, operating profit up 16% year-on-year and net profit up 14% year-on-year.

Note: In June 2019, SGX announced a new organizational structure and also re-jigged its business segments. The previous three major segments “Equities and Fixed Income”, “Derivatives” and “Market Data and Connectivity” will now be re-arranged into four different segments instead. They are Fixed Income, Currencies and Commodities (FICC), Equities (including cash and equity derivatives), Data, Connectivity and Indices (DCI), and Global Sales and Origination (GSO).

Consistent Free Cash Flow

SGX has a consistent track record of generating strong operating cash flows, and over the last ten years, operating cash flow has ranged from S$300 million to S$400 million+. Capital expenditure has remained less than S$100 million during the same period, and the exchange, therefore, churns out copious amounts of free cash flow every year. This allows it to invest in more capabilities, make acquisitions and also pay out regular, stable dividends.

Dividends

SGX has been a very generous payer of dividends over the years, as can be seen from the table above. The bourse operator pays a quarterly dividend, which is very attractive for an income-focused investor as he will receive cash flow every three months.

SGX used to back-load its dividends, paying out a large dividend when it released its year-end results, but since FY 2019, it has changed this to a more balanced quarterly dividend of 7.5 cents per quarter. This practice has carried forward into FY 2020 as well, with the first two quarters this year seeing dividends of 7.5 cents per quarter. At SGX’s last traded price of S$8.79, the trailing dividend yield is 3.4%.

Business segment highlights

The above table offers good insights into SGX’s three divisions, with equities and fixed income (FI) and derivatives being its two core divisions.

First off, it can clearly be seen that the equities and Fi division’s revenue is on a downtrend, as the securities daily average volume (SDAV) continues to dwindle year-on-year due to the moribund state of the stock market, more delistings and fewer new IPOs over the years. This division, which used to command operating margins close to 70%, has now seen its margin shrivel to 45%, though this is still fairly respectable.

Turning to Derivatives division, its prominence has risen significantly over the years but has made more of an impact in the last four years, with revenue surpassing the S$300 million mark. In FY 2019, Derivatives finally overtook equities and FI to become the major contributor to group revenue, at 50.5%. SGX’s shift towards derivatives has also seen its operating margin improve significantly over time, from a low of 30.7% in FY 2010 to 54.5% in FY 2019.

With more growth envisioned for Derivatives as the exchange releases more products in this category, and along with higher operating margins, this looks set to drive further growth in the overall business, even as equities and FI play a less important role.

Growth Strategies and Catalysts

SGX has a disciplined growth strategy that was articulated during its FY 2019 presentation briefing. There are three key pillars that form the group’s strategic priorities: build a multi-asset exchange, grow international presence and widen partnerships and networks.

As mentioned above, SGX has been growing its derivatives division by introducing new financial products in many different sub-categories. Some examples of new products are the FlexC FX Futures (for forex), rubber options (for commodities) and the Nikkei 225 Index TRFs (for equity derivatives). SGX’s FTSE China A50 Index Futures is also a very popular product, accounting for nearly half the derivatives volume for FY 2019, as it is one of the only futures products that allows participation in Mainland China’s index.

For its second pillar, SGX has opened offices in New York and San Francisco in FY 2019 in order to slowly grow its presence and make itself known to international investors.

Building partnerships is the last pillar and also an important one, as SGX conducts “bolt-on” acquisitions to boost its capabilities and offerings for its suite of products. Examples include investments in Trumid, BidFX and Freightos to support growth in its FI, currencies and commodities sub-businesses. These smaller businesses may have capabilities that act as add-ons to SGX’s existing competencies, enhancing the level of service that the bourse can offer its clients.

Just last month, SGX also concluded the acquisition of a 93% stake in Scientific Beta for EUR 186 million in order to scale up its index business. This acquisition is expected to be accretive to earnings in FY 2021 and comes at a time of growth in factor investing. In addition, SGX has also established an S$1.5 billion multicurrency debt issuance programme, with the aim of tapping on leverage to execute even more such accretive acquisitions in the future.

Bourse Operators: A Dynamic, Evolving Industry

The bourse operator industry is a unique one, as each country normally either has just one or two large exchanges. Exchanges make natural monopolies and do, therefore, trade at fairly high multiples to justify their dominance. However, the industry is far from static, as the changing landscape in investment and equity trading has forced many bourses to diversify their offerings in order to search for growth.

