It was 13 Jul 2015. Oil price tanked from US$115 to US$57 over a year. That’s a good 50% drop! Many investors were spooked and started to sell their shares in oil and gas companies. Blue chip companies were not spared either. In the same period, Keppel fell from $10.69 to $8.11 or a 24% decline.

Sembcorp fell from $4.04 to $2.82 or a 30% drop. Large order books didn’t count much to comfort investors. In fact, it was expected that many of these orders would be cancelled. Even receivables were not safe, clients could go bust and not a penny could be recovered.

Even the strongest believers in blue chips have their faith wavered.

‘Could this go worse from here?’

‘What if the price goes down further if I do not sell the shares now?’

Such doubtful self-questioning are bound to happen from time to time. It is only human.

Oil and gas is not the best industry and most stocks have failed our criteria

Most of the oil and gas stocks wouldn’t pass our Value Factor and the Conservative Net Asset Value (CNAV) strategy.

The oil and gas is an asset heavy and high capital expenditure industry. Companies likely have to borrow large amount of money to fund the purchase and maintenance of the equipment. Thus they end up with higher debt levels and depresses the book value. It would be hard for their share prices to trade below their asset values and hence we would not invest in most of them. To make things worse, they usually have to pay for the cost of construction and material costs and only collect payments when certain milestones have been completed. This is bad for cash flow and problems come when clients stop paying and your creditors start asking for money.

For example, companies like Ezra used to be the darling stocks during the oil-booming years. With a debt-to-equity of 150% before the crisis, it didn’t even come near to passing our criteria. It is now suspended from trading as they have defaulted on their bond payments. And it was a good thing that our rules saved us from the many disastrous stocks that eventually ran into problems.

One oil and gas stock did surface in our screened results and that was PEC.

It caught our attention as it was rare an oil and gas stock pass our criteria. This could be an opportunity as even fundamentally strong stocks could be heavily mispriced when the entire industry is in the doldrums. But as long as they pass our criteria, they should have sufficient assets to weather the storm and emerge unscathed.

Why invest in PEC?

PEC provides engineering, procurement & construction services to industries like oil & gas, petrochemicals, oil & chemical terminals and pharmaceuticals. Basically they build and maintain production plants.

We can split the oil and gas industry into upstream and downstream activities. Upstream activities include exploration and production. Companies like Keppel and Sembcorp Marine that build oil rigs are considered to be in the upstream.

PEC on the other hand, serve the downstream customers, those who are involved in oil refining and petrochemical production.

Generally, low oil prices are bad for upstream businesses as the production will decline and the whole economic pie shrinks. On the contrary, it would be good for downstream businesses as now the input, which is crude oil, is cheap. This would translate to higher profit margins. Hence, you shouldn’t be surprised that the crude oil price drop does not correspond with an equal decline in petrol prices at the pump stations.

Vertically integrated companies like Exxon Mobil and Shell whereby they have both upstream and downstream businesses will be more resilient despite the cyclical nature of oil prices. They simply make more money on either side depending on the oil price.

Hence PEC should not be punished so much as the downstream activities should carry on.

We wanted to see if PEC had good assets to back up our investments. If worse comes to worst that PEC collapses, the assets could be liquidated and we could still make a profit. But it is very unlikely since these companies that pass our criteria tend to be lowly geared, have healthy cash flow and good assets. It is more likely that they will survive the downturn while other highly geared and cash flow strapped competitors go bust. The surviving companies would then gobble up the market share left behind by the exiting firms, and grow stronger after the industry recovers.

Looking at PEC’s balance sheet in 2014 below, the major assets were

Property, plant and equipment are understandable as they have fabrication plants to produce parts required for construction projects. We would discount half of this value.

Their largest asset was receivables (contracts-in-progress + trade receivables) with a total value of $128m. But we want to be conservative and assume some of the clients could not pay up, we only count half of the value. There were no concentration of customers as the three largest customers comprised 13% of the receivables.

Lastly, they have a healthy cash position of $82m so their runway should be long enough and unlikely to collapse.

On the other hand, they only had $6m debts! That’s very low and the cash is more than enough to repay the debts.

But they do have large payables and the total liabilities were $108m, which were manageable.

The operating cash flow was positive and hence it is unlikely they will drain their cash. It is very unlikely they will go bust.

Moreover the executive chairwoman, Edna Ko, together with her brother, own 56% of the company. There’s enough skin in the game such that they would suffer most financially if PEC sinks.

