In what’s slated to be the largest tech and gaming deal to date, Microsoft has announced an all-cash acquisition of Activision Blizzard, the maker of “Warcraft”, “Call of Duty” and “Overwatch” for $95 per share. The transaction is valued at $68.7 billion.

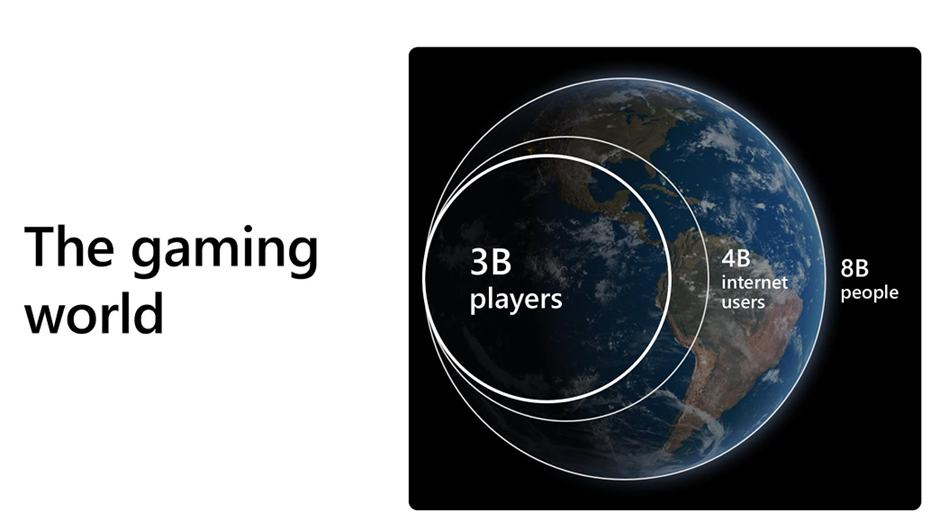

With three billion people actively playing games today, gaming is now the largest and fastest growing form of entertainment.

With this acquisition, Microsoft has the noble intention of bringing the joy and community of gaming to everyone, across every device.

Satya Nadella, the CEO of Microsoft commented:

“Our vision is for a river of entertainment where the content and commerce flow freely, driving a renaissance across the entire industry to make games more inclusive and accessible to all. And together with Activision Blizzard, that’s what we will be able to deliver. Removing these barriers will only become more important as the digital and physical worlds come together and the metaverse platforms develops.”

Immediate market impact

When the news was announced, the effects of the deal was felt strongly across many gaming stocks with Sony (TYO:6758) declining 13% as investors were worried about the added competition that Sony’s Playstation would face against Microsoft’s XBOX.

Electronic Arts (Nasdaq:EA), the second largest gaming company in America after Activision Blizzard saw its share price increase by nearly 8% in its intraday high on speculation that it could also be a potential buy out target.

Similarly, Stocks such as Unity Software (NYSE:U) and Roblox Corporation (NYSE:RBLX) all made strong intraday highs before the weak broader market sentiments took share prices down a notch.

When will the deal be done?

The transaction, which is subjected to customary closing conditions, completion of regulatory reviews such as anti-competition reviews.

Activision Blizzard’s (Nasdaq: ATVI) shareholder approval came after a blockbuster year for gaming related stocks with successful IPOs for stocks such as Roblox and Unity while stocks such as GLU Mobile and Zynga (Nasdaq:ZNGA) were bought out or in the process of being bought out.

The deal is expected to be closed in Microsoft’s fiscal year 2023 (i.e. between July 2022 and June 2023) and will be immediately accretive to Microsoft’s bottom line.

Why does Microsoft want to buy Activision Blizzard?

The acquisition will increase Microsoft’s revenue, utilise its growing cash hoard and substantially grows its gaming segment and any metaverse opportunities that comes along with it.

When the transaction closes, Microsoft will become the world’s third-largest gaming company by revenue, behind Tencent and Sony. The planned acquisition will add iconic franchises from the Activision, Blizzard and King studios such as “Warcraft,” “Diablo,” “Overwatch,” “Call of Duty” and “Candy Crush”. Activision Blizzard is also involved in global eSports activities through Major League Gaming and the company has studios around the world with nearly 10,000 employees.