One key trend that is being witnessed now is the shift towards passive, or index investing. More and more monies are being channelled to such strategies, and bourses need to adjust their business to this new reality. Commissions and fees for equity trading have also plummeted in the last decade, implying that bourses need to rely on alternative sources of income in order to grow and survive.

Finally, there is also competition between bourses, especially those within the same region (e.g. Asia). Initial public offerings (IPO) are an attractive revenue source, and many bourses actively court large companies with the hope that they will list there and bring in a raft of investors and traders, thereby boosting liquidity and the exchange’s standing.

Competitor Analysis

For competitive analysis, I chose stock exchanges that are close in proximity to SGX, as these are more representative of the actual competition that SGX faces when it comes to attracting clients and companies. The competitors in the table above include Bursa Malaysia (KLSE: 1818), Hong Kong Exchanges and Clearing Limited (SEHK: 388) and ASX, the Australian bourse operator.

In terms of margins, SGX has one of the lowest operator margins of the four, while net margin is also on the low side compared to HKEX and ASX. However, this is offset by the year-on-year growth in revenue and net profit, which hit double-digits for SGX. Bursa saw a decline in both revenue and net profit on a year-on-year basis, while HKEX only posted a low single-digit year-on-year increase. Only ASX managed to post a double-digit increase in net profit as well.

Of the four bourses, SGX has one of the more attractive dividend yields at 3.4%, while HKEX and ASX sport dividend yields below 3%. Though Bursa has a slightly higher dividend yield at 3.8%, do note that revenue and net profit posted declines.

Valuation-wise, SGX appears to have the most attractive price-earnings ratio at 22x, compared to more than 30x for HKEX and ASX. This is despite posting good revenue and profit growth as well as having a decent dividend yield.

Risks to the business

The main risk to SGX’s business right now is the potential introduction of a new futures contract on the MSCI China A Index by HKEX.

This was first announced in March 2019 but the China Securities Regulatory Commission has yet to approve its launch. Currently, SGX’s FTSE A50 China Futures is the only product for A-share futures available for offshore investors, and also makes up the bulk of derivatives volume. The impending launch of a new futures product by HKEX could potentially steer investors away from SGX and towards HKEX.

A mitigating factor here is that the market may actually be large enough for both participants (i.e. SGX and HKEX) to co-exist happily without impacting SGX’s volumes in an adverse way. Also, SGX is diversifying its sources of derivatives revenue away from China by introducing more products along the way, and in an August 2019 announcement, SGX and the National Stock Exchange of India (NSE) have received regulatory dispensations over the previous dispute over the Nifty 50 products, paving the way for SGX to revive these Indian products before the end of 2020.

Another big risk is that persistent and continuous decline in SDAV for the equities and FI divisions of the business. However, SGX has proven that it is able to offset this decline by building up and growing its derivatives volumes and revenue base over time.

Valuation and conclusion

SGX has successfully morphed itself into a multi-asset exchange in the last few years, under the capable leadership of CEO Loh Boon Chye. Though the bourse is not trading at what can traditionally be thought of as cheap valuations (22x earnings), investors should note that SGX does command a natural monopoly, and its track record of generating free cash flow and paying dividends is impeccable.

Rather than just being content to be a yield play, SGX is also transforming itself into a regional growth play, with the angle being that it can continue to grow its derivatives volumes through the introduction of innovative new financial products. With the S$1.5 billion debt programme active and its track record of accretive and complementary acquisitions, there is much that investors can look forward to in terms of multi-year growth. The sweetener, in this case, is the quarterly dividends paid out by SGX as the investor waits for more positive catalysts for the business

Editor’s Notes

Some points to note;

- A major recession can still spell trouble and I think that’s on the books. When funds get yanked by investors from the markets, total dollar transactions dip and earnings naturally drop – which means share price of SGX drops too.

- Investors should be ready to watch the stock price tank and be ready to pick it up while it’s cheap. This is not a lump sum play

- I’m bullish SGX for the same reason I’m working in the finance sector. I think Singaporeans are underinvested. I think financial awareness for investing is growing. And I think each successive generation that grows up will increasingly be taking greater participation in the markets. All of that is good for SGX.

- Read about the GPAD strategy in our free factor based investing guide.