Berkshire Hathaway needs little introduction. Under the stewardship of Warren Buffett and the late Charlie Munger, it has evolved into a conglomerate renowned for its investing prowess.

Berkshire Hathaway’s annual shareholder meetings attract widespread attention, with Buffett’s insights on investing and business eagerly awaited by investors worldwide.

At the point of writing, BRK-A trades at US$605,560 while BRK-B trades at US$402.39. If you’re thinking of becoming a shareholder, you may be wondering:

Is it better to buy BRK-A or BRK-B?

If you have a large capital and intend to hold Berkshire Hathaway for a long time, BRK-A shares are the original share class. Buffett has mentioned that BRK-A shares will never undergo a stock split. However, BRK-A shares tend to be illiquid.

If you have limited funds and want a position in Berkshire Hathaway, BRK-B is more affordable. However, do note that it takes about 1,500 BRK-B to equal 1 BRK-A share.

Both BRK-A and BRK-B shareholders are able to attend Berkshire Hathaway’s annual shareholder meetings.

What are the key differences between BRK-A vs BRK-B?

In a nutshell, here’s the key differences to note:

| Berkshire Hathaway Class A | Berkshire Hathaway Class B | |

|---|---|---|

| Ticker symbol | BRK-A | BRK-B |

| Trades on | New York Stock Exchange | New York Stock Exchange |

| Share equivalent | 1 | 1/1,500 |

| Voting Rights per share | 1 | 1/10,000 |

| Is it convertible? | Yes. BRK-A can be converted into 1,500 shares of BRK-B. | No. BRK-B cannot be converted into BRK-A. |

BRK-A vs BRK-B: Why is Berkshire Hathaway Class B so much cheaper?

1 BRK-B share is equivalent to 1/1,500 of a BRK-A share. This means the price is way accessible to the public.

Instead of having to fork out over $600k, you can become a Berkshire Hathaway shareholder with less than $500 (at the point of writing).

Warren Buffett dislikes share splits and hence the original Class A had never undergone any share split since the initial listing. Over time as the company grew, price keep going up.

BRK-A vs BRK-B: Which is more liquid?

Given the price, BRK-B is way more liquid than BRK-A.

As investors, liquidity is a key consideration because you want to be able to trade your shares quickly and as close to market prices as possible.

Here’s a comparison of BRK-A and BRK-B’s liquidity, using their 10 day and 3 month average trading volume as a proxy.

| BRK-A | BRK-B | |

|---|---|---|

| 10 day average trading volume | 14.77k | 4.46M |

| 3 month average trading volume | 10.86k | 3.61M |

BRK-A vs BRK-B: Is there a difference in price performance?

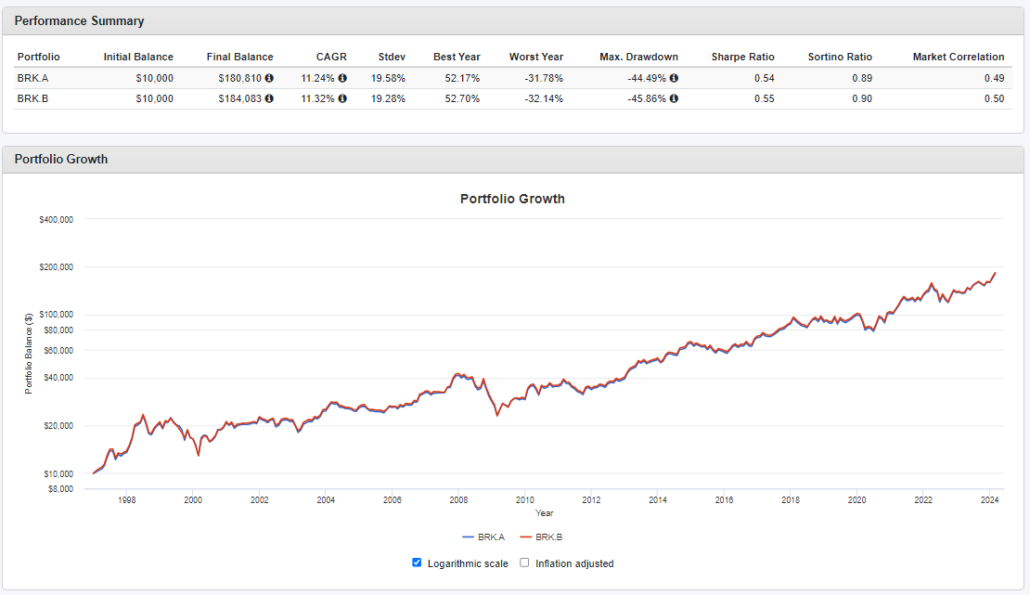

BRK-A and BRK-B tend to move in tandem.

