Seatrium Limited (SGX: S51) is a blue chip stock listed on the Singapore Exchange. The company provides innovative engineering solutions to the global offshore, marine and energy industries.

Seatrium has 60 years of track record in the design and construction of rigs, floaters, offshore platforms and specialised vessels, as well as in the repair, upgrading and conversion of different ship types.

In keeping up with the current times, Seatrium is focused on sustainable solutions to advance the global energy transition and maritime decarbonisation.

Seatrium’s offerings include offshore renewables, new energy, and cleaner offshore & marine solutions. Its customers include major energy companies, owners of floating production units, shipping companies and cruise and ferry operators.

Formerly known as Sembcorp Marine

If you’re wondering where Seatrium came from…it was previously known as Sembcorp Marine.

It was renamed on 27 April 2023 as Seatrium Limited, following its merger with Keppel Offshore & Marine Ltd, is a global player with deep engineering expertise.

Seatrium retains Sembcorp Marine’s ticker S51 and was added back into the Straits Times Index on 19 June 2023, replacing Keppel DC REIT.

What does Seatrium do?

Seatrium operates in the Offshore and Marine industry serving drilling contractors, shipping clients and more. Here are the 4 Strategic Business Units within Seatrium:

1) Oil & Gas Newbuilds and Conversions:

Globally-integrated design and construction of complex rigs and production turnkey solutions such as but not limited to Gas terminals, Gravifloat solutions, offshore fixed platforms, modules and drillships

2) Renewables and New Energies

Turnkey solutions for fixed platforms, offshore wind and new energies solutions such as but not limited to Offshore windfarm fixed platform, wind turbine installation vessels and floating wind turbines

Design and build a range of viable, cost-effective and highly adaptable solutions to the highest technical specifications for a global clientele.

3) Specialised Shipbuilding

Design and construction solutions for high-performance, specialised vessels with a focus on the global energy transition and decarbonisation.

Building Future-proof Specialised Vessels and Solutions such as but not limited to Renewable energy support vessels, Offshore support vessels (heavy-lift, pipe-lay and accommodation), Naval support and security vessels, Research and scientific survey vessels.

4) Repairs & Upgrades

Dry-docking, repair, refurbishment, retrofitting, life extension, upgrading and conversion of offshore & marine vessels and structures.

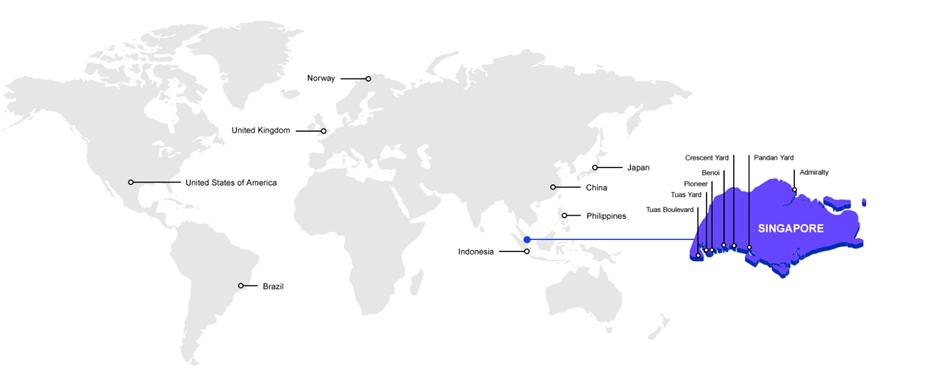

Seatrium provides these services out of shipyards and other facilities in Singapore, Brazil, China, Indonesia, Japan, the Philippines, Norway, the United Kingdom and the United States.

Seatrium’s 1HFY23 Financial performance

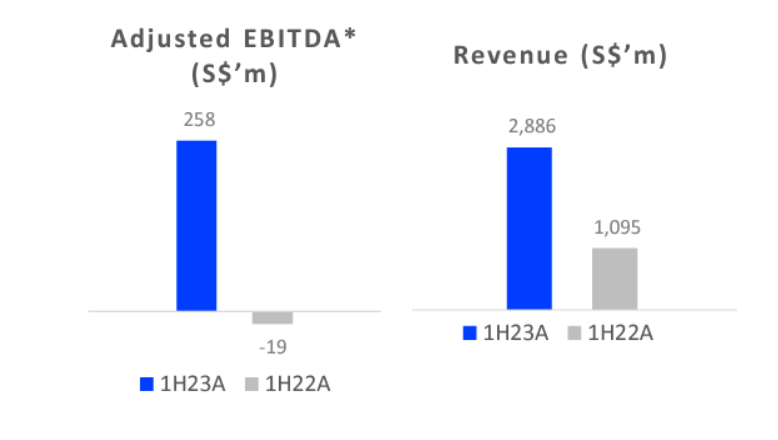

Seatrium announced its 1H2023 financial results in July 2023, showcasing good revenue growth traction, positive EBITDA and a track record of timely project deliveries, with substantial progress made in the completion of projects in the pipeline.

