What is Lucid?

Lucid (NASDAQ:LCID) is an American electric vehicle (EV) manufacturer that was taken public in July 2021 in one of the largest SPAC deals in history. It is currently valued at more than US$60 billion.

It has also just been added to the NASDAQ-100 Index, making it the only other car manufacturer besides Tesla in the index. This adds a certain degree of credibility to its brand. It is led by a former Tesla Chief Engineer and is comprised of seasoned executives with backgrounds in Automotive, EV, and Tech.

Current scale of production

It currently has two models under production: one luxury sedan and one SUV. Both models are manufactured in-house in a factory that currently has a production capacity of 34,000 vehicles a year. It started production in September 2021, and the first customers picked up their cars by the end of October 2021.

Plans for expansion

Lucid currently has expansion plans to scale up its factory to 90,000 vehicles a year by the end of 2023, with an end goal of approximately 400,000 vehicles a year.

It also has more than 17,000 reservations valued at more than US$2.0 billion for its flagship model, the Lucid Air Dream Edition, and reservations are rapidly increasing as the brand takes off.

Lucid is also targeting expansion in China and the Middle East and has plans to build factories in these regions by 2025.

What does Lucid bring to the table?

1) Technological prowess and superior product

We will not go into detail concerning the technical specifications of the Lucid Air and how it compares to Tesla or other competitors. However, we have noted that Lucid’s flagship model, the Lucid Air Dream Edition, is being regarded as the longest lasting and most power-dense EV in production to date. By any standard, it has superior range and acceleration.

Furthermore, both the exterior and interior designs are viewed by car experts as innovative and superior to competitors.

2) Opportunity for scalability and new segment growth

As Lucid is in a nascent stage of growth compared to its competitors globally, there is an opportunity for substantial growth over the next few quarters.

- Global expansion

To further increase its sales, Lucid is also expanding its retail and service locations via a direct sales strategy, with studios slated to open in US and Canada in the coming months. Entry into European and the Middle East markets is also expected by the middle of 2022.

- Using batteries as energy storage devices

Lucid is also testing an energy storage system for commercial and residential areas, focusing on finding ways to repurpose older batteries from its EV. While Lucid is years away from having to contend with a large number of used batteries, this could be an alternative source of revenue in the future.

According to Lucid, batteries typically retain a charging capacity of around 70% once they are removed from EVs, which means they potentially have another decade of useful life. The battery-cell modules that power Lucid’s vehicles are identical to the ones that will be used for energy storage, making them well-suited as storage devices.

Lucid’s battery currently powers every car in the world’s premier EV racing series. Its battery pack and software have the potential for a wide range of applications, including eVTOL aircraft, military, heavy machinery, agriculture, and marine.

3 reasons why we think Lucid will not be like Tesla

1 – Lucid is still struggling with funding

Lucid significantly strengthened its balance sheet, bringing in US$4.4 billion as part of its listing.

However, it is in the early stages of production, without first-mover advantages. It is also still reporting negative operating cash flows.

The funds raised as part of the listing are already earmarked to scale up its factory for the production of its two models, the Lucid Air and the Lucid Gravity SUV. They are also allotted for other general operational expenses.

2 – Lucid does not have a charging infrastructure

- Tesla has built an enormous charging network

With 30,000+ Superchargers, Tesla owns and operates the US’s largest global, fast-charging network. Branches are located on major routes near convenient amenities.

This took years to build and required significant capital expenditure levels to expand the network. In fact, it is estimated to cost Tesla more than US$8 billion.

The Tesla charging network is available to drivers of Tesla cars without membership fees. It bills drivers for charging by the minute or per kilowatt-hour for supercharging.

Now, Tesla is making its DC fast-charging stations available for use with other electric vehicles, with the intention of making Superchargers open to other electric vehicles in all countries.

- NIO’s battery swap service

Similarly, NIO has a foothold on the battery-as-a-service (BaaS) or battery swap service in China and is rapidly expanding to Europe to capture market share.

Lucid’s answer to its competition

Consumers buy a product not just for its existing functionalities but also for the after-sales support and maintenance. The ownership of infrastructure is important to consumers for many reasons, including assurance of service and potential safety and liability.

Lucid has partnered with Volkswagen-owned Electrify America to mitigate this risk, which is expected to have 800 charging station sites by the end of 2021.

3 – Lucid does not have a visionary leader

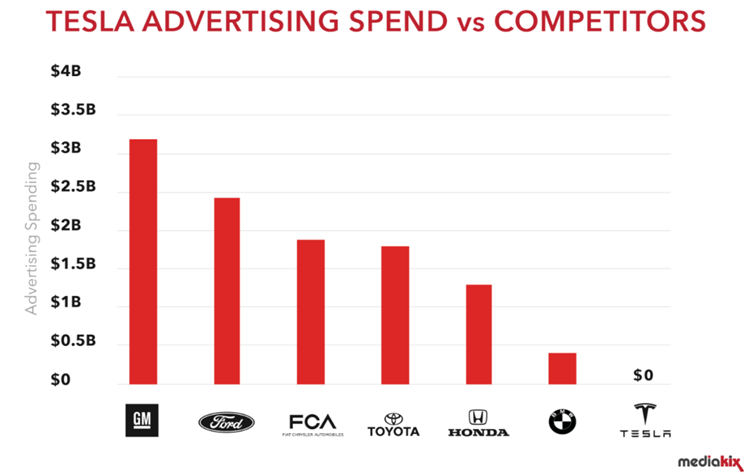

Tesla has a zero cost, one-man marketing machine known as Elon Musk.

Elon, the CEO of Tesla, was recently named Time magazine’s person of the year. He is an icon in his own way and is well regarded by many consumers and investors. It is reasonable to say that many car purchasing and stock investing decisions were made because of Elon at the helm of the company.

Further, Tesla has the first-mover advantage and a solid net cash balance sheet. These are some reasons why Tesla has a superior valuation to its peers.

Concluding statement – is Lucid a serious challenger to Tesla?

While it seems like Tesla currently has a superior position due to its early mover advantage, Lucid does bring a lot to the table and is aggressively competing against Tesla.

It is worthwhile noting that about 80 million automobiles are produced annually, of which 5 million are EVs. Tesla has a significant market share, producing about 1 million, while Lucid aims to ramp up capacity to 0.4 million by 2023.

Hence, we take the view that Lucid is a challenger that Tesla has to be aware of. Nevertheless, we must also not neglect that the competitive landscape involves EV manufacturers and traditional automobile manufacturers.

Because of this, each player should probably just focus on itself, working towards long term trends with technological advancement and production efficiency.

P.S. if you want to catch profitable stocks by identifying the right megatrends, join Alvin in his live webinar to learn how to grow your portfolio .