Here’s their price action since 1996 when BRK-B was listed:

BRK-B is set up in a way where it can never trade MORE THAN 1/1500 of the price of BRK-A. If this happens, BRK-A will be sold, converted to B and price will be pushed back down.

However, BRK-B can sell for less than 1/1500 of BRK-A’s price. This can happen when the demand for BRK-B is down.

That said, as we can see from the graph above, BRK-A and BRK-B trade in union most of the time.

What is Berkshire Hathaway?

Originally a small textile manufacturing company established in Rhode Island, Warren Buffett took over control of the company in 1964 after owning majority of the business since he started buying its stock in 1962.

As investors, Warren Buffett and the late Charlie Munger retained Berkshire Hathaway’s name but evolved it into a conglomerate with a diverse range of investments, including in insurance, utilities, and consumer goods.

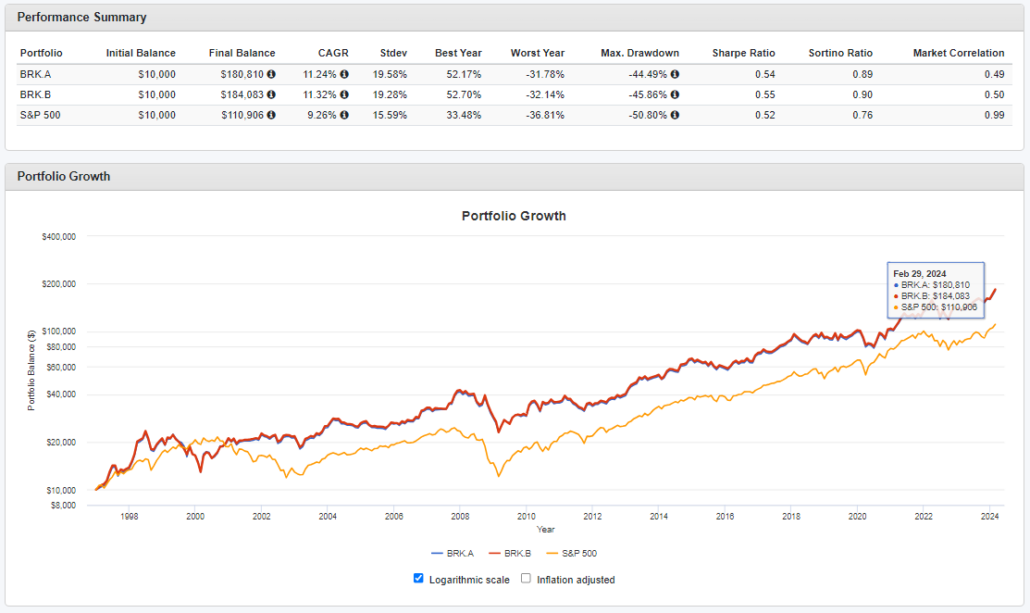

The company is renowned for its long-term value investing strategy, disciplined capital allocation, and impressive track record of consistently outperforming the market.

Unlike typical annual meetings where you seat in a room listening to stiffy board members present a bunch of tiny numbers on a screen, Berkshire Hathaway’s annual shareholder meetings are known for being like a carnival. Many investors make an annual trip to Omaha just for the experience.