Our conservative valuation of PEC was around $0.44 and the share price was trading at $0.39. This gave us an 11% discount and we believe the investors have overreacted to the oil price shock and priced PEC stock irrationally.

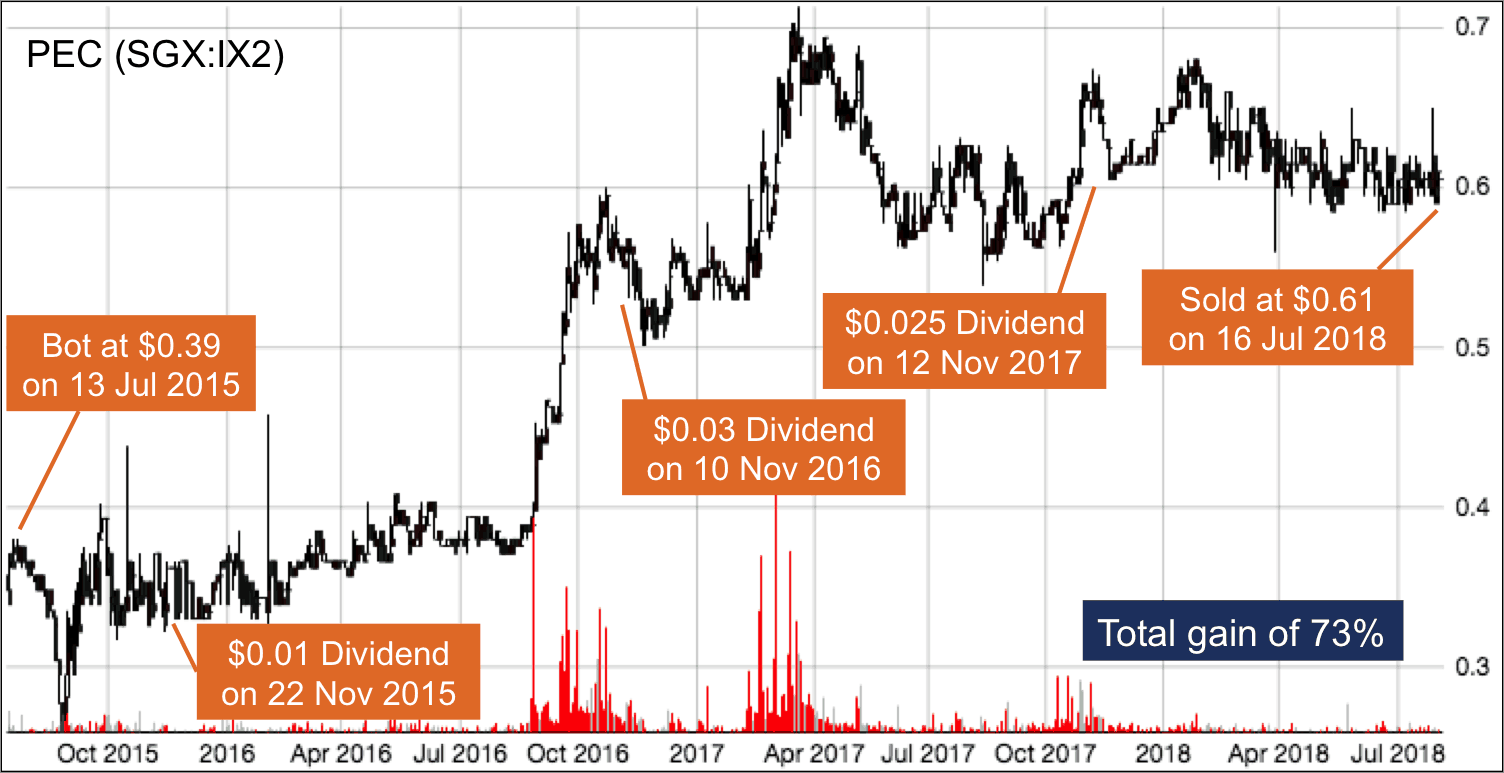

We took a position on 13 Jul 2015.

We were proven right and we sold PEC

Swiber, Ezra, Rickmers Maritime, Otto Marine, and Marco Polo Marine eventually ran into debt problems. They had to restructure the debts and loosen bond convenants. Many bond holders had to assume they are not getting their money back. This is where the ‘bonds are safer than stocks’ belief can torn down to shreds.

