OpenAI made the headlines again with the release of GPT-4.

GPT-4 is the latest and most advanced AI language model. Building on the success of its predecessor, GPT-3, the new model boasts enhanced capabilities, improved performance, and a wider range of applications. GPT-4 is expected to revolutionize industries such as content creation, customer support, and data analysis.

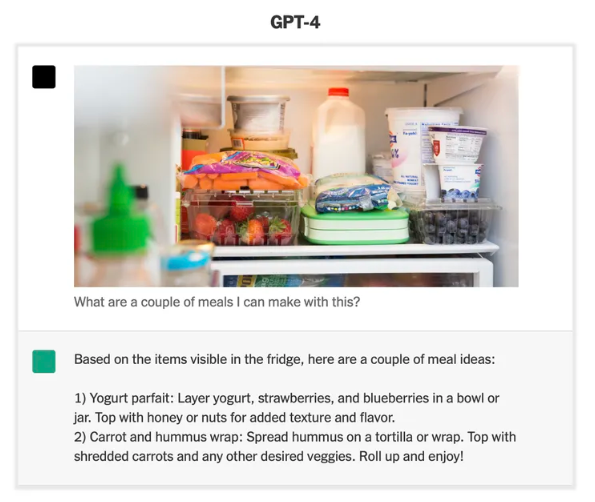

Naturally, the one noticeable function of GPT-4 is the ability to contextualize images.

So I tried my best to come out with ways to see whether it can help investors up their game in stock analysis. (I’ve share how you could use GPT3 to analyze stocks previously.)

The Roadblock

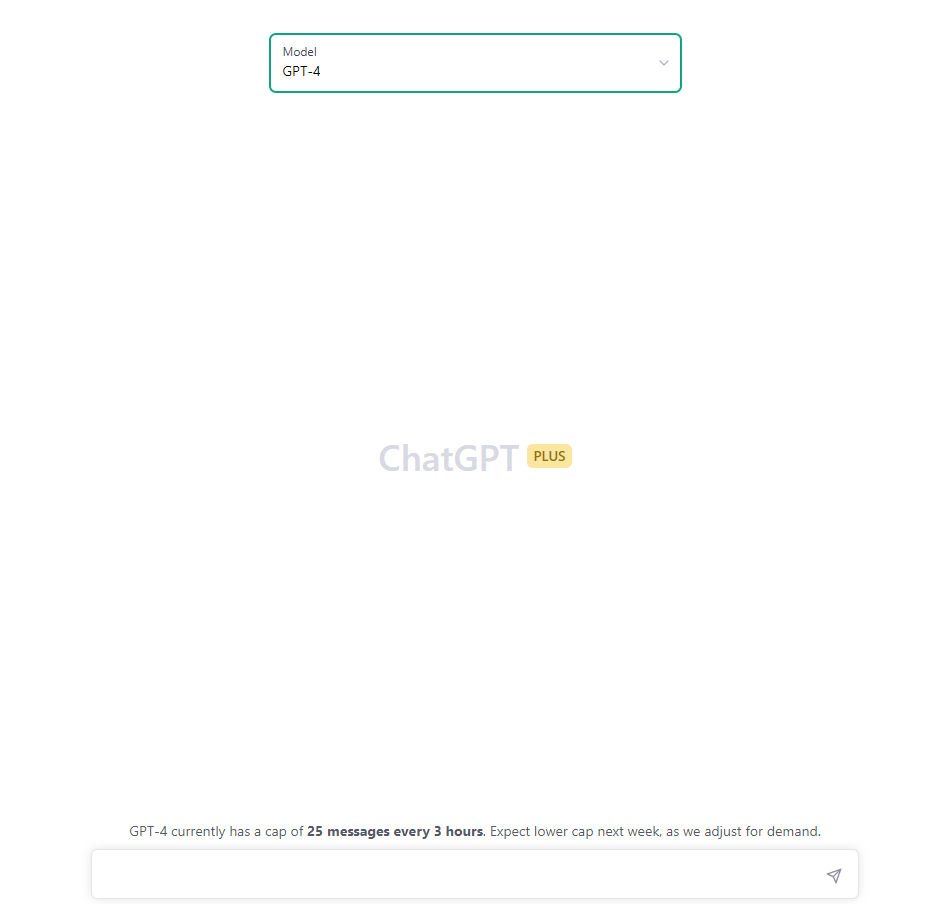

Do note that to enjoy GPT-4, a subscription to GPT Plus is needed.

It means you have to pay USD 20 per month for a subscription.

Once you are over the paywall, your GPT will allow you to choose the GPT-4 as your model

And by the time of writing, GPT-4 still does not allow image insertion and contextualization.

Not even copy + paste, let alone apply the URL address.