Seatrium’s revenue during 1H2023 was S$2.9 billion, recording a notable increase of 164% from S$1.1 billion YoY. This increase in revenue was attributed to the combination, strong operational execution, achievement of production milestones, and initial contributions from new projects.

Seatrium’s EBITDA of S$27 million in 1H2023 was higher than the negative S$19 million in the same period last year.

EBITDA before provision for contracts and merger expenses amounted to a creditable S$258 million for 1H2023. However, the Group reported a net loss of S$264 million in 1H2023 due to provision for contracts and merger expenses.

These provisions were for identified contracts in the US where delivery was extended due to border closure and manpower issues.

Seatrium anticipates operational and financial performance to continue to improve, unfortunately it expects to make a net loss for FY2023.

Additional takeaways from 3Q23 business updates

On 8 Nov 2023, Seatrium released their latest 3Q23 updates. Here’re 2 takeaways that you should note about the state of Seatrium:

1) Robust Orderbook status

Seatrium continues to execute projects well with eight key deliveries YTD and 33 projects in progress with deliveries till 2030.

After including contract wins of S$4.3 billion to date, net order book stands at S$17.7 billion. The order book mix comprises approximately 40% renewables and cleaner/green solutions.

Seatrium continues to build a strong track record in the renewables market segment, in line with the marine and offshore industry’s commitment towards decarbonisation and low-carbon energy solutions.

2) Market outlook

Currently, there are issues in the offshore wind industry arising from macroeconomic forces, construction supply chains and regulatory support on energy transition. The issues are largely confined to the east coast of the USA but has affected wind turbine demand and prices globally.

Seatrium stated that it is not affected by the issues and noted that all of its contracts are cashflow neutral given that it is paid based on milestones and will not suffer in the event of a cancellation. This is of course with the assumption that it gets paid for its milestone progress.

From a longer term outlook, the US still retains its plans to increase its clean energy sourcing by scaling up its offshore wind power substantially.

In Europe, the offshore wind industry appears more stable given that Seatrium’s exposure is via national grid operators such as RWE and TenneT, which are very focused on energy transition.

In its repair and upgrade segment, Seatrium remains ambitious and optimistic especially now that Singapore only has a single yard attracting business instead of Keppel Offshore & Marine and Sembmarine competing for work.

Looking out into 2024 and beyond, Seatrium highlighted that it will start to move away from pure repair and instead facilitate energy transition via vessel upgrades such as the installation of decarbonisation technology and deployment of new technology underpinned by demand for dual-fuelled vessels which arose from the new decarbonisation rules and regulations from the International Maritime Organisation.

Lastly, Seatrium is carrying out a Strategic Review and the outcome will be communicated within 1H2024.

What happened to Seatrium?

Previously in June 2023, we mentioned that Seatrium has a strong balance sheet, sizeable order book and order pipeline underpinned by industry tailwinds.

However, due to the market cap size, the company would have to deliver strong net margins on its revenue to justify a reasonable price to earnings ratio valuation.

To do that, Seatrium needs to execute on its sizeable order book, deliver strong profits and reward shareholders accordingly.

Since June, share prices have fallen by about 15%.

Share Disposal by Keppel Corp

Keppel treats Seatrium as a non-core investment that is to be disposed of. Hence, Keppel Corporation (SGX: BN4) has been disposing Seatrium shares multiple times this year and now only has a 2.069% stake in Seatrium as compared to 7% at the onset of the merger.

The retained stake was intended to be used to meet certain identified contingent liabilities, should they arise, for a period of up to 48 months from the completion of the merger.

There were no claims made to date and we believe Keppel is reducing its stake as the contingent liabilities reduce over time.

Is Seatrium a good buy?

Now that Seatrium has released its 1H23 financials as well as provided a 3Q23 business update, we have more visibility on Seatrium’s execution.

The company had achieved an EBITDA excluding provision for contracts and merger expenses of $258 million for 1H23. After including the provisions and meger expenses, Seatrium recorded a net loss of $264 million. Due to this sizeable loss, Seatrium has also forecasted to make a net loss for FY23.

Seatrium also has not disclosed much about the provisions except that it is a sizeable amount. As projects are still ongoing, there could be more provisions in 2H FY23, albeit potentially of a smaller quantum.

While it has to be acknowledged that Seatrium is able to execute projects well, as projects tend to span a few years, this leaves investors concerned on any further exposure to the status of the project as the macro environment changes in the short term.

At this point, we are still not convinced that Seatrium would be a buy and may not ever be convinced until something substantial changes.

At 11c will Sembmarine price go down or attempt another right issue ?….at what price we can buy ?

Currently, we are still not convinced that Seatrium would be a buy. Will have to see if it can weather the upcoming macro environment changes.

As for rights issues, we can only speculate and wait for official announcements from the management.