A household name for most, we remember times when free Grabcar promocodes were an everyday affair.

Since then, Grab’s growth trajectory has been exponential and it comes at no surprise that listing on a stock exchange was next on their agenda. In fact, Grab has just confirmed its merger with Altimeter Capital on 13th April 2021, and this happened overnight:

Below, I’ll briefly touch on the business model of Grab and the pathway that they have taken to go public. Then jump into the challenges/opportunities which Grab will face down the road, and provide a qualitative analysis of the company. Lets gear up and head right in!

TLDR – The Merger in a nutshell

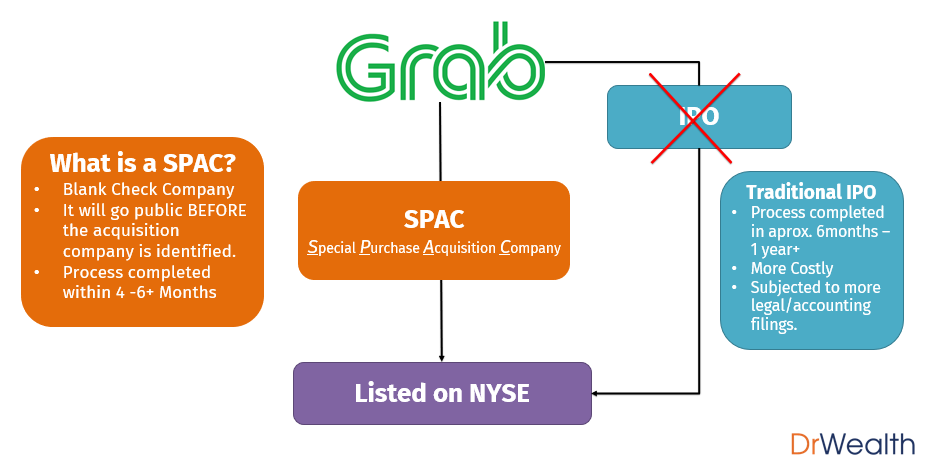

Most of us would be familiar with what an Initial Public Offering (IPO) is however not many would be familiar with a SPAC. With its rising popularity, readers should familiarize themselves with the basics of a SPAC.

In its most basic definition, “SPAC” is an acronym for Special Purchase Acquisition Company.

- A SPAC is a Blank Check Company which is already listed on the Stock Exchange.

- The entity which launched the SPAC will search for target companies to acquire.

- Once a target company is identified, the merger negotiation process begins.

- Entire merger process is expected to complete within 4- 6 months.

In this case, the SPAC is Altimeter Growth Cor. (NASDAQ:AGC) and the target company is Grab.

While I am unable to verify which party initiated the merger, it is likely that Grab shifted their focus to going public via a SPAC route when the merger with Gojek was passed on last year.

On a deeper level, there are numerous considerations which targeted companies like Grab have to consider when deciding between a SPAC or an IPO. For readers interested in the details of a SPAC, do refer to this article.

From January to October 2020, some 165 SPACs were listed, according to financial markets data provider Refinitiv. That’s nearly double the number of global SPAC IPOs issued in the whole of 2019 and five times that of 2015.

CNBC.com

The numbers above are a clear indication of the growing momentum behind SPAC Mergers and it is very likely that this momentum will continue on to 2021.

Here are some SPACs which have made it to the media in recent time.

What type of Company is Grab?

I believe that many of us have experienced the changes which come with every Grab application update on our mobile phones. With each update, we have new features being added to the app and where it was once used primarily for ride-hailing, we now have a plethora of services ranging from food delivery to parcel delivery which we can access from just one app.

Grab as a Super App

Unknown to many, there is a structure as to the type of app which Grab has evolved into.

Grab has now become what we call a Super app where with just one single app, a user can now access a variety of services. In addition, we have Grabpay as the in-house payment system which facilitates the transactions conducted within the app.

Another key feature of a Super app is how it is usually designed in a way that allows the application to become a key gateway for many consumer services therefore encouraging repeated usage of the application. This is essential to the success of any Super app.

In my opinion, the key to Grab’s profitability from the Super app model lies in 2 parts,

- How quickly they are able to make the Super app a habit in the lives of the population. (Do you open the app at least once everyday to use/book a service?)

- The extent of which habit can be monetized by Grab (Service fees charged by the platform etc.)

Business Model & Valuations

In terms of valuations, we are looking at the LARGEST SPAC Merger to date with the entire merger being valued at an aprox. USD $35 billion (SGD $47 billion). In comparison with some of the previously mentioned SPAC mergers, this deal is set be a little over 10x larger than that of QS and DKNG.

