The rise of Artificial Intelligence has certainly piqued my interest in it from an investment and practitioner perspective.

Recently, I’ve been tinkering with ChatGPT (and now the newly released ChatGPT4). With its ability to pass medical and law exams, I was curious if it could help me analyze stocks.

If you have used ChatGPT, you would know that you’ll need to ask smart open-ended questions rather than “close-ended questions”. For example, questions like “Should I invest in Tesla stock?” will not yield you a meaningful answer:

After spending weeks chatting with ChatGPT, I think I’ve finally managed to optimize the process to using the AI chatbot to help analyze stocks.

Here’s how (using Tesla as an example):

1. Ask ChatGPT what you need to know before investing in a stock

I asked ChatGPT what should I analyze and check before investing in any company. ChatGPT returned 6 pointers which I generally agree with. They are:

- financial statements,

- company performance,

- industry analysis,

- management team,

- risks, and

- valuation.

2. Ask for financials of the stock

Next, I asked ChatGPT to brief me about Tesla’s financials. Apart from highlighting its strong growth, it did not divulge much breakdown and details.

In summary, ChatGPT reports that Tesla has been growing well.

However, it got antsy when I asked for a detailed breakdown of Tesla’s historical financials.

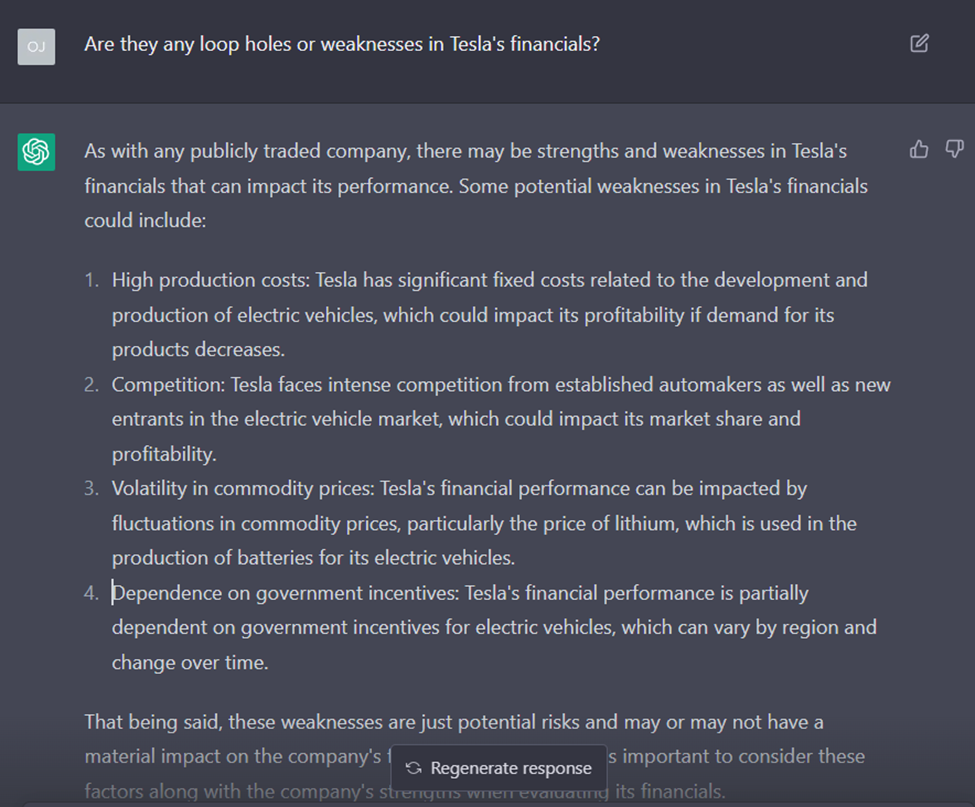

3. Ask for weaknesses of the stock

I changed the direction, asking it to highlight the weaknesses of Tesla’s financials.