A few years prior to this bond debacle I have heard some bank clients were offered some of these bonds plus leverage. This means that the bank lend them money to buy more of these bonds so that their yields can be higher. For example, an investor can buy $250k worth of bonds and the bank lend another $750k to him so he effectively hold $1m. If the interest is 5%, he could get over 10% after the leverage and accounting for the interest spread incurred. It definitely look lucrative and bonds are safer than stocks, right?

While the oil and gas industry continue to sink, PEC was still paying dividends every year. The business was not affected and soon investors recognised PEC was not like the rest of the oil and gas companies. The share price rose and PEC even gave special dividends in 2016 and 2017. We would have preferred to sell it at around $0.89 but we have a time stop rule where we would sell a value stock if we have held it for three years. Hence we sold it for $0.61 on 16 Jul 2018 for a total gain of 73%.

Hi Alvin

As most US companies were fairly/overpriced by market, I am slowly switching some of my USD holdings to adding some position on emerging market (China companies) with good earning records and reasonable/good valuation. China market/Shanghai Composite had go down >40% from last peaked at 4611 points. Risk – “The Chinese stock market is still in the initial stage of development and the total market capitalization is becoming bigger and bigger, but the quality of the stock market still has some problems (such as) the transparency, the supervision, the maturity of the investors and whether they know what they are doing.

I also start adding some position on real/hard asset, precious metal (Silver) and later also Gold when gold price get more attractive (hope it goes below USD1,000/troy ounce). I am also learning to value miners if gold & Silver price continue to go down more eventually some of the miners with good underline asset, good management, low leverage & low mining cost, long mining live/reserve, stable geographic and reasonable earning will begin to looks attractive (preferable to buy miners after they survey the current low precious metal price and the coming financial crisis).

Holding precious metal in Singapore may consider saver environment (low crime). Singapore has no capital gain tax & no GST for buying/selling most precious metal. Nil freight cost as compare to buying from US. I will also advertise online to buy Silver at spot price if as I confident knowing what I m buying (test silver with hard drive magnet, listening to the right sound for pure silver, precise weight, silver with recognized LBMA standard).

Demand from the silver investment bar and coin sector is strong with demand also being supported by the diverse industrial and technological applications which require silver. With demand outstripping supply and with silver mining output set to shrink in the next years, the silver market looks fundamentally strong. Furthermore, above-ground stockpiles of silver, unlike gold, are very small, which puts another constraint on potential supply. Potential manipulation of silver prices is an additional consideration which may have put pressure on the price during many years.

I like Silver (for hedge) as the price had come down from last peak at USD47/troy oz to current price USD14.00/troy oz. At current price I am almost buying at World average Silver miners production cost about USD14/troy oz. A bargain that with limited down site and huge up site reward when the next Silver run.

I had invested 15% at USD14/ troy oz and plan add another 20% if the price drop every 20% from USD14. This way I can withstand 60-80 % drop.

Increasing strong demand for industrial tech applications, Jewelry, Coin & Bars, Silver investment trust reserve holding demand, strong economy, easy monetary policy, above-ground stockpiles of silver are very small which eventually Wall Street and everyone will look into having Silver again.

Silver & Gold have been considered monetary asset throughout most of recorded history.

One Dollar In Silver payable to the bearer on demand and 1933 gold standard dollar bill. This clause became obsolete.

One dollar during 30s can buy an Oz of Silver but can’t buy a little of fuel now. If we choose to go to the bank and change the one dollar to keep one Oz of silver at peak we can buy 47 little of fuel.

With rising US T bond rate causing higher USD should make commodities like Silver & gold priced in USD to cost more. I start buying at physical silver at USD14/oz ( paper silver like (SLV) don’t required to pay spread & premier) is for 1. Price is reasonably low enough so i can start buy some ( can’t wait to touch them and like the beauty of some nice looking silver after cleaning them with baking soda & boiling water on an aluminum foil. 2. In exchange to reduce wife n children spending – when my wife wanted to spend for a longines watch, i talked her into buying a 100oz JM instead, when my son wanted to spend on his #6 pair of sport shoes, i bough him a 1KG Heraeus. You need to explain to them the reason to buy silver. I understand precious metal have cycle and wasn’t a productive asset that can generate cash flow over time ( which’s why Warren Buffett don’t like gold). I am also learning value investing