Despite the sheer size of this merger, the big question here is does Grab still have room to grow in the post Covid-19 world? For the rest of this article, we will be exploring the macroeconomic challenges and opportunities which Grab may encounter moving forward.

Does Grab still have room for growth in the post Covid-19 World?

Qualititative analysis

Bull Case for Grab – Strengths & Opportunities

1 – Revenue Trajectory

As Grab is still currently a private company, it is not legally required to disclose its earnings or revenue. However we do occasionally get snippets of its profitability from the news. Reference to Grab’s overall performance, ” its total group net revenues growing approximately 70 per cent year-on-year in 2020 compared to 2019“.

Very much like stock picking, it is recommended for investors to have a diversified rather than concentrated portfolio. In the case of Grab, while the Circuit Breaker completed disrupted services like its transport, hotel and ticketing functions, it experienced exponential growth in other areas such as its food and delivery.

It is therefore safe to conclude that the diverse range of services provided by the Grab Super app allowed its revenue model to be relatively ‘pandemic-proof’. This in my opinion puts Grab in a good position to continue its operations despite fears of future pandemics or even the resurfacing of the current Covid-19.

2. Market Dominance – Beating the Competition

I believe that the home ground advantage in Singapore has allowed Grab to beat the competition and will leave them relatively unchallenged in terms of market share. By home ground, I define this as the,

- Depth of understanding of their target market

- Speed of decision execution. (Distance between HQ & Operating Market)

For most of us, chances are we felt more comfortable with Grab than with Uber. This level of familiarity which we have with Grab reflects their understanding of their target market over here in Singapore. In the words of Associate Professor Chu Junhong, from the NUS Business School’s department of marketing, he mentions that Grab was always “seen as friendlier – as, in some ways, more in tune with the needs of their customers”.

It is important that Grab retains their market dominance in Singapore as it is often trouble at home that can lead to ruin. Reference to the competition between Uber & Grab back in 2018 where one of the leading causes of Uber exiting various Asian markets were due to the problems that they were facing back in the US.

For the continued growth of Grab, global expansion beyond Singapore is key. It is essential for Grab to ensure stability in the Singapore market as any instability here at home may put them in the very same situation that caused Uber to lose focus in their expansion plans.

3. Digital Bank License

On 4th of December 2020, the Monetary Authority of Singapore (MAS) awarded a digital full bank license to the Grab-Singtel consortium. (More details here).

Any entity which holds a digital bank license will be able to provide both retail and corporate customers with the complete suite of services which traditional banks offer with an added clause that digital bank operators have to conduct all their activities online.

While the concept of a digital bank is new in Singapore, the model has been explored by many other countries such as Korea, India and China. Though it may be difficult to determine the degree of material impact which this license can have on Grab, it is likely that such a venture may be positive for profitability of Grab.

This can be attributed to the following,

- Half the Battle won – For most digital bank providers, a key challenge will be the lack of visibility as they are operating strictly in an online space. In the case of Grab having been established in Singapore since 2012, they will not be a new entrant to the market and will likely face a very low degree of doubt amongst new consumers seeking to work with digital banks.

- Aggressive Market Penetration – It is likely that Grab may kick of this digital bank campaign with their aggressive use of ‘promos’ to penetrate the market and capture market share. I would think that at this point, they are probably the ‘masters’ of promocodes having employed this strategy against Uber and emerge victorious.

- Earnings Trajectory – Though the outcome of this venture for Grab remains uncertain, we can take reference from the performance of other digital banks in the Asia Pacific region. Based on the chart below, most digital banks in the region have been able to become profitable in less than 2 years. I do not expect Grab to do any differently. (More benchmark performance indicators of digital banks in Asia Pacific can be found here)

4. Disrupting Disruption

Ride hailing companies like Grab and Uber disrupted the traditional taxi industry. It is likely that within our lifetime, they themselves will be disrupted by autonomous vehicle (AV). The questions remains as to which side of disruption will they be on.

In the case of Grab, it is likely that they are indeed exploring the possibility of creating a service where the ride is completely autonomous. This would cause significant material impact on their revenues as,

The driver represents the single largest expense in non-autonomous ride-sharing at 80% of the total per mile cost, according to estimates by research firm Frost & Sullivan. By removing the driver from the equation, fully autonomous vehicles dramatically lower the cost of a ride while boosting its addressable market.

