Have you ever wondered:

- What is a “CDP” account for and why do I need it?

- How do I sign up for a CDP account?

- Why don’t the figures in my brokerage statement match with my CDP statement?

Then you have landed on the right article. Here, we will cover what a CDP account is, why you need it, and why you don’t have to panic when your CDP statement doesn’t match your brokerage account statement.

Let’s begin!

What is a CDP Account?

A CDP Account is a Central Depository Account (henceforth referred to as CDP). If you want to buy and own your first shares in Singapore, you will need to set up a CDP account.

A CDP account acts like your personal safe for your stocks. Whenever you buy a share in a listed company through the open market, it gets deposited into your CDP account.

How To Set Up A CDP Account In Singapore?

There are 2 easy ways for you to set up your own CDP account.

1. Do-It-Yourself Via SGX

Step by Step guide to opening a Central Depository Account (CDP)

- Have a local Bank Account

- Prepare required Supporting Documents

- Fill up an application form on SGX website

1. Have a local Bank Account with Direct Crediting Service

This allows you to receive your dividends and cash distributions via the Direct Crediting Service (DCS). Participating banks with DCS are:

- Citibank NA (Citibank)

- DBS Bank Ltd (DBS/POSB)

- Malayan Banking Berhad (Maybank)

- Oversea-Chinese Banking Corporation Limited (OCBC)

- Standard Chartered Bank (SCB)

- The Hongkong and Shanghai Banking Corporation Limited (HSBC)

- United Overseas Bank Limited (UOB)

2. Prepare required Supporting Documents

What do you need to apply for a CDP Account?

You will need to fill up the online CDP application form and upload the following:

i) Primary Support Document

For Singapore Citizens/PRs:

- NRIC; or

- Singapore Armed Forces ID; or

- Singapore Police ID with Passport

For Malaysia Citizens:

- Malaysia IC; or

- Passport

- Work Pass

For Other Nationalities:

- Passport

- Work Pass

ii) Secondary Support Document

any one of the following will do:

- Bank statement from any MAS licensed banks, or

- CPF statement, or

- Latest Notice of Assessment for income tax from IRAS.

Do note that your support document must be recent (within the past 3 months) and must contain matching applicant’s name and residential address.

iii) Singapore Bank Account

iv) Photograph or Scan copy of your Signature

For authentication purposes only

v)Tax Identification Number (TIN)

This is basically your IC number, for Singaporeans.

But, if you have a tax residency status outside Singapore, you will also need to provide:

- Country/Region of Tax Residency

- Completed Form-W9 (For US citizens)

Don’t worry, non of these are for any surveillance purpose. (we’re sure you’ve paid your taxes) This is simply to allow SGX to do a confirmation check that the address in your NRIC tallies with your current address.

Once you have all the documents above, simply head to SGX’s CPD Account Opening service to complete your online form and upload all the supporting documents as per the instructions provided.

3. Fill up an application form on SGX website

Head to SGX’s website to sign up for a CDP account.

Sounds too troublesome? Fret not, Singaporeans and PRs can now apply for your CDP account online within a few clicks, using MyInfo!

If you’re not comfortable with opening your CDP account online, you can also make an appointment and drop by the SGX Office to make your application.

Or, you can get your broker to do it for you.

2. Get Your Broker To Do It For You

The other way to apply for a CDP account is to get your broker to do the work for you. While you are signing up for a brokerage account, your broker will courteously ask you if you have a CDP account.

You can simply tell your broker to sign up for a CDP account on your behalf using the information that you provided on your brokerage sign up form.

All you need to do is to sign an extra ‘CDP application form’ while signing up for your brokerage account.

Personally, we prefer this option as it allows us to ‘kill two birds with one stone’. Much easier and hassle-free.

What’s The Difference Between a CDP Account and a Custodian Account?

Standard Chartered has been the pioneer of low commission rates for investors since it introduced its brokerage services.

One key difference between Standard Chartered and most brokers is the location that their clients’ shares are being kept. Whenever you buy shares, most brokers will help to facilitate the trade and deposit your shares in your personal Central Depository (CDP) account.