There is immediate synergy as the deal will add nearly 400 million monthly active players and 25 million game pass subscribers to Microsoft’s community, hence substantially enlarging Microsoft’s successful gaming ecosystem and propelling Microsoft to become the world’s third largest gaming company.

Details of Microsoft’s Activision Blizzard acquisition

On an annual basis, Activision Blizzard will contribute more than $8 billion of revenue and $2 billion of net income to Microsoft’s current revenue of nearly $170 billion and net income of $61 billion.

The acquisition is valued at about 8 times Activision Blizzard’s 2020 revenue and about 6.5 times its forecasted 2021’s revenue which is lower than Microsoft’s current valuation of about 13 times price to sales.

The acquisition will also add about $0.26 per share of earnings to Microsoft’s $8.05 per share earnings on an annual basis.

Is the acquisition good for Microsoft’s shareholders?

The acquisition is great for Microsoft’s shareholders as Microsoft is able to deploy its cash holdings more meaningfully, gaining a foothold in this segment with the acquisition and increasing earnings attributable to shareholders. The acquisition is also financially better for Microsoft as compared to using its cash for share buybacks due to Microsoft’s current valuation.

Microsoft had more then $130 billion in cash as at 30 September 2021 and would be able to fully fund the acquisition without taking on additional debt. Microsoft will still be in a net cash position after the acquisition.

In addition, Microsoft currently pays a dividend of $0.62 per quarter and recorded earnings per share of $8.05 in its latest financial year ending 30 June 2021 which means that it is unlikely that Microsoft has to reduce its dividend. In fact, as the acquisition is accretive, Microsoft is able to increase dividends to shareholders.

One downside for Microsoft would be potential challenges of having to integrate Activision Blizzard into the company as there has been questions over the culture of Activision Blizzard due to the lawsuits over harassment and discrimination.

Alvin also shared his take on how this acquisition could help Microsoft stay ahead in the metaverse race.

Is the acquisition good for Activision Blizzard’s shareholders?

The company has been in turmoil since July 2021 when news broke of a lawsuit against the company due to numerous complaints about unlawful harassment, discrimination, and retaliation against employees. The lawsuit has continued to play out with new findings surfacing, causing senior employees to leave the company. Employees also staged a walkout demanding the CEO’s resignation following more allegations surfacing.

The offer price of $95 is a substantial 45% premium over its last traded price before the announcement. It is slightly below the all time high of $104 recorded in February 2021. Activision Blizzard was trading around $90 in July 2021 and immediately after the lawsuit was disclosed, share prices fell to $80 and hit a 52-week low of $56 in December 2021 as it became evident that the lawsuit was impacting the company significantly.

The acquisition provides an opportunity for Activision Blizzard’s shareholders to cash out on a company that has some short term headwinds from negative sentiments over the company.

In summary

Microsoft’s acquisition of Activision Blizzard will allow it to become the third largest gaming company in the world, establishing a foothold and positioning it to build a stronghold in this segment. The acquisition has many clear positive rationale and seems to be beneficial to both shareholders due to the reasons mentioned above.

It is noted that Activision Blizzard’s share price closed at $82.30 at the end of the first trading day, a substantial discount below the offer price. As the offer is all cash and does not have a share component, the value of the offer is not subjected to fluctuation.

While the offer is still subjected to regulatory approval, as Microsoft does not control a significant portion of the gaming segment, chances of regulatory approval are high. This provides an opportunity for investors to carry out merger arbitrage by buying Activision Blizzard’s share and wait for the merger to be completed between July 2022 and June 2023.

Of course, there is always a risk that the merger may be delayed or not proceed at all due to market conditions, antitrust concerns or other reasons. Should the merger not proceed, Activision Blizzard’s share prices will likely be impacted.

p.s. not sure if a stock like Microsoft is a good fit for your portfolio? Alvin shares how Dr Wealth picks profitable stocks for their own real money portfolio at his live webinar. Click here to check if there are free slot available.