Yet another delisting from the Singapore Exchange.

On 30 March 2021, Neo Group Limited (SGX:5UJ) has announced its plans to delist from the Singapore Exchange. Neo Group is an integrated food solutions provider in Singapore, which operates familiar brands like Neo Garden and Umisushi. Those who have catered buffets may have come across this company before.

In the article, let us analyse Neo Group’s offer and determine if it is fair for its shareholders.

Besides, as SGX has been suffering from a run of delisting recently, let us investigate if previous delisting have been beneficial to its shareholder.

Neo Group delisting offer

Although Neo Group’s CEO, Neo Kah Kiat said that there were no plans to delist despite holding 76.9% of the company back in 21 August 2020, this offer may not come as a surprise. After all, Neo Group has been religiously buying back its shares, since the second half of 2020.

Taking a look at the documents, Forestt Investment (an investment holding company owned by Neo Kah Kiat and his wife Liew Oi Peng) is offering S$0.60 per share for Neo Group’s share. This offer price represents a premium of approximately 20% over the last traded price per share (at the point of writing) and is also the highest closing price of the share in over 2.5 years.

The delisting documents, therefore, conclude that this is an exit opportunity for shareholders to realize their investment.

This is indeed great news, if you have bought the shares recently.

However, if we look at the long-term chart, Neo Group has been trading above S$0.60 between 2014 to 2018. As such, if you have bought the shares long ago, you would most likely be selling at a loss. (not accounting for any dividend you have received.)

Over the past few years, Neo Group has also performed quite well with its revenue increasing every year. From its 1HFY2021 report, Neo Group has also expressed optimism in the recovery of its business from the pandemic.

Based on the offer price of S$0.60, Neo Group’s PE ratio will be around 14x (taking the earnings per share of 4.30 cents from FY2020). While this is close to the SG Commercial Services industry average of 15.8x, it is ultimately still at a discount to the market.

$0.60 – Fair deal or not?

Whether the deal is good or bad depends on when you have bought the share, nonetheless I believe investors do not have much say in this delisting.

According to SGX’s delisting rules, if the offeror manages to receive approval from 90% of the total shares, the offeror would be entitled to exercise the rights to compulsory acquire all the shares of shareholders who have not accepted the offer.

Given that Neo Kah Kiat the founder, chairman, and chief executive of Neo Group together with his wife, Liew Oi Peng already owns around 82.26% of the Neo Group, there is a high probability this delisting would go through.

Alvin has recently done an in-depth video analysis on Neo Group, you can watch it below if you wish to understand the delisting more. In the next section, I share a deeper analysis of why investors must be careful of companies with high insider ownership.

History of Delisting in Singapore

Neo Group is not the only one that is choosing to delist. In fact, over recent years there has been a spike in delisting. You can see the full list of companies that have delisted recently here.

Let’s take a look at 3 companies that you may have heard of and have delisted recently.

SK Jewelley Group

SK Jewellery Group is a jeweller headquartered in Singapore and is involved in the business of selling jewellery across Singapore, Malaysia, China, and Thailand. In 2020, the founders of SK Jewellery through an investment holding company OroGreen Investment had issued an offer of S$0.15 per share for all public shares to take it private.

The offer price represents a premium of approximately 70.5% over the last traded price per Share on 27 August 2020. This offer price also exceeds the highest closing price of the Shares in over two years preceding the last trading day.

Looking at the share price performance of Sk Jewellery Group, the offer price seems to be above its 5 years average. With inconsistent revenue over the past 5 years prior to Sk Jewellery Group’s delisting, the offer price of S$0.15 per share which was at a 30% premium compared to its FY2019 net assets per share of S$0.11 seemed like a good deal for its investors.

Before the last trading day, only 15.6% of the company share was held by the public, indicating high insider ownership. In the end, SK Jewellery Group received 97.8% approval to delist.