In other words, it is in the safe possession of you and only you. However, if you use Standard Chartered as your broker, your shares will be kept in the custody of Standard Chartered, instead of your CDP account.

And you will not have access to the following ‘perks’ of being a shareholder:

i) Rights to attend Annual General Meetings

An AGM is a mandatory annual meeting of shareholders. At the AGM, companies present their financial statements (also known as “accounts”) before the shareholders (also known as “members”) so that they can raise any queries regarding the financial position of the company.

If you are purchasing stocks under a custodian, they will act on your behalf. Should you wish to attend the AGMs, you need to notify Standard Chartered 7 working days before the AGM.

You will be entitled to the food. But, you will not be able to vote at the AGM. Instead, you will be attending it as an ‘observer’.

*updated! Thanks to Elijah for pointing this out!

ii) Flexibility in choice of Brokers

If your shares are held by the custodian, you can only access them via the same custodian. This means that when you want to sell the shares, or take any other actions with your shares, you will need to go through the same custodian/broker.

If your shares are held in the CDP instead, you can sell your shares through any broker. There is no limitations to use the same broker through which you had bought the shares.

iii) Notice of Corporate Actions

Moreover, if your shares are not held in your CDP, you will not be notified of corporate actions such as rights issue, dividend reinvestment plan and dividends directly via your mail (physical mail). Instead, you will be notified by your broker.

Depositing Cash Upfront For Lower Commission Rates

It’s common for brokerages to get you to open a cash management account with them.

From the brokerage’s perspective, this means that you are committed to using their platform to trade.

They are able to offer you lower commission since they are gunning for you to make more trades with them in the long run.

Beware Of Hidden Brokerage Fees

Some brokerages may charge a management fee if you do not meet their minimum requirement.

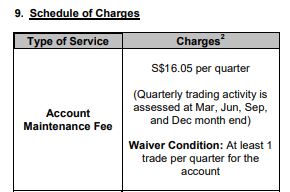

For example, Phillip’s Prepaid (CC) Account charges $16.05 per quarter if no single trade is made within a quarter.

Phillip Prepaid (CC) account maintenance fee

Do read the terms and conditions before you sign up.

Give up on perks for even lower commissions

With the arrival of discount brokers (which are mostly custodian accounts), Singapore investors now have access to even lower trading fees. Chris Ng even compared the potential profits you’ll enjoy with the lower trading fees here.

However, you’ll need to sacrifice some of the shareholder perks mentioned above.

That said, most investors don’t attend AGMs and you’ll still retain your access to corporate actions done through your broker, which doesn’t sound like a huge sacrifice really.

We think that most investors would likely opt for discount brokers because of the fees, but we hope that our local stock brokers will step up their game in time to come.

Brokerage Account vs CDP Account: 6 Reasons Why Your Shares Quantity May Be Incorrect

You will often see the following message when you click on the portfolio in your brokerage account. The wordings may differ but the meaning is the same.

The Portfolio… will not be updated for trades performed with other brokers or for any corporate actions taken on these shares. Information contained within these pages are also subject to manual updates made by clients. Clients should always confirm their actual holdings with CDP or their CPF Investment Agent Banks.

This is to warn you that you should not trust the figures shown on your brokerage account. This is because the account is not linked to your CDP and any changes to the quantity of shares would not be automatically reflected in your brokerage account.

I will share with you 6 scenarios:

#1: Change of Stock Symbol

You may have noticed that a counter you used to own suddenly disappears from your account. You do not remember selling it, but it isn’t there anymore!

Do not panic, you still own the stock. It is likely the stock has changed its symbol and your brokerage account did not replace the entry with the new symbol.

This was very common when SGX’s Minimum Trading Price (MTP) criteria was released and many stocks had to be consolidated to meet the MTP. In the process of consolidation, the stocks changed their stock symbols.

If unsure, always login to your CDP account and check your holdings. It is the most accurate. If you still have the stock, you can manually add the stock into your brokerage account.

