What are treasury bills?

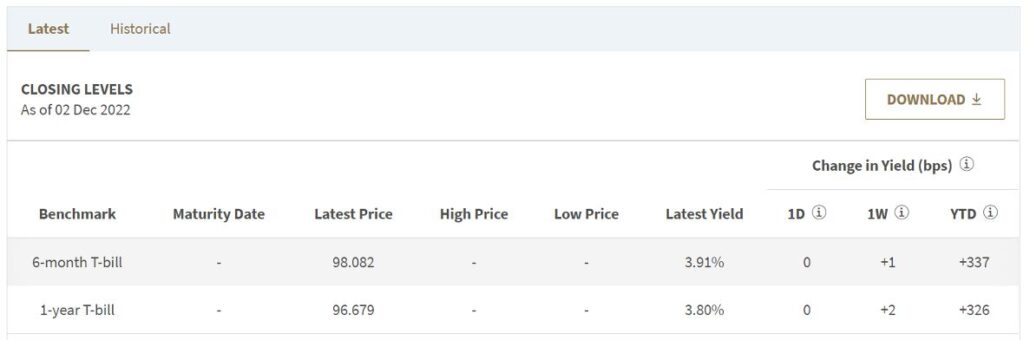

Treasury bills or T-bills are short-term tradable Singapore Government Securities (SGS), available at six-month or one-year tenors. T-bills do not pay out interest, instead, they’re issued at a discount to the face value. Upon maturity, you will receive the full face value.

If you can set aside your money for a year, you can consider investing in one-year T-bills. In an upward sloping yield curve, they may offer higher yields compared to six-month ones, as there is more risk priced into the security due to the longer duration. The longer tenor also provides certainty of the rate of return for a longer duration.

Although treasury bills are considered low risk, with a fixed return, that also means the return will likely be lower than other investments long-term.

Regardless of the economic or interest rate environment, treasury bills are always one of the lowest yielding assets, due to the comparably lower risk profile.

Here are 4 reasons why I will never put money into Treasury bills.

4 Reasons why I’ll never put money into T-Bills

1) Low investment returns

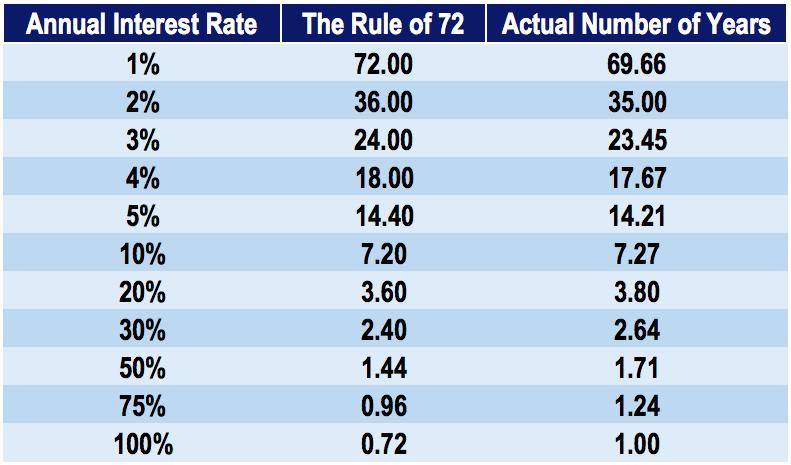

A yield of approximately 4% is inadequate in many regards. Based on the rule of 72, with an annual interest rate of 4%, it takes nearly 18 years for the investment to double.

The upside of investing in stocks over bonds is that the potential for profits can be greater. When companies perform well and economic outlook is positive, stock prices can increase multiple times.

The S&P 500 Index has long been one of the best-known proxies for the U.S. stock market. People often use the S&P 500 as a yardstick to compare investment return.

The most recent 20-year span, from 2001 to 2021, not only included three bull markets and three bear markets, but also experienced a number of major black swans with the “tech wreck” and terrorist attacks in 2001, the financial crisis in 2008, and the COVID-19 pandemic of 2020-22.

Despite these unprecedented events, the S&P 500 still managed to generate a total annual return of 8.06% with reinvested dividends. The total return over this period was 409.13%, which means that a $10,000 investment made at the beginning of 2001 would have been $50,913.05 by the end of 2021 or 5 times the amount.

A 3% yield would have provided a return of only 80% over 20 years while a 4% yield would provide a 119% return on investment. A 5% yield, which is highly probable based on the current Fed’s interest rate projections would provide a 165% return over the 20 year time period.

All pales against the S&P 500.

2) High Inflation environment

Inflation acts as an anchor to the value of cash. In a high inflation environment, to avoid devaluation to one’s assets, investors tend to seek higher returns. In this case, with the Singapore rate of inflation at more than 5% in 2022 and US rate of inflation at nearly 8%, having a yield of 4% is inadequate to mitigate against inflation.

In Singapore, the Monetary Authority of Singapore (MAS) said that domestic inflation is likely to persist at elevated rates for some time, as firms adjust prices to catch up with the steep increases in input costs that have accumulated along production chains. MAS reiterated its 2023 projections for core inflation – which exclude accommodation and private transport costs – to average 3.5% to 4.5%, and headline inflation to average 5.5% to 6.5%.

On the other hand, many other asset classes benefit from inflation. For example, property prices tend to increase as wages increase.

For stocks, although companies may be impacted in the short run where they are unable to pass on higher input costs to customers through price hikes, in the longer run, companies tend to be able to pass on these higher costs. This means that overall revenue and profit will increase, which leads to higher share prices.

3) Short tenor (Duration risk)

There are market expectations that rate hikes will be completed by 1H23, with another 1% interest rate increase by that time. In addition, some analysts expect interest rates to be cut from 4Q23.

Although a short tenor provides flexibility, with T-bills being only six-month or one-year in duration, in a period of declining interest rate, for investors who typically allocate a certain percentage of their investments into bonds and other similar assets, they may be faced with a low interest rate on the next renewal/rollover.

Investors who are concerned over interest rates becoming lower in a year’s time can mitigate against duration risk by placing their cash in longer tenor products such as the Singapore Government Securities Bonds with maturities ranging from 2 years to 50 years.

Of course, that said, 50 years is too long and a more appropriate tenor should be considered.

4) Opportunity cost

Some would say that the true cost of investing is opportunity cost.

It’s a core concept for both investing and life in general. When you invest, opportunity cost can be defined as the amount of money you might not earn by purchasing one asset instead of another.

For T-bills, despite the short tenor, cash is still locked up and there is an opportunity cost to investing in the T-bill. Although there is an option of selling the T-bill in the open market to switch to another asset, with a possible worst case scenario of a few percentage points loss, many investors would baulk at this idea and would rather hold to maturity.

Closing statements

T-bills are widely regarded as a stable, low-volatility source of income with a lower risk of permanent losses than stocks and at the same time, the higher yield than savings helps protect value against inflation.

However, T-bills can lose value if you sell the bond before maturity and interest rates have increased and it has also generally underperformed stocks as a long-term investment.

Portfolio diversification is perhaps the most important consideration of investing. That depends on your investing goals, your risk tolerance and your portfolio’s makeup.

While waiting for the bear market to end, one may be tempted to deploy as much as possible into T-bills but one should always be aware that the end of the bear market is unpredictable and should maintain flexibility with their investments.