Perennial Real Estate Holdings Limited

Perennial Real Estate Holdings Limited is an integrated real estate company that owns, develops, and manages primarily large-scale mixed-use developments.

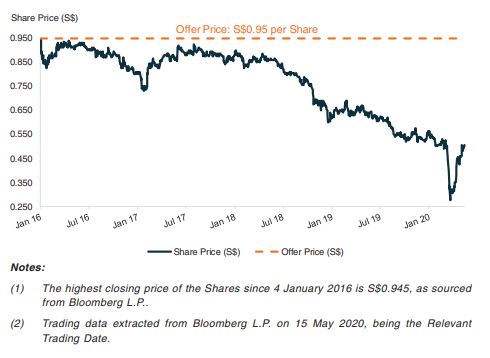

On July 2020, Primero Investment, the offeror, issued an offer of S$0.95 per share for all public shares to take it private. Primero is a consortium that comprises Perennial’s chief executive Pua Seck Guan, chairman Kuok Khoon Hong, vice chairman Ron Sun, Agri group Wilmar International, and Beaufort Investment Global Company.

At the offer price of S$0.95, it represents a premium of approximately 88.1% over the last trade price. This price exceeds the highest closing price of the shares in over 4 years back in January 2016.

This deal does seem like a good one but with a NAV of $1.58 per share then, the offer of $0.95 was around a 40% discount from its net asset value. Given that the consortium had already held 82.43% of the shares which was close to the 90% mark, shareholders had little said in the privatization too.

Take a look at this article by Alvin to find out more about this deal.

BreadTalk Group Limited

BreadTalk Group is a multinational food and beverage corporation that started as a bakery. Some common household brands you may have heard of include BreadTalk, food republic, Toastbox, and Din Tai Fung.

On 25 February 2020, Breadtalk group founder George Quek led a consortium to take his company private at S$0.77 per share. This offer marks a premium of 19.4% over its last traded price on Feb 2020. Together with a NAV of around 26.1 cents per share, this deal also seems good for its shareholder.

However, if we were to look at the price chart, those who have bought before 2019 would be realizing a loss.

The consortium had already owned 70.53% stake in the company before this offer. With this, they only required another 19.47% support from the public to cross the 90% mark which then the company can acquire all public shares, as such shareholders didn’t have much say in this.

Alvin had written an in-depth discussion on BreadTalk’s delisting offer previously.

The Power of High Insider Ownership

If we look at these delisting offers, we can see a trend, these companies tend to have high insider ownership. The offer price also tends to be higher than the last traded price to entice investors to accept the offer. While this is great for investors who wish to unlock the value of their holdings, some of the stocks are grossly undervalued.

Ultimately you will be at the mercy of the owner on the price they are willing to offer.

Nonetheless, it could be a good value play if you had invested in the right company as these deals usually unlock some values of the stocks.

Insights taken from Alvin’s mentoring session

The above are just what you could see on the surface. In fact, if you were to dig deeper into these offers, you may start to question if the offer is truly good for investors.

Here are some insights Alvin has found over the years:

1 – Auric Pacific

Auric Pacific delisted Food Junction for $31 million in 2013 and then sold it to Breadtalk for $80 million in 2019.

2 – Thomson Medical

Peter Lim delisted Thomson Medical for $396 million in 2010 and listed it again at $1.6 billion via Rowsley in 2017.

3 – Osim

Osim Group was delisted by its owner at a valuation of $1 billion in 2016. A portion of it was then sold to KKR in 2018, at a total valuation of the company standing at $1.7 billion.

4 – ERA

ERA was delisted at $141 million in 2013 and relisted at $234 million under the name of APAC Realty in 2017.

Moving forward – what should you do?

From this article, I hope you can see the drawback/benefits of investing in a company that has high insider ownership.

Delisting can unlock the stock value and potentially allow investors to bag some gains especially if you have recently bought it. However, this may not be the case for shareholders who have bought the company’s shares a few years back, as such ‘forced’ offer may not be favourable.