So I hit another wall.

The Idea

Since GPT-4 is purportedly able to contextualize images into text, it means it has the capability to generate views, ideas, and findings from images.

Think of it as having a smart analyst on your team, potentially removing any blind spots we might have.

One good application of GP-4 is potentially prompting it with stock chart price movements, with all the relevant indicators, be it the Stochastic RSI, Moving Averages, etc.

This way, you can further complement your stock analysis on top of the fundamental analysis using Chat-GPT that we previously covered here.

Working a way around the wall

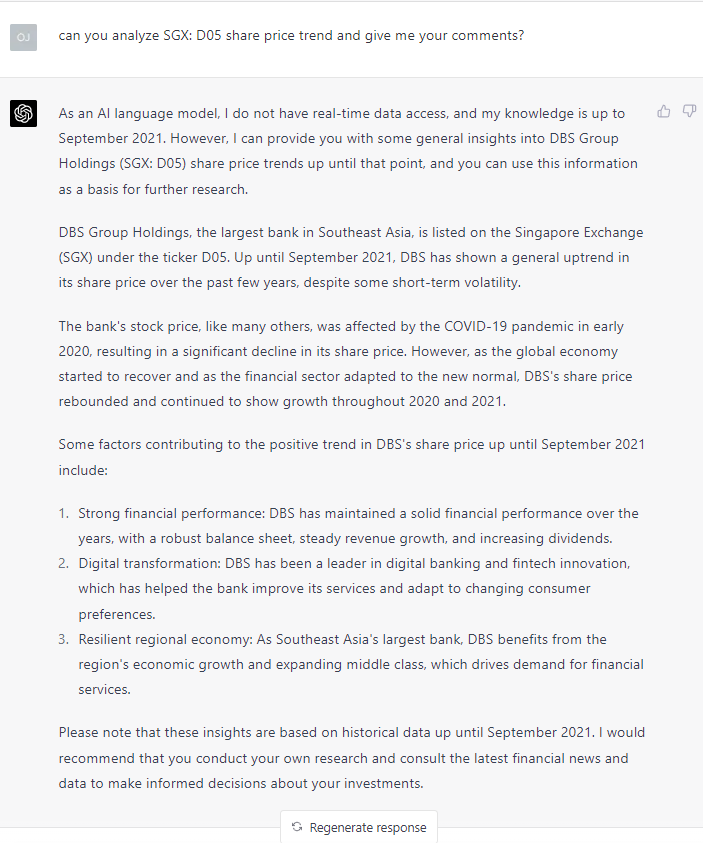

Without giving up, I prompted GPT-4 to analyze the price trend of DBS.

At least my prompt returned me with something!

Even though GPT-4’s database is only up till September 2021, we are now in 2023.

This means we can use future data (Dec’21 and after) to verify whether it managed to predict the price trend of DBS back then!

Testing out GPT-4’s Price Trend Analysis

DBS Group Holdings, the largest bank in Southeast Asia, is listed on the Singapore Exchange (SGX) under the ticker D05. Up until September 2021, DBS has shown a general uptrend in its share price over the past few years, despite some short-term volatility.

GPT-4

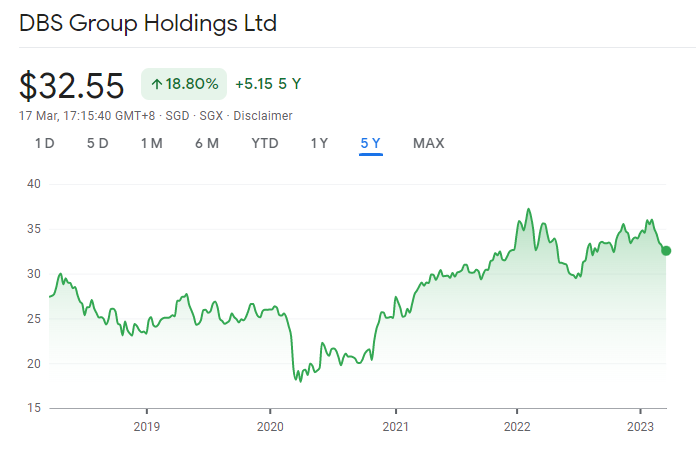

From Mar’20 until Sep’21, we can notice that even though we were still under lockdown measures, share prices of DBS have shown a general uptrend, which was picked up and commented on by GPT-4.

Testing out GPT-4’s Fundamental & Forward Analysis

On top of providing a view of the price trend accurately, GPT-4 also quoted some fundamental reasons for the share price appreciation.

GPT-4

- Strong financial performance: DBS has maintained a solid financial performance over the years, with a robust balance sheet, steady revenue growth, and increasing dividends.