Historically, Berkshire Hathaway has outperformed the S&P 500 with a CAGR of ~11% since 1996:

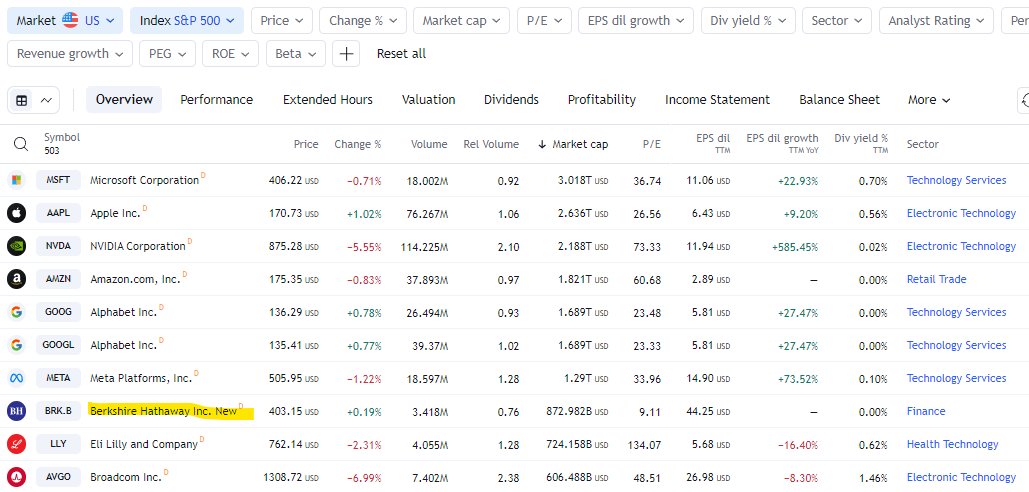

At the point of writing, Berkshire Hathaway is also the top 10 stock in the S&P 500 by market cap:

Why does Berkshire Hathaway have 2 stocks?

Berkshire Hathaway Class B was listed in 1996 to allow investors who were not able to afford the Class A shares.

This was during a time when Berkshire Hathaway was getting very popular and there had been attempts to list unit trusts that would buy Berkshire Hathaway Class A to resell them as smaller units to the public.

Warren Buffett did not like the idea. He mentioned in the 1996 shareholder letter that:

“Holders of those trusts would’ve bought into an entity that had a defined life, but that had considerable, in the way of costs and some tax consequences, that they might not anticipate when they came in.

a great many people would end up buying these unit trust holdings without any idea, really, of what they were buying, and with unrealistic expectations as to the future.

The very action of the creation of these, and that push on the demand, would — might very well create some speculative spurt in the stock, which in turn, would induce people who had been approached about the trust to feel they were missing even more of a good thing by rushing in.”

Hence, he decided to launch Berkshire Hathaway Class B to make it easier for retails to own the stock without having to rely on third party unit trusts.

This also allows Buffett to protect the value of Berkshire Hathaway Class A shares.

At the point, you may also be wondering about the following questions. (p.s. if your question is not listed below, leave us a comment and we’ll get back to you!)

Can Berkshire Hathaway Class B shareholders attend annual meeting?

Yes.

As mentioned in a Memo by Warren Buffett, both Berkshire Hathaway Class A and Class B shareholders are entitled to attend the Berkshire Hathaway Annual Meeting.

Can Berkshire Hathaway Class B (BRK-B) shares be converted to Berkshire Hathaway Class A (BRK-A)?

No.

You may be thinking of accumulating 1,500 BRK-B shares overtime before converting them into BRK-A. Unfortunately, that is not possible. BRK-B shares cannot be converted to BRK-A.

Conversion can only work in one direction; BRK-A to BRK-B.

What is the ratio of Class B to Class A Berkshire Hathaway?

1 Berkshire Hathaway Class B share (BRK-B) is equal to 1/1500 of a Berkshire Hathaway Class A share (BRK-A).

However, this doesn’t translate to the same voting rights.

1 BRK-B share confers 1/10,000 of voting rights instead.

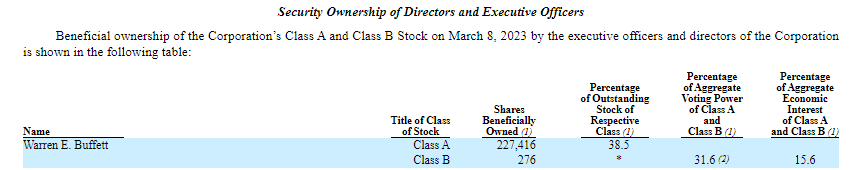

How many Class A shares of Berkshire Hathaway does Buffett own?

According to the latest SEC filing in 2024, Warren Buffett owns:

- 227,416 Class A shares

- 276 Class B shares

This makes him the largest shareholder of the company.