#2: Multiple brokerage accounts

Some investors have more than one stock brokerage account. Since stocks are stored with CDP, you can buy from one broker and sell it through another broker, as long as both of them are SGX Trading Members.

However, when you use different brokers to buy and sell, your portfolio in both accounts would not tally. One would still show you have the stocks while the other might show that you have a short position. It’s like having two bank accounts which you use to do different things with.

Hence, you need to be careful when you use multiple brokerage accounts to transact. When in doubt, always refer to your CDP account.

It should clearly display the current balance of shares that you currently own.

#3: Share Split and Consolidation

This should be the most obvious scenario because the number of shares definitely will change.

Splits will increase the number of shares while consolidations will decrease the number of shares.

Similarly, the quantity is not automatically adjusted in your brokerage account.

Some investors might be worried to see their stock price ‘dropped’ significantly after a stock split or be surprised by the ‘jump’ in prices after a share consolidation, misleading them to sell their holdings.

Investors have to manually adjust the quantity after the split and consolidation. Failing to do so might result in you selling a wrong quantity some time down the road.

#4: Bonus Issue

Bonus shares are given to shareholders for free. They are not automatically adjusted in your brokerage account.

On the day that the stock goes ‘Exclude Bonus’ shares (XB), the share price is likely to decrease proportionately to the increased share base.

You would need to adjust it manually.

Read more about what is bonus issue.

#5: Subscribed to Rights Issue

Rights issue give investors the opportunity to buy more shares in the company, at a proposed price. A rights issue can be optional or mandatory and trade-able, depending on the conditions of its proposal.

When you subscribe to the rights, which are essentially more shares, you communicate directly with the issuer. Hence, your broker does not know about the additional shares you are going to receive.

Your CDP should reflect the additional shares after the allotment date and you can update your brokerage account accordingly.

Read more about what is a rights issue.

#6: Pledged Shares For Sale In Voluntary Cash Offer

At some point of your investing journey, you might receive a cash offer from big investor(s) who wants to buy over your shares.

Such announcements would be made public and the offer price made known. If you feel that the offer price is a fair price, you will need to sign and return the acceptance letter to sell your shares.

After you have done so, the brokerage account would still reflect that you ‘own’ the shares but it is no longer the case in reality.

Thus, check your CDP and delete the counter from your brokerage subsequently.

Quick Conclusion

As an investor, you will need the 2 basic accounts to own and invest in stocks. A CDP account to store your shares, and a brokerage to help you execute your trades.

To provide flexibility in cost for smaller investors, brokerages have provided a wide range of products for you to choose from. We’ve provided a quick comparison of using the CDP account vs using a custodian account above.

The most important thing to note as a small investor is the fees.

Before you commit to any broker, make sure you understand the fees you will need to bear as a customer.

Hi!!! Can I check if it’s possible to transfer shares from the custodian account to CDP?

Hi Paul,

You usually are able to transfer shares from your custodian account to your CDP, subjected to fees.

For example, Standard Chartered’s case it will cost $10.70 (with GST) per counter per transfer. You will need to check on the fees with your brokerage/broker.

(you can see their fees here: https://www.sc.com/sg/investment/online-trading/#self4)

Would that be $21.40 instead? CDP also charges for transfer, was wondering if we will be doubly charged (by brokerage and CDP)

“If you want your shares to be held in your CDP instead, you can opt for DBS Cash Upfront Account. It is the only brokerage that does not act as a custodian for your shares.”

I’m pretty sure that Phillip offers a Cash Management account that is linked to CDP, not to mention other brokerages?

Can I also clarify, since CDP is for Singapore stocks only, so CDP linked brokerage account will automatically hold your foreign shares in their custody right?

Hello Pearlyn ,

It might not have double charges ($21.40), as CDP transfer fee applies when you are transferring shares rather than receiving shares. It’s better to check with them directly since it involves various parties.

Awesome!! thanks for the info!

Hi,

I would like to clarify the part (Rights to attend AGMs), for Stan Chart custodian account, you are still able to attend the AGM – you just need to inform Stan Chart. The only downside is that you are not able to vote.