CNBC

Though Grab has been relatively quiet on the AV front at present, back in 2018, Grab’s President Ming Maa said “the company wants to commercialize its robo-taxi service “definitely earlier” than 2022″. While it is unclear if the robo-taxi service is still on track, one thing is certain thats the significant expense decrease which will come with such a venture.

Bear Case for Grab – Potential Weaknesses & Threats

1 – Has not achieved Profitability

There are investors which follow the school of through where they would never invest in a business which is not yet profitable (and for good reasons).

Unfortunately, Grab is NOT profitable at the moment and depending on your point of view, this can be bearish in the sense that investors may feel more confident buying into companies which are already profitable over companies which are loss making.

However, from a bullish viewpoint, if we have investors buying into Grab when it is not profitable, it is possible that more investors may buy into it if it gets profitable.

The company registered negative free operating cash flow (FOCF) and EBITDA in 2019. According to a Standard and Poor’s research note, Grab’s free operating cash flow (FOCF) and EBITDA will remain materially negative until 2022.

Singapore Business Review

In my opinion, the profitability of a company often has less of an impact on its share price as afterall, the market is always forward looking. Take for example Pinterest (NYSE :PINS), it is not yet profitable but its shareprice is currently up more than 3x from its IPO price of $24 back in April 2019. Another example more relatable to Grab would be Uber (NYSE :UBER) which is currently up about 1.5x from its IPO price of $42.

2. Challenges in the Macroenvironment – Legal & Socio-Cultural

It is often companies which disrupt traditional industries the most that face the most intense backlash. While we may not see much of it here in Singapore, it is disruptive companies like Grab and Uber which can potentially face very strong (and lasting) opposition from the local people.

Though most of us think that such protest are matters of the past, local opposition (Socio-Cultural Macroenvironment) to Grab has recently resurfaced late last year as Grab in Hanoi increased the commission rates for their GrabBike services. While the protest was reportedly peaceful, such news is bad public image of the company and while it may cause some uncertainly in the short term, it is no doubt a positive note for investors in the long term.

Aside from opposition from riders, one area which has the potential to severely hurt the profitability of Grab is to do with the classification of employment for its riders.

At the time of writing, Uber is going through immense pressure from authorities in the UK with regard to how their drivers should be entitled to the minimum wage.

As of 17th of March 2021, Reuters reported that “Following a UK Supreme Court defeat last month, the Silicon Valley-based company reclassified its more than 70,000 drivers in Britain as workers, meaning they are guaranteed entitlements such as holiday pay.” – Reuters

As the gig economy continues to gain momentum due to its relative ease of entry, it is highly uncertain as to the amount of legalities which it may be subjected to in the near future. What’s even more uncertain is the extent of such legalities on the bottom-line profitability of Grab. Though I can only speculate, it is likely that any attempt made to reclassify gig economy workers (currently classified as self-employed) may eventually be potentially devastating for Grab.

Concluding Thoughts

As a keen observer of the SPAC mergers in the US market, I urge readers to take caution in the near-term. Although the merger is confirmed at the time of writing, investors should be weary of the volatility involved in such mergers. An example of a SPAC merger which experienced extreme volatility upon completion of its merger was CCIV which saw its share price fall as much as 50% when the merger was complete.

Overall, I am bullish on the performance of Grab in the long term due to their progress within Singapore and in the region. I believe that they will be able to easily dominate the Singapore market due to the lack of competition with the financial capability to challenge them. Furthermore with their venture into the digital banking space as well as their R&D into autonomous vehicles, the future does look promising.

On a personal note, I dare-say that someday Grab may eventually become the very first “SEA Super app”. The reason I’ve come to this conclusion is that as a regular business traveler (pre-covid), I used Grab wherever I went from Malaysia to Indonesia and even Vietnam.

Here is a screenshot of some promocodes which I can use for my next trip back to Vietnam.

I am vested in AGC at the time of writing.

Hi Bryan. Noticed that you didn’t include a section on valuation in comparison to its competitors (Eg. Uber). Not that familiar with how SPACs work but what would be the P/S ratio based on the current SPAC price?

Thanks.

Hi Royston,

Thank you for checking in. It has been difficult for me to conduct a through valuation of the AGC share price as I have not found a reliable source of information relating to Grab’s income statement.

This could be due to how Grab is not yet a listed company and is therefore not required to disclose any of its financials.

However based on Market Cap, Grab is currently valued at about $35 billion USD whereas UBER at $11.14 billion USD

I will follow up with this as soon as I can.

Have a great week ahead.

Regards,

Bryan