- Digital transformation: DBS has been a leader in digital banking and fintech innovation, which has helped the bank improve its services and adapt to changing consumer preferences.

- Resilient regional economy: As Southeast Asia’s largest bank, DBS benefits from the region’s economic growth and expanding middle class, which drives demand for financial services.

To fact-check that, let’s look back at DBS’ Q3’22 & Q4’22 results.

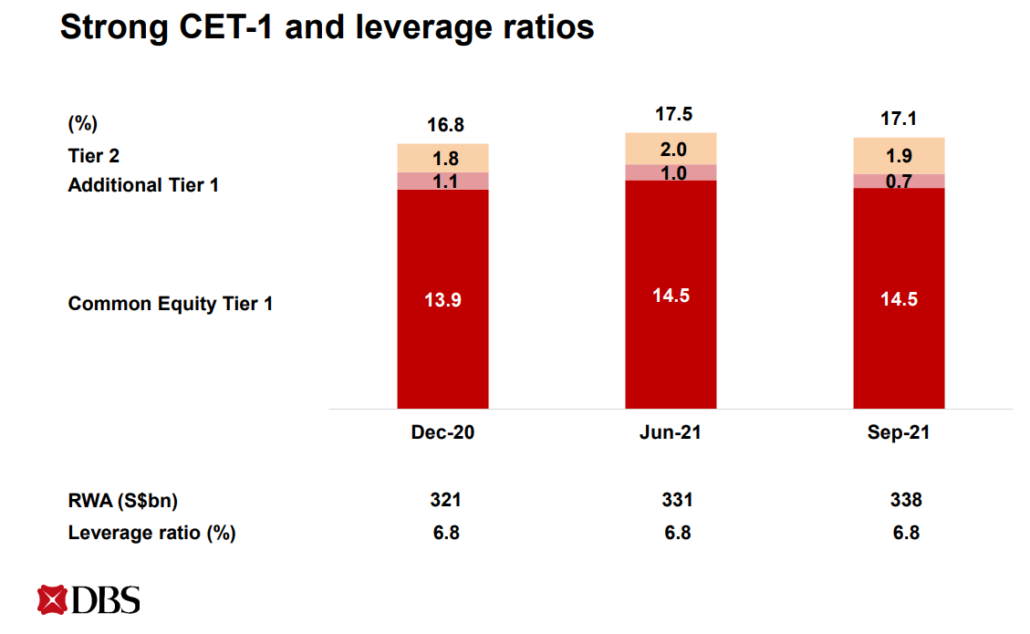

DBS’ balance sheet was indeed robust back in Q3’21 and still is as of today. Its CET 1 ratio grew and stabilized at 14.5% in Q3’21.