While it did give an elaborated point form description of other matters, it highlighted Tesla’s high production costs, and the tendency of Tesla’s margin to be impacted by commodity prices, particularly lithium.

3b. Fact check

Although the AI is pretty well-trained, the current version had only been trained with data up to 2021, so remember to do your own fact-checking!

That said, so far ChatGPT is quite accurate.

Tesla’s gross margin did fluctuate between 27% to 16% for the last 10 years. Its operating expense has also ballooned and grown. But since Tesla is still growing, these expenses are justified. Growth comes with a cost, so long as the margins are protected or do not get severely eroded, escalating expenses should not be penalized.

Since ChatGPT raised the issue of volatility in lithium cost, I wanted to find out whether Tesla hedges its lithium requirements.

Unfortunately, ChatGPT was not able to come back with an answer. So homework time for interested investors!

4. Ask for the historical & future performance of your stock

Anyone with investing experience would know that Tesla has been one of the most impressive growth companies for the last few years. Tesla has disrupted the traditional automotive industry and has become a major leader in the electric vehicle (EV) market. The company’s vertical expansion into energy storage and solar products has helped in terms of diversification.

While the AI doesn’t have a crystal ball to predict the future, we know that the EV and clean energy markets are growing rapidly. Thus, current market leaders will still benefit from the expansion of the total addressable market.

Should Tesla keep up with its growth, initiatives, and momentum, the future still looks good.

5. Ask for the market share of your stock

When prompted on the market share of Tesla in total EV sales and the entire spectrum of vehicles sold, ChatGPT replied as below:

6. Ask for an analysis of the related industry

Next, you need to understand if the industry will do well in the future.

In the case of Tesla, I asked ChatGPT for its analysis on the EV industry. ChatGPT provided a brief summary of the demand, supply, challenge, and opportunities of the EV industry.

In a nutshell, EVs became an alternative in the wake of concerns over climate and pollution, while being provided support through policies, incentives, and even technological advancements. This not only gave rise to new EV companies but also incentivized internal combustion (ICE) engine car makers to embark on EVs as well.

However, some major challenges that EVs face right now are the infrastructure for charging and also the relatively high costs an EV costs.

7. Ask for a Management analysis

Management team analysis is more subjective compared to facts and figures. But after prompting ChatGPT, I felt it replied well for an AI.

Elon Musk can be talented and a visionary, but he can be controversial. Of course, since ChatGPT’s database is from 2021 and before, it had no real comments on the Twitter acquisition side effect on Tesla’s future since now Musk has to juggle his attention between both Tesla and Twitter.

8. Ask for potential Risks

This a subtopic that many investors choose to ignore when doing due diligence studies on potential companies to invest in.

ChatGPT named some of the key risks of investing in Tesla. This includes Elon Musk himself as a key personnel risk, tight competition, and also share price volatility.

One key risk that I fully agree with is its production and delivery challenges – any unfavorable production and delivery numbers can hurt Tesla’s share price really badly due to volatility.

9. Ask for Valuation

Next, the million-dollar question – Valuation.

This topic seemed to hit a snag as ChatGPT was not really helpful in giving an opinion.

Hence, I tried to get it to vomit out some facts and figures, prompting it to analyze multiple valuation ratios numerically. Again, it did say that SOME INVESTORS consider it cheap, and SOME INVESTORS considered it expensive.

So, we hit a wall on this one.

Then again, this is the reason why valuation and investing are also an art.

Depending on the metric and qualitative analysis done, different investors can come up with different conclusions.

Use ChatGPT the RIGHT way

ChatGPT is powerful and can be trained into something even better than its present-day model. It is very good at explaining facts, and figures and providing a general perception.

However, like most of us, it struggles to grasp topics and items that hold multiple perspectives and tolerances.

It can be used to find info fast and can be utilized wisely to upgrade your company analysis. Pretty useful in highlighting any items, or risks that you might have missed out.

But also try to learn by asking it smart questions rather than open-ended questions.

Alternatively, just stick back to content created by investors, for investors 😊