Here are their T&Cs Link, use search function and search for the word AGM: https://www.sc.com/sg/help/faqs/bank-with-us-faqs/#online-trading

Hi Elijah, thanks for pointing that out!

Thanks for the details, it is very helpful.

I have a doubt, if I buy shares/etf in other markets apart from Singapore will it be shown in my CDP account? Can you please eloborate how CDP / custodian works in case of non-Singapore trading done via Brokers in Singapore?

No. CDP is only for SGX listed counters.

If you buy foreign shares, your broker will hold the shares on behalf of you.

Thanks for the wonderful insights. I’m very new to trading, so pardon my ignorance if this is a stupid question. What happens if a broker closes down what whatever reason? What will happen to any local stocks and overseas shares we may have bought?

If you stocks are stored in SGX CDP which is most of the time then you don’t have to worry should the brokerage close down. However, your money in the brokerage may be stuck.

in events of passed on what happen to our cdp. what is the best arrangement if we dont have will. Is it possible to make written arrange with cdp earlier? or what is the alternative. thanks

I believe it will be disbursed according to the Interstacy Law, as with your other assets.

Does cdp has record of my shares purchase 20 years ago

Dear CDP, It is consider immediate family when I intent to transfer share to my brother.

How much CDP will charge for the share transfer

A transfer fee of S$10.70 (inclusive of GST) per counter is chargeable for each transfer request.

Deceased Malaysian with CDP Account left a will on administrator for his assets. Grant of Probate obtained from the High Court. If want to check if there is still shares in the CDP Account, what’s the procedures? Please provide contact and address of CDP for communication.

Note: Remisier said he’s unable to check. Asked to refer to CDP.

General Enquiries : +65 6535 7511

24-hour automated answering service for information on CDP

account related services.

Email : asksgx@sgx.com

Operating Hours

• Monday to Friday: 8.30am to 5.00pm

• Saturday: 8.30am to 12.00pm

Location

11 North Buona Vista Drive #01-19/20

The Metropolis Tower 2

Singapore 138589

Hi, may i know how do i sell my shares in CDP account? I bought the shares through DBS Vickers and link to CDP.After purchased, the shares information no longer exist in my DBS Vickers account(so i can’t sell the shares through their website.All the shares stored in CDP account.But there isn’t any “Sell” button for me to sell the shares in CDP. So how can i sell it?

you can sell through Vickers as long as it is connected to your CDP account.

To be sure, login to your CDP to determine the exact number of holdings you have.

1. When my shares are loaned out – what interest do I earn .??

2. When my shares are loaned out – am I able to sell the loaned shares .??

1) depends on the stock, the duration of the loan and the broker.

2) Yes.

more info here: https://drwealth.com/how-to-add-up-to-2-8-to-your-dividend-yield-by-lending-out-your-shares/

hi,i receive 1 cdp notification saying my cdp securities account and trading account with phillip securities pte ltd has been processed successfully on 13/10/2020 but I receive another letter on 23/11/2020 saying my linkage between cdp securities account and trading account has been terminated due to closure of my trading account.can u tell me what does this mean?

Trading accounts have to link to CDP if you want to keep your stocks in the latter.

Many trading accounts can link to one CDP.

If you close the account, it will not link to CDP. But your CDP account is still there.

I know individual can only own 1 CDP account, what about custodian account?

Custodian account is where the broker keep your shares on your behalf

Hi & howdy,

Can you please provide the link to download form for dividend payout to be deposited direct into my bank account? Thanks & happy working!

Rose

https://www.sgx.com/apply-services

Hi Dr Wealth,

Assuming 1 stock is offering Rights.

I have some shares in CDP and some shares in custodian holding by broker, can i do 1 subscription for my CDP holding and another subscription for those shares in custodian holding?

Yes. CDP and your broker will notify separately so you can tell them the instructions.

CDP Joint Account.

Can the 2nd person in the joint account act on behalf of the main account holder in all matters besides buying or selling shares? The main account holder is still around except that he do not understand English.

My experience is that one person can act on behalf on most matters such as applying for rights issue. Closing down account might need both agreement. Best to check with CDP directly with the task you want to carry out.