Looking ahead, you may want to re-evaluate your portfolio and see if you are holding on to any stocks with high insider ownership and consider your next course of action.

As of April 2021, here are 99 companies listed on SGX with less than 20 percent of free float. (Meaning only 20 percent is held by public investors) Companies with low free float percentages that could not be verified has been removed.

| Companies | Free Float Percentage |

|---|---|

| Atlantic Navigation Holdings (Singapore) Ltd (SGX:5UL) | 10.0 |

| Pacific Century Regional Developments Ltd (SGX:P15) | 10.0 |

| MYP Ltd (SGX:F86) | 10.1 |

| Pollux Properties Ltd (SGX:5AE) | 10.1 |

| Neo Group Ltd (SGX:5UJ) | 10.1 |

| Place Holdings Ltd (SGX:E27) | 10.2 |

| Hotel Properties Ltd (SGX:H15) | 10.4 |

| GP Industries Ltd (SGX:G20) | 10.5 |

| Aoxin Q&M Dental Group Ltd (SGX:1D4) | 10.7 |

| GDS Global Ltd (SGX:5VP) | 10.7 |

| Fortress Minerals Ltd (SGX:OAJ) | 10.7 |

| Moya Holdings Asia Ltd (SGX:5WE) | 11.1 |

| Old Chang Kee Ltd (SGX:5ML) | 11.2 |

| Thomson Medical Group Ltd (SGX:A50) | 11.2 |

| United Industrial Corporation Limited (SGX:U06) | 11.4 |

| ABR Holdings Limited (SGX:533) | 11.4 |

| Amcorp Global Ltd (SGX:S9B) | 11.6 |

| Straco Corporation Ltd (SGX:S85) | 11.7 |

| Bonvests Holdings Ltd (SGX:B28) | 11.7 |

| Fraser & Neave Ltd (SGX:F99) | 12.0 |

| Great Eastern Holdings Ltd (SGX:G07) | 12.0 |

| Fragrance Group Ltd (SGX:F31) | 12.1 |

| World Precision Machinery Ltd (SGX:B49) | 12.2 |

| Asian Healthcare Specialists Ltd (SGX:1J3) | 12.2 |

| Golden Energy and Resources Ltd (SGX:AUE) | 12.3 |

| Hiap Hoe Ltd (SGX:5JK) | 12.4 |

| BH Global Corporation Ltd (SGX:BQN) | 12.7 |

| Frasers Property Ltd (SGX:TQ5) | 12.7 |

| United Global Ltd (SGX:43P) | 12.9 |

| Yongmao Holdings Ltd (SGX:BKX) | 13.1 |

| SLB Development Ltd (SGX:1J0) | 13.2 |

| Colex Holdings Ltd (SGX:567) | 13.2 |

| Lum Chang Holdings Ltd (SGX:L19) | 13.6 |

| First Sponsor Group Ltd (SGX:ADN) | 13.8 |

| Samko Timber Ltd (SGX:E6R) | 13.9 |

| World Class Global Ltd (SGX:1E6) | 13.9 |

| Cortina Holdings (SGX:C41) | 14.1 |

| Challenger Technologies (SGX:573) | 14.5 |

| Hai Leck Holdings Ltd (SGX:BLH) | 14.7 |

| MoneyMax Financial Services Ltd (SGX:5WJ) | 14.7 |

| Aedge Group Ltd (SGX:XVG) | 15.1 |

| Jardine Strategic Holdings Ltd (SGX:J37) | 15.1 |

| Indofood Agri Resources Ltd (SGX:5JS) | 15.2 |

| Aspial Corporation Ltd (SGX:A30) | 15.2 |