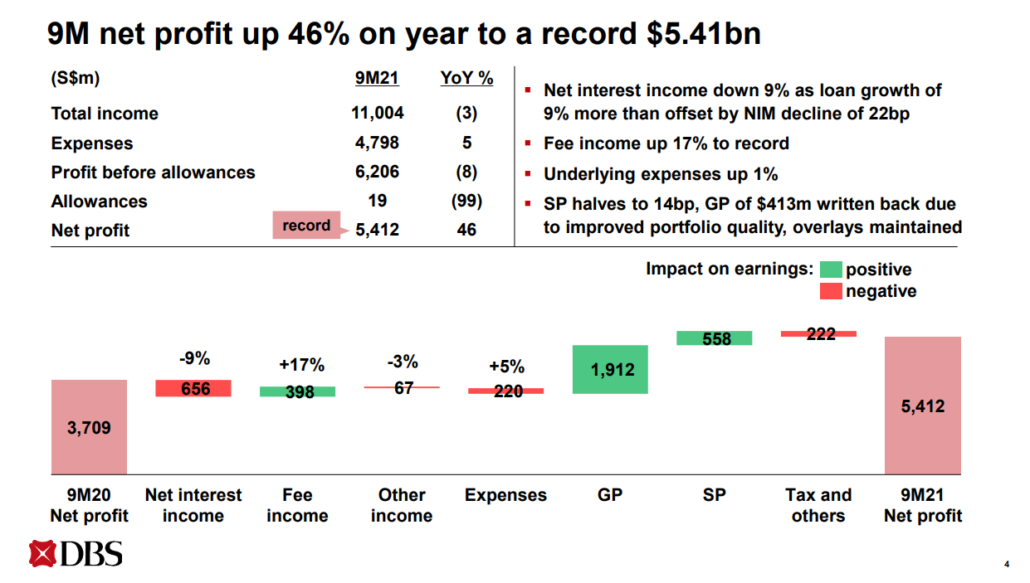

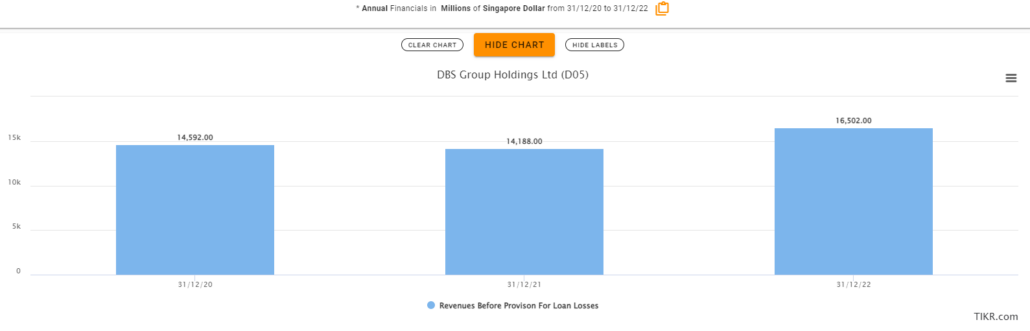

Even though Total Income for 9M’21 was down a mere 3% YoY, looking back at total FY’21 vs FY’21, total income would be considered resilient during that period of uncertainty.

Regarding dividend per share payout, DBS eventually went on to pay SGD 1.20, which is just 3 cents short of SGD 1.23 in FY’19, its pre-pandemic level.

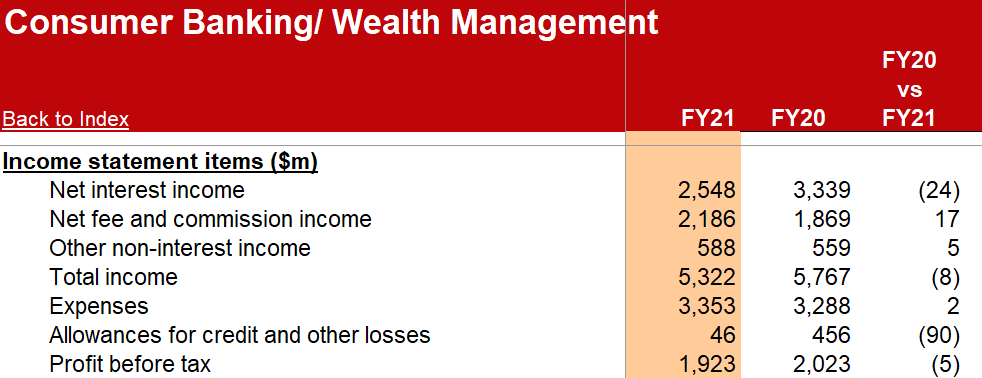

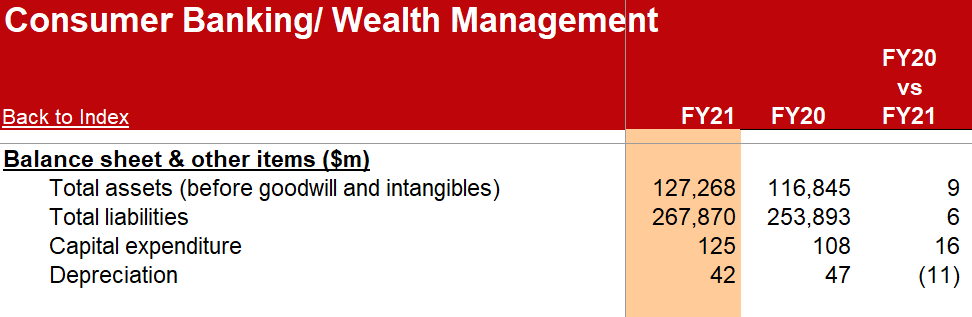

If we zoom in on DBS’ FY’21 vs FY’20 consumer banking & wealth management segment, due to lower net interest margins, net interest income was down by 24% YoY.

But net fee and commission income, which is unaffected by net interest margins, surged by 17% YoY.

Total assets also grew by 9% YoY.

Would it have been different using other stocks?

After going through the exercise of testing out GPT-4, albeit the initial roadblock, it seems like GPT-4 is able to contextualize images into text quite well while offering some potential of a stock.

If only it was released back then, I guess most of us would have bought DBS at SGD 30 per share and laughing our way to the bank right now, even though it was at a historical high back then.

However, would this be accurate and replicable for other stocks? Can GPT-4 actually mix and match strategies, trend movement, momentum, and technical analysis together with fundamental analysis to help investors up their investing game?

It’s all a guessing game right now. And I admit picking DBS as a candidate I probably provided GPT-4 an easy question.

So far so good now, but be mindful, AI is just a smart computer.

It is by no means a crystal ball that can 100% predict the future!