In the past, individuals have had to contend with a limited number of investment options that are often too costly. Today, we suffer from the paradox of choice – we simply have too many options – besides stocks, bonds, unit trusts, endowment plans, investment-linked policies (ILPs), we now have exchange traded funds (ETFs) and roboadvisors.

It has become intimidating to decide, so intimidating that we rather procrastinate on investing, until we are sure. The thing is, the investment options will keep expanding while our investment horizon gets shorter – decision making will only get more difficult later, not easier.

DBS launched a digital advisory within DBS NAV Planner to solve this issue. You can find it by clicking on the ‘Plan’ tab in your digibank app right now. I prefer to see it as a meta-investment advisor. “Meta” because it covers the widest range of products – from Unit Trusts and ETFs to insurance products such as Endowment and ILPs, and not forgetting a robo-advisor, digiPortfolio.

There’s currently no other service that can match the scope of DBS NAV Planner. It is truly meta.

Think about it.

A financial advisor would not provide you access to ETFs.

A roboadvisor would not carry individual bonds.

The implication of this is that none of them is going to holistically look at your investment options. Their recommendations would be skewed towards the products they carry. This is a structural issue.

You would not have this problem with DBS NAV Planner. It leverages on the wide variety of products carried by the bank and pairs that with a digital advisor which can help you scan through all the investment options and give you suitable recommendations.

This means that you get to choose what works best for you, without the fear of being siloed into any particular product.

Let me show you how it works.

Complete your investment profile

In the past, you had to physically meet up with a licensed representative and go through a series of questions to determine your profile before you are recommended financial products.

I am glad that we have finally progressed beyond that and such profiling can now be done 100% online.

There are 5 sections to be completed – it may sound intimidating but it isn’t. I completed the entire profile in 5 mins.

First, you need to decide on your investment objective. Do you want to:

- Grow your wealth over years, or

- Collect cash flows from your investments, or

- Minimize losses to your invested capital?

For me, I do not need the cash flow now and I am pretty aggressive. With a long investment horizon, I chose the first objective – ‘Growing your wealth’

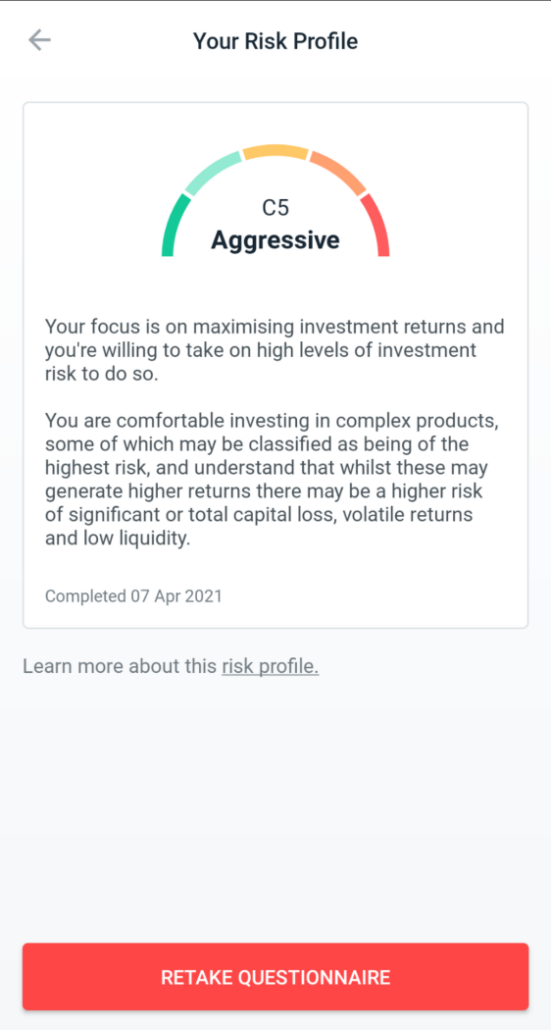

The second section is where DBS determines your risk profile. There are only 4 questions and based on your answers, the app would assign you to one of the five risk levels (C1 to C5). This is mandatory, the advisory would not be able to dish our recommendations and you will not be able to proceed if you do not wish to complete this assessment.

Third, you will also need to complete the Customer Knowledge Assessment (CKA) which is necessary to buy specified investment products as stipulated by the regulator. This is a safeguard for investors, to prevent them from buying high risk products that they have no knowledge in.

The fourth section is about how often you monitor your investments. I am pretty active so I chose ‘monthly’. But you are not me and it might be better if you don’t check your investments frequently because they can compound quietly in the background without your short-term meddling.

The final check that the app would do is to ensure that you have positive cash flow and sufficient emergency savings. As part of DBS financial planning framework, customers with negative cashflow and insufficient cash balance (12 months of emergency savings) do not get any product recommendations. Customers who experience negative cashflow but have more than 12 months of emergency savings will still be given product recommendations. For those with positive cash flow, you only need 3 months of emergency savings to qualify.

If you have synced SGFinDex to the DBS digibank app, you can skip this step as DBS already knows if you have enough emergency savings based on your financial data.

You just need to get these done to start receiving investment recommendations.

After you have completed the profile, you will see the unmissable button that says ‘WHAT CAN I INVEST IN?’ Click on it and the magic happens.

What can I invest in?

Below is a screenshot of the recommendations for me!

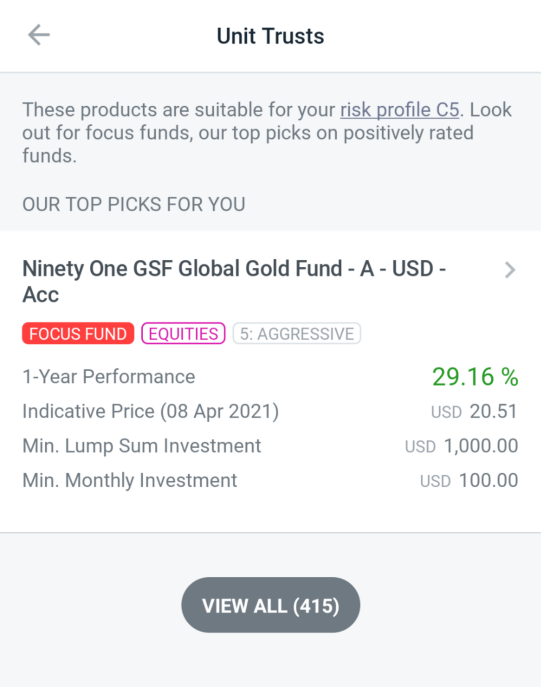

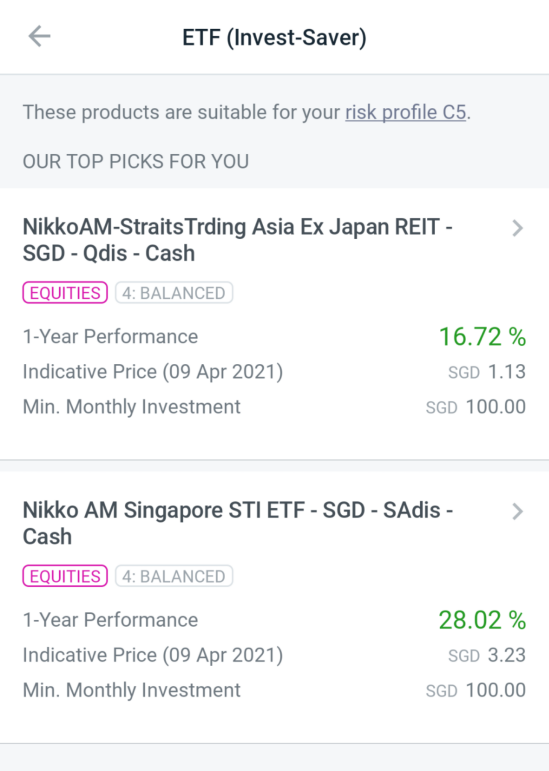

The top three products were Unit Trusts, Investment-Linked Policies and ETF.

There are hundreds of unit trusts and ETFs and I wouldn’t want to look through all of them. Luckily, DBS NAV Planner went one step further to limit the number of recommendations to a maximum of 3 picks for each product.

For example, I only had one recommended unit trust (out of 415) when I click on the module. This really reduced my effort to scour through a list of unit trusts. It is truly a recommendation engine and not a mere screener.

Likewise for ETF, I had 2 recommended picks:

The DBS NAV Planner’s recommendations are based on a set of rules prescribed by the DBS financial planning framework and take inputs from your objective, risk profile and review frequency. This framework has been put together by a group of experienced and knowledgeable finance experts in DBS. It is not powered by an Artificial Intelligence.

Most importantly, I have full control of the process while the app is here to assist me in choosing my investment.

I can look beyond what was recommended to me too. I could either view all options in a product or explore other products – you can see the screenshot below whereby I could navigate to Managed Portfolios and Endowment Plans if I am not interested in the options recommended to me.

This is like ‘omakase’ – I don’t want to think about what I want to invest in. Give me some recommendations and I can decide from there.

The most comprehensive digital investment advisor is now in your hands

A bank’s advantage is that it carries a wide variety of financial products. DBS has created a digital advisor to help you sift through your investment options to make sure no stones are unturned. You no longer need to visit multiple institutions to make your own comparisons. You can do everything with the DBS NAV Planner.

The best part? You can do all these conveniently on your smartphone. You do not need to schedule an appointment with an advisor to get recommendations or to purchase a product. This gives you more control over your investment choices and decisions.

Most importantly, aspiring investors no longer need to procrastinate on investing because they think it is too difficult or time consuming. DBS NAV Planner can recommend a suitable menu to you, and you can make smarter ala-carte decisions.

It is not too late if you have not done anything to make your money work harder. Open the DBS digibank app and get it going.

This is a sponsored article by DBS but the views belong to the author.

This advertisement has not been reviewed by the Monetary Authority of Singapore.