| OIO Holdings Ltd (SGX:KUX) | 15.3 |

| Mary Chia Holdings Ltd (SGX:5OX) | 15.3 |

| Bund Center Investment Ltd (SGX:BTE) | 15.4 |

| Vividthree Holdings Ltd (SGX:OMK) | 15.4 |

| Bumitama Agri Ltd (SGX:P8Z) | 15.4 |

| Southern Alliance Mining Ltd (SGX:QNS) | 15.4 |

| Katrina Group Ltd (SGX:1A0) | 15.5 |

| RE&S Holdings Ltd (SGX:1G1) | 15.5 |

| Jawala Inc. (SGX:1J7) | 15.6 |

| Yinda Infocomm Ltd (SGX:42F) | 15.8 |

| Second Chance Properties Ltd (SGX:528) | 16.2 |

| Southern Packaging Group Ltd (SGX:BQP) | 16.2 |

| Spindex Industries Ltd (SGX:564) | 16.3 |

| Hotel Grand Central (SGX:H18) | 16.3 |

| Jumbo Group Ltd (SGX:42R) | 16.4 |

| Maxi-Cash Financial Services Corporation Ltd (SGX:5UF) | 16.5 |

| Resources Global Development Ltd (SGX:QSD) | 16.7 |

| ValueMax Group Ltd (SGX:T6I) | 16.7 |

| NSL Ltd (SGX:N02) | 16.8 |

| TalkMed Group Ltd (SGX:5G3) | 16.8 |

| Don Agro International Ltd (SGX:GRQ) | 16.8 |

| Olam International Ltd (SGX:O32) | 16.8 |

| Tat Seng Packaging (SGX:T12) | 17.0 |

| Grand Venture Technology Ltd (SGX:JLB) | 17.1 |

| Oxley Holdings Ltd (SGX:5UX) | 17.3 |

| Multi-Chem Ltd (SGX:AWZ) | 17.5 |

| Azeus Systems Holdings Ltd (SGX:BBW) | 17.6 |

| UG Healthcare Corporation Ltd (SGX:8K7) | 17.8 |

| Roxy-Pacific Holdings Ltd (SGX:E8Z) | 17.9 |

| First Ship Lease Trust (SGX:D8DU) | 17.9 |

| Healthbank Holdings Ltd (SGX:40B) | 17.9 |

| Vallianz Holdings Ltd (SGX:WPC) | 18.0 |

| Japfa Ltd (SGX:UD2) | 18.1 |

| Nordic Group Ltd (SGX:MR7) | 18.1 |

| Huationg Global Ltd (SGX:41B) | 18.2 |

| Memories Group Ltd (SGX:1H4) | 18.2 |

| HRnetGroup Ltd (SGX:CHZ) | 18.2 |

| Singapore Kitchen Equipment Ltd (SGX:5WG) | 18.3 |

| Guocoland Ltd (SGX:F17) | 18.4 |

| Santak Holdings Ltd (SGX:580) | 18.4 |

| Goodland Group Ltd (SGX:5PC) | 18.6 |

| AnAn International Ltd (SGX:Y35) | 18.6 |

| Zhongmin Baihui Retail Group Ltd (SGX:5SR) | 18.7 |

| Ho Bee Land Ltd (SGX:H13) | 18.9 |

| Blumont Group Ltd (SGX:A33) | 19.3 |

| GL Ltd (SGX:B16) | 19.4 |

| Koh Brothers Eco Engineering Ltd (SGX:K75) | 19.5 |

| International Press Softcom (SGX:571) | 19.6 |

| MS Holdings Ltd (SGX:40U) | 19.6 |

| Cheung Woh Technologies Ltd (SGX:C50) | 19.8 |

| BHG Retail REIT (SGX:BMGU) | 19.8 |

| SP Corporation Ltd (SGX:AWE) | 19.8 |

| ISEC Healthcare Ltd (SGX:40T) | 19.8 |

| Zhongxin Fruit and Juice Ltd (SGX:5EG) | 20.0 |

| Boldtek Holdings Ltd (SGX:5VI